Bank of Canada’s Rate-Cutting Marathon: Are We Near the Finish Line?

In a decisive policy shift, the Bank of Canada (BoC) recently reduced its policy rate by half a percent, bringing it down to 3.75%. This cut is part of a series of reductions totalling 1.25% since June, as the Bank tries to boost the Canadian economy in response to slower growth and easing inflation. Economists expect this could be just the beginning, with different forecasts on how far the BoC will ultimately go. Financial experts agree the BoC may have to keep cutting rates to support the economy, but they don’t all agree on how low the rate will go or how fast the Bank should get there.

Faster Rate Cuts in Response to Slowing Growth

According to RBC Economics, Canada’s economy is struggling, and the BoC will likely need to continue with more cuts. RBC predicts that the Bank will lower the rate by another half percent in December and then move to smaller cuts of a quarter percent in early 2025 until it hits a target of 2% by mid-2025. RBC believes these cuts are necessary because growth is lagging, with GDP (a measure of economic health) expected to grow only 1% this quarter—a figure far below earlier predictions. Canada’s job market is also looking weak, with fewer job openings and higher unemployment, which makes rate cuts seem like the right choice.

Desjardins sees things similarly, although they believe the BoC may stop at a slightly higher rate of 2.25% by mid-2025. Desjardins points to the slowing population growth in Canada, especially among non-permanent residents, and the large number of mortgages set for renewal at higher rates in 2025 and 2026. These pressures, they argue, make it necessary for the BoC to reduce rates quickly to help ease financial stress on Canadians.

“[T]he headwinds to growth are only just starting to come into view. Population growth, particularly among non-permanent residents, has only recently started to show signs of slowing as fewer study permits have been issued to foreign students. The mortgage renewal wall is also just around the corner in 2025 and 2026…, and the case for a more rapid return to the neutral rate is now quite strong.” ~ Desjardins Economic Finaincial Outlook, October 2024

Meanwhile, Scotiabank suggests a more cautious approach. Their economists expect that after the recent half-percent cut, the BoC will move to quarter-percent cuts, bringing rates down to around 3% by the middle of 2025. Scotiabank thinks the BoC’s gradual cuts will help balance inflation control with the need to support housing and consumer demand. They warn that any additional government spending related to Canada’s upcoming elections could fuel consumer demand and make it harder for the BoC to keep inflation under control.

“[W]e continue to believe there are meaningful upside risks to consumption and housing market activity that should make the Bank of Canada more cautious in cutting interest rates”. ~ Jean-François Perrault, Senior Vice-President and Chief Economist at Scotiabank

Inflation on Target but Risks of Going Too Low

RBC also warns that with inflation slowing, there’s a risk of it going lower than the BoC’s target range of 1%-3% by next year. RBC argues that as the Canadian economy weakens, there is little standing in the way of further rate cuts. They believe inflation could even drop to the lower end of the BoC’s target range, allowing the Bank to continue cutting rates aggressively, eventually reaching the low target of 2%.

TD Bank, on the other hand, cautions against these large rate cuts. They believe the BoC should aim for a rate of around 2.75% to stay within a safe range for the economy. TD and Scotiabank’s economists worry that aggressive rate cuts could lead to a jump in housing demand, which could increase prices and lead to more inflation. Since Canadians have responded strongly to past rate cuts, TD warns that rapid reductions might ultimately make it harder for the BoC to maintain stability.

Population Growth and Labour Market Struggles

RBC and Desjardins are also concerned about Canada’s slowing population growth, especially given recent government plans to limit the number of non-permanent residents coming to Canada. This change could impact Canada’s economy since fewer new arrivals would mean slower growth in the labour force and potentially less demand for housing and other services.

RBC expects that rate cuts will help boost consumer spending and job growth in the second half of 2025 but warns that slower population growth will make it harder for the Canadian economy to grow.

Where Will Rates Settle?

While financial experts disagree on the exact target rate, they expect the BoC to land somewhere between 2% and 3% by mid-2025. RBC predicts a lower end at 2%, while Scotiabank and TD are a bit more conservative, suggesting a slightly higher rate.

RBC’s more aggressive forecast is rooted in concerns about the continued weakening of Canada’s economy. At the same time, TD and Scotiabank take a more cautious approach, focusing on the potential risks of rapid rate cuts.

As Canada heads into an election year, the BoC’s journey isn’t over yet, and shifting economic conditions mean it will need to navigate carefully to balance supporting growth with keeping inflation steady.

What does this mean for mortgages?

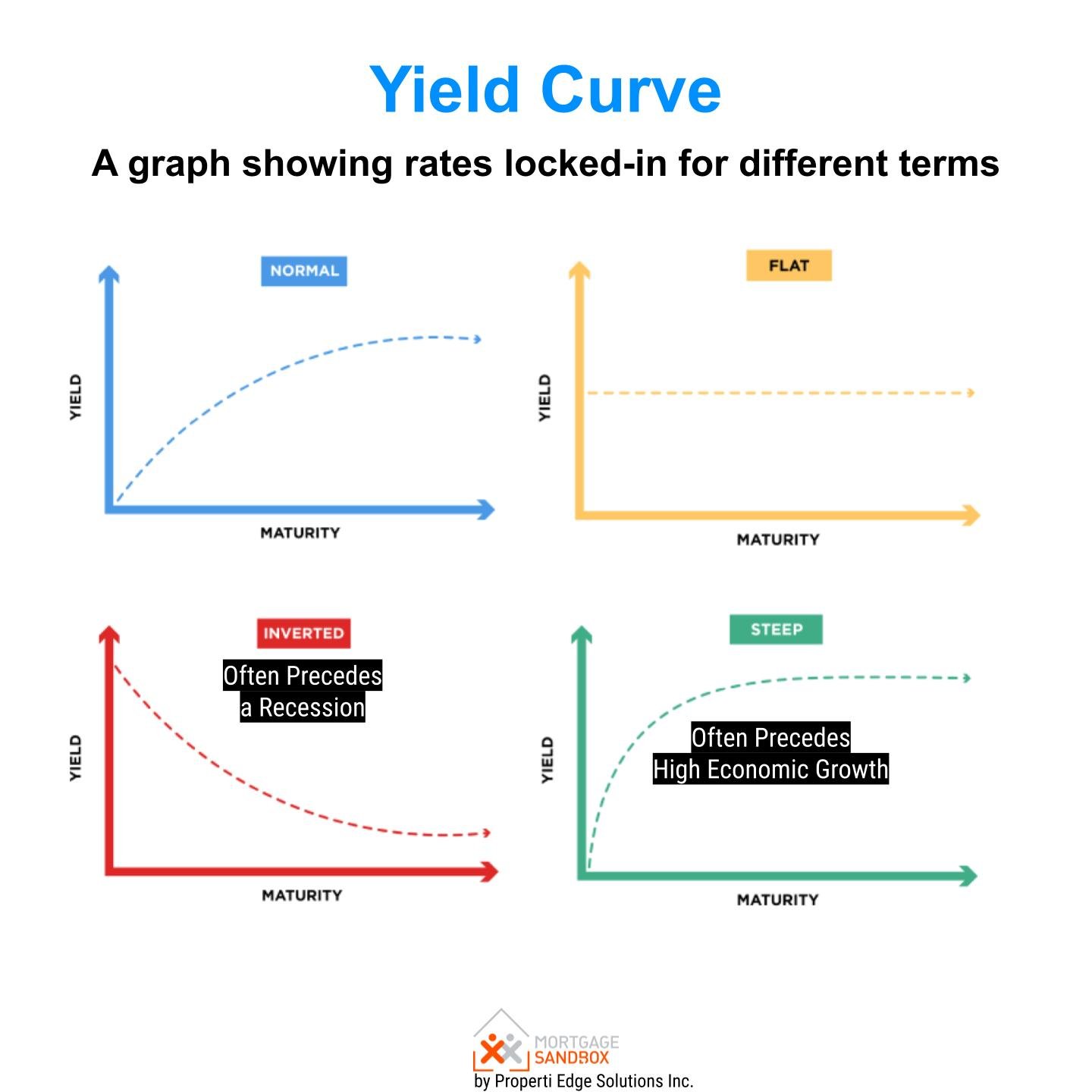

The BoC’s projected rate cuts could bring significant relief for homeowners with variable-rate mortgages. With economists forecasting the BoC’s rate to eventually land between 2% and 3%, variable mortgage rates are expected to drop by roughly 0.75 to 1.75 percent. This would lower monthly payments for many borrowers with variable-rate mortgages. However, those hoping for a big drop in the popular 5-year fixed rate may be disappointed. The BoC’s cuts aim to normalize the interest rate curve, where typically, short-term rates are lower than long-term rates. Currently, short-term rates sit higher than long-term rates, so as the BoC reduces its rate, it is primarily normalizing the angle of the curve rather than pushing down the entire curve.

This means that most rate changes will impact variable rates, with only a modest effect on fixed rates. Since mortgage qualification is calculated using fixed rates rather than the often-lower variable rates, the BoC’s cuts may have a limited effect on overall affordability for new borrowers. Buyers will not qualify for significantly larger mortgages in a year.

Fixed-rate mortgages, often preferred for their stability, may still be less affordable in the near term despite the central bank’s rate cuts. Potential buyers will need to consider how fixed-rate qualification standards impact their purchasing power.