Edmonton's Property Market: One of Hottest Markets in Canada Dodges Downturn

The real estate market in Metro Edmonton is hot, but it is still influenced by seasonality and is entering the slow season. Correspondingly, prices have begun to ease — but at a slower rate than in past shoulder seasons.

Despite the challenges of high mortgage rates and inflationary concerns, Edmonton’s housing market uniquely contrasts the broader Canadian real estate landscape. Between January and August, home values in Edmonton gained 10 percent, driven by the region's high demand and growing investor activity.

However, as these forces collide, Metro Edmonton finds itself at moderate risk of a market correction. The key question for homeowners, investors, and prospective buyers alike is: where is the Edmonton property market heading, and how should participants respond?

The State of Edmonton's Property Market

Metro Edmonton, with a population of 1.3 million, has long been a relatively affordable housing market compared to its southern neighbour, Calgary, or major hubs like Toronto and Vancouver.

As a result, Edmonton has had historic home value gains as homebuyers and investors crowd the market.

Yes, prices have plateaued and are likely to drop in autumn and winter, but this is typical of the Edmonton market's seasonality.

The Edmonton housing market continues to benefit from steady migration into the region from other parts of Canada and internationally. This influx of new residents has sustained demand, particularly for affordable homes and rental properties, in an environment where many prospective buyers in other Canadian cities are hesitant to make purchases due to historically high mortgage rates.

Supply and Demand: Off Balance

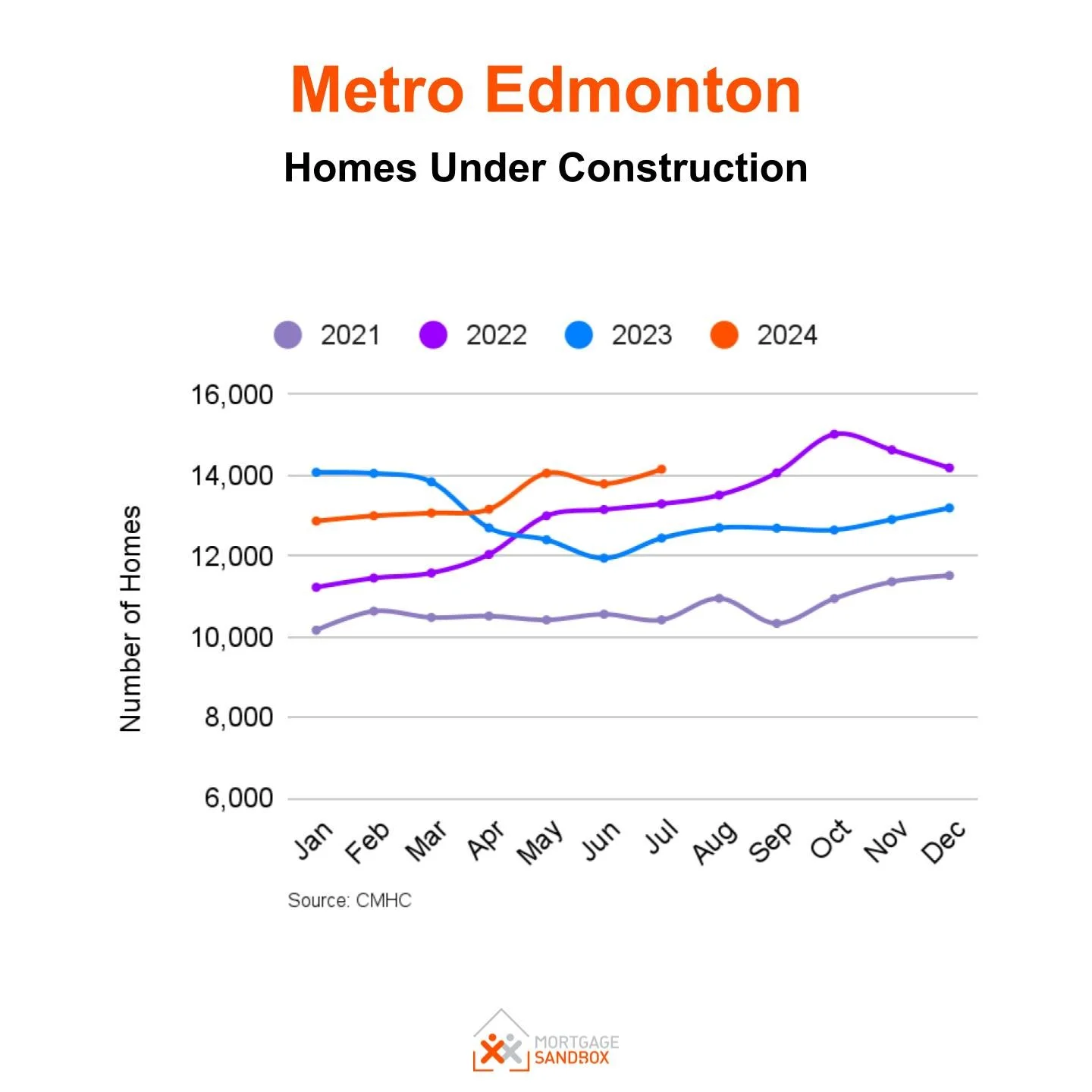

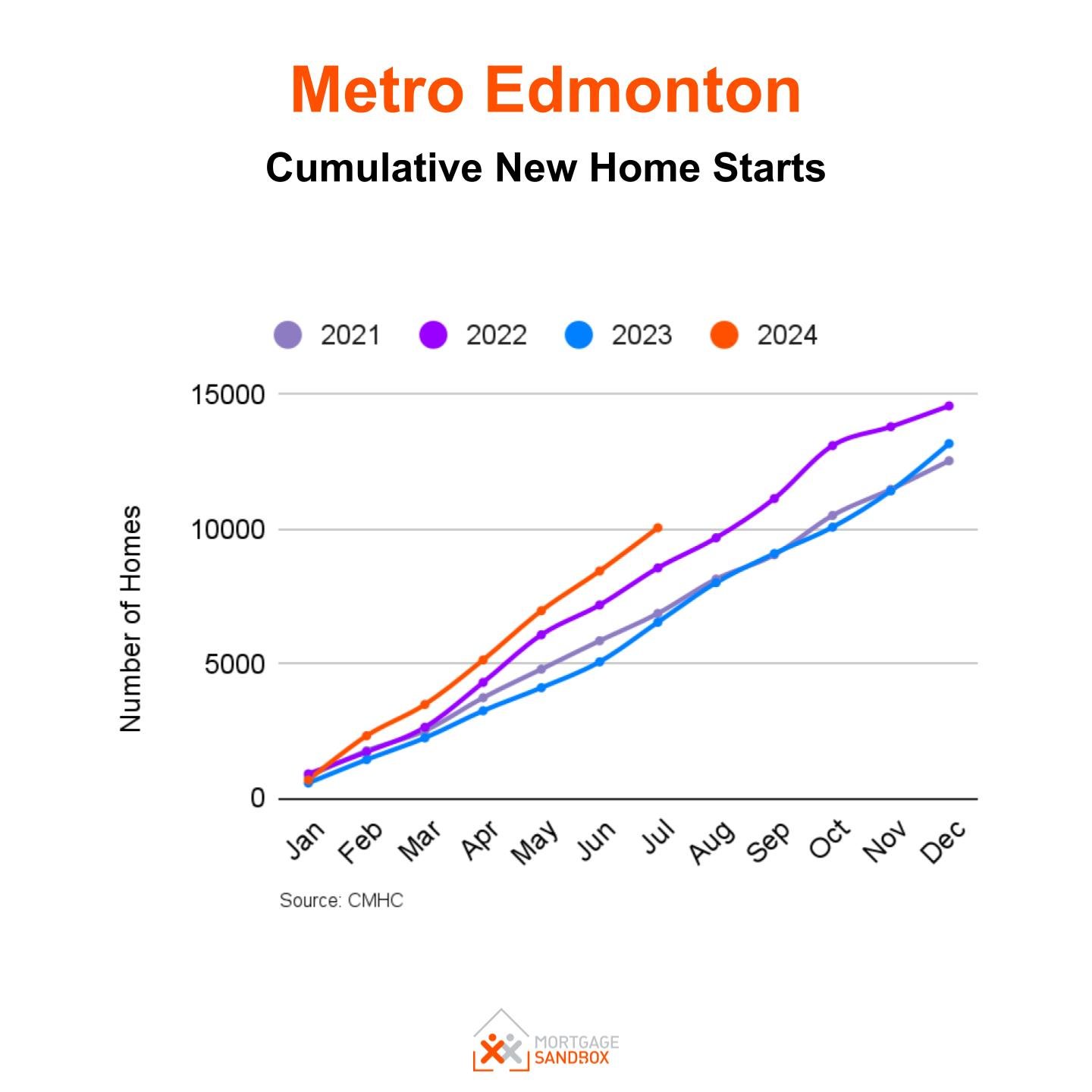

A persistent imbalance between supply and demand is one of the central drivers of Edmonton’s property market dynamics. Inventory levels have been constrained by voracious buyer activity and a scarcity of active listings, even as new construction activity has soared. The city has seen a record number of homes under construction, which has the potential to ease the supply shortage once completed, but for now, the pressure on existing homes remains.

With supply bottlenecks and steady demand, Edmonton faces competition that pushes home prices up, particularly in the detached housing market. Buyers are now confronted with bidding wars and limited options, a situation exacerbated by investor activity. Rental yields in Edmonton are attractive to investors, especially compared to Vancouver and Toronto, where the price-to-rent ratios are much less favourable. Edmonton’s rental market provides twice the income per dollar spent on homes as Vancouver does, making it a hotspot for investors seeking higher returns.

As such, the market has become more competitive for local owner-occupiers, who are increasingly priced out of home ownership. With investors snapping up properties, the availability of homes for first-time buyers continues to dwindle. If this trend continues unchecked, it could lead to affordability concerns and a long-term sustainability problem for Edmonton's real estate market.

New Construction and Price Dynamics

The construction of new homes in Edmonton has picked up rapidly since mid-2023, but the impact of this surge has yet to fully materialize in the market. With rising prices for new and existing homes, there is speculation that Edmonton’s pre-sale housing market might soon hit a ceiling.

Signs of Instability

Still, new homes in Edmonton are seeing robust price growth, with pre-sale opportunities attracting attention. However, prospective buyers should be aware that while prices are rising, they may encounter volatility and downside risk as market conditions evolve.

Edmonton is a mid-sized Canadian market with some of the highest unemployment nationally. Increasing loan delinquency rates have followed rising unemployment. At 2 percent, Edmonton has the highest delinquency rate among major Canadian cities. As these new homes come onto the market over the coming eighteen months, it will raise questions about Edmonton’s capacity to absorb ‘premium’ newly built homes.

In the condo market, Edmonton has also experienced a marked uptick in values, with apartments—particularly smaller floor plans—gaining popularity among investors and first-time buyers. Ontario-based investors, attracted by Edmonton’s landlord-friendly tenancy laws and lower price-to-rent ratios, have contributed to this surge. However, as more generous floor plan condos enter the market, smaller units may see some price moderation, particularly if buyer preferences shift toward larger living spaces as work-from-home arrangements become more entrenched.

The Outlook for Edmonton's Home Prices

The coming years present a foggy outlook for Edmonton’s property market as broader economic uncertainties loom. Interest rates, a key determinant of market activity, are expected to remain elevated into 2025. For buyers, this means a more expensive mortgage environment that could deter purchases in the short term. Even though rates have shown signs of normalizing, they are unlikely to fall to pre-pandemic levels in the near future.

Therefore, buyers may be caught between waiting for a more favourable lending environment and potentially facing a higher price or moving forward under conditions with less favourable terms but a lower negotiated price.

For those contemplating selling, time may be of the essence. While prices have been on a gradual upward trajectory, a correction may be looming if supply surges or demand weakens. The data presents mixed signals. On one hand, demand remains strong due to Edmonton’s relative affordability and steady migration inflows, while on the other hand, rising unemployment and delinquency rates could suppress buyer activity, leading to a potential price plateau or even a decline.

Given these uncertainties, some homeowners may opt to sell now, cashing in on current price levels before any downturn materializes. Investors, however, may see an opportunity to hold or even increase their portfolios, particularly in the rental market, where yields remain strong compared to other major cities.

Investors: Hold or Fold?

For investors, Edmonton remains an attractive proposition, thanks in large part to the city’s favourable rental yields. Compared to other Canadian cities where rental returns are less attractive, Edmonton provides a steady stream of income for property investors, particularly in the condo and apartment markets. However, investor caution is warranted. A market correction could dampen rental yields and reduce the value of properties, leading to potential losses for those who overextend their portfolios. The Alberta economy is also strongly influenced by the fortunes of oil prices. At the moment, oil prices are above average, but oil prices have a history of high volatility.

Nevertheless, Edmonton's fundamentals still appear sound in the medium to long term. Even in the event of a short-term price correction, the city's population growth and demand for affordable housing will likely underpin the market's recovery, making it a favourable environment for long-term investors.

Should You Buy Now?

Prospective buyers face a tough decision. While current mortgage rates are high, waiting for a drop could mean missing out on current home prices, which are still lower than in many other Canadian cities. Edmonton's relative affordability compared to cities like Vancouver, Toronto, and Calgary continues to draw first-time buyers and families looking for larger homes at lower prices.

However, patience might be prudent for those who can afford to wait. As new supply comes online, prices may stabilize or even decrease slightly, offering better entry points for buyers. For others, especially those with pressing housing needs, locking in a purchase now—even with higher borrowing costs—might be the best way to secure a home before prices rise further or supply constraints deepen.

A Market in Transition

The Edmonton property market is at a crossroads, with competing forces of high demand, rising construction, and cautious consumer sentiment shaping its trajectory. While the market remains relatively affordable by Canadian standards, higher mortgage rates and a potential supply surge introduce risks that buyers and sellers must navigate carefully.

For now, Edmonton’s housing market presents a complex picture of opportunity and risk, with outcomes depending heavily on external factors such as interest rates, government policy, and immigration trends. Whether the market will see further gains or experience a cooling off remains uncertain. Still, for those who can adapt to the changing landscape, the Edmonton market continues to offer potential rewards amid the risks.