Penalties for Early Mortgage Repayment (Prepayment)

When you pay off a “closed mortgage” mortgage early, there can be fees and penalties. First, we will describe the penalties because these are usually higher, and then we will look at the range of fees lenders charge for paying off your mortgage.

What is the difference between a “closed mortgage” and an “open mortgage”?

Open mortgages allow you to repay any amount of your mortgage at any time without a penalty. They’re flexible, and because they offer an advantage to the borrower (to the detriment of the lender), they usually have higher interest rates.

With closed mortgages, the borrower commits to leaving the mortgage in place (and paying interest to the lender) for a minimum timeframe. Usually, the contract allows borrowers to repay 15% to 20% of the original mortgage amount annually without triggering the penalty.

It is difficult to predict life events. Typical events like having a child, getting a job offer you can’t refuse, or a relationship split can lead you to sell your home sooner than expected and cancel your mortgage.

People focus so much on the up-front rates when comparing mortgage offers that they sometimes get caught by back-end penalties and fees.

Penalties

If you pay off a closed-term mortgage early (i.e., exceed the limits of your early repayment privileges), you will get charged a penalty. The penalty will be laid out in the mortgage agreement, and there are two ways of calculating the penalty: the borrower is always charged the higher amount.

Three months of interest

Interest rate spread (interest rate differential)

3 Months Interest

Three months’ interest is simple to calculate. The only tricky part is converting the mortgage interest rate from compound semi-annual to annual when calculating a fixed-rate mortgage.

Let’s take the example of a $400,000 mortgage at a rate of 5.00% compounded semi-annually.

Step 1: Convert compound semi-annual rate (CSR) to simple annual percentage rate (APR).

To do the math yourself, use the equation above. The simple annual percentage rate (APR) is 5.06%.

It is standard industry practice to quote rates as compounded semi-annually because it makes the rate look a little lower and charging an extra few 0.01% on every Canadian mortgage adds up to a lot of profit for lenders.

Step 2: Calculate three months’ worth of interest.

Interest Rate Spread

Interest Rate Spread, or Interest Rate Differential (IRD), only applies to fixed-rate mortgages and is much more complicated. On the day you pay off the mortgage, the IRD is the difference between the interest rate on your mortgage with the lender and their latest posted rate for a mortgage with a term similar to the time remaining on your contractual term. Still, there are three ways of calculating this penalty.

|

People focus so much on the up-front rates when comparing mortgage offers that they sometimes get caught by back-end penalties and fees. |

Sample Interest Rate Spread Calculations

In January 2017, Jim and Nancy get a 5-year locked-in rate mortgage with the following characteristics:

|

5-year Fixed Posted Rate: |

6% |

|---|---|

|

5-year Fixed Negotiated Contract Rate: |

5% |

|

Negotiated Interest Rate Discount |

1% |

|

Mortgage Amount: |

$406,000 |

|

Mortgage Lifespan: |

30 years |

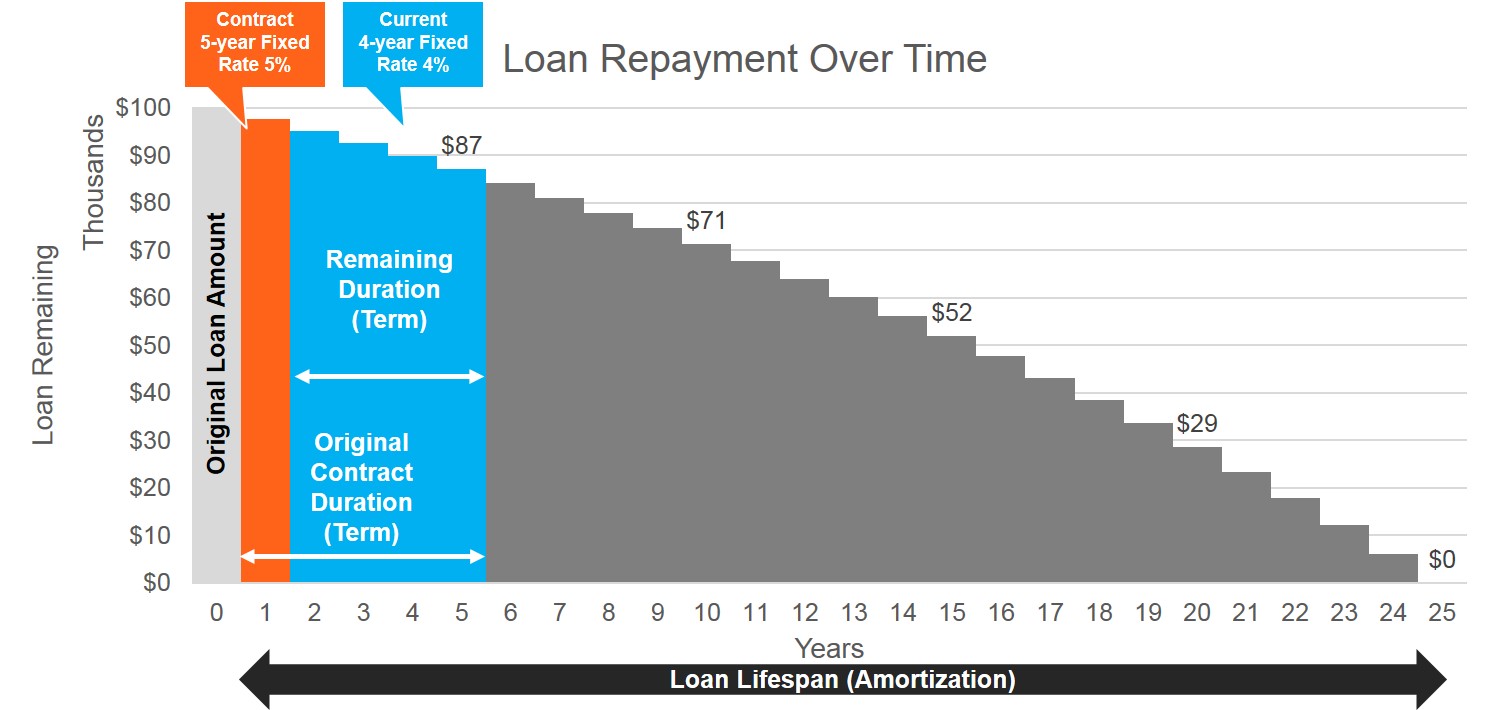

It is now January 2018, and Nancy has got a promotion at work that will transfer her to Toronto, so they need to sell their condo. Four years remain on the mortgage contract, and the 4-year posted mortgage rate is 4%. What is the interest rate spread penalty?

|

Standard |

Discounted IRD Penalty1 |

Posted |

|

|---|---|---|---|

| Remaining Mortgage Balance | $400,000 | $400,000 | $400,000 |

| 2017 Comparison 5-year Rate | 5% contract | 5% contract | 6% posted |

| 2018 Comparison 4-year Rate | 4% posted | 3%2 | 4% posted |

| Penalty Charged | $4,090 | $8,160 | $8,200 |

|

1. Most of the 7 largest banks in Canada use the discounted IRDc calculation. 2. 4% posted minus the 1% discount negotiated back in 2017. |

There is a big difference between these numbers. Imagine Nancy spent weeks negotiating an extra 0.1% off of the mortgage rate (a savings of approx. $1,975 over five years). Still, she doesn’t know that the lender offered the better rate because they use a higher penalty calculation and 30% people have to break their mortgage and pay a penalty.

When Nancy breaks the mortgage after 1 year to take a great job in Toronto then she will only gain $400 from the extra rate discount but will pay $8,000 in penalties to break the mortgage. In that scenario She loses $7,600 for focusing too much on rate.

Fees

In addition to penalties for Early Repayment, there are also fees. Many of these fees are simply fees for paying off your mortgage whether you break the contract or not, but since these fees can be substantial they are worth considering when making the final lender choice.

I took the liberty of inspecting the “cost of borrowing disclosures” from 5 lenders to illustrate the range of fees. These disclosures are often provided at the lawyer's office (after you’ve passed the point of no return).

|

Fee/Charge |

Lender 1 |

Lender 2 |

Lender 3 |

Lender 4 |

Lender 5 |

|---|---|---|---|---|---|

|

Discharge (B.C.) |

$75 |

$75 |

$75 |

$75 |

$75 |

|

Transfer to other Lender |

$365 |

$200 |

$260 |

$250 |

$75 |

|

Reinvestment Fee (if contract broken within 3 years) |

$500 w/in 1 yr $400 w/in 2 yrs $300 w/in 3 yrs |

- |

$300 |

n/a |

- |

| Discharge Registration Fee |

- |

- |

$35 |

$29 |

- |

|

Early Renewal |

$75 |

- |

- |

- |

$200 |

|

IRD Calculation |

Standard |

Discounted |

Discounted |

Discounted |

Standard |

There are seven large Canadian Banks, hundreds of credit unions, and dozens of other large mortgage lenders across Canada. It is unrealistic for consumers to research all of this information, and people in the branch only know their own fees, which is another reason we recommend Mortgage Brokers.

Penalty Reduction Strategy

You can significantly reduce your early repayment penalties by making an allowable early repayment of 10% to 20% of the original balance 15 to 30 days before the final pay-off. This strategy will reduce your penalty.

You must take cash out of your savings or borrow from a line of credit to do it.

Like this information? Like us on Facebook.