Toronto Real Estate Market Update – Better or Worse?

Torontonians like to compare the local market to other global cities, so it is important to point out that most of Toronto’s market indicators are similar to those seen recently in Sydney, Stockholm, London, and Manhattan, where there are weak markets and home prices, have begun to drop. The Toronto Real Estate Board says, “Residential sales…for July 2018 amounted to 6,961 – up 18.6 per cent compared to July 2017. Over the same period, the average selling price was up by 4.8 per cent to $782,129”. Is that an assessment of the market or are they pushing their product?

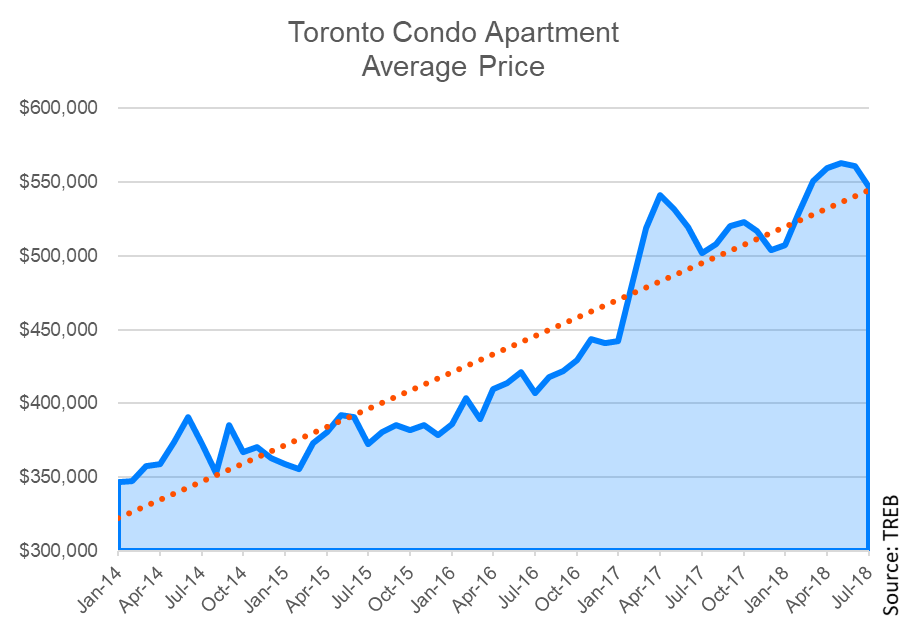

At Mortgage Sandbox, we have looked at the data trends and concluded that they are wearing rose-tinted glasses. Home prices may be up when you compare July 2017 to July 2018 but they are don’t appear to be rising strongly upward. For both apartments and detached homes, prices are headed below the long-term trend-line.

Further, the number of homes sold at current prices is trending much lower than the past. With that said, the Toronto market looks stronger than Vancouver’s. There is between 2 and 4 months of inventory for sale in Toronto whereas there is 3 to 7 months of inventory for sale in Vancouver. Perhaps the Toronto report should say “Toronto’s market remains tepid but not as bad as Vancouver’s”.

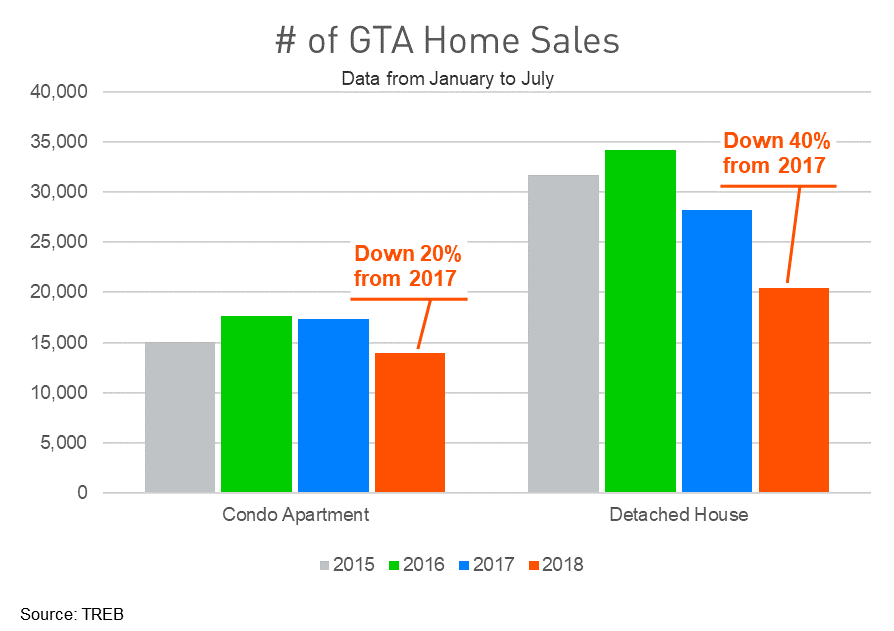

7-month comparison

Sales have dropped significantly when compared with the first 7 months of recent years. Government intervention is likely a factor but the elephant in the room is affordability. Few households can afford the $1 million average house let alone with current interest rates, even if prices are on average $200 thousand cheaper than the peak in March 2017. Without a major price correction people will continue to pile into condos, but even condo sales are declining in the face of exorbitant prices. The Toronto Real Estate Board can sugar coat it, but it’s clear real estate agents are taking a pay cut in 2018.

If non-resident buyers are the foundation of current high prices, have they stepped away? There are many theories that try to explain why prices continue to climb, but economic fundamentals aren’t one of them. In April, CMHC, the government agency charged with helping Canadians to achieve home ownership, reported that prices in Toronto and Hamilton “are higher than incomes, mortgage rates and other fundamentals can justify.”

What’s selling?

Detached houses are less than half sales. The GTA market is driven by homes priced under $1 million.

The most frequent condo sales are in the $400,000 to $500,000 range while the most attractive mid-range homes (Semi-detached/Row/townhome) are in the $600,000 to $700,000 thousand range.The most common detached house purchase is in the $600,000 to $900,000 range.

Conclusion

At present, there is a lot of uncertainty in Canadian real estate markets. You could try to time the market, but nobody knows the best time to buy. If you wait, rising interest rates will erode your home buying budget yet further price reductions would allow you to buy more home for your buck. Based on the slow sales in the first half of 2018, it appears most prospective buyers are taking a “wait-and-see” approach.

If your family is growing and you need a larger space, simply a place to call your own, or you believe timing the market is pointless, then take advantage of these tips to reduce your risk.