Canadian Mortgage Rate Forecast to 2027

Last updated:

HIGHLIGHTS

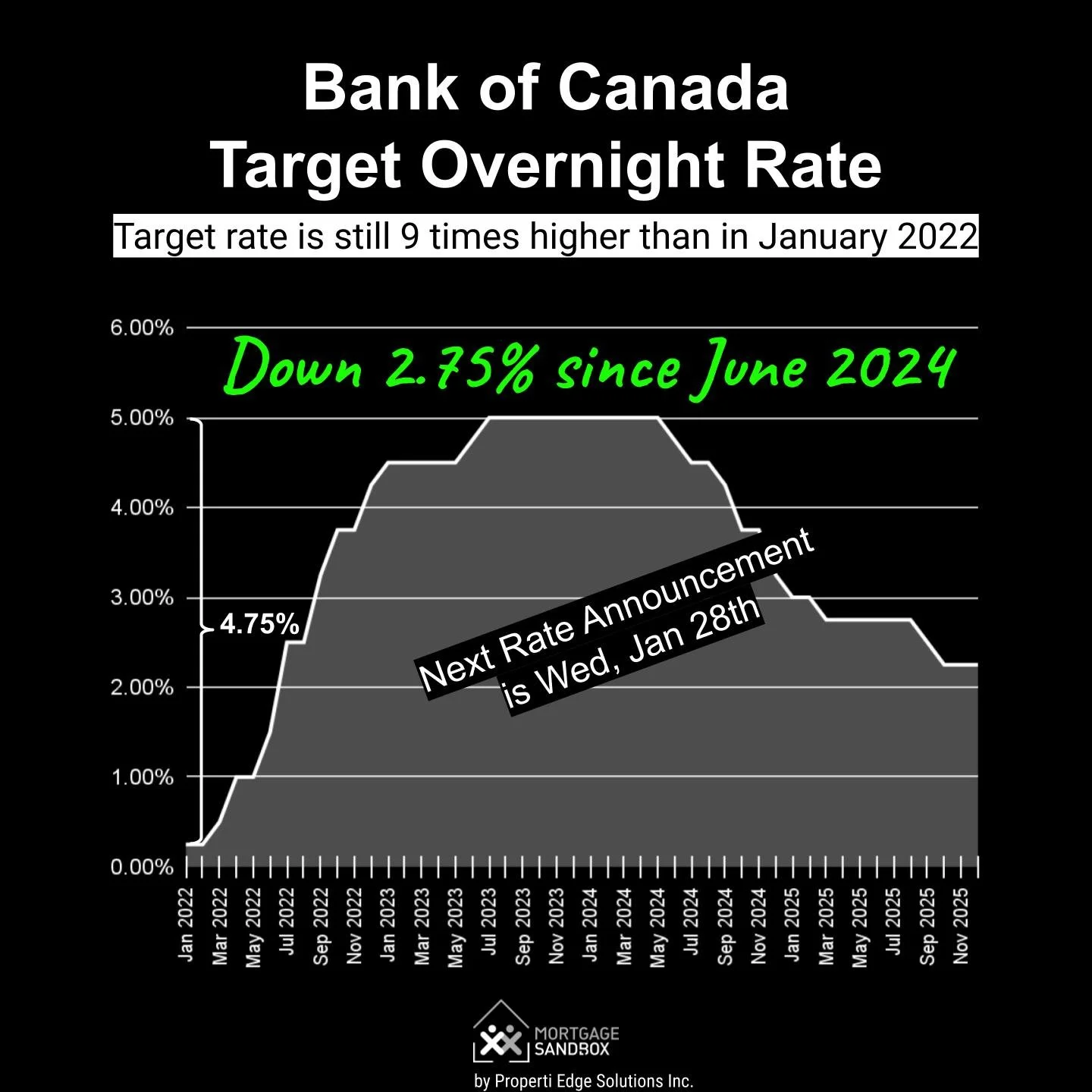

Bank of Canada Leaves Rate Unchanged: The Bank of Canada (BoC) has reduced its interest rate from 5% in 2024 to 2.25% as of October 2025. In its most recent announcement on Wednesday, December 10th, the BoC decided to keep its policy rate unchanged. The Governor of the Bank of Canada has stated that he believes interest rates are at the lower end of their range.

Variable-rate Mortgages: Variable-rate mortgages are linked to the Bank of Canada rate and are expected to move in tandem with both the bank rate and the prime rate. Therefore, they will likely remain flat until at least 2026.

Five-year fixed-rate mortgages: The typical five-year fixed mortgage rate has fallen by about 2% since its peak in November 2023. Unlike variable rates, fixed rates are linked to bond markets instead of adjustments to the Bank of Canada policy rate. They have risen slightly in recent months.

Inflation: Canada’s core inflation rate remains at 3.0%, while the total inflation rate is at 2.2%. This situation puts pressure on the Bank of Canada to maintain steady rates and even consider raising them to combat inflation. The Bank is tasked with stabilizing prices and aims for an average inflation rate of 2%.

U.S. Trade War: Additionally, Canada’s ongoing trade dispute with the United States and negotiations are stalled. This trade war could further exacerbate inflation and potentially lead to a recession and job losses simultaneously.

Outlook: According to our research, only Desjardins and BMO Bank of Montreal believe there will be one more cut to 2% sometime in 2026. The remainder (CIBC, RBC, TD, Central 1, Scotiabank, and the National Bank of Canada) believe this is the bottom of the current rate-cutting cycle.

The Bank of Canada dropped its key interest rate to 2.50% in September, but beneath the surface, trouble brews: core inflation (stripping volatile items like food and fuel) remains stubbornly high at 3.0%.

Fighting Inflation

Having started rate cuts in June 2024, the Bank of Canada is carefully steering toward neutrality. Sustained inflation in a range of around 2% is crucial for anchoring price stability.

The trade war’s inflationary impacts might limit the BoC’s ability to lower rates to support the economy, leaving it to federal and provincial governments to find ways to cushion the economic blow.

The Canada-China Trade Conflict

Prime Minister Carney is seeking to mitigate the impact on trade by securing deals abroad while demonstrating to the U.S. what they stand to lose from a prolonged dispute. Canada has signed an agreement to buy jet fighters from Sweden rather than the U.S. and has recently secured investment commitments from the U.A.E. In the past, the U.S. pressured Canada to reduce its ties with China; however, Carney has recently shifted back toward China as part of a comprehensive trade diversification strategy. While these are positive moves, they will take time to bear fruit.

The Bank of Canada Rate Forecast: Near the Bottom

Bank of Canada Policy Rate

Variable mortgage rates are shaped by the Bank of Canada’s policy decisions and lender risk premiums. While rates generally move in tandem with central bank adjustments, competitive pressures can cause deviations. Forecasts point to additional rate cuts of 0.25% to 0.75% from current levels, but caution against expectations of a return to ultra-low, pandemic-era rates.

As a result, forecasting variable mortgage rates depends on the central bank’s approach to maintaining a stable currency and encouraging economic growth.

5-year Government Bonds

The five-year fixed mortgage rate aligns closely with the yield of the five-year Government of Canada bonds, plus a risk premium reflecting the relative riskiness of mortgages. Falling bond yields suggest further rate declines, though a widening risk premium in a recessionary environment could counteract this trend.

Bond rates are currently falling, but most forecasts predict that fixed five-year rates have hit a floor and will rise toward the end of 2026 and into 2027.

Sources

To develop our analysis, we’ve surveyed the most prominent Canadian banks and their forecasts.

Current Mortgage Rates in Canada

Recent Mortgage Rate Trends in Canada

Fixed Mortgage Rates

Fixed rates have retreated from their pandemic-era peaks but are unlikely to fall as sharply as variable rates.

Optimistic forecasts suggest that the five-year fixed rate could decline to 4.2% by the end of 2025.

Variable Rates

Canada is in an “easing phase” of the interest rate cycle.

During economic downturns, recessions, or periods of low inflation, central banks lower (ease) interest rates to stimulate borrowing and spending, boosting economic activity.

Forecasts suggest the five-year variable rate could decline to 4.0%.

Impact of Rates on Homebuyer Budgets

Lower mortgage rates increase homebuying budgets.

Lower mortgage rates, while beneficial for prospective homebuyers because they increase buyer budgets, often lead to increased competition in the housing market due to Canada's persistent housing shortage.

These dynamics can offset affordability gains provided by lower rates, as limited supply coupled with higher demand may drive up property prices.

It often takes 18 months for rate cuts to ripple through the housing market.

Need a mortgage refinance?Talk to one of our affiliated Mortgage Brokers Powered by Properti Edge |

Mortgage Rate Predictions up until 2027

Fixed-rate mortgages offer stability but come at a cost. Borrowers typically pay a premium for locking in rates over longer terms. Beyond that threshold, the extra cost for fixed-rate stability may outweigh the benefits?

Will Mortgage Rates Go Down in 2026?

Will the 5-Year Fixed Rate Fall Further?

The five-year rate is expected to begin rising in 2026 and will likely remain above 4 percent.

How much further will Variable Rates Drop?

Variable rates are expected to fall below fixed rates in the medium term, but only by a quarter of a percent to one percent. Is it worth the risk to get a slight discount?

Try our mortgage offer comparison tool to calculate the dollar difference (not percent) between two offers. Find out how much cash you’ll save with a lower rate and the potential fees that come with different choices.

In Today’s Market, Is A Fixed or Variable Rate Better?

Buying or Renewing in 2025? A 3-year fixed term is a good strategy to bridge today’s uncertainty with 2026’s projected variable rate dips. The 3-year fixed rate is roughly 0.25% lower than a variable rate and slightly lower than the 5-year fixed, and when it comes to renewal, variable rates are expected to be lower.

Eyeing variable? Discounts off prime (now 4.95%) range from 0.5–1.5%, but prepare for volatility.

Borrowers are expected to come out ahead if they opt for a variable rate. The next Bank of Canada rate announcement could be a 0.25% drop, and that would match the 3-year fixed rate in just a few months. The sticking point is that more rate reductions, while senior economists may predict them, are never guaranteed.

Pros and Cons of a 5-year Fixed Rate Mortgage

Fixed Rate Mortgage Holders Will Likely Pay More

Variable rates will likely continue their downward trend in 2025. However, the decline will be modest, likely to around 4%. If you lock in a fixed rate today at 4.4% for five years, your average mortgage interest costs will probably be higher than those of a variable-rate mortgage.

However, there are no guarantees with variable rates. If inflation starts to rise, then rates might rise with it.

Fixed Rates Offer Stability But at a Cost

A fixed-rate mortgage term provides a sense of security for those anxious about volatile mortgage rates. Locking in your rate shields you from future increases, offering peace of mind—but this stability has potential downsides.

Beware of Cancellation Fee and Penalty Risks

Variable-rate mortgages are subject to a fee of three months' interest if you break the contract term (e.g., a 5-year term).

Fixed-rate mortgage penalty fees can be higher. If you break a fixed-rate contract term, you can be charged three months of interest or a fee called the interest rate differential (IRD), whichever is higher. The IRD is often higher.

Read: Mortgage Cancellation Fees and Penalties

These are important considerations for selling or relocating in the next few years. Breaking a mortgage contract before the term ends can trigger hefty penalty fees.

Not sure you've been offered a good renewal rate?Try our mortgage offer comparison tool Powered by Properti Edge |

Pros and Cons of a Variable Rate Mortgage

Variable Rates: Risk and Reward

Variable mortgage rates are usually lower than fixed rates because borrowers shoulder the risk of fluctuating interest rates. However, due to post-pandemic inflation, variable rates are higher than longer-term fixed rates.

However, variable rates are projected to drop to around 4 percent in 2025, still high by historical standards but lower than fixed rates.

While there is a broad consensus that variable rates will continue to fall, there is little agreement on what the “new normal” will look like or how quickly we will achieve it. Two-percent mortgage rates are unlikely ever to return.

Not sure you've been offered a good deal?Try our mortgage offer comparison tool Powered by Properti Edge |

How to Get the Best Mortgage Rate

We suggest contacting a Mortgage Broker as early as possible to lock in a rate. You can lock in your mortgage rate up to 120 days before closing on a home purchase or your mortgage renewal. Even if you’re taking a variable-rate mortgage, you can begin to negotiate the discount on your variable rate.

The average discount on prime for variable rate mortgages in Canada ranges from 0.5% to 1.5%, depending on the term and other factors.

Variable rate details :

3-year term: Discounts range from 0.15% to 1.50% from the prime rate

5-year term: Discounts range from 0.50% to 1.50% from the prime rate

Further Reading: Our mortgage renewal guide that will help you navigate the process.

Is it a better time to Buy or Sell a home?

More economic factors are on balance, putting downward pressure on home prices than upward pressure. However, the same could have been said during the pandemic. Markets do not always follow the logic of economic fundamentals.

Homebuyer Advice

While rates are falling, they’re still higher than the pre-pandemic 10-year average. Higher mortgage rates have shrunk the buying power of those dreaming of a bigger home. If you’re one of them, it’s time to take a hard look at your budget and adjust your expectations accordingly.

Home Seller Advice

Are you thinking of selling? Now might be the best time. Property markets in many Canadian cities are cooling because mortgage costs and higher home prices have priced many buyers out of the market.

The first half of the year typically favours sellers, and between now and January, the market typically favours buyers. If you’re in a market where prices are falling, price declines could accelerate in the second half of the year. While waiting until Spring might bring more people to your open house, by springtime, the value of your home might have dropped 2 to 10%. In these weaker markets, it could take years to recover to current prices.

Like this report? Like us on Facebook.

|

Do you have a financing strategy?Try our our Financing Strategy Explorer Powered by Properti Edge |

Canadian Real Estate Forecasts

Toronto

Real Estate Trends and Forecast

Montreal

Real Estate Trends and Forecast

Hamilton-Burlington

Real Estate Trends and forecast

Victoria

Real Estate Trends and Forecast

Vancouver

Real Estate Trends and Forecast

Ottawa

Real Estate Trends and forecast

Calgary

Real Estate Trends and Forecast

Edmonton

Real Estate Trends and Forecast

London, ON

Real Estate Trends and Forecast

Okanagan Valley

Real Estate Trends and Forecast

Like this report? Like us on Facebook.