Toronto's Property Market: A Delicate Balance of Demand, Supply, and Uncertainty

Toronto's real estate market has long been a focus of international attention, lauded as one of the world's most vibrant urban centers. However, since the pandemic, the city’s property landscape has experienced volatility that has left both prospective homeowners and investors on edge.

After years of dramatic price surges and subsequent corrections, the uncertainty surrounding Metro Toronto's real estate future is palpable. Industry experts, once optimistic about a rebound in early 2024, now face a sobering reality: economic challenges are far from over, and the road to stability remains uncertain.

A Market in Flux

Metro Toronto, home to approximately 6.7 million people, ranks among the top global cities in terms of livability. Despite its enduring appeal, recent years have exposed vulnerabilities in its real estate market. The pandemic, which initially ignited an unprecedented surge in home prices, now serves as the baseline for a prolonged period of erratic behavior. Since 2021, the market has been on a rollercoaster, with significant peaks followed by sharp declines. This unpredictable pattern has given rise to growing concerns about the market's stability in the face of economic pressures.

Home Prices: Volatility and Risk

In the immediate aftermath of the pandemic, home values skyrocketed, pushing many prospective buyers further from their dreams of homeownership. However, the subsequent rise in mortgage rates, a measure taken to counter inflation, has only exacerbated affordability issues.

Many would-be buyers remain on the sidelines, discouraged by the high cost of borrowing and elevated home prices. The Toronto Real Estate Board (TREB) reported that while prices initially bounced back due to low supply in early 2024, the situation has since deteriorated.

For those eyeing an entry into the housing market, mortgage rates remain a crucial barrier. The long-anticipated interest rate cuts have been delayed due to persistent inflationary pressures. As a result, aspiring homeowners must reconcile their aspirations with the harsh reality of higher borrowing costs. In better news, the Bank of Canada has begun to lower its policy rate however this hasn’t made an appreciable difference to mortgage rates and the property market, yet.

For sellers, the advice is clear: if possible, hold off until Spring 2025, when supply is likely to be more constrained and demand peaks once again, driven by families looking to settle before the new school year.

The Detached Housing Market: A Distant Dream

Detached houses in Greater Toronto Area (GTA), once the most coveted segment of the market, have seen demand plummet. While prices initially held up, they are now under downward pressure due to increasing supply. With more homes entering the market, the delicate balance that previously supported price levels is being eroded. House listings are now at their highest level in five years, with prospective buyers reluctant to commit under the weight of current mortgage rates.

Political actors and industry stakeholders have long sought to guide the housing market toward a sustainable growth rate of 1-3% per year—closely aligned with income growth. However, the reality is that home prices have vastly outpaced income gains, making even modest price increases unsustainable for many households. Affordability has become the central issue, with only a fraction of potential buyers capable of realizing homeownership dreams in today’s market.

For first-time homebuyers, the situation is dire. Median income households earning around $97,000 annually can only qualify for mortgages of roughly $345,000—far below the price of a typical detached home in the city, which often exceeds $1 million. As a result, the market has seen a significant reduction in demand from both first-time buyers and those seeking to upgrade.

New Construction: Cracks in the Foundation

Toronto’s new construction market has also faced notable shifts. Once a symbol of the city’s rapid growth, prices for new builds have been trending downwards, a signal that developers are adjusting to new economic realities. Buyers who purchased early in new developments may find themselves grappling with the realization that more recent purchasers secured better deals as prices continued to fall.

Pre-sale units, once a hot commodity, have seen demand cool significantly. In response, savvy buyers are negotiating harder, demanding discounts, and developers are increasingly accommodating. The softening of the pre-sale market suggests a broader shift in market dynamics, as both investors and homeowners grow wary of overextending themselves in an environment marked by risk.

According to the Mortgage Sandbox analysis, Metro Toronto is particularly vulnerable to a significant market correction. Rising inventories and softening demand have created a scenario in which further price declines are likely. Those seeking to invest in pre-sale properties are advised to proceed with caution, as the risk of negative equity grows.

The Condo Conundrum: Fewer Buyers, More Supply

Toronto's condominium market, once the darling of investors and first-time buyers alike, is also under strain. During the pandemic, condo prices soared to new heights, driven by a surge in demand. However, this upward trajectory has reversed. Condo sales have dropped off dramatically, with the number of active listings reaching record levels. According to the Canada Mortgage and Housing Corporation (CMHC), this trend is unlikely to reverse in the short term, given the high levels of new condo construction in the pipeline.

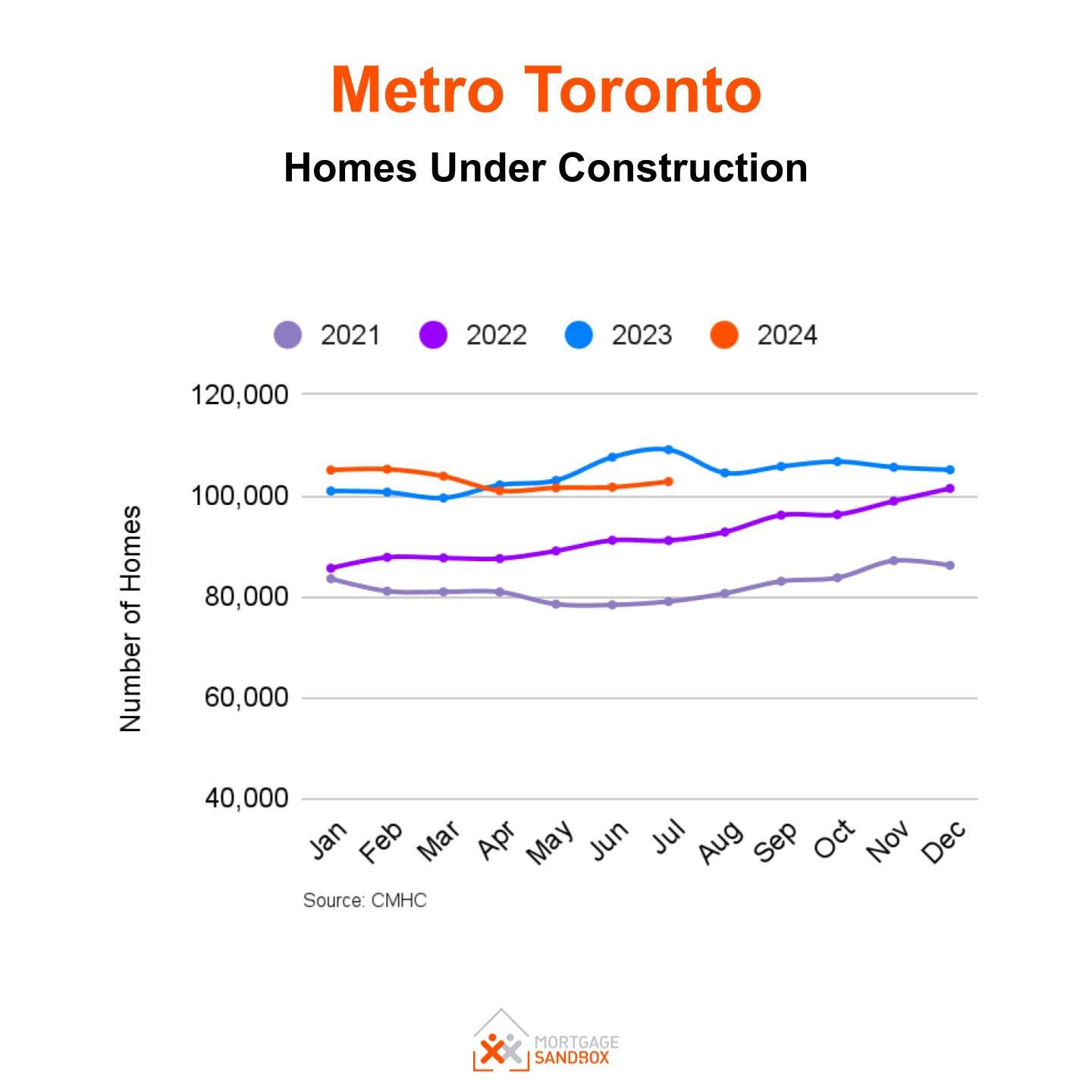

Metro Toronto New Homes Under Construction 2021 to 2024

Investors, particularly those who bought into smaller units at higher prices, now face the grim reality that their investments may no longer generate positive cash flow. A 2023 report by CIBC and Urbanation found that less than half of leveraged condo investors were cash flow positive. With higher interest rates, many investors have left Toronto for more affordable markets, such as Edmonton and Calgary, further diminishing demand.

Where Are Prices Headed?

Forecasting the future of Toronto's real estate market has become increasingly complex. The uncertainty surrounding key factors—such as immigration policy, mortgage rates, and the potential for an economic recession—has led to divergent predictions among experts. Some are cautiously optimistic, pointing to strong immigration levels and Toronto’s continued desirability as a global city. Others, however, warn of a potential correction that could see prices fall further, particularly if interest rates remain high.

The consensus among leading real estate firms and economists, including Royal LePage, RE/MAX, and TD Bank, is that price growth will remain subdued over the next few years. While some are hopeful for a return to 1-3% annual price increases, others caution that more significant price drops could materialize, particularly if high levels of construction continue to outpace demand.

The net effect is average expectations for modest increases beyond 2024 but a wide range between the best and worst-case scenarios.

Should Investors Sell?

For investors, the question of whether to sell has become more pressing. With a growing inventory of properties on the market and demand weakening, many are concerned that holding onto assets could lead to diminishing returns. While Toronto’s long-term prospects remain strong, the short-term risks have intensified.

Experts advise that now may be the time to sell, particularly for those who purchased at or near the market peak, who have cash flow negative rentals, and are facing a mortgage renewal at a much higher interest rate. The typical annual real estate cycle favours sellers in the first half of the year, making Spring 2025 a potentially opportune time to exit the market. However, timing the market is notoriously difficult, and investors should weigh the risks carefully before making a decision.

Is It a Good Time to Buy?

For prospective buyers, the decision is equally complex. While prices have been falling, the high cost of borrowing has offset much of this benefit. Some industry insiders suggest that waiting until late 2024 or early 2025, when mortgage rates are expected to decline, could be a more strategic move. However, predicting the precise moment when prices will hit their lowest point is challenging, if not impossible.

Ultimately, for those buying a "forever home" and planning to hold onto the property for at least a decade, the risks of purchasing now are lower. For short-term investors, however, the risks may outweigh the rewards.

Conclusion: Uncertainty Reigns

Toronto’s real estate market stands at a crossroads, buffeted by economic uncertainty, rising mortgage rates, and shifting buyer preferences. While the city remains one of the world’s most desirable places to live, the near-term outlook for its property market is fraught with risk. Buyers, sellers, and investors must navigate these choppy waters carefully, balancing short-term pressures with long-term potential. In the end, patience and prudence may be the best strategies in a market that remains as unpredictable as ever.