How much fuel is left in the real estate rocket?

Canadian condos have shown tremendous price growth since 2016 but it is uncertain how much price growth potential remains in condos. Some major Canadian banks have forecast the real estate market in Vancouver and Toronto will hit a tipping point by the end of 2019. As the impact of interest rate increases, government regulation, and taxes work their way through the market toward the middle of 2018 the accuracy of these forecasts will be revealed.

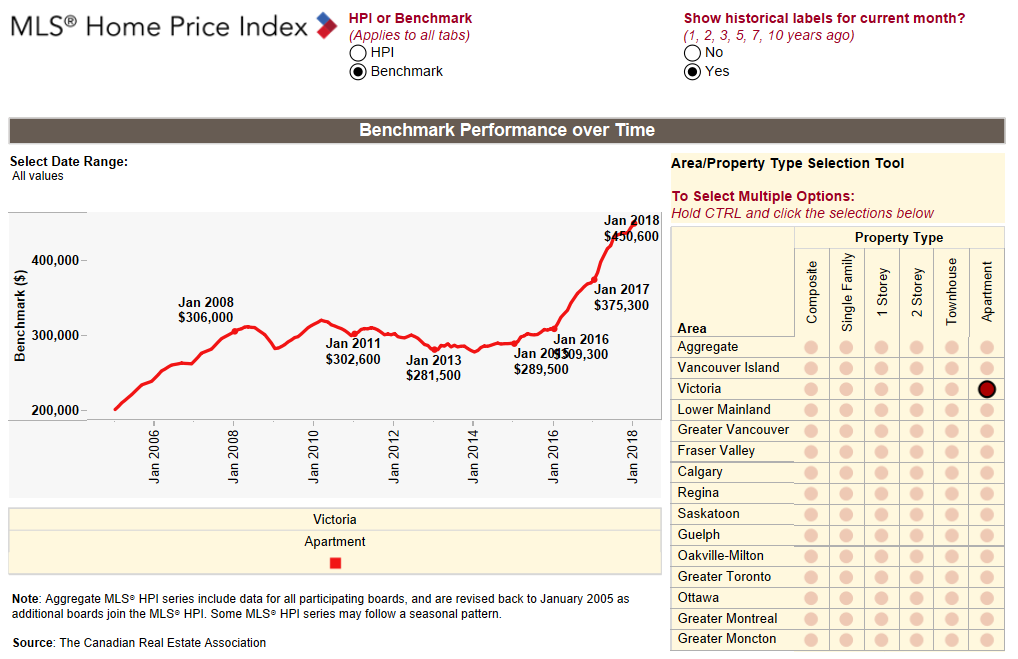

Prices of detached homes have already begun to to drop in Vancouver and Toronto, while condos are on track for another year of double digit price gains. Looking at the recent price gains in the 10 year context makes them all the more remarkable. If condos were to appreciate in value by 20% for another two years then they would start to approach the prices of detached homes and that seems unlikely.

Royal Bank is predicting the market Vancouver market to turn downward in 2019 while National Bank forecasts that 2018 will the the tipping point. TD's December forecast said ongoing gains are unlikely to last in light of regulatory changes but projected prices would continue to rise in BC through 2019.

Regardless of the forecasts, readers should note that for the 7 years from 2008 to 2015 condo prices in Vancouver and Victoria were flat, so the recent +20% annual gains are not necessarily a long term sustainable trend.