How is a Mortgage Broker's Commission Calculated?

According to a recent CMHC survey, most buyers contacted up to 3 lenders and 2 mortgage brokers for information or advice. As well, 47% of home buyers used a mortgage broker to negotiate their mortgage. Often a mortgage broker (“broker”) will say there is no charge for their help in finding a good mortgage and negotiating mortgage terms with the lender. This isn’t entirely true! Here are some direct quotes from brokers’ websites.

“Mortgage professionals work for you, and not the banks; therefore, they work in your best interest. From the first consultation to the signing of your mortgage, their services are free.”

“We never charge fees to close your mortgage, ever.

In fact, lenders pay us to process your mortgage on their behalf.”

Let’s revisit the last line, “lenders pay us to process your mortgage on their behalf.” That means that, to some degree, the mortgage broker is really working for the lender and not you. You need to know that lenders have structured the fees to mortgage brokers in a way that provides the brokers with an incentive to:

Be loyal to one lender

Not discount the 5-year mortgage interest rate

It makes perfect sense; they want to reward people who send them lots of business and if the broker does things that cost the lender money then the lender wants the broker to share some of the cost.

Since brokers don’t work for free should you be concerned about who is paying them and how? As a borrower, does your broker have any incentive to betray your trust? This article will explore the qualities you should look for in a broker, broker compensation, the resulting incentives, and the potential issues you should know about.

Before diving into the details, let’s recognize that most brokers do a superb job and are ethical and honest. In 2019, 76% of buyers surveyed would recommend their Broker to a friend! The purpose of this article is simply to help you understand the factors in play.

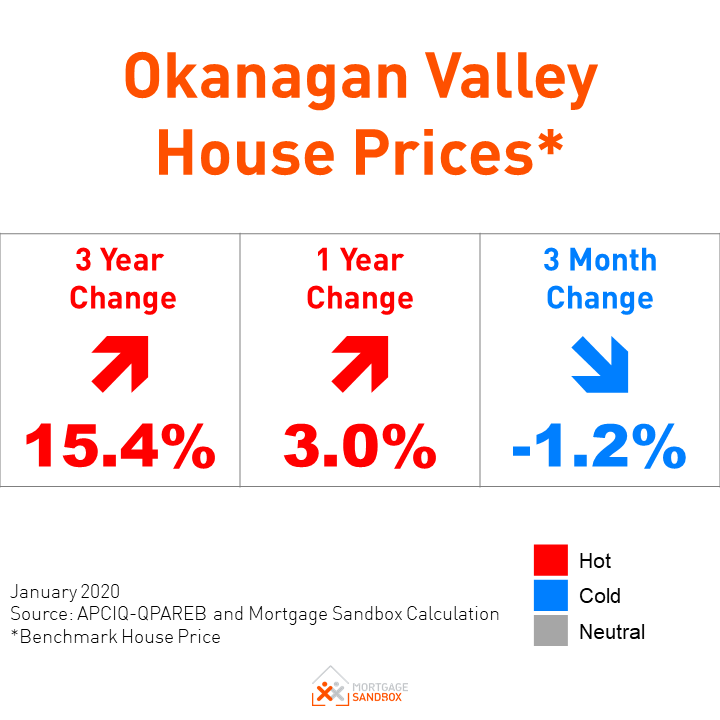

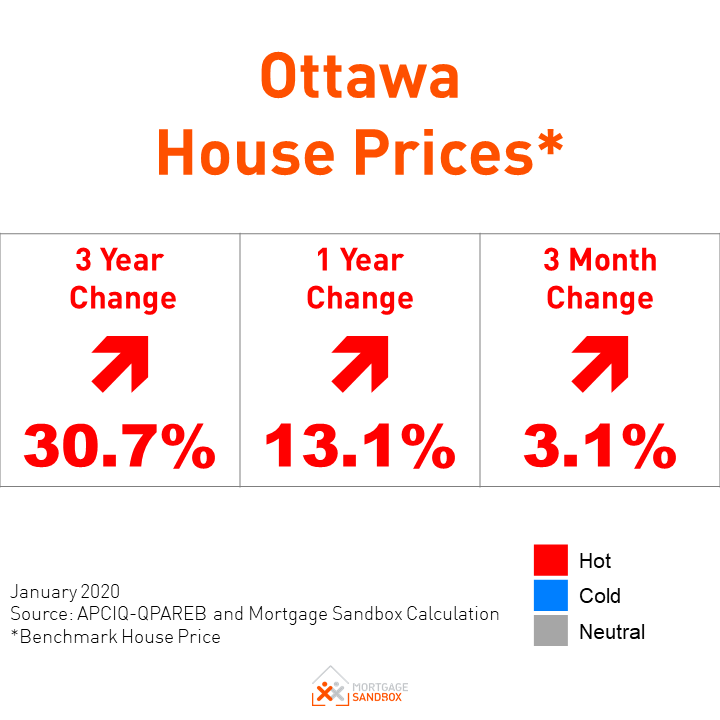

Read the latest forecast for major Canadian cities:

Why do people choose mortgage brokers?

Buying a home is typically the biggest financial commitment you will make in your life and you need to feel confident in your decision. Mortgage brokers are a valuable resource to help Canadians get access to a variety of traditional lenders and innovative lenders. This enables home buyers to find the best financing for their circumstances. Some of these lenders are exclusive to brokers; instead of spending millions buying up real estate for branches and staff, they offer their mortgages exclusively through brokers.

Mortgage brokers are provincially licensed and regulated and are expected to meet high ethical standards.

Just keep in mind that mortgages have some critical product features (e.g., early repayment penalties, amortization) other than the rate that lenders often won’t take the time to explain. That’s another reason mortgage brokers, who are not beholden to a single lender, are better ar explaining the pros and cons of these features.

To illustrate the complexity of mortgage products, we counted 9 different rates for a 5-year fixed rate with a single lender and there are just as many 5-year variable rates with the same lender. Imagine how complex our task becomes when we try to compare the 3-year variable and fixed rates to the 5-year rates across more than one lender! That is why Mortgage Sandbox recommends that you work with a mortgage broker to help you get a competitive rate and help you understand all the features of your mortgage aside from the rate.

How mortgage brokers are paid

Brokers make money in two primary ways:

A finder fee is paid by the lender

The broker charges a fee to the borrower

1. Lender Paid Finder Fee

Finder fees vary depending on the duration of the mortgage contract.

We’ve spoken to some mortgage brokers and if you commit to 5 years with the lender, the mortgage broker would be paid between 0.75% and 1.00% depending on the lender and the type of mortgage. If you commit to two years, the broker will be paid between 0.45 and 0.75%. For example, a broker that sources you a 5-year contract on a $300,000 mortgage would be paid $2,250 to $3,000.

On a 5-year fixed mortgage, some lenders allow brokers to “buy down” the interest rate by up to 0.10% by giving up some of their fees. In the example above, the broker would have to trade between $900 and $1,200 of their finder’s fee to get the borrower 0.10% off from the 5-year fixed mortgage rate. Essentially, they would lose 40% of their income to get you an extra 0.10%.

Since finders’ fees are consistent across most lenders, lenders have tried to make themselves more attractive to brokers by offering volume bonuses and other perks to reward brokers for funnelling more business to them.

Lenders also penalize brokers who have a low funding rate (i.e., they got approval but failed to fund the mortgage) by no longer looking at their deals or reducing finders’ fees. They do this because reviewing and approving a mortgage deal spends the lender’s time and money. Keep this in mind when you ask a broker to approve a mortgage for you. This is one reason brokers don’t send deals to 10 lenders and pick the best one. Instead, they pre-screen the deal and identify the best lender for that borrower. They then send the deal to the best-suited lender. They will be penalized if you take your business elsewhere whereas branch staff at a bank or credit union aren’t penalized in the same way.

2. Borrower Paid Broker Fee

Only “Prime Lenders” and some “Alternate Lenders” pay finders fees. Private lenders don’t pay the broker a fee, so the broker needs to charge a fee to cover their time invested in finding your financing.

In this case, a broker can negotiate the fee with you and can then act as an advocate on your behalf. This fee structure has the least potential for conflict of interest, but the fee is paid by the borrower and not the lender.

For a typical private deal, a broker will charge 1% of the value of the mortgage. If your deal is a difficult one, then they may ask for 2% or more. If they don’t successfully find you financing, they are paid nothing. Keep in mind that if you sign an agreement and they find you a good deal then you are on the hook to pay their fee. Looking at the $300,000 mortgage, the borrower pays the broker $3,000.

Let’s do the math to figure out a broker’s revenue. A Vancouver household with the median income can only qualify for a $320,000 mortgage. If a broker gets a full finder fee, then they will have to complete 20 mortgages annually to gross $64,000 annually. To complete that many mortgages, they will need to start applications with 100 applicants per year. Why so many? Well, some are already approved elsewhere and are simply rate shopping (time wasted for the broker), others are looking to transfer at renewal time but then decide switching isn't worth the legal fees and trouble, still others would love to work with the broker but can’t buy at current home prices.

Brokers Usually Work with Lenders

Since lenders offer bonuses and perks for high volumes and will sometimes cut off brokers who do not send them enough business, brokers pool their business. In effect, a group of brokers will run all their deals for Lender A through one individual who will gain a high status with that lender, earn volume bonuses, and receive perks on behalf of the group. Obviously, this is “gaming” the system, but lenders seem to encourage it. Perhaps because they take comfort from the fact that all deals are going through a gatekeeper who knows their rules and policies well? Or perhaps they started offering this system to brokers and now they risk losing business if they try to stop the practice?

What Costs do Brokers Face? Critics of broker commissions tend to focus on the gross commission but that ignores significant broker expenses. Corporate and franchise brands (e.g., Dominion Lending, Mortgage Alliance, Verico) take a percentage of a broker’s gross revenue to cover their costs. They then use this money to invest in technology, sponsor the Home Show, run ads on TV (e.g., Dominion Lending used to have Don Cherry as their spokesperson) and rent out offices. They can charge brokers up to 25% of their finder's fees to pay for all of this.

As well, there are individual expenses like driving to meetings with borrowers, other marketing and promotional expenses, and sometimes gifts/fees paid to realtors or other professionals for referring customers to them. If we factor 25% expenses into the equation, a broker needs to fund a minimum of 25 mortgages annually to make $60k after expenses and before taxes. That’s a lot of hustle.

What Factors Incentivize Brokers?

Regardless of the strength of a broker’s ethics, you need to be aware of how their financial incentives can influence them. Sometimes what is good for a broker is also good for the borrower, but sometimes it’s not.

| Make More Money | Spend Less Effort |

|---|---|

|

A broker will get paid more if the borrower:

|

A broker is paid the same whether they take the deal to 1 lender or 10, so they will do the intelligent thing and:

|

Sandbox Suggestion: Don’t get suckered with rate bait. Some lenders advertise enticingly low rates for which you are unlikely to qualify.

Unfortunate Behaviours

Broker incentives can lead to some unfortunate behaviours.

Focus on the 5-year rate

Nearly 7 in 10 Canadians opt for a fixed-rate mortgage and most of them choose a 5-year fixed rate. Since home buyers tend to have this rationale, it is easier for a broker to continue to offer a fixed rate when it may not be the best option for a customer’s situation. Additionally, a mortgage broker will be paid a slightly higher finder's fee for a 5-year contract than a shorter one resulting in a general bias towards the 5-year fixed rate.

Order-taker rather than advice-provider

Many customers have researched mortgages and approach a broker with aggressive and inflexible interest rate demands. The broker may want to provide valuable advice but doesn’t want to be perceived as uncooperative. In this case, the broker may give the customer what they ask for whether it's in their best interest or not. They do this because they are afraid the customer will interpret the brokers' questions as an unwillingness to give them what they want. We estimate there are potentially 90,000 different mortgage feature combinations which we explore in more detail in our mortgage basics. A mortgage broker can take the time to understand your priorities and find the right features for your personal situation. If they merely take your order it could be to your detriment because they can be a powerful advisor.

Our platform matches you with local, pre-screened, values-aligned Realtors and brokers because shared values make better working relationships.

Turning a blind eye to misrepresentations

If you lie on your application for a mortgage, you may be able to qualify for more money or a lower rate. Although this may seem like a victimless crime, it is still fraud. After funding, if a lender suspects misrepresentations or forged documents in a mortgage application they can demand new documentation to confirm the fact, and if they discover fraud, they can press charges and demand repayment.

The jury is out on whether brokers who earn 100% commission income have a stronger incentive to turn a blind eye to misrepresentations than bank staff who have a salary with a bonus tied to sales targets. Brokers get a bigger incentive “carrot” for more sales, but they can’t be fired. Bank staff who, when they don’t hit aggressive sales targets, may lose their jobs could have the incentive to bend the rules. Mortgage broker ethical infractions are published by the provincial regulator while branch staff infractions are usually handled as an employee disciplinary issue and settled privately to protect the institution’s reputation.

Values Matter

There are rules against unethical behaviour and brokers can receive a written warning, a fine, or have their license revoked if they’re caught doing something unethical, but the proof is often hard to establish.

Some people feel that brokers make too much money, or the job is easy, but realistically very few brokers are getting rich. About 3,500 brokers in British Columbia sold 39% of the 153,000 mortgages issued. That’s an average of 17 transactions per year for each mortgage broker which is below the threshold we calculated necessary to gross $60,000 in revenue. In truth, some brokers are talented, have extensive networks, and do very well while others don’t make much money at all. It’s inaccurate to directly compare commission incomes or small business incomes to stable full-time employee salaries.

To put the risk of this industry in perspective, on January 1st, 2018 the federal government enacted new mortgage rules that will reduce the average mortgage size by 20%. That’s essentially a law that gives mortgage brokers a 20% cut in pay from one year to the next!

Being a broker can be a very tough job. They may have to meet many hopeful home buyers with only a fraction turning into paying business. They work weekends and evenings and are generally on-call at all hours.

Mortgage Sandbox still feels that more could be done to protect consumers from unethical practices and we are developing an easy to use, data-driven, matching tool that connects Canadians with pre-screened, local, ethical real estate professionals, who share their interests and values, and have complementary ways of working.