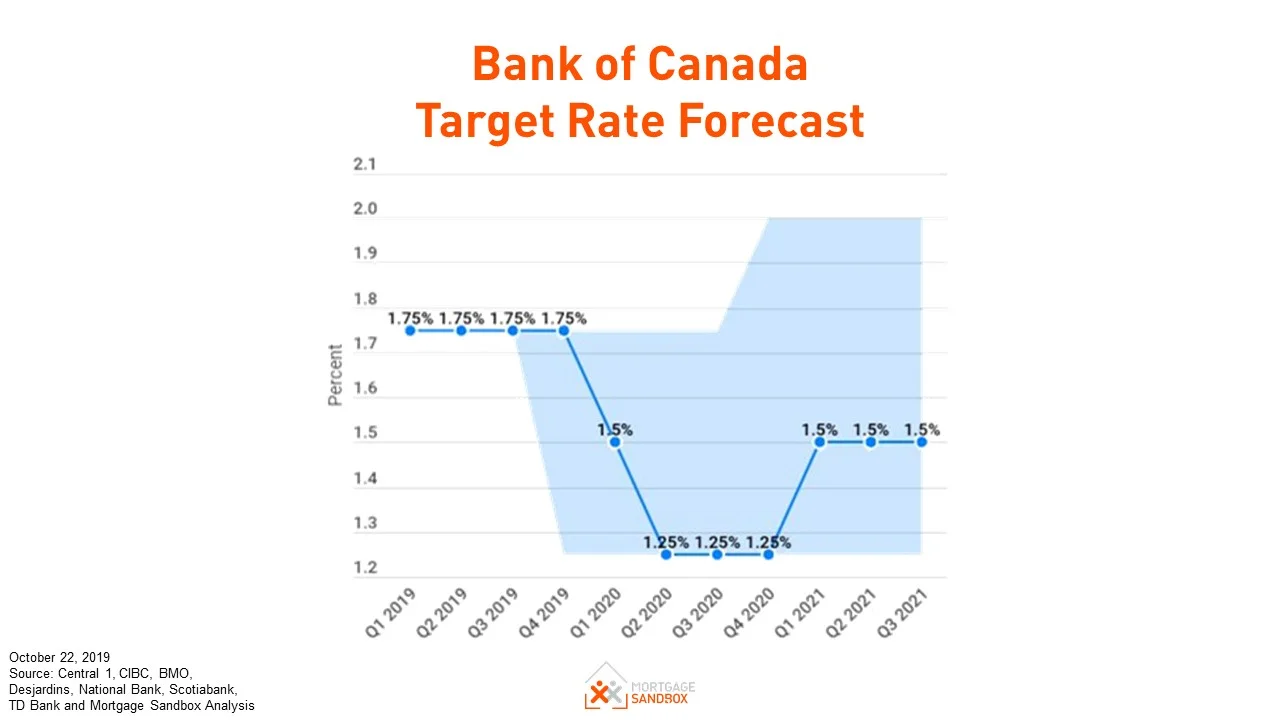

The Bank of Canada rate announcement on October 30th, 2019 has left interest rates unchanged.

All in Rates

How risky will Canadian real estate be in 2020?

Leading economists are predicting a global economic slow down in 2020. What risk does this pose to Canadian real estate?

Top 5 recession warning indicators

Learn about the key indicators, why they’re significant and where to find them yourself.

Will the Bank of Canada drop rates next Wednesday?

Have rates peaked? A slowing global economy, an unpredictable real estate market, high household debt, and growing trade tensions suggest a rate cut may come soon.

BoC raises key interest rate. Why is this important?

As many leading economists and all 6 big banks predicted, the Bank of Canada has raised the overnight rate to 1.75%. In this article, we explore why all these rates matter to every Canadian household, why the BoC has raised interest rates, and what to expect in the year ahead.

Why is the Bank of Canada increasing your borrowing costs?

The Bank of Canada is raising rates toward a “neutral interest rate” and this will lead to higher borrowing costs, and less money in your wallet.

The Trick To Getting A Mortgage With Bad Credit

Getting a mortgage with bad credit is possible. Depending on your situation, you could get financing from a Major Bank, Mortgage Specialist Bank, or Private Lender. They all want new business and this article will explain what each lender needs to make the deal work.

Why you should care that the Bank of Canada raised rates

As expected, the Bank of Canada has raised the overnight rate to 1.50%. This is significant because the overnight rate has risen 300% since beginning of 2016 when it was only 0.5%.

In this article, we explain the impact of this trend on mortgage payments and home prices.