Five Forces Driving B.C. Home Prices

Last updated:

At the highest level, supply and demand set house prices and all other factors drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are core demand, non-core demand, government policy, supply, and popular sentiment.

In the long run, the market is fundamentally driven by economic forces, but sentiment can drive prices beyond economically sustainable levels in the short run.

Summary

Core and non-core demand in British Columbia were poised for a recovery in 2025, fueled by rapid population growth, declining mortgage rates, and heightened investor activity. These factors had sustained upward pressure on property values, creating a highly competitive housing market. However, the recent migration policy pivot and the imposition of tariffs by the Trump administration threaten to disrupt this momentum, introducing new economic uncertainty.

Supply has been accelerating, with record-high construction levels helping to ease constraints. While the market remains relatively balanced, conditions are shifting in favour of buyers, with inventory levels rising to between five and nine months of supply. If this trend continues, prices may continue to slide, derailing the recovery that had appeared to be taking shape.

1. Core Demand

Core Demand is a function of:

Population Growth: The pace at which people are moving to an area. On average, roughly 2.5 people live in a household.

Home Price Growth: Changes in the market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away, plus any equity you have in your existing home.

Financing: Your maximum mortgage is calculated using your income (i.e., how much money you can put toward mortgage payments) and interest rates (how large the mortgage payments will be). Local employment (unemployment) levels factor into this because you need a job to qualify for a mortgage.

Population Growth

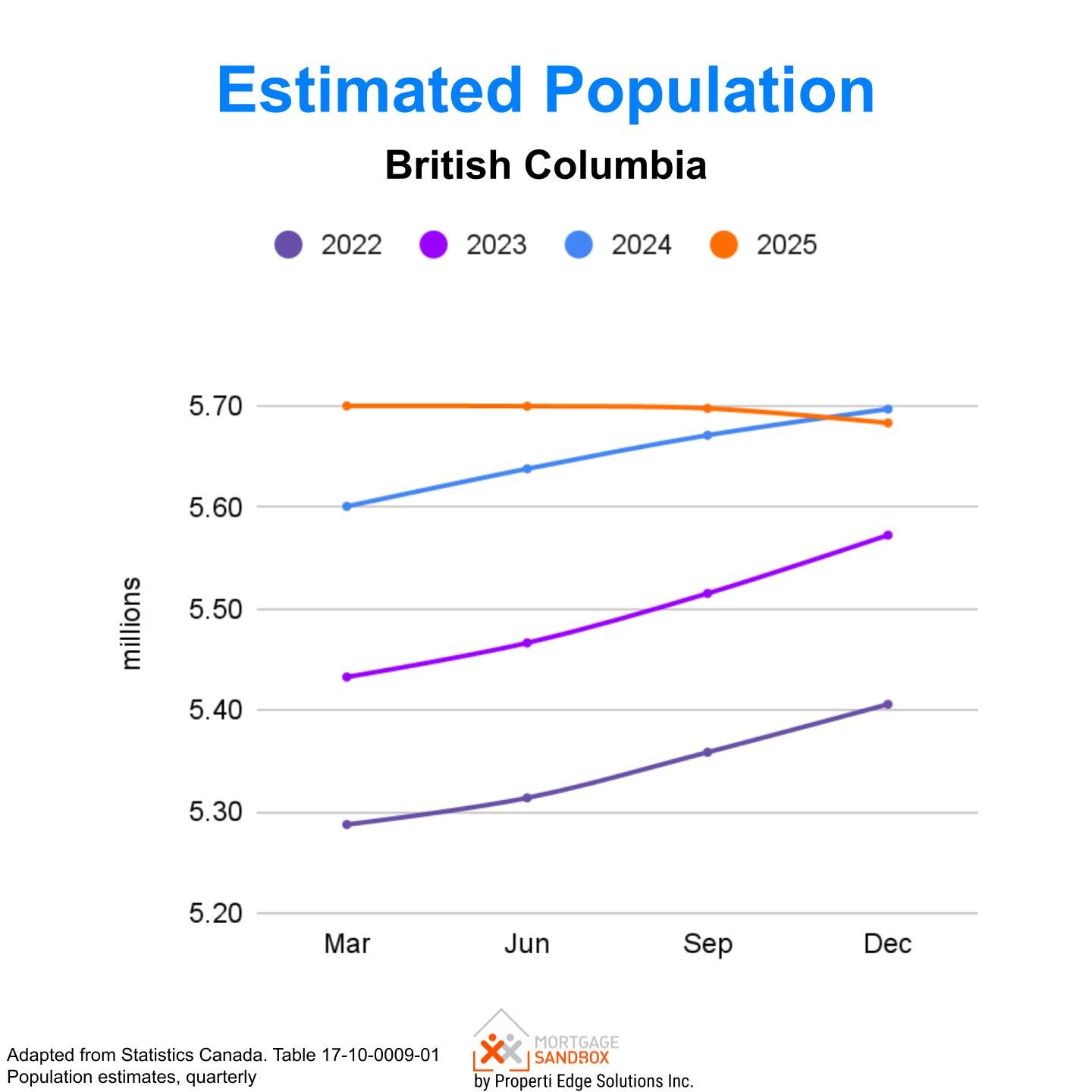

BC’s population has long been on an upward trajectory, but the rate of growth is what truly matters for housing markets. If population expansion merely keeps pace with historical trends, it exerts little additional pressure on property prices. A sharp acceleration fuels demand and drives valuations higher, while a slowdown—or outright contraction—could have the opposite effect.

After stalling in 2020, BC’s population growth rebounded, making up for lost ground during the pandemic; however, this also led to housing availability challenges. The federal government’s recent pivot on immigration policy, which aims to curb overall inflows, raises the prospect of a population decline in 2025. A shrinking population could weigh on economic growth and housing demand, challenging the market dynamics that have driven prices upward in recent years.

Early data suggests this has begun to affect population growth, which has already plateaued in BC.

Home Price Changes

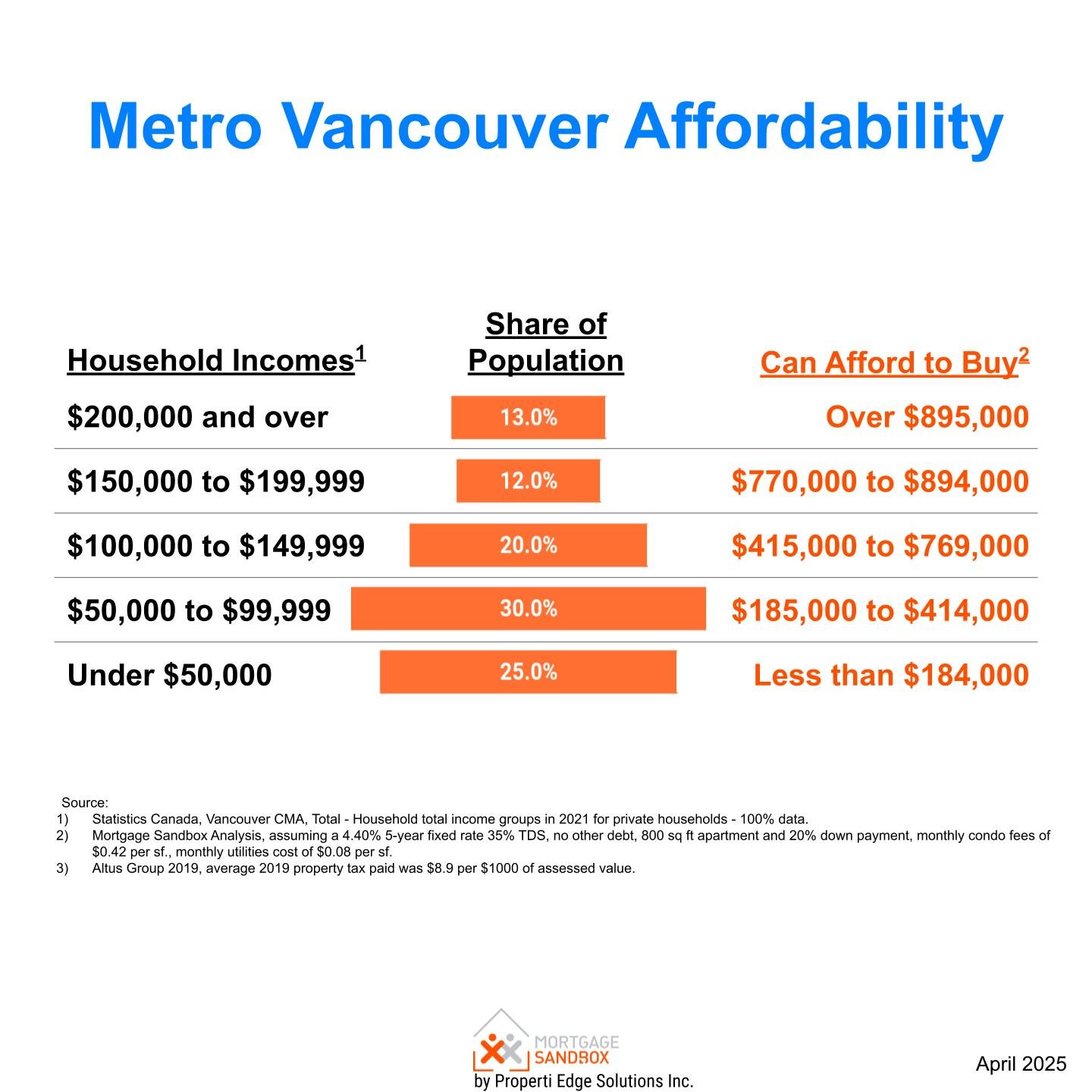

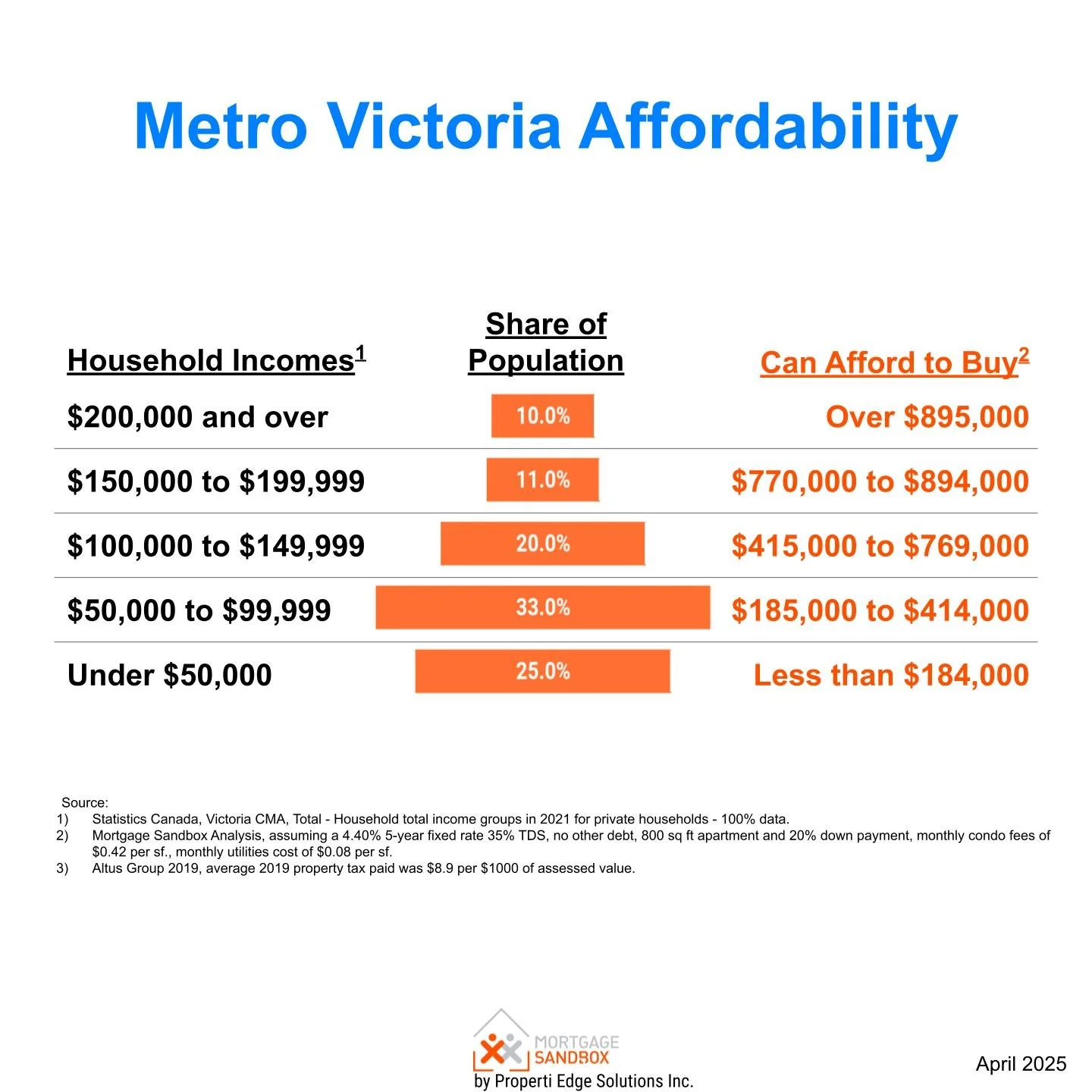

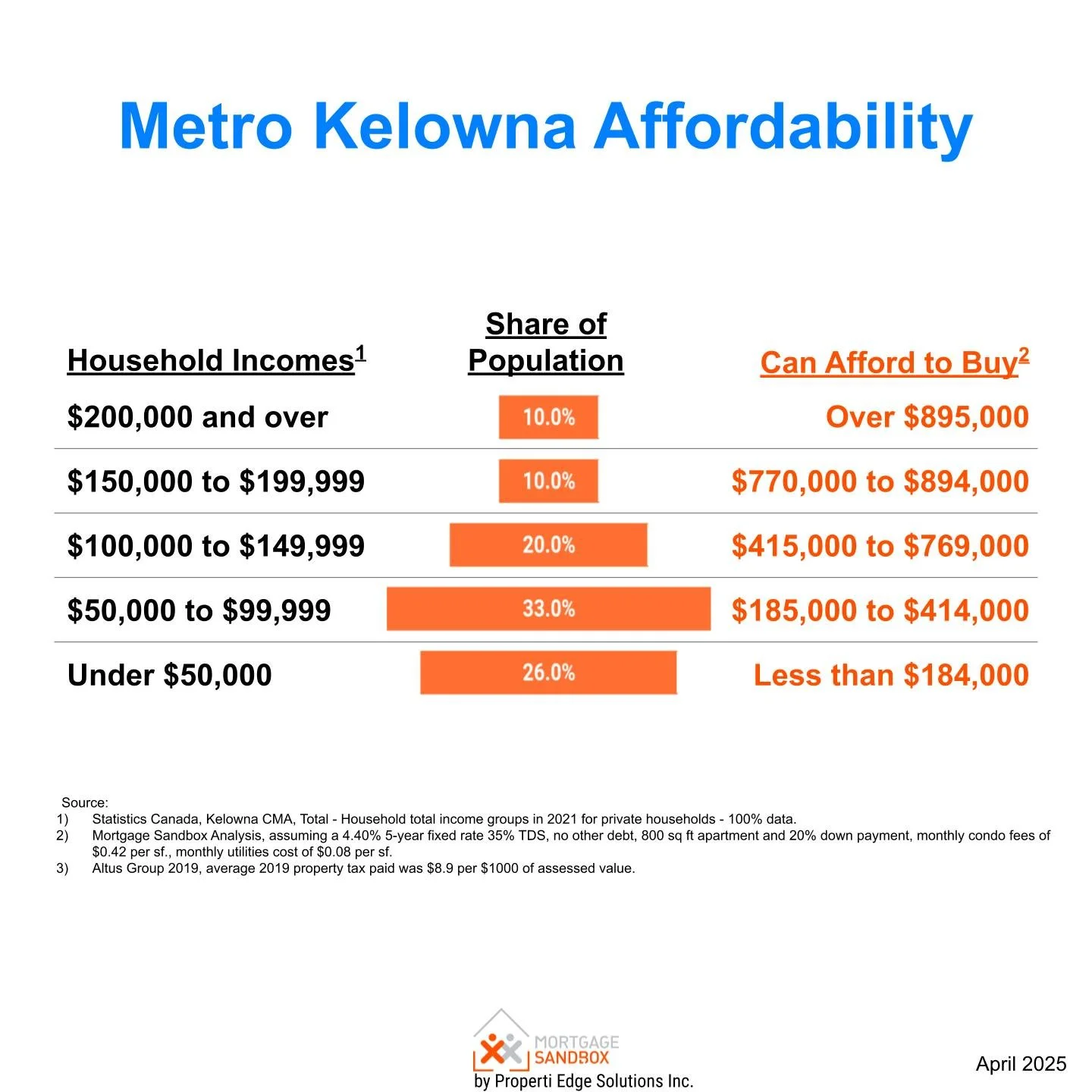

Price growth reduces affordability and reduces the pool of qualified potential buyers. In an ironic twist, rising prices create downward pressure on prices. This is a factor for first-time homebuyers trying to buy an entry-level apartment.

As a rule of thumb, homeownership costs are considered unaffordable when they exceed 40% of household income.

According to RBC Royal Bank, homeownership costs in Vancouver were 97% of the median household income, whereas, in Victoria, ownership costs were 69%. In other words, B.C. home prices are above sustainable levels according to long-term economic fundamentals.

Savings-Equity

Equity

Existing homeowners benefited from price appreciation, so they have more home equity to use when buying another home.

A recent market softening has eroded some of this equity, but not enough to have a significant impact.

Condo-to-House Price Gap

A large gap means more savings and mortgage financing are needed for condo owners to upsize to a house.

B.C.’s house values rose more quickly during the pandemic than those of apartments; the gap between house and condo prices in the past few months plateaued.

A narrowing price gap helps to make upsizing more accessible for condo owners.

Savings

With inflation rising faster than incomes, everyday items are becoming more expensive while paychecks are unchanged. If this trend continues, Canadians will run out of savings (including nest eggs for buying a home) and begin taking on debt to cover everyday expenses.

Financing

Mortgage Interest Rates

Since 2023, mortgage rates have been falling, however, they’ve not dropped since March. Variable mortgage rates have crept higher in the last few months. While rates are lower than the 2023 peaks, they are still significantly higher than they were during the pandemic. Many homeowners have mortgage renewals coming due in 2025, and they will likely face higher monthly payments going forward.

Lower rates also boost property buying budgets.

Employment and Incomes

While the employment picture has weakened, and when it picks up, you must hold a job for 3 to 6 months before applying for a mortgage.

Job growth is critical because high population growth will not put upward pressure on home values if those new arrivals don't have meaningful work.

Recently, full-time employment has failed to keep pace with population growth. B.C. and Metro Vancouver cannot sustainably accept hundreds of thousands of new immigrants without enough jobs to absorb them. This explains the federal government’s shift in immigration policy.

Homeownership Costs

The cost of utilities (heating oil, natural gas, and power) has been rising. In many cases, heating costs alone have risen $100 per month. Add the rising cost of groceries and gasoline to the equation, and it is clear that homebuyers have less disposable income to put toward mortgage payments.

Overall Core Demand

While British Columbia’s population has stalled, so has full-time employment.

The biggest driver on the core demand side is the decline in interest rates. A household that would have qualified for a $390,000 mortgage in 2023 will now only qualify for a $475,000 mortgage. While this boosts home buyer budgets, it appears that prices are still out of reach for the available buyers. Many industry analysts argue that government intervention is necessary to increase demand; however, in a market where prices are determined by supply and demand, our assessment is that prices outpaced demand during the pandemic and will need to fall further toward the buying capacity of willing buyers.

Many people in Ontario want to own their first home or upsize. However, fewer households have the financial capacity to make their desired purchase at current prices.

Need a Realtor?

We match you with local, pre-screened, values-aligned Realtors and Mortgage Brokers.

2. Non-core Demand

Non-core demand represents short-term investment, long-term investment, and recreational demand (i.e., homes not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Since non-core demand is ‘optional’ (i.e., not used to shelter your own family), it is more volatile than core demand.

Foreign Capital

The Federal Government, using its housing agency, has announced a temporary ban on home purchases by non-Canadians from January 1, 2023, to January 1, 2027. The foreign-buyer ban won’t apply to students, foreign workers, or foreign citizens who are permanent residents of Canada; however, the additional hurdles will reduce the flow of capital to Canadian real estate compared to previous years.

Long-term Rental Investors

Rental investments are a significant driver of home prices. Nearly 50 per cent of City of Vancouver condos are not owner-occupied, and almost 20 per cent of detached single-family houses in the city are not occupied by the owner. The percentage of investors drops to 31 per cent of condos once you consider the entirety of the Greater Vancouver region. Similar trends are reflected in the Okanagan and Victoria.

Rental investments are a significant driver of home prices. Demand increased in the major cities as many people began to recognize they would need to return to the office or adopt a hybrid work model.

New risks exist in the rental market due to potential planned reductions in study permits, rising mortgage costs, and rising property taxes.

1. Immigration Policy

The Minister of Immigration, Refugees and Citizenship announced that the Government of Canada will set a two-year study permit intake cap. For 2024, the cap is expected to result in approximately 360,000 approved study permits, a decrease of 35% from 2023. It is unclear what impact this will have on rent rates.

Rent rates have dropped recently in Calgary and Edmonton, and this could be enough to move many potential investors to the sidelines until rents stabilize.

2. New Mortgage Rules

The new federal rules will reduce market demand by directly increasing borrowing costs and constraining leverage for a significant segment of buyers. By prohibiting the double-counting of rental income across multiple properties and classifying loans heavily reliant on that income as higher-risk, the regulations will suppress the purchasing power of investors, who constitute over a quarter of Canadian homebuyers. This impact will be disproportionately higher for condos. A sharp reduction in investor activity, particularly within this concentrated segment, could remove a foundational source of demand, placing considerable downward pressure on a market that is already structurally dependent on investment purchases.

Short-term Rentals

According to the British Columbia Housing Minister, there are 19,000 entire homes available year-round on short-term rental platforms that are never owner-occupied.

In October 2022, according to Airdna.co, short-term rentals were:

Vancouver: 4,000 rentals with 87% occupancy.

Victoria: 1,100 rentals with 88% occupancy.

Kelowna: 1,600 rentals with 71% occupancy.

An occupancy rate between 70% and 95% is typically considered a supportive investment environment.

Tourism is finally on track to match or exceed pre-pandemic levels! This bodes well for short-term rentals.

House Flippers

When house prices rose consistently, it was easier for house flippers to make money. The market has softened, and house flipping is beginning to look risky.

This might be partly because, on January 1st, the B.C. government introduced a new tax on the sale of real estate held for less than two years. A tax rate of 20 percent will apply to income from properties sold within 365 days of purchase. It will gradually decline to zero between 366 and 730 days.

Note: The flaw with the chart below is that most flippers will "live in the property" for at least 1 year before selling so they can claim it as their principal residence and avoid capital gains tax on the sale. The regulators don’t count flips that occur within 18 months. The rate of flipping could be much higher.

Dark Money

Dark money is the proceeds of crime or money that are transferred to Canada illegally. Dark money includes funds earned legitimately that are transferred illegally from countries with capital controls (e.g., China) and legitimate earnings moved from nations subject to international sanctions (e.g., Iran, Russia, and North Korea).

It is laundered in the real estate market to hide the illegal nature of the funds. Sometimes, the property's true owner is hidden by using a Straw Buyer, and other times the property is owned by a shell company.

Sometimes a real estate agent or lawyer will accept the illegal cash to help the nefarious individuals hide their true origins. In 2015, a British Columbia realtor was caught with hundreds of thousands of dollars in her closet at home.

The new British Columbia land registry is hoped to stop money laundering, but some economists challenge this assumption. Kevin Comeau from Transparency International says the new system does not require the “proactive” verification of the identity of the true beneficial owner of a property. In other words, the ultimate owner, whose name is not listed on the land title, does not need to be verified - it’s an honour system. As a result, the system offers little value to law enforcement agencies and others who search the registry.

We see no evidence of a diminished role for dark money in British Columbia real estate.

Overall Non-core Demand

Given the foreign buyer restrictions and volatility in the rental market, we assess that capital inflows toward residential real estate for non-core uses will soften at least until mid-2025. This adds some downward pressure on B.C. home prices.

Find out how much you can afford to buy!

3. Government Policy

Foreign Buyer Restrictions

The Federal Government, using its housing agency, has announced a temporary ban on home purchases by non-Canadians from January 1, 2023, to January 1, 2027. Some exceptions are made for those with temporary work permits, refugee claimants, and international students.

The ban was implemented to allow the government to study whether it reduces speculation and commoditization in the property market.

Short-Term Rental Regulation

B.C. short-term rental rules were enacted on May 1st, 2024, that limit short-term rentals to a property owner’s principal residence — plus one additional unit or suite on that property — for municipalities with more than 10,000 people. The change is expected to add 19,000 homes that are currently short-term rentals to the long-term rental market.

Also, B.C. is launching a short-term rental registry with annual fees that aims to stop market speculators. Fees will range from $100 for hosts who live on the property to $450 for those who live elsewhere and $600 for so-called strata hotels.

Transit-Oriented Development (TOD) Areas

The province has mandated that municipalities allow the development of higher density and height and allow less parking near major transit hubs. TOD Areas are defined as areas within 800 metres of a rapid transit station (e.g., a SkyTrain station) and 400 metres of a bus exchange.

Minimum Density and Height Requirements: Within these TOD areas, municipalities must allow for minimum density and height requirements, which vary depending on the distance from the transit hub. This means taller buildings and more units per acre are permitted.

Reduced Parking Requirements: In many TOD areas, parking minimums have been reduced or eliminated, encouraging more sustainable transportation options such as walking, cycling, and public transit.

The aim is to increase housing supply and reduce upward price pressures. This goes a long way toward challenging the common narrative that “housing supply in Greater Vancouver will never catch up to population growth; therefore, prices will continue to rise above local incomes indefinitely.”

Overall Government Influence

Overall, the government unwound many programs supporting home values through the pandemic and subsequently implemented restrictions on foreign investment and measures to accelerate the creation of new housing stock. Compared to a year ago, there is significantly less support from the government to maintain home values.

4. Supply

Supply comes from two sources.

Existing sales: Existing home sales are sales of ‘used homes.’ They are homes owned by individuals who sell them to upgrade, move for work or for other reasons. The B.C. Real Estate Association only reports existing home sales and listings.

Pre-Sales and Construction Completions: Before construction starts, most new homes are sold via pre-sales. These are predominantly apartments and townhomes. Data on pre-sales is private and difficult to find, but construction starts (reported by the government) are a very accurate lagging indicator of pre-sale activity.

Rising supply releases the upward pressure on prices caused by demand.

Months of Supply of Existing Homes

While the total number of homes for sale is a key supply metric, shown below, the ratio of listings to purchases expressed in months of supply better indicates where prices are headed. Months of supply show the relationship between supply and demand. If supply and demand drop together, the market balance is maintained, and price pressures remain unchanged.

Supply was surprisingly tight throughout the pandemic and is now trending upward.

Pre-sales and Completions

New Construction:

Home construction in Metro Vancouver is booming. All major centres in B.C. are experiencing record levels of construction.

As these projects are completed within the next 18 months, they may enter a soft market. While many of the homes under construction are pre-sold, their new occupants will be vacating or selling their current residences.

Pre-sales:

Pre-sales are purchases of unbuilt and completed brand-new homes from developers. Typically, a developer must sell 70% of homes in a building before starting construction, so housing starts are a good indicator of successful pre-sales.

Pre-sales are purchases of brand-new homes from developers.

The chart below provides good data for Vancouver, where the market has weakened.

Victoria is trending below average, and Kelowna is well above average.

Popular Sentiment

Popular sentiment can be volatile and easily influenced by the latest headlines. Sentiment can shift quickly, as witnessed in the past two years.

Canadian Consumer Confidence

The Ipsos-Reid and Nanos Canadian Confidence Index shows that Canadian consumer confidence has improved significantly, and confidence in real estate values has improved. Less than 40 per cent of Canadians believe home prices in their neighbourhood will rise over the next six months.

Although consumer sentiment is a key factor contributing to real estate price trends, sentiment on its own is not an accurate predictor of future prices.

Conclusion

Here is a quick summary:

Core demand is weaker because of higher mortgage rates and weak job creation. It is at risk of deteriorating further because of Canada’s plans to freeze or shrink population growth and the potential impacts of Trump’s tariffs on the economy and jobs.

Non-core demand is weaker due to a ban on foreign buyers, falling rents, and some of the country’s tightest restrictions on short-term rentals.

Existing supply is rising, and there are record numbers of homes under construction, many of which will be completed in the next 18 months.

Consumer confidence in real estate is mildly negative, indicating that prices are weakening.

While it is not guaranteed, the current conditions dramatically increase the risk of a significant market correction.

See our B.C. Home Price Forecasts

Like this report? Like us on Facebook.