Okanagan Valley

Real Estate Trends and Price Forecast

HIGHLIGHTS

Okanagan home values have been volatile since 2021. Values have recently been flat.

While industry experts saw signs of improvement in late 2024, conditions have since deteriorated.

Multi-factor analysis identifies the Okanagan as a higher-risk real estate market.

Mortgage rates have eased from their peak but remain high relative to the 2010–2020 average, limiting buyer budgets.

Economic uncertainty is rising due to Canada’s recent migration policy shift and the Trump administration’s tariffs, which could further weigh on the market.

This article covers:

What is the state of the Okanagan property market?

Where are prices headed?

Should investors sell?

Is this a good time to buy?

1. What is the state of the Okanagan property market?

Home Price Overview

The Okanagan Valley in British Columbia holds a unique appeal, distinct from both Vancouver and Victoria. Here's what makes it so attractive:

Warm and Dry Climate: The Okanagan boasts a semi-arid climate, with hot, dry summers and mild winters. This is a major draw for those seeking sunny weather and an extended outdoor season.

Lake Lifestyle: The region is dotted with beautiful lakes, most notably Okanagan Lake, providing ample opportunities for swimming, boating, fishing, and other water sports.

Wine Country: The Okanagan is renowned for its thriving wine industry. Numerous wineries offer tastings and tours, attracting wine enthusiasts from around the world. The beautiful vineyard scenery is also a huge plus.

Outdoor Recreation: Beyond water sports, the Okanagan offers excellent hiking, biking, and golfing opportunities. In the winter, there are nearby ski resorts.

Agricultural Abundance: The region's fertile soil and sunny climate support a vibrant agricultural sector. Fresh produce, including fruits and vegetables, is readily available at farmers' markets and roadside stands.

Relaxed Pace of Life: Compared to the bustling urban centers of Vancouver and Victoria, the Okanagan offers a more relaxed and laid-back lifestyle. This appeals to those seeking a slower pace and a greater connection to nature.

Growing Communities: Towns like Kelowna are experiencing growth, offering amenities, and services that are increasingly drawing in people of all ages.

Supply levels have been higher than in previous years at this time of year. Buyers have a greater advantage, and sellers have less power in negotiations.

|

Not yet pre-approved for a mortgage?Talk to one of our affiliated Mortgage Brokers Powered by Properti Edge |

Okanagan Valley Detached House Prices

Since the peak in Spring 2022, house prices in the Okanagan have fallen significantly. Higher interest rates are weighing on the market. While values have stabilized, many factors are influencing prices lower.

Our politicians are striving to return the market to a more typical real estate cycle, where prices grow consistently and modestly at an annual rate of 1 to 3%, in line with income growth.

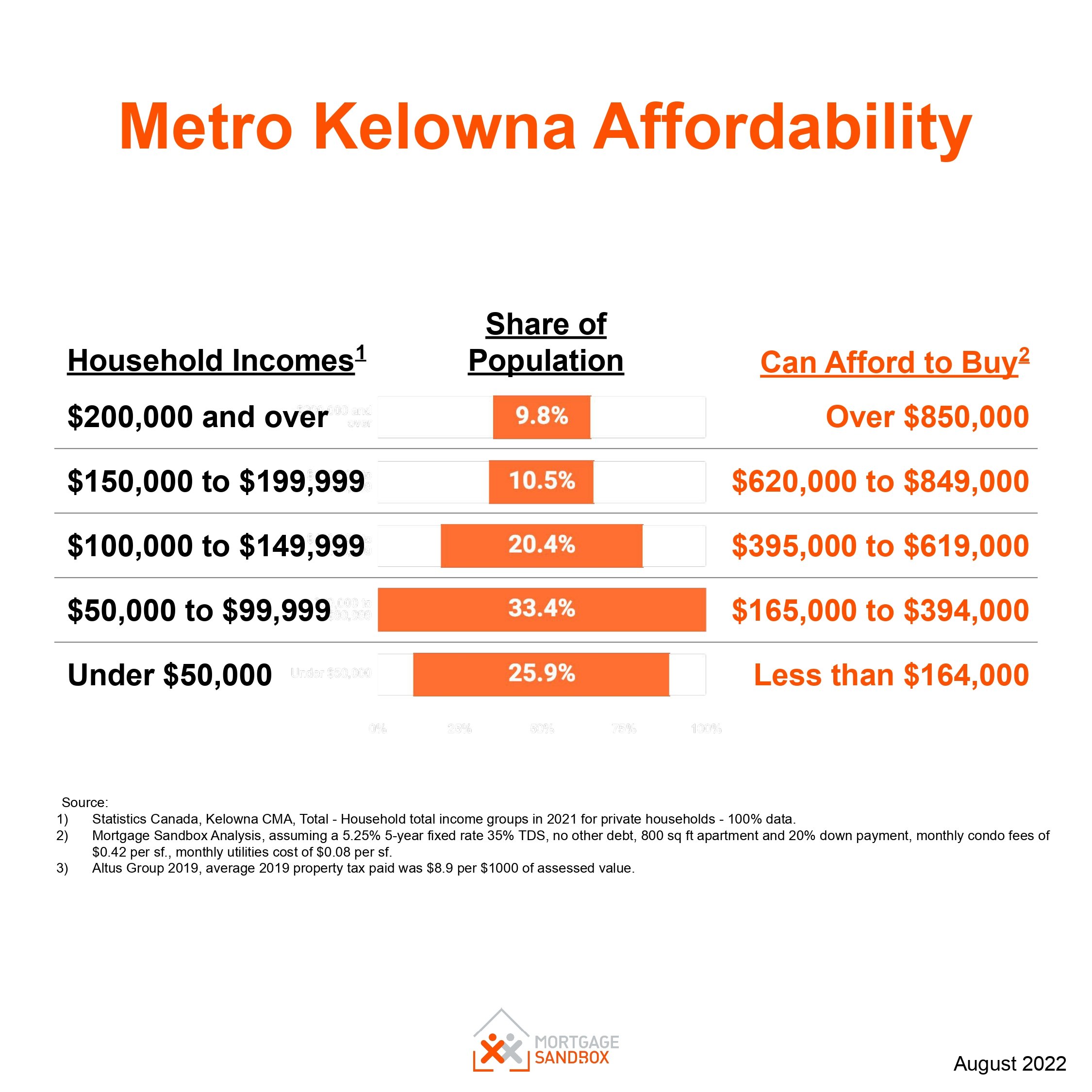

Demand in the Okanagan is low. Many people want to buy a home, but affordability is very low, which is reflected in the number of successful purchases. Significantly fewer people can realize their homeownership dream in these market conditions.

New homebuyers can’t afford to get onto the first rung of the homeownership ladder, and high rates trap existing owners. Families that want to upgrade to a larger home can’t qualify for a new mortgage at the current rates.

Meanwhile, the total active listings are trending upward. They are at their highest level in three years.

Metro Kelowna New Construction Home Prices

Prices of new homes are on a long-term downward trend, and some new construction homebuyers who locked in their price in 2022-23 might find they will have paid much more than the most recent buyers in their development.

Does this concern you? Read the Pros and Cons of Buying Pre-sale Homes

Market Risk

Based on Mortgage Sandbox Analysis, Kelowna is at high risk of a significant market correction.

Our platform matches you with local, pre-screened, values-aligned Realtors.

Shared values make better working relationships.

Okanagan Condo Prices

Like house prices, the Okanagan benchmark apartment price is trending sideways.

Purchases are picking up, but the increased demand is not keeping pace with sales listings. Active listings are higher than in the last three years.

With more people working-from-home, we expect developers will begin marketing larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floor plans comes to the market, it may depress the values for small floor plan condos.

At Mortgage Sandbox, we would like developers to build 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Canadians who now work from home need more room to segregate workspace from living space within their homes.

Many Canadians with longer working hours find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

Okanagan Valley Townhouse Prices

Sub-market Reports

Still a challenge for first-time homebuyers

Although Okanagan home prices have moderated, they are still not very affordable. A homebuyer household earning $71,000 (the median Metro Kelowna household before-tax income) can only get a $270,000 mortgage. For that household to buy a condo, they would need to save at least $100,000 cash for a down payment or receive a very generous gift from family. For most people, that’s just not on the cards.

What about the rest of B.C.?

Read the Vancouver Home Price Forecast and Victoria Home Price Forecast.

Are you interested in specific areas of the Okanagan Valley? Try these reports!

2. Where are Okanagan Valley home prices headed?

There is a lot of uncertainty in the forecasts for looking out toward 2027. Many of the forecasters we've surveyed have different expectations for:

Will the federal government’s recent migration policy pivot lead to a shrinking population?

Will mortgage rates drop to the 2 to 3 percent range that Canadians have grown used to?

Will Canada’s trade wars with China and the United States lead to a recession?

How do we arrive at our forecast range? Check out our full assessment of the five factors that drive these forecasts. These five forces help explain why several forecasters are anticipating price drops.

Need a Realtor?

We match you with local, pre-screened, values-aligned Realtors and Mortgage Brokers.

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many real estate risks can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms. We then present the most optimistic estimates, the most pessimistic prediction, and the average forecast. Do you want to learn more about real estate risk?We've written a comprehensive report explaining the uncertainty level in the Canadian real estate market.

Our forecast inputs:

Get a mortgage broker to pre-approve you

Realtors want you to be pre-approved before you look at homes

3. Is it a good time to sell a home in the Okanagan?

From a seller’s perspective, more changes in the market influence prices downward, so this year may be a better time to sell than in two years. Remember that the house and apartment markets are on different trajectories too.

The annual real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

Fixed or Variable rate mortgage?

Find out where mortgage rates are headed before you start to negotiate.

4. Is it a good time to buy an Okanagan property?

Prices have been flat or falling, and supply is higher than during the pandemic. Mortgage rates are relatively high and falling. Also, the annual real estate cycle usually favours buyers in late summer and autumn.

These factors would lead buyers to conclude that later in 2025 or 2026 will be a better time to buy than now.

It's almost impossible to time the market perfectly. However, if you are buying your forever home and don't plan to sell for ten years, the risks of buying now are lower than a year ago.

If you are considering buying, be sure to drive a hard bargain and pay as close to market value as possible. Also, don't bite off more than you can chew when it comes to financing.

Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

How much home can you afford?

Our mortgage calculator takes uses up-to-date mortgage rates and calculates the price of a home you could afford.

Here are some recent headlines you might be interested in:

Bleak outlook for B.C. real estate as TD predicts prices to drop (BIV | Apr 02)

Liberals’ vow to cut GST for homebuyers may not cut it in Vancouver (City News | Mar 20)

Vancouver’s housing market better prepared for tariffs than Toronto’s, says TD (BIV | Mar 18)

Canada’s housing market retreats amid trade war (RBC Thought Leadership | Mar 17)

CREA reports home sales fell in February amid tariff uncertainty (City News | Mar 17)

Mortgage payment shock risk surges as renewals near (MPA | Mar 17)

Canada housing market unlikely to surge despite plunging interest rates (MPA | Mar 14)

Why Canada's economy – and real estate industry – thrive on dirty money (MPA | Mar 13)

Canadian housing markets struggle as U.S. trade woes mount (REM | Mar 12)

Mortgage broker sees Ontario home prices ‘grinding down’ amid trade war (BNN Bloomberg | Mar 12)

Like this report? Like us on Facebook.