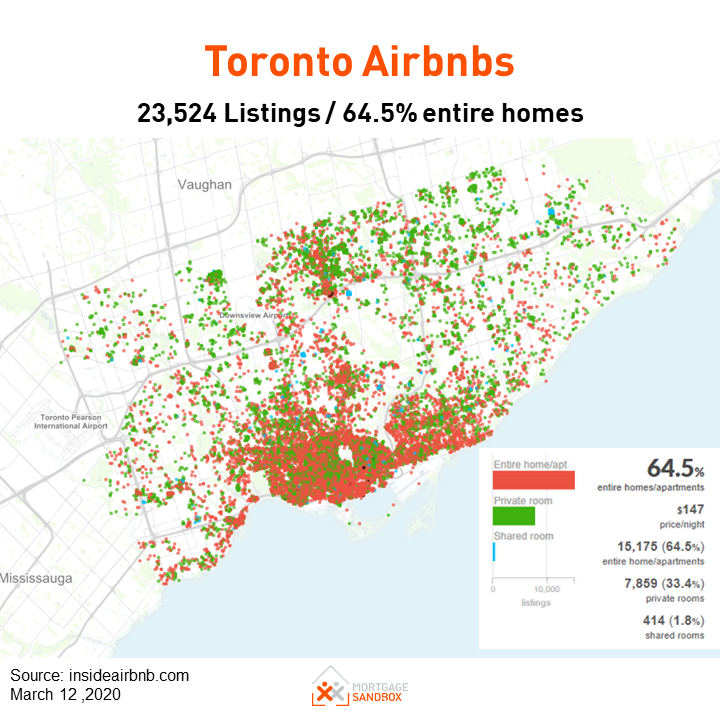

As a result of Coronavirus, Toronto’s short-term rentals will be empty for three to six months. Can the owners afford it?

All tagged Toronto

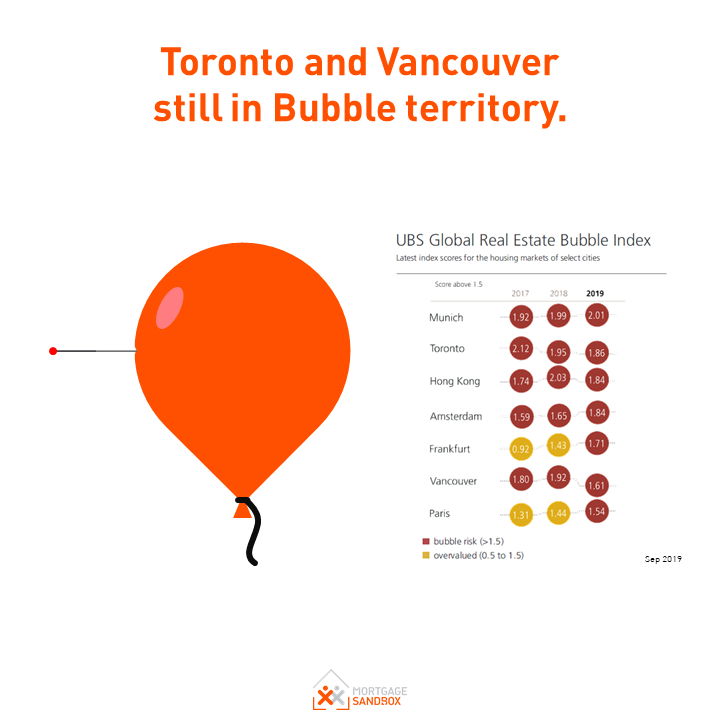

Is Canadian Real Estate Less Risky Now?

Home prices in Vancouver and Toronto are now lower. Does that mean the bubble is deflated and real estate is less risky?

Most people think real estate is a low risk and high return investment however many experts disagree. This article explains why many economists are concerned about risk in Canadian real estate and it’s potential to derail the economy.

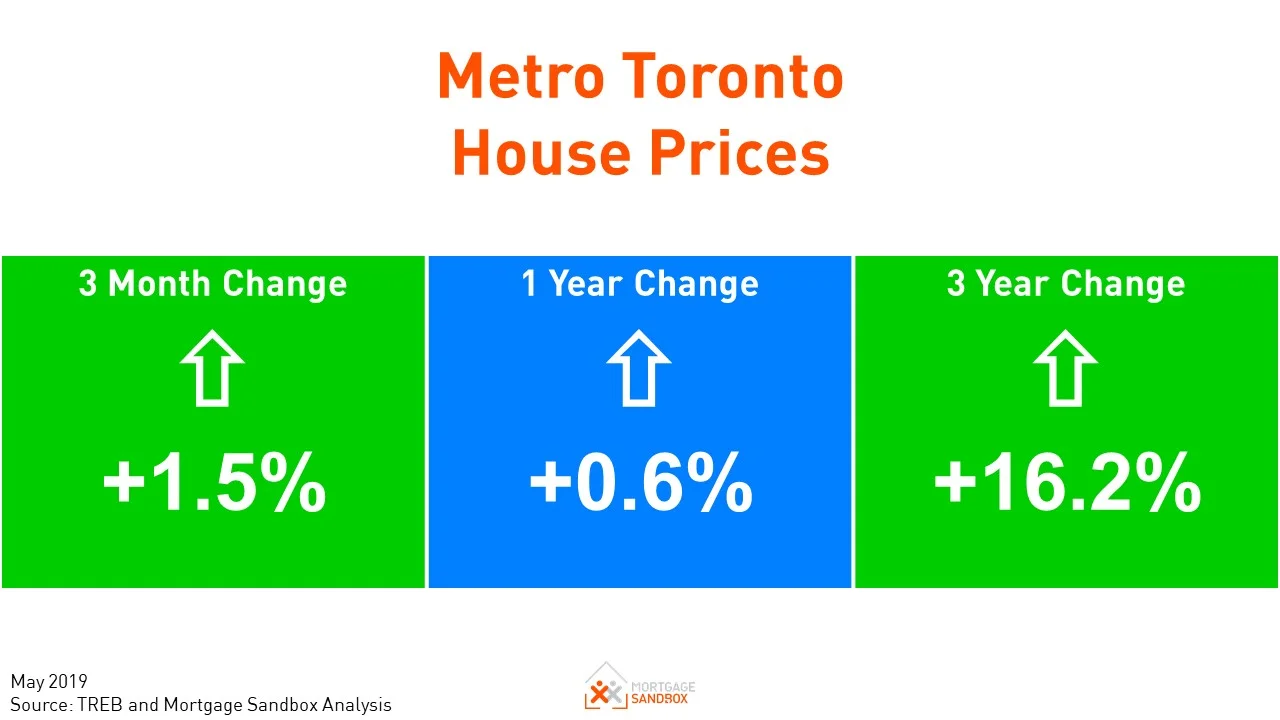

Metro Toronto Home Prices on the Rise

Latest Toronto house price trends and price forecast.

What Canada can learn from the U.S. Housing Crisis

Many Canadian analysts have erred by using defaults to predict a housing correction. It’s the other way around! Lessons from the U.S. show a housing slowdown causes defaults.

Toronto Home Price Forecast for 2019

Most analysts expect further price increases but given recent trends we think prices will more likely drop in 2019. Find out why.

How will mortgage rates affect the housing market in 2019?

Key forces are aligning to push home prices down in Vancouver and Toronto.

Toronto Real Estate Market Update – Better or Worse?

Over the past ten years there have been many government interventions intended to cool the housing market. It appears we may have hit a tipping point. The market has stalled and is either about to provide a “soft landing” or “hard landing” delivering much needed affordability to the market. Alternatively, this could just be a breather before prices continue their upward march.

How much fuel is left in the real estate rocket?

Canadian condos have shown tremendous price growth since 2016 but it is uncertain how much price growth potential remains in condos. Some major Canadian banks have forecast the real estate market in Vancouver and Toronto will hit a tipping point by the end of 2019. As the impact of interest rate increases, government regulation, and taxes work their way through the market toward the middle of 2018 the accuracy of these forecasts will be revealed.