5 Forces Driving B.C. Home Prices

At the highest level, supply and demand set house prices and all other factors simply drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are affordability, capital flows, government policy, supply, and popular sentiment.

In the long-run, the market is fundamentally driven by economic forces, but in the short-run, sentiment can drive prices beyond economically sustainable levels.

1. Affordability

Affordability is a function of:

Home Price Changes: Changes in the market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: Your maximum mortgage is calculated using income (i.e., how much money you can put toward mortgage payments) and interest rates (how big are the mortgage payments).

How have these changed lately?

Home Price Changes

Price growth reduces affordability and creates downward pressure on prices. Homeownership costs are considered unaffordable when they exceed 40% of household income.

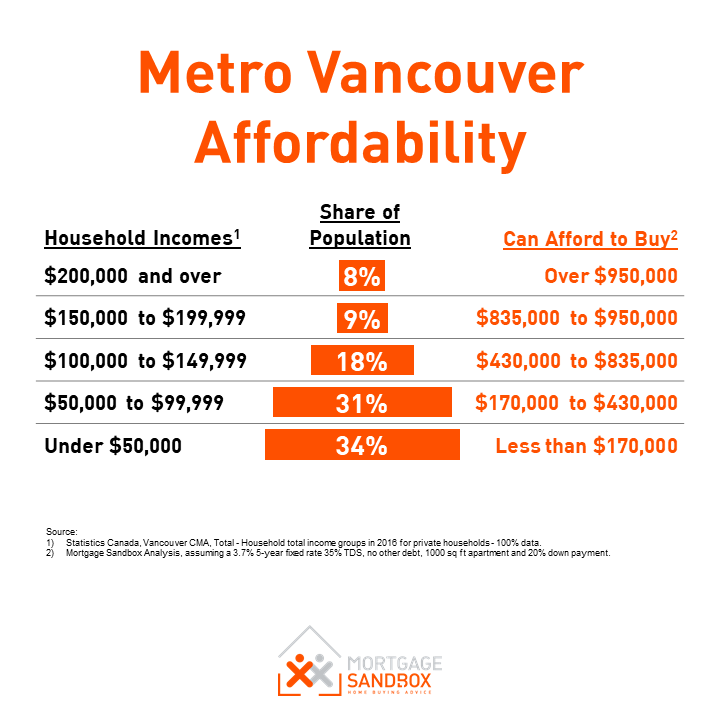

In March 2020, homeownership costs in Vancouver were 80% of the median household income, whereas, in Victoria, ownership costs were 58%. In other words, the B.C. home prices had exceeded economic fundamentals before the impact of the Coronavirus.

Savings-Equity

Rents were rising faster than incomes, so first-time buyers struggled to come up with down payments. To add insult to injury, anyone who managed to save a down payment and invested it in ‘blue-chip stocks’ may now find out they’ll need to save for a few more years.

Existing homeowners benefited from price appreciation, so they had more home equity, which they could use to buy a bigger home. That price gain may be short-lived as the Coronavirus is likely to depress prices trapping people in their ‘starter home’ until prices recover.

With the Coronavirus containment efforts, the banning of evictions, the conversion of AirBnBs into long-term rentals, and a halt to immigration, we believe rents will drop. That will allow renters to save more toward a future purchase when the market thaws.

Financing

Median incomes have not changed materially, but employment levels are dropping. To mitigate the impact, the Bank of Canada has reduced rates dramatically, but mortgage qualifying interest rates have not fallen nearly as much.

Lower interest rates were a significant factor driving up home prices between 2018 and 2019.

Job losses from Coronavirus containment efforts are a more powerful force than low mortgage rates. Without income, you can not qualify for a mortgage.

Canada shed nearly two million jobs in April, as the novel coronavirus pandemic tore through the Canadian economy. The official unemployment rate soared to 13%, but it would have been 17.8% if the agency had included the 1.1 million Canadians who stopped looking for work — likely because the COVID-19 economic shutdown has limited job opportunities.

We expect the Coronavirus Recession to drag out at least until the end of 2020. Click here to find out why there is likely to be another wave of infections and a corresponding lock-down.

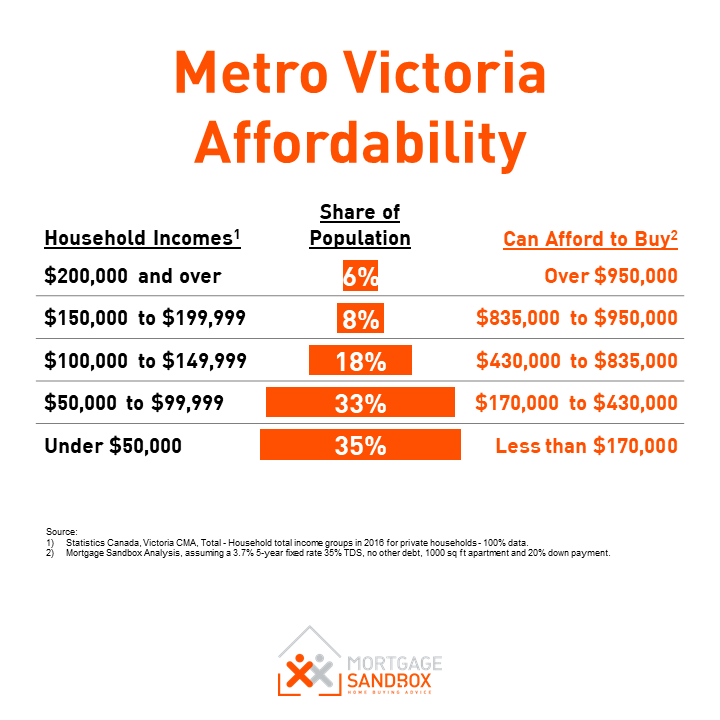

Overall Affordability

Overall, due to the impacts of the Coronavirus, homes are much less affordable than they were in 2019. The charts below are based on 2016 household income levels; however, they illustrate the poor affordability before the Coronavirus pandemic struck.

2. Capital Flows

These represent short-term investment, long-term investment, and recreational demand (i.e., not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Capital inflows raise demand and put upward pressure on prices while capital outflows have the opposite effect. If capital sits invested in real estate and nothing is bought or sold, it has no impact on the direction of prices.

Foreign Capital

Foreign Capital inflows were already dropping due to a combination of taxes and the ownership registry:

The annual B.C. speculation and vacancy tax rate is 2% for foreign owners and satellite families.

Since some foreign buyers were circumventing the tax using Canadian shell companies and straw buyers, the B.C. government will launch its corporate beneficial ownership registry in May of 2020.

Now with the travel bans that are part of Coronavirus containment efforts, we can expect there will be very little foreign investment in Canadian real estate.

Hong Kong Unrest

Some industry observers are speculating the fallout from Hong Kong residents’ clash with China’s government could put further pressure on the real estate markets of Vancouver and Toronto, as well-heeled expatriates and new Chinese immigrants seek safety in Canada.

The answer to this is complicated. The same story was told in August 2019 but the wave of immigrants never materialized. As well, if Canada suddenly accepted a surge in Kong Kong immigrants it is likely they would displace Mainland Chinese immigrants and immigrants from other geographies. It’s difficult to say whether arrivals from Hong Kong will be wealthier than the immigrants they’ve replaced and whether China will allow them to bring their wealth with them.

Canada’s relations with China deteriorated significantly in late 2018 after Ottawa arrested a Chinese high-tech executive on a U.S. extradition request. Accepting Hong Kong asylum seekers would be viewed by China as Canada acknowledging human rights abuse in a Chinese jurisdiction and this would further strain diplomatic and economic relations.

Long-term Rental Investors

Nearly 50 percent of Vancouver condos are not owner-occupied and almost 20 percent of detached single-family houses in the city are not occupied by the owner. Similar trends are reflected in the Okanagan and Victoria.

Rental investments are a significant driver of home prices. As it relates to our analysis, we expect domestic interest in long-term rental income properties to dry up for as long as Coronavirus eviction bans are in place. The government has not developed an exit strategy for landlords with rent arrears when social isolation policies are lifted. How will tenants repay three to six months of rent arrears?

As well, recent reports of rents falling across Canada will discourage new rental investment until rental rates stabilize.

Rental investors will simply try to time any future property purchases for they see an end to the Coronavirus impacts on revenue properties, and they will avoid properties with tenants who have outstanding rent arrears.

Short-term Rentals

We are watching short-term rentals closely because travel bans will effectively shut down short-term rentals for the next few months (Canada’s tourist high season).

House Flippers

With Coronavirus containment efforts underway, house flipping will be very risky so we expect serial flippers will stay out of the market until they see a bottom to the market. Then they will try to pick up some bargains.

Dark Money

Dark money is the proceeds of crime or money that are transferred to Canada illegally. This includes money earned legitimately that is illegally transferred from countries with capital controls (e.g., China) and legitimate earnings moved from countries who are the subject of international sanctions (e.g., Iran, Russia, and North Korea).

In order to hide the illegal nature of the funds, it is laundered in the real estate market. Sometimes the true owner of the property is hidden by using a Straw Buyer and other times the property is owned by a shell company.

Sometimes a real estate agent or lawyer will accept the illegal cash to help the nefarious individuals hide its true origins. In 2015, a B.C. realtor was caught with hundreds of thousands of dollars in her closet, at home.

$5 billion in illicit cash was laundered through real estate in 2018, and approximately three percent of straw buyers were students, homemakers or unemployed. An eye-opening report by Royal LePage says that Canadian residents on student visas buy 1 out of 10 homes in B.C. It would appear that the parents of students are using their children to evade the Foreign Buyer Tax. The beneficial ownership registry may reduce the number of student purchasers if their parents, who are foreign residents, are identified as the ultimate beneficial owners.

We see no evidence of a diminished role for dark money in local real estate.

Overall Capital Flows

The net effect of all the recent changes to Capital Flows will be to reduce inflows of capital toward residential real estate, and this will put downward pressure on home prices.

3. Government Policy

Governments were trying to engineer a ‘soft landing’, but now they are trying to protect against a housing crash by encouraging banks to allow borrowers to defer their mortgage payments up to six months.

COVID-19 Support Measures

Mortgage Payment Deferral:

A mortgage deferral is an agreement between the borrower and the lender to pause or suspend mortgage payments for a certain amount of time.

After the agreement ends, your mortgage payments return to normal. The mortgage payment deferral does not cancel, erase, or eliminate the amount owed on your mortgage. The borrower still accrues interest that will have to be paid.

A Canadian with a $250,000 mortgage who defers their mortgage by six months adds approximately $4,000 in accrued interest to their mortgage balance.

Eviction Bans and Suspensions

The B.C. government has suspended the enforcement of evictions indefinitely and Residential Tenancy Branch will not issue any new eviction orders until further notice. Sheriff's offices have been asked to postpone any scheduled enforcement of eviction orders.

Short-term Rental Regulation

A recent court decision upheld a strata corporation’s restrictions on short-term rentals. In this case, the condo owner was ordered by a B.C. Civil Resolution Tribunal to pay $46,400 in fines.

In most B.C. municipalities, short-term rentals must be licensed and must be the host’s principal residence. They must also be compliant with strata corporation bylaws.

Speculation and Vacancy Tax

At the end of 2019, the annual Speculation and Vacancy Tax rate on foreigners quadrupled from 0.5% to 2.0%.

Beneficial Ownership Registry

BC’s Corporate Beneficial Ownership Registry came into effect in May of 2020. This should help to reduce dark money in B.C. real estate however it will be difficult to discern the effect of the registry on home prices because of the market volatility caused by the pandemic.

4. Supply

Supply comes from two sources.

Existing sales: Existing home sales are sales of ‘used homes’. They are homes owned by individuals who sell them to upgrade, to move for work, or some other reason. The B.C. Real Estate association only reports existing home sales and listings.

Pre-Sales and Construction Completions: Most new homes are sold via pre-sales before the construction has started. These are predominantly apartments and townhomes. Data on pre-sales is private and difficult to find, but construction starts (reported by the government) are a very accurate lagging indicator of pre-sale activity.

Rising supply releases the upward pressure on prices caused by demand.

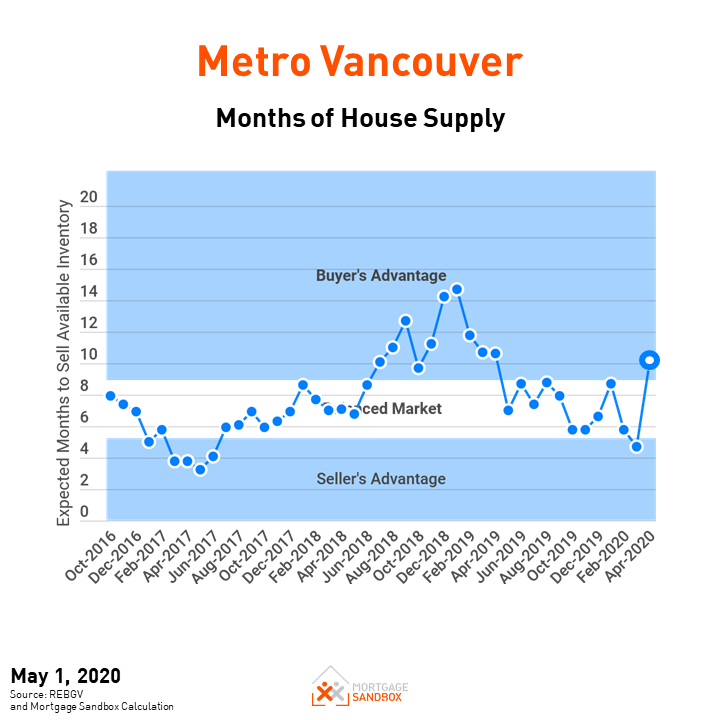

Months of Supply of Existing Homes

Spring is traditionally the busy season for real estate activity; however, this year, it has been more challenging to buy homes with social distancing measures.

In the past, a lack of active listings was driving the seller’s market. During the pandemic, we expect the market will shift in favour of buyers.

Coronavirus mortality and hospitalization rates (short-term impact)

We know that older Canadians are more vulnerable, and the fatality rates follow a pretty clear trend:

People aged 80 and up have an expected 14.8 percent mortality rate

8 percent of those 70 to 79 succumb to it

3.5 percent of 60 to 69 year-olds are likely to pass away

In 2020, 45% of baby boomers will be over 65 years old.

Obesity is also a COVID-19 risk factor and 22% of B.C. residents are obese.

The Coronavirus could cause an unusually large number of homes to come to market in areas favoured by retirees. Real estate prices in Penticton may be particularly vulnerable.

Coronavirus short-term rentals sold or converted (short-term impact)

Travel bans will effectively shut down short-term rentals for the next few months (Canada’s tourist high season). The drop in bookings may force many owners of apartments primarily used as short-term rentals to sell their condo or repurpose it for long-term rentals adding thousands of homes to the market in the next six months.

We are already seeing the impact of these homes joining the long-term rental market.

Mortgage Delinquencies and Foreclosures

The most recent data indicates that more Canadians are missing their monthly payments, and job growth has been healthy. Some economists have been warning of a recession, and even without a recession, it appears more Canadians are over-extending themselves. Surprisingly, the increases in delinquencies are led by Ontario and British Columbia, and not Alberta.

According to Equifax, the credit bureau company:

“Mortgage delinquencies have also been on the rise. The 90-day-plus delinquency rate for mortgages rose to 0.18 percent, an increase of 6.7 percent from last year. Ontario (17.6%) led the increases in mortgage delinquency followed by British Columbia (15.6%) and Alberta (14.8%). The most recent rise in mortgage delinquency extends the streak to four straight quarters.”

A recent survey by MNP reported a staggering number of Canadians are stretched to their limits:

“Over 30 per cent of Canadians say they’re concerned that rising interest rates could push them close to bankruptcy, according to a nationwide survey conducted by Ipsos on behalf of MNP, one of the largest personal insolvency practices in the country.”

Job losses from Coronavirus containment will worsen this situation. Although the CMHC can help Canadians via Canadian lenders offers options to defer payments, re-amortize mortgages, add interest arrears to your mortgage balances. It will not help overextended Canadians from their credit card debt nor will it protect Canadians who chose to finance their homes with private mortgage lenders.

Antrim, one of the larger private lenders in B.C. has lent $500 million in British Columbia. 1,529 of their mortgages are in Metro Vancouver, with an average weighted interest rate of 8%. Most of the private lender mortgages need to be re-approved every 12 months, and in a deteriorating market, they may choose not to renew those mortgages. That would force the borrowers to sell their properties.

Baby Boomers Downsizing?

According to a recent survey, 26 percent of B.C. Boomers who own a home had most of their retirement savings tied up in real estate. Another survey from RBC says, “Over the coming decade, we expect baby boomers to ‘release’ half a million homes they currently own—the result of the natural shrinking of their ranks, and their shift to rental forms of housing, such as seniors’ homes, for health or lifestyle reasons.”

As baby boomers begin downsizing and list their million-dollar homes for sale, they will add supply in what is considered the luxury market. If not enough Gen-X and millennial buyers are to buy these expensive homes, there is a risk that this may depress prices at the top of the market, which will then compress prices for townhomes and condo apartments.

In the near-term, supply is tight, but in the medium-term, there are risks of excess housing supply.

Pre-sales and Completions

New Construction:

There are a record number of homes under construction in B.C. Those new homes will help alleviate the extreme supply shortage. Keep in mind that rental vacancy needs to reach 3% before a Metro Area can be considered to have enough supply, and vacancies are currently below 1%.

A key consideration - condo units completing in late 2021 were sold at peak prices before the recent price correction. These “peak price” condos will be very difficult to flip at a profit and buyers taking possession will have difficulty obtaining mortgages when if the market value turns out to be lower than the purchase price. As a result, peak priced condos may be re-released to the market but with tight sales timelines which would lead to a flood of supply.

Pre-sales:

Pre-sales, which are purchases of brand-new homes from developers, have trended down substantially since 2018.

Pre-sales will trend down further as showrooms close during the pandemic. Developers need to sell at least 70% of a project to secure financing and begin construction, so when social distancing measures are lifted they will likely try to entice buyers with price discounts, move-in allowances, and cool amenities.

Popular Sentiment

It’s difficult to anticipate popular sentiment, but as witnessed in the past two years, sentiment can shift quickly.

If cases in B.C. begin to rise again then we can expect sentiment to worsen. In the short-term, we expect buyers will hold back while many sellers will move forward.

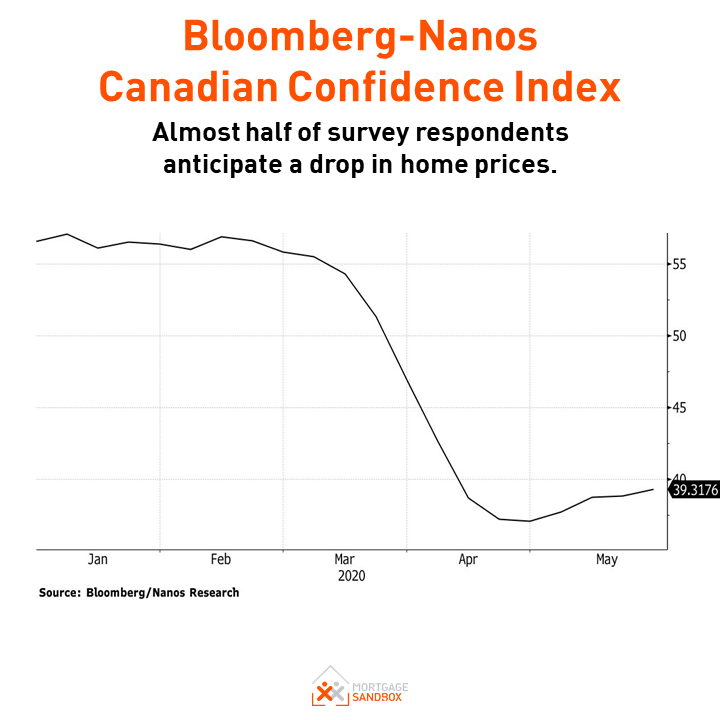

The Nanos Canadian Confidence Index has shown a noticeable drop in confidence. “Even as overall sentiment has improved in May, expectations around real estate are weakening. Over the past two weeks, almost half of survey respondents anticipate a drop in home prices.”

Find out where prices are headed in B.C.

Like this report? Like us on Facebook.