Is the Canadian Real Estate Market a Bubble?

Here Are the Risks to Consider

The Canadian real estate market has been very volatile in recent years, but there are some risks that investors and homeowners should be aware of. This article explores the key risks to the Canadian real estate market, including high household debt, rising interest rates, and a potential recession.

Last Updated April 15, 2025.

HIGHLIGHTS

Prices peaked in the Spring of 2022, and according to our analysis, many Canadian housing markets are already bursting bubbles. There has been a price turnaround, but purchases are well below the 10-year average.

The trade wars with China and the United States have unsettled the property market. A March Reuters Poll predicted that the average Canadian house price would rise 2% in 2025.

In its vulnerabilities assessment, the Bank of Canada has expressed the greatest concern with inflated real estate prices (real estate market imbalances) and high household debt because they make Canadians more vulnerable to an economic crunch.

Since the pandemic's lows, fixed five-year mortgage rates have remained above 4%, and higher rates lead to higher homeownership costs.

With most cities exhibiting moderate or high-risk indicators, Canadians should buy homes as a shelter and lifestyle choice rather than considering real estate a low-risk and high-return investment.

What is Risk?

Economists measure risk in terms of volatility and uncertainty. Volatility occurs when prices in a market move dramatically (e.g., up or down). Uncertainty occurs when price movements are unpredictable (e.g., not connected to local economics and not following the seasonal real estate cycles). This article will examine Canadian real estate price volatility and uncertainty, but we want to address the elephant in the room before forging ahead.

What is a Bubble Burst?

A bursting bubble is a market correction that leads to a drop in values greater than 20 per cent. Anything less than 20 per cent is considered a market correction.

From peak to trough, Canadian average home prices dropped 25 percent between 2022 and 2023.

Similarly, the number of purchases dropped dramatically.

Technically, a bubble burst in 2023, but the big question is whether the market has hit bottom or has more room to drop. The market has failed to gain pace with mortgage rates around 4 percent; more time may be needed for sellers to adjust price expectations downward to a level where buyers can afford to make offers.

Property Price Volatility

In the past two years, Toronto and Vancouver’s prices have risen, fallen, and risen once again. In Spring 2022, ‘benchmark’ house prices in both cities peaked and trended downward.

Was Canada in a real estate bubble? Did the bubble burst in 2022, or was that simply a mild correction? Do all bubbles eventually burst?

The Toronto and Vancouver housing markets (which touch almost 1 in 3 Canadians) are volatile. Toronto experienced a correction in 2022, and even though prices are stable, the market has low transaction volumes. A growing share of people want to sell and a shrinking share of people are willing to buy.

Vancouver hit a bump in 2022, but prices bounced back immediately. Vancouver also has low market activity but stable prices, for now.

From an economist’s standpoint, a market that swings wildly upward is likelier to drop downward. Hence, there is growing concern that the recent upward swing, if it overshoots, could lead to another sizeable downward swing. Especially, if demand from buyers doesn’t pick up.

According to the Teranet-National Bank House Price Index™, prices across Canada are over 4 percent short of the Spring 2022 peak. Toronto is down 12 percent from the peak, Ottawa is down 6 percent, and Hamilton is down 16 percent. Cities in British Columbia have fared better, dropping 16 to 5 percent from the peak.

Uncertainty

When property prices have distanced themselves from local incomes and economic fundamentals, they become more dependent on buyer sentiment. At the moment, buyer sentiment is negative and dropping.

In times like this, people start reaching for other explanations for why prices will remain high.

The most persuasive argument suggests that home values will remain high because there is very little housing supply, Canada’s population keeps growing, and the supply will never catch up to demand.

However, the 2023 correction happened even with record population growth.

In 2024, the federal government pivoted on immigration policy to curb overall inflows, raising the prospect of a population decline in 2025. Under the new plan, Canada’s population is expected to decline by 0.2% in 2025 and 2026 before returning to a population growth of 0.8% in 2027. A shrinking population could weigh on economic growth and housing demand, challenging the market dynamics that have driven prices upward in recent years.

Supply is more complicated than total housing stock. New listings can drive up supply in the short run. Active condo apartment listings are breaking records in Toronto and rising steadily in other markets.

Metro Toronto Condo Apartments for Sale | Active Listings

Metro Vancouver Condo Apartments for Sale | Active Listings

The cost of ownership has risen to levels not seen in decades, and even though many people may want to buy, very few will be able to at current prices. Also, many existing owners facing rising costs might cash in their equity instead of subsidising their real estate investment from their savings. A recent report estimates 81 percent of new condo rentals in Toronto are losing money every month.

Recently, affordability has improved across Canada because mortgage rates have decreased, but buying property is still out of reach for the majority of potential buyers.

Price growth reduces affordability and creates downward pressure on prices. As a rule of thumb, homeownership costs are considered unaffordable when they exceed 40% of household income. Recently, affordability has worsened across Canada because mortgage rates have increased.

Vancouver homeownership costs are 97% of median household income.

Toronto homeownership costs are 75% of median household income.

Ottawa homeownership costs are 47% of median household income.

Montreal homeownership costs are 49% of median household income.

Calgary homeownership costs are 42% of median household income.

To put it plainly, we could argue that 100% of Canadians want to own a home, but higher borrowing costs and prices make home ownership out of reach for most younger Canadians.

If economic fundamentals reassert themselves, according to the International Monetary Fund (IMF), that would lead Metro Toronto and Metro Vancouver home prices to drop significantly.

When buyers see a hot market softening significantly, they begin to fear a crash, and these feelings of uncertainty prompt them to take a ‘wait-and-see’ approach. They want to avoid buying at a peak when waiting a few months may save them five percent or more on the price of a home.

In a weak market, potential homebuyers wait for news that inspires more confidence in an upward price movement.

Buyers can almost always wait, but sellers facing financial challenges may not have the luxury to defer their home sale until the market recovers.

Who else believes there is risk in Canadian real estate?

Before the recession, some of the most respected economic analysts in the world believed there was concrete evidence that Canadian real estate was at a high risk of a significant correction.

The Bank of Canada

In early December 2023, the Bank of Canada released a report that delved into two housing-related vulnerabilities: the elevated level of household indebtedness and high house prices.

Bank of Canada Vulnerability #1: High household debt

Canadian Debt to Disposable Income Has Been Rising Steadily

“Turning to high indebtedness, a key concern here is that financially stretched households have little breathing room to absorb any disruption to their income. A job loss could force many to drastically cut their spending to keep servicing their debt. A drop in housing prices could also reduce household consumption because many people use their home as collateral to secure a home equity line of credit or refinance their mortgage. And an increase in unemployment or drop in house prices would have worse effects on the economy today because both debt levels and the share of wealth concentrated in housing have risen over time”

In a speech to the Ontario Securities Commission, the Bank of Canada Governor Tiff Macklem acknowledged rock-bottom interest rates are inflating house prices and that The Bank is monitoring Canada’s heavily indebted households.

“Let me sum up our current assessment of the housing market. House prices have increased significantly over the pandemic. The moderation that we saw until recently pointed in the right direction, but housing remains very expensive. And the risk of a correction in some markets is a concern that we need to watch,” Macklem said.

During the pandemic, because of record-low interest rates, Canadian insolvencies plummeted.

Insolvencies have returned to the long-term average and are trending upward.

What will happen as homeowners renew their mortgages at higher rates? Interest costs on variable-rate mortgages have more than doubled since the beginning of 2022.

In its latest Annual Risk Outlook, the Office of the Superintendent of Financial Institutions (OSFI) noted that more than one-third (36%) of Canadian mortgages will be up for renewal by the end of 2026.

Equifax reveals significant increases in mortgage delinquency rates across Canada. Montreal, Vancouver, and Toronto witnessed the most substantial surges, with delinquency rates jumping by 36.0%, 28.4%, and 25.8% year-over-year.

A recent study by TransUnion Canada found that nearly a third (30%) of Canadians report that they expect to be unable to pay at least one of their current bills and loans in full. To manage these financial pressures, this group is considering increased reliance on credit (33%). The "Q4 2023 TransUnion Canada Consumer Pulse" study also reveals that Canadians are adjusting their spending habits in response to rising living costs. Over half (57%) plan to cut back on discretionary spending, while 22% explore credit options like applying for new cards or refinancing existing ones.

Bank of Canada data highlights that loan arrears are rising - typically, there is a waterfall effect. People first fall behind on consumer loans (buy now pay later deals), then credit cards, followed by auto loans and mortgages. This is because most people need a car to get to work and a house to live in so debt is the last to fall behind.

With record-high debt and rising interest rates, Canada could be headed for a high financial stress event.

In 2013, the Bank of Canada published a paper providing examples of financial stress events. Remember, these impacted financial markets and often resulted in recessions but did not necessarily result in a significant house price drop. We have added the COVID-19 Pandemic to the list of stress events:

2020 - The Coronavirus Pandemic resulted in government and Bank of Canada emergency intervention.

2007 - Lehman Brothers bankruptcy leads to the Great Recession

1994 - Mexican peso crisis

1992 - Black Wednesday, European exchange rate mechanism crisis

1989 - Toronto house price collapse

Bank of Canada Vulnerability #2: Imbalances in the housing market

The biggest concern was Canadians taking out large mortgages to buy homes, so it is no coincidence that their second most pressing concern is the housing market.

“When house prices grow at a faster pace than can be explained by economic fundamentals, a price correction that leads to financial stress becomes more likely. This can be serious when buyers are highly indebted.

Overall, imbalances in housing have diminished but remain an important vulnerability. Froth from rising expectations of house price growth has declined in housing markets in the Toronto and Vancouver areas over the past two years. While the Toronto market appears to be stabilizing, prices and resale activity continue to decline in Vancouver. Ongoing difficulties in the oil sector are weighing on housing markets in oil-producing provinces.”

In other words, if homes become too unaffordable, there is a risk that affordability will be reached and economic fundamentals will be re-established through a significant price correction.

Commercial Banks

The CEO of Scotiabank and the Chief Economist for CIBC feel that these risks are much less likely to affect Canada. These banks have huge mortgage portfolios and are closely watching these risks. These same banks have been tightening their mortgage rules.

RBC Royal Bank

Their 2024 annual report acknowledged that Canadian housing and high household indebtedness are key risks. They didn’t mention that the U.S. was exposed to this area.

“Canadian housing and household indebtedness risks remain heightened given the current interest rate environment and affordability challenges. Concerns around the ability of Canadian households to meet debt obligations could escalate if interest rates remain elevated for longer, if there is a resurgence in inflation, or if the job market deteriorates significantly, potentially resulting in, among other things, higher credit losses or reduced housing market activity. Moreover, slowing economic growth could further adversely impact housing market activity and housing prices, which could push loan-to-value (LTV) ratios higher and further increase credit losses. While interest rates have started to decline, a slowdown in the real estate rental market, challenging affordability conditions, an increase in condominium supply, and elevated borrowing and construction costs, may have an adverse impact on future real estate investment and demand. The combination of multiple challenges, including but not limited to elevated home prices, high debt levels, an increasingly high cost of living, a rising unemployment rate and government policy uncertainty (e.g., immigration policy), may make key Canadian housing markets particularly vulnerable to a potential economic shock or financial instability.”

RBC feels that they are managing this risk well and they continue to provide new mortgages. They are the largest mortgage provider in Canada with $389 billion in Canadian mortgages outstanding in 2024, up $30 billion from 2023.

UBS Bank

According to UBS, a Swiss bank that serves the world's ultra-wealthy, six financial centres are in high or elevated bubble territory. Toronto is in the company of the cities at an elevated risk. Vancouver is at moderate risk.

NOTE: UBS issues their updated Bubble Index in early October each year.

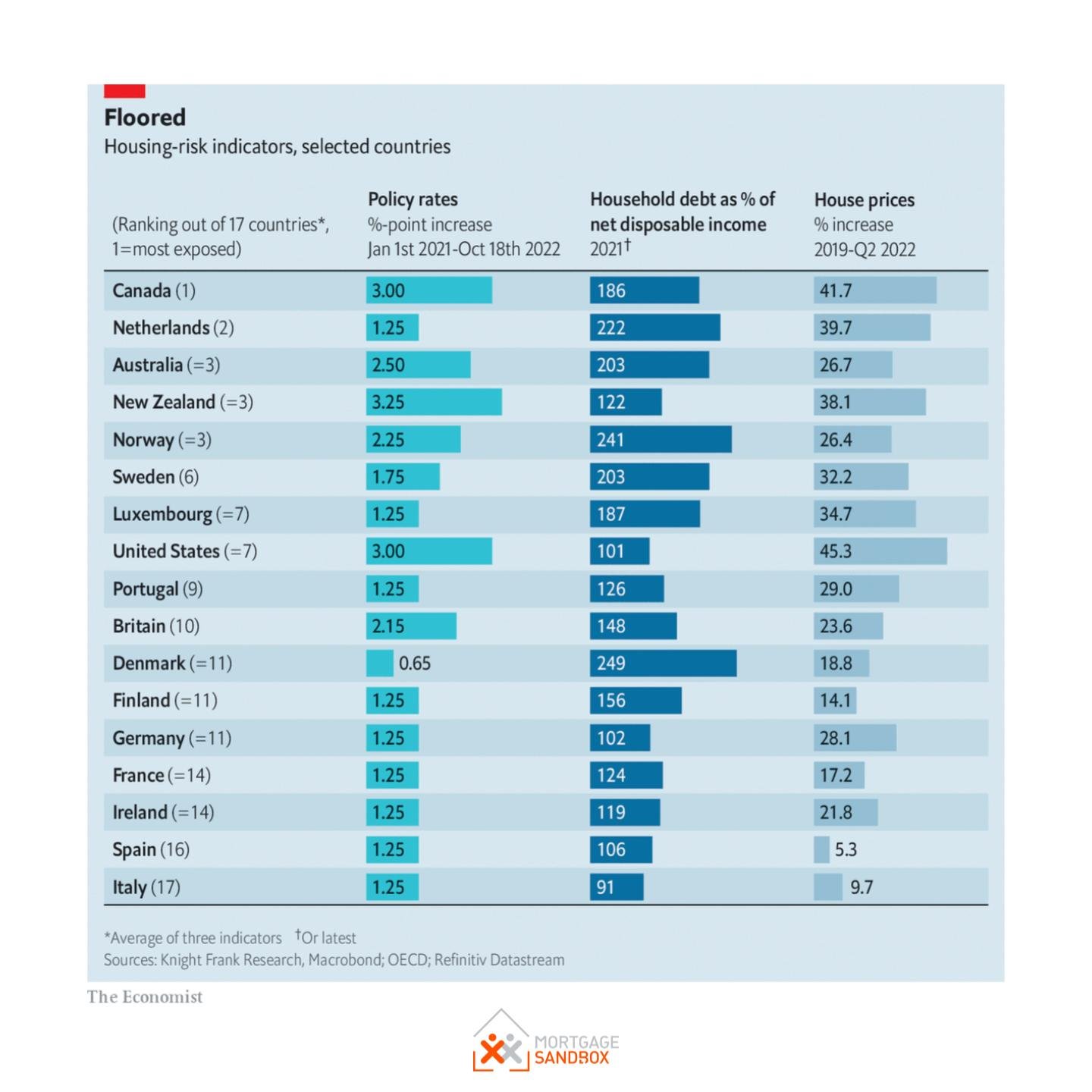

The Economist Magazine

Frontier Centre for Public Policy

The Urban Reform Institute and the Frontier Centre for Public Policy, in their Demographia International Housing Affordability Survey, found that the affordability issue is particularly critical due to the strong increase in remote working (telework) during the pandemic.

Mortgage Sandbox Analysis

Our risk assessment concludes that most of the larger Canadian cities are moderately vulnerable, with Kelowna and Calgary being the most vulnerable.

Concerned by real estate market risk, CMHC and the Canadian Federal Bank Regulator began enacting policies in 2008 to reduce the amount Canadians could borrow.

2008: Reduced the maximum lifespan of a mortgage from 40 years to 35 years.

2010: Applied a stress test against the 5-year mortgage contract rate with a down payment of less than 20%.

2011: Reduced the maximum lifespan of a mortgage from 35 years to 30 years.

2012: Reduced the maximum lifespan of a mortgage from 30 years to 25 years on mortgages with a down payment of less than 20%.

2016: Banned default insurance on refinances, mortgages over 25 years, and single-unit rentals.

2018: Applied a stress test to mortgages with a down payment of over 20%.

2020: Raised the credit quality requirements for mortgage applications.

2024: Raised the price limit for properties eligible for default insurance from $1 million to 1.5 million and increased the allowable amortization from 25 years to 30 years - only for first-time homebuyers purchasing newly built homes. This last change allows people to borrow more but benefits a tiny share of Canadians. You would need a combined household income of $240,000 and $200,000 in savings to buy a home worth over $1 million with an insured mortgage.

The continued government interventions show unabated concern about elevated household debt levels and potentially unsustainable home values.

Office of the Superintendent of Financial Institutions (OSFI)

The Office of the Superintendent of Financial Institutions (OSFI), the government agency that oversees bank risk, says “key vulnerabilities include Canadian household indebtedness.” On June 4th, 2019, the amount of capital Canadian banks need to hold increased to weather a financial crash. The regulator ordered Canadian banks to take out a more extensive insurance policy against a financial crisis.

OSFI is the same government arm that, in January 2018, required Canadian banks to apply a stress test when Canadian borrowers apply for a mortgage.

What about other International Economic Institutions?

Based on BIS’s analysis, Canada has a greater than 50% chance of a financial correction (BIS would call it a “stress event”).

Finally, in June 2019, the IMF said that in the event of a downturn, Canadian banks will be fine while Canadian households are vulnerable. The impact on families would be significant as the share of households with debt at risk (defined as households with mortgage payments greater than 40% of income) would increase from 17% to 29%. If that happened, defaults would rise, and the Federal government would have to inject C$15 billion into the Canada Mortgage and Housing Corporation (CMHC).

Canada was risk-laden before the pandemic. Our regular debt payments are too high relative to our income, and the situation will worsen if the 5-year interest rate continues to rise.

At the core of these warnings is a belief that people’s loans should not exceed their ability to repay them. In the short-term, this means smaller home buying budgets since most Canadian debt is to support home purchases.

Will home prices drop? For how long?

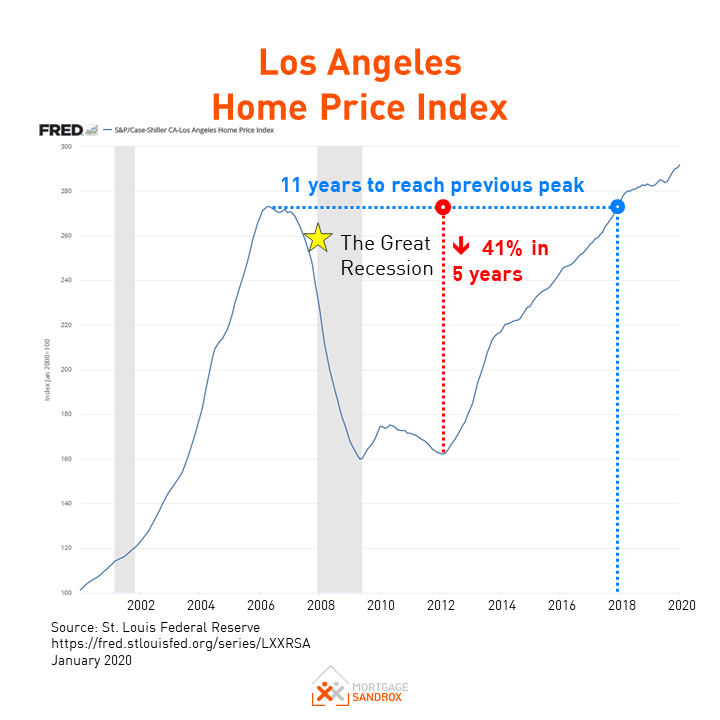

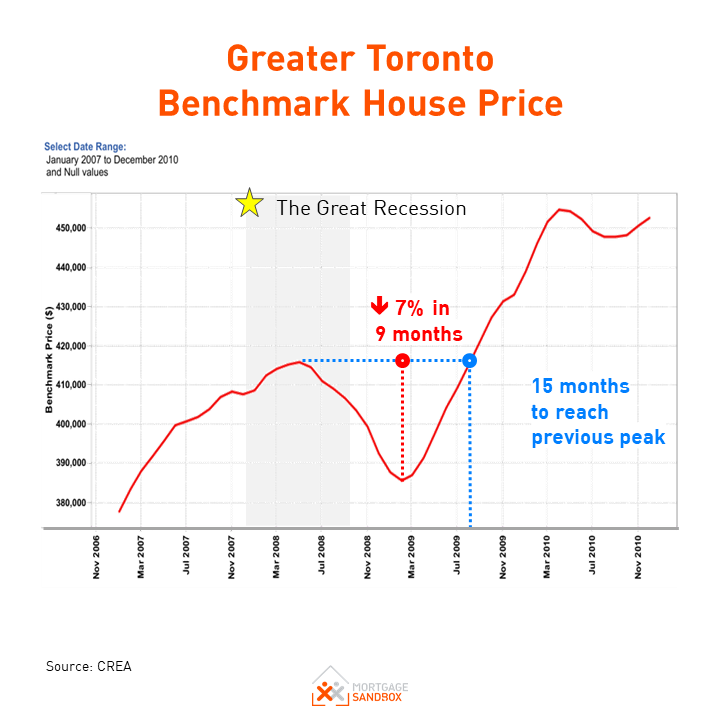

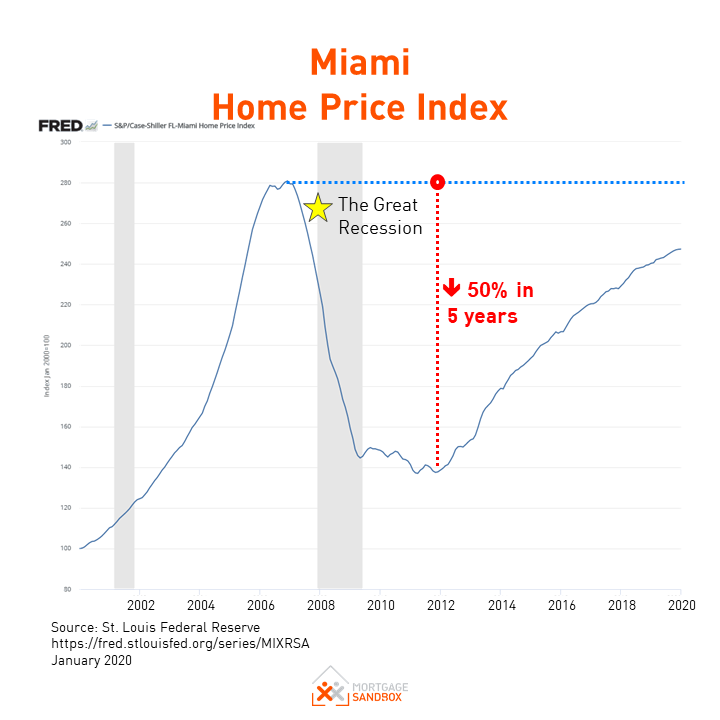

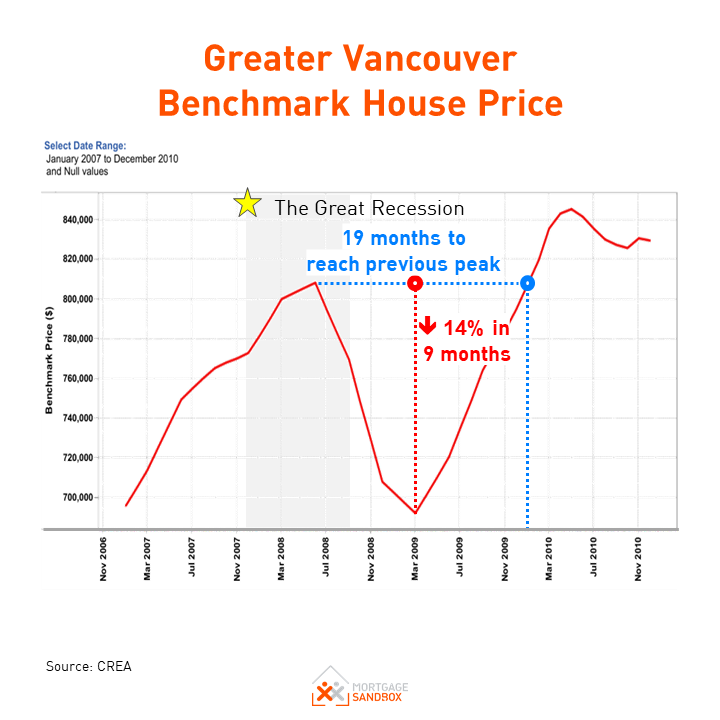

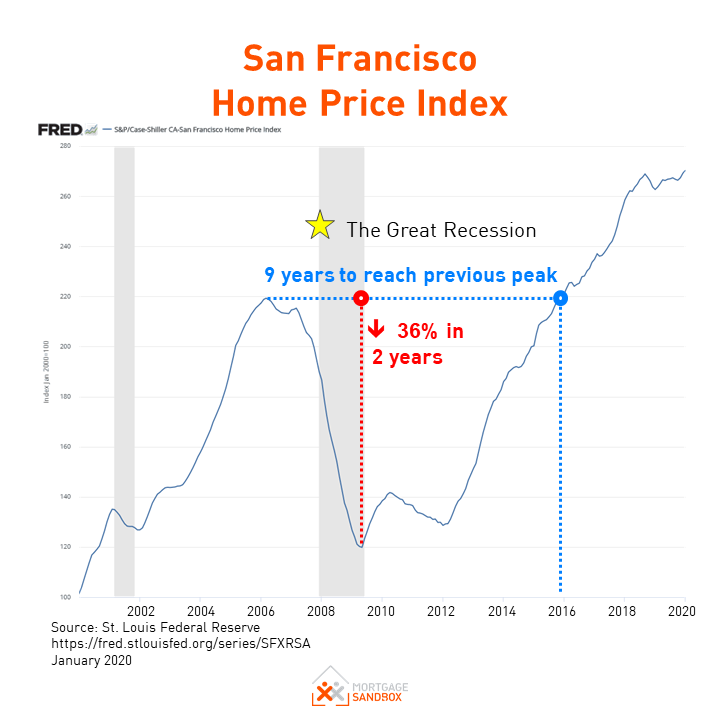

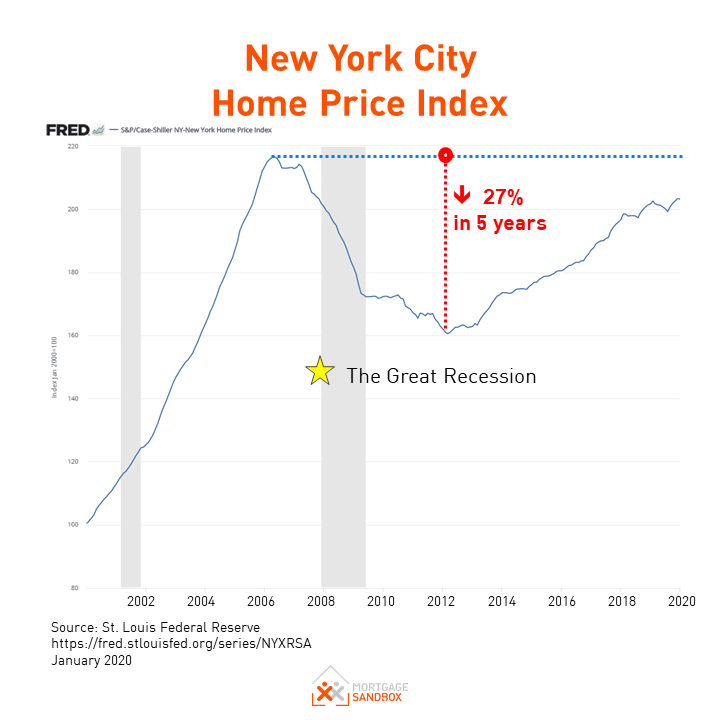

If past economic patterns are good predictors of future economic mechanics, we can use the 2008 Financial Crisis as an example.

In the financial crisis, local markets behaved differently, and we saw that price drops ranged between 7% and 50%. In some cases, it took a decade for home prices to reak their previous peak.

What should I do?

This article is important in the spirit of transparency because many in this industry avoid discussing the downside risks in real estate values. Buyers and Sellers need to be aware of the risks to make well-informed decisions.

Should Homeowners Sell?

If you will need to sell within 3 years, or your retirement savings are tied up in real estate, then you may want to sell now. We recommend you discuss this with a real estate agent and a financial advisor first. Your local market may be insulated from a housing correction.

Is it a Good Time to Buy?

A wait-and-see approach may be prudent. It can take two or more years for real estate values to hit bottom and mortgage rates are expected to be lower in 2025. If your family is growing, then go ahead and buy, but be sure to drive a hard bargain.

Like this post? Like us on Facebook for the next one in your feed.