2020 Toronto Real Estate Forecast

HIGHLIGHTS

|

This article covers:

Where are Metro Toronto prices headed?

What factors drive the price forecast?

Should investors sell?

Is this a good time to buy?

1. Where are Metro Toronto home prices headed?

Home Price Overview

The bad news (for buyers) is that in the past year prices have risen significantly faster than incomes. Prices rose consistently upward throughout 2019 and barely responded to the forces at play in a traditional seasonal real estate cycle. People planning to sell their home will take heart in the fact that waiting one year will have earned them a high rate of return. House prices are still lower than the peak reached in May 2017.

In this section, we review recent price trends for houses, townhouses and condos in the GTA and then share a forecast developed with input from a range of leading Canadian forecasters. If you would like to skip the current trends, you can scroll ahead to the 2021 Metro Toronto House Price Forecast.

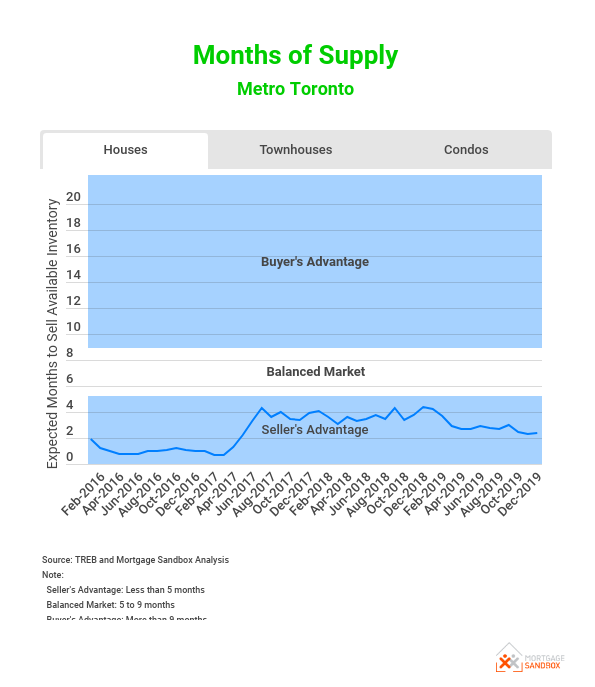

Metro Area Detached House Prices

Are Toronto house prices falling? Not really. Most sub-markets have seen a modest rise in prices but Oakville house prices were down slightly toward the end of 2019.

In 2019, benchmark Metro Toronto house prices rose closer to $1 million. The federal, provincial, and municipal governments have implemented measures to cool the market and bring about a “soft landing” but they have been vague in defining the type of soft landing they are targeting. Likely they are seeking price growth in the range of 1 to 3% annually – in line with income growth.

Although the benchmark house price for Metro Toronto is rising, not all areas are seeing price gains. In some sub-markets, house prices have surged while in other sub-markets prices have been dropping.

Additionally, 65% of GTA houses purchased in 2019 were valued at less than $1 million. Throughout the year, 30% of homes bought were in the range of $700 to $900 thousand.

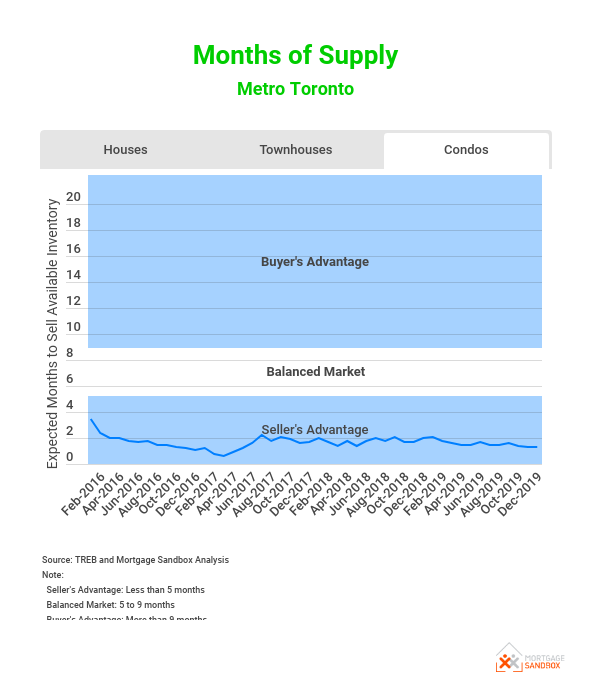

Metro Toronto Condo Apartment Prices

Are Toronto condo apartment prices falling? Only in Milton, Oakville and Aurora. Most sub-markets have seen a modest rise in apartment prices with Pickering and Mississauga doing best toward the end of 2019.

Metro Toronto apartment prices skyrocketed in 2019, not quite as dramatically as in 2017 but impressive nevertheless. Today, the benchmark Metro Toronto condo is almost affordable without help from the bank of mom and dad. Putting this into context, a benchmark Toronto apartment is still more expensive than a single-detached house in Calgary.

Although homes are selling quickly, most of the interest is in cheaper apartments while more expensive units are sitting untouched. 81% of condos purchased in 2019 held prices lower than $700,000 and 66% had values of less than $600,000. In due course, the higher quality and larger (i.e., 2 and 3 bedrooms) condos will drop in price and this will shift the prices downward for more modest condos.

Metro Toronto Townhouse Prices

In 2018, 90% of condominium townhomes purchased had values of less than $800,000 and 61% had values less than $600,000.

Still a challenge for first-time homebuyers

Toronto house prices have become even less affordable but not as bad as Metro Vancouver where the benchmark price of a house is $1.4 million.

A first-time homebuyer household earning $78,000 (the median Metro Toronto household before-tax income) can only get a $320,000 mortgage. To buy a benchmark priced condo, a first-time homebuyer needs to save almost $250,000 cash for a down payment or receive a very generous gift from mom and dad. For most people, that’s just not on the cards.

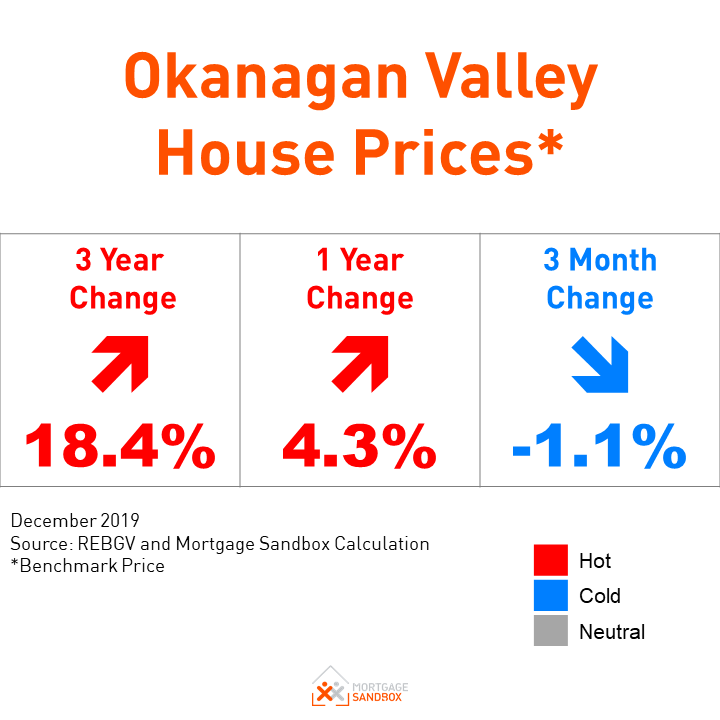

What about the rest of Canada?

Read the Ottawa Real Estate Forecast, Montreal Forecast and the Metro Vancouver Forecast.

2021 Metro Toronto House Price Forecast

At the beginning of 2019, RE/MAX predicted house prices in Metro Toronto would rise only 2% while Royal LePage offered a conservative 1.3%. Moody’s, the bond rating agency, projected a pessimistic 3.6% drop in prices for last year. Given the low accuracy of forecasts, it’s curious that Royal LePage added the decimals. In the end, a benchmark Metro Toronto house price rose by 5.9% but this hides some regional variation. For example, Burlington houses rose by 9.5%, Brampton 8.9%, and Oshawa house prices gained 8.8%. Markham was less impressive rising only 2.2% and in Richmond Hill, a rise of 0.8% didn’t even keep up with inflation. Mississauga and the City of Toronto were middle of the pack with increases of 6.3% and 5.4% respectively.

For 2020, we expect Metro Toronto to experience seasonal price variations that are reflective of a more balanced market. The average of the forecasts used in our analysis predicts a modest rise of 4% in 2020 and 3% in 2021.

There is still a pile of risks that could derail a price recovery and 2020 is unlikely to be a return to the booming real estate prices of the 2010s.

Like 2019, we expect high-end areas and high-end properties to underperform in 2020.

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because there are many risks in real estate that can impact prices. Risks are events that may or may not happen so as a result, we review a variety of forecasts from leading lenders and real estate firms and we present the most optimistic forecast, the most pessimistic forecast, and the average forecast. Want to learn more about real estate risk? We’ve written a comprehensive report that explains the level of risk in the Canadian real estate market.

Our forecast inputs:

2. What factors drive the price forecast?

Mortgage Sandbox 5 Factor Framework

At the highest level, supply and demand set house prices and all other factors simply drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are affordability, capital flows, government policy, supply, and popular sentiment. Below we will summarize how the five factors result in the current forecast but for more detail, we recommend you read the full report of how these factors are affecting prices in Metro Toronto.

Affordability

Affordability is a function of:

Home Prices: The current market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: This is driven by income levels (i.e., how much money you can put toward mortgage payments) and interest rates (how big are the mortgage payments).

How have these changed lately?

Home prices: Prices are still 5 to 20% lower than the peak in 2017 depending on where the home is located and what type of home it is. Of course, lower prices improve affordability and add upward pressure on prices. However, given that prices are still very high, the current price drops aren’t making homes that much more affordable.

Savings-Equity: With rents rising faster than incomes, first-time buyers will struggle to come up with down payments and since homes prices have dropped most homeowners will have less home equity going in 2020 than they did in 2018.

Financing: Median incomes have not changed materially but mortgage qualifying interest rates dropped about 9% since 2018. Most forecasts predict mortgage qualifying rates will rise in 2020. Lower interest rates are a major factor driving home prices.

Over the course of 2019, affordability has improved which will add some fuel to home prices coming into 2020. Prices are still beyond the reach of a median Metro Toronto household with an income of $78,000 (before taxes) and in 2020 mortgage qualifying interest rates are expected to rise, so we expect affordability to suffer toward the end of 2020 and this would put downward pressure on prices.

Capital Flows

These represent short-term investment, long-term investment, and recreational demand (i.e, homes not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Foreign Capital Flows are believed to be dropping but it’s not clear that is actually happening. In 2017, Ontario implemented a 15% foreign buyer tax. This may seem like a bold move but Vancouver has a 20% foreign buyer tax and Singapore’s is 20% as well. New Zealand banned foreign ownership and Australia only allows foreign buyers to purchase expensive new pre-sale homes. Compared to these markets Ontario is fairly attractive.

Home flipping activity has declined dramatically in Vancouver (see chart below) and John Pasalis, a prominent Toronto-based analyst, says “The flippers are definitely getting a little bit squeezed now” in Toronto as well.

As it relates to our analysis, we expect domestic interest in long-term rental income properties is unchanged, but short-term rentals may be sold now that new short-term rental bylaws are coming into effect. These rules mean people can only host short-term rentals in their principal residence. These rules will likely be enforced with the help of condominium boards and neighbours.

We see no evidence of a diminished role for dark money in local real estate. An eye-opening report by Royal LePage says that almost 1 out of 10 homes purchased in Metro Ottawa and the GTA are bought by Canadian residents on student visas. It would appear that the parents of students are using their children to evade the Foreign Buyer Tax.

Going forward, we see very little change to Capital Flowing into Ontario real estate with the exception of the City of Toronto. The short-term rental rules could have a downward impact on central Toronto condos apartment prices.

Government Policy

There has been a lot of policy aimed at housing in recent years but we are mostly concerned with any recent changes that impact the real estate market. Changes made in 2018 and earlier are pretty much already “baked-in”.

In September 2019, the federal liberals created the First-Time Home Buyer Equity Incentive to help people purchase their first home. Under the program, the government offers to put in equity worth 5% or 10% of the home’s purchase price. It is difficult to qualify and it has a lot of strings attached so we expect it will have little effect in the Metro Toronto market.

The City of Toronto mayor and councilors approved slightly higher taxes and are debating new and higher taxes. City staff are studying the possibilities and there are some of the ideas.

In December, Toronto council voted to increase property taxes by 8 percent over 6 years. It will pay for transit and infrastructure and its slow introduction will likely have little impact on the market.

In January, Councillor Ana Bailao pitched the idea of including an empty home tax in the city’s 2020 budget, along with an increase to the municipal land transfer tax charged on luxury homes.

At the end of 2019, the City of Toronto laid plans for regulating short-term rentals: Here are the highlights:

Short-term rentals are allowed in principal residence only.

The maximum stay is 28 days per stay and the home can be rented a maximum of 180 nights per year.

Applicants will be required to pay a one-time licence application fee of $5,000.

People renting their homes on a short-term basis will be required to pay $50 per year and a 4 percent Municipal Accommodation Tax (MAT) on all rentals that are less than 28 consecutive days.

Short-term rental companies like AirBnB will be required to provide a procedure for dealing with problematic operators and responding to complaints.

The stress test implemented in 2018 effectively reduces the amount homebuyers can borrow by 20% and its short term impact has been fully absorbed in home prices but we do believe it may have a long term impact affecting the supply of active listings. First-time homebuyers impacted by the test can simply buy a cheaper home and, luckily for them, home prices have dropped. But first-time homeowners who bought before 2018 may be in a bind. If they try to upgrade to a larger home they will qualify for 20%-30% less mortgage that they were previously qualified for because interest rates have risen and there is a stress test. So these people who might have graduated from their starter home to something larger are forced to sit tight and pay down their mortgage. Across Canada, in every city, fewer people are choosing to sell their homes than in previous years and it is possible that the federal stress test is the root cause.

The provincial government is going to work with municipalities to reduce red tape and plans to sell up to 243 underutilized properties for redevelopment into housing but progress is slow. In January 2019 they sold some land in London. In April 2019, they sold a property in downtown Toronto that may create 700 homes.

Up until now, the desired effect of the municipal and federal policies is to reduce unnecessary demand until more supply can come to the market. The provincial government is focused on supply but has not made much progress. If governments fail to moderate prices, then we should expect more policy interventions and more price uncertainty.

Supply

Supply comes from two sources.

Existing sales: Homes owned by individuals who sell them to upgrade, to move for work, or for some other reason. This is the primary source of detached houses since relatively few new detached houses are being built in Metro Toronto. Only existing home sales are reported by the real estate board.

Pre-Sales and Construction Completions: Usually, up to 70% of new homes are sold via pre-sales before the construction is completed. These are predominantly apartments and townhomes. Data on pre-sales is private and more difficult to find whereas home completions are reported by the government.

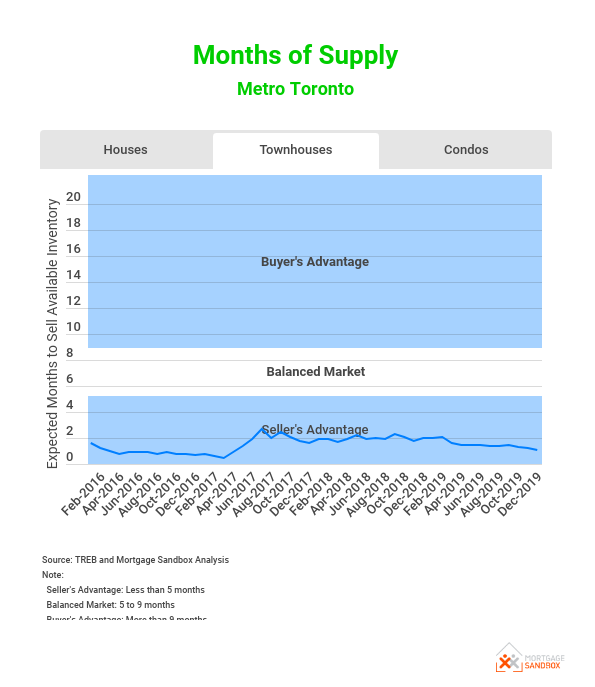

Months of Supply of Existing Homes

In recent months, sales have increased to healthier levels but haven’t broken any records. The true driver of higher prices has been a lack of active listings. The number of people willing to sell their homes declined in the second half of 2019. This seems to be driven by market sentiment and may also be explained by the stress test. The stress test was covered under Government Policy and Popular Sentiment will be covered in the next section, but the net effect is that the balance between purchases and listings is solidly tilted toward a seller's advantage and that means prices are likely to continue trending upward in the near-term. We are deep in a seller’s market with bidding wars and no-subject offers and life will continue to be stressful for buyers.

Baby Boomers Downsizing?

In 2020, 45% of baby boomers will be aged 65 and over and, according to a recent survey, almost half (49 percent) of all Ontario Boomers respondents said they plan to move into a smaller home as they near or enter their golden years, the highest rate in among all provinces surveyed. A recent report on all Canadian Boomers from RBC says, “Over the coming decade, we expect baby boomers to ‘release’ half a million homes they currently own—the result of the natural shrinking of their ranks, and their shift to rental forms of housing, such as seniors’ homes, for health or lifestyle reasons.”

As baby boomers begin downsizing and list their million-dollar homes for sale they will add supply in what is considered the luxury market. If not enough Gen-X and millennial buyers can be found for these expensive homes, there is a risk that this may depress prices at the top of the market, which will then compress prices for townhomes and condo apartments.

In the near-term supply is tight, but in the medium-term, there are risks of higher than expected supply.

Mortgage Delinquencies and Foreclosures

The most recent data indicates that more Canadians are missing their monthly payments and job growth has been healthy. Some economists have been warning of a recession and even without a recession, it appears more Canadians are over-extending themselves. Even though delinquency rates are relatively low, it is surprising that the increases in mortgage delinquencies are led by Ontario and British Columbia, and not Alberta.

According to Equifax, the credit bureau company:

“Mortgage delinquencies have also been on the rise. The 90-day-plus delinquency rate for mortgages rose to 0.18 percent, an increase of 6.7 percent from last year. Ontario (17.6%) led the increases in mortgage delinquency followed by British Columbia (15.6%) and Alberta (14.8%). The most recent rise in mortgage delinquency extends the streak to four straight quarters.”

A recent survey by MNP reported a staggering number of Canadians are stretched to their limits:

“Over 30 per cent of Canadians say they’re concerned that rising interest rates could push them close to bankruptcy, according to a nationwide survey conducted by Ipsos on behalf of MNP, one of the largest personal insolvency practices in the country.”

Pre-sales and Completions

New Construction: There is a record number of homes under construction and many are nearing completion. As these buildings complete in 2020 and 2021, and people move out of their rental or sell their current home, this new supply should alleviate some of the pressure in the market.

Pre-sales: Pre-sales, which are purchases of brand-new homes from developers, have trended down substantially since 2018. Since developers need to sell at least 70% of a project to secure financing and begin construction, they are trying to entice buyers with price discounts, move-in allowances, and cool amenities. Some developers have offered up to a $100,000 bonus to the buyer realtor who can convince their client to buy! We recently received a pre-sale ad that offered homes for sale with only a 5% deposit when normally a 20% deposit is required for pre-sales!

Popular Sentiment

Buyers who were sitting on the sidelines are now springing into action but sellers, who remember when their home worth 10% more, may be reluctant to sell. At its core, seller reluctance is what is holding prices up. If listings rise, then the market will tilt back in favour of buyers and prices will drop. There’s no way of predicting seller sentiment but, as witnessed in 2017 and 2019, sentiment can shift quickly.

3. Should Investors Sell?

From a seller’s perspective, there are more changes in the market that influence prices downward so now may be a better time to sell than in two years and the seasonal real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

4. Is this a good time to buy?

With accelerating prices, homebuyers that took a cautious wait-and-see approach in 2019 have been penalized. With prices continuing to trend upward, 2020 definitely appears to be a favourable time to buy. Looking forward to 2021, prices may be higher or lower but they are unlikely to rise as dramatically as they did in 2016 and 2017. Also, keep in mind that the seasonal real estate cycle usually favours buyers in late summer.

If you are thinking of buying just be sure to drive a hard bargain and pay as close to market value as you can. As well, when it comes to financing, don’t bite off more than you can chew.

Buying a home is a big decision, so check out Mortgage Sandbox’s Canadian Homebuyer Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

Toronto-area home prices to surge past $1 million in 2020, according to Royal LePage (The Star)

Rising Toronto home prices, sales lift national real estate forecast (The Star)

Housing data reveals ‘growing divergence’ between eastern and western Canada (Global News)

Toronto condo prices see weakest growth in 5 years as tight lending rules bite (Financial Post)

Nearly 40% of Toronto condos not owner-occupied, new figures reveal (The Guardian)

Canada’s Risky Housing Market Has Traded Places With The U.S., IMF Says (Huffpost)

Like this report? Like us on Facebook.