Metro Vancouver Property Market: A Volatile Landscape

Once hailed as the first port of call for many property investors, the Greater Vancouver property market is now weathering turbulent times. This once seemingly invincible property market has experienced dramatic shifts, possibly fueled by China’s property market woes, skyrocketing mortgage rates, and an uncertain post-pandemic recovery.

While 2024 property purchases started stronger than 2023, demand weakened in May, and we might end 2024 with fewer completed purchases than 2023.

Affordability issues, volatile prices, tepid demand and growing supply have plagued the region. In this article, we dissect the current state of the market and explore what the future holds for buyers, sellers, and investors alike.

Price Rollercoaster

Greater Vancouver’s housing market is nothing short of a rollercoaster. Since peaking in the spring of 2022, property prices have oscillated, driven by booms and subsequent correction. In just a short span, Vancouver's detached home prices saw staggering fluctuations, with values shifting by as much as $100,000 to $300,000 at different points. The market appears to be at the top of another cycle, and prices are poised to drop over the autumn and winter months.

This volatility isn’t just a matter of market cycles. The pandemic fundamentally altered real estate dynamics, pushing mortgage rates to historical lows and sparking unprecedented demand. The rush to secure homes, compounded by low inventory, drove prices to a very high peak. Possibly a peak that was only achievable with ultra-low mortgage rates. The post-pandemic environment has reversed the credit cycle. Mortgage rates, once the key driver of the boom, have now become the crux of affordability problems, with the Bank of Canada raising rates to combat inflation.

Many homeowners are finding themselves in a bind. Those who took advantage of low-interest mortgages during the pandemic are hesitant to sell, unable to afford the cost of upgrading to a larger home at today's elevated rates. First-time buyers, meanwhile, face even greater challenges, with affordability now at its worst level since the 1980s.

Affordability Crisis Deepens

Vancouver’s housing market has a particularly severe affordability dilemma. With mortgage rates soaring and inflation still proving difficult to control, the prospect of buying a home in Metro Vancouver has become a distant dream for many would-be homeowners.

A typical household in the region earns around $75,000 annually, which, at current rates, qualifies for a mortgage of about $300,000. However, the benchmark price for a condo in Vancouver is a staggering $770,000, creating a vast gap between what prospective buyers can afford and the actual cost of a property. For those without significant family financial support, breaking into the market seems nearly impossible.

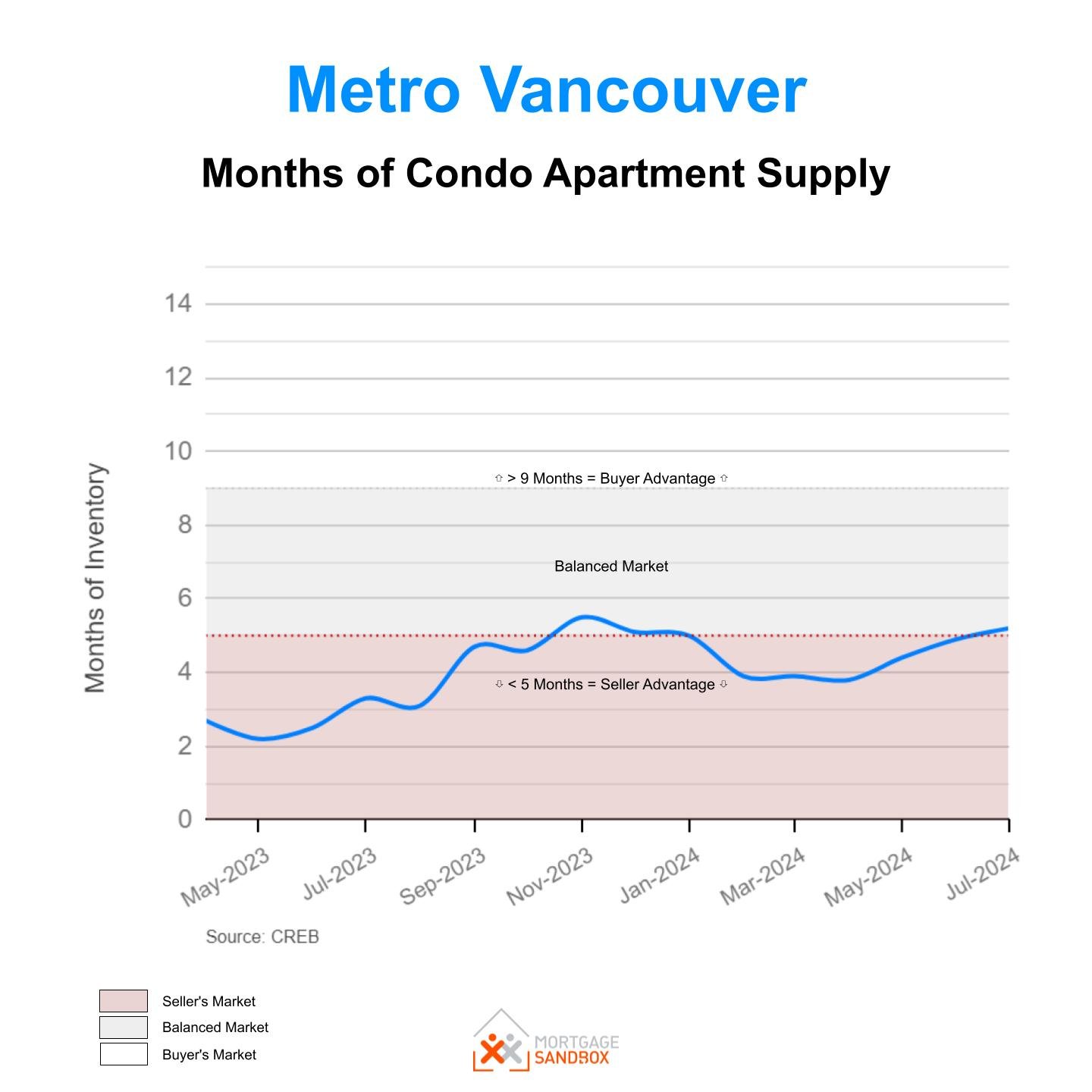

This stark contrast between incomes and home prices has sidelined a generation of potential buyers, with many continuing to rent or live in shared accommodations. As of 2024, the inventory of available homes is higher than in the past three years, but the increase in supply has done little to ease affordability pressures.

On the other hand, thousands of homeowners bought homes during the pandemic, and while they could afford the mortgage at ultra-low mortgage rates, at renewal, they are finding homeownership to be too great a financial burden. Many are trying to cash in their gains by listing their homes for sale, leading to a significant increase in listings.

The Impact of Immigration and Supply Constraints

British Columbia Estimated Population Growth YoY 2021 to 2024

Canada’s aggressive immigration strategy—intended to replace an aging workforce and stimulate economic growth—has only added fuel to the housing demand. The country aims to welcome over 400,000 immigrants annually, many of whom settle in British Columbia and Vancouver, where housing supply is already constrained. British Columbia’s population grew by an estimated 167 thousand in the last twelve months.

However, employment isn’t keeping pace with population growth, and Vancouverites need healthy salaries to attempt to enter the housing market. Today, there are fewer full-time employees in Metro Vancouver than at the same time last year.

As new arrivals pour into the city, demand for housing continues to outstrip supply, particularly in the affordable segment of the market. If there were affordable supply, it would be quickly absorbed; latent demand would remain strong despite a drop in overall buying activity.

Many individuals and families are waiting for mortgage rates to decline, thereby increasing their purchase budget.

This “wait-and-see” approach has led to a paradox: while demand for housing is high, fewer purchases are taking place. It would seem most newcomers are destined for the rental market. The net effect is a market in limbo.

Developers are shifting their focus in response to these evolving dynamics. New construction starts in the region have remained relatively flat, the prices of newly built homes have plateaued, and pre-sale buyers should think twice before paying a high pre-sale premium. They risk encountering a lower market value at completion than the pre-sale contract price.

Price Forecast: The Uncertain Path Ahead

Predicting the direction of home prices in Metro Vancouver has become a difficult exercise, with economic uncertainty clouding even the most informed forecasts. The primary factors influencing the market—immigration, interest rates, and broader economic conditions—are in a state of flux, leading to conflicting predictions from analysts.

Vancouver’s real estate sector is grappling with challenges: high mortgage rates, a bulging construction pipeline, and the risk of a recession.

Metro Vancouver Homes Under Construction 2021 to 2024

While some analysts are celebrating the Bank of Canada’s aggressive rate-cutting trajectory, they have turned a blind eye to the cause of the rate cuts. The Bank of Canada is now more concerned about averting a Canadian recession than out-of-control inflation. There are indications of a possible slowdown in the U.S. – if one should happen, it would undoubtedly affect the Canadian economy.

Most forecasts suggest that home prices will remain relatively flat over the next few years, with only modest gains or losses depending on economic conditions. Some analysts are even predicting further price corrections. If a recession hits, prices could dip significantly, especially in the higher-risk segments of the market.

Should Sellers Act Now?

For homeowners considering selling, the first half of the year has traditionally been the best time to put a property on the market and now is no exception. With high inventory levels, people looking to sell may find February and March 2025 to be an opportune moment. Mortgage rates should be lower, buyer budgets higher, and typically there are fewer competing listings early in the year. Have a sober discussion with your real estate agent on pricing strategy. The cooler market means that bidding wars, once a common occurrence, are more difficult to orchestrate and less likely to drive up sale prices. You might find yourself in a one-to-one negotiation.

Is it a Good Time to Buy?

The question on many buyers' minds is whether now is the right time to jump into the market or to continue sitting on the sidelines. As is often the case in real estate, the answer is complex.

On the one hand, prices have come down from their peak, and the seasonal real estate cycle suggests that late summer and fall can be a more favourable time for buyers to negotiate.

The market is more favourable to buyers than it has been for years. On the other hand, borrowing costs remain high, meaning that the overall cost of homeownership is still steep, and if rates continue to decline, they might put you in a better financial position in 2025.

For those planning to stay in their homes long-term, purchasing sooner may be a prudent decision. Buyers who are not overly reliant on market timing may find that locking in a home at current prices, with the expectation of lower rates in the future, could ultimately work in their favour. However, for short-term investors or those with tight budgets, the market’s inherent risks may be too great to justify an immediate purchase.

Buying in today’s market is not without its risks. Buyers may find it difficult to secure financing with high rates and a market with falling values. Be sure to make offers conditional on successful financing and a satisfactory inspection.

The Outlook for Investors

Real estate investors in Vancouver face a different set of challenges. With interest rates expected to remain elevated for the foreseeable future, the cost of financing new purchases has become prohibitive for many. While a cash flow negative rental can be sustained in the short term, it is doubtful it will lead to a long-term return on investment that justifies the risk. You might be better off investing in the stock market. Additionally, the long-term outlook for price appreciation remains unclear, particularly in a market as high-risk as Vancouver.

Investors who bought during the market’s peak in 2021 or 2022 may be feeling the pinch, as rental yields are not keeping pace with the cost of borrowing. For those with existing holdings, now may be a good time to assess whether holding onto properties will yield sufficient returns in the coming years. The potential for a further price correction means that the value of investments could decline before the market rebounds.

In the meantime, developers are cautiously optimistic about the future. Pre-sales have continued steadily, with over 1,000 units being released in most months.

Conclusion

The Greater Vancouver real estate market remains in a state of flux. The underlying challenges—affordability, mortgage rates, and economic uncertainty—continue to weigh heavily on both buyers and sellers. For those navigating the market, whether as prospective homeowners, investors, or sellers, the next few years will require a careful balance of patience, strategy, and flexibility.

As Metro Vancouver continues to evolve in response to broader economic forces, it is clear that the days of rapid price appreciation are behind us—at least for now. What remains to be seen is how the market will stabilize, and whether Vancouver will return to the more modest, sustainable growth that policymakers and economists alike are hoping for.