Will the Bank of Canada drop rates next Wednesday?

A slowing global economy, an unpredictable real estate market, high household debt, and growing trade tensions suggest a rate cut may come soon. This may be great news in the short run but it could be bad news in the long run. Here’s why.

Most economists expect rates will drop within 6 months

Macquarie Bank expects rates will drop in September, whereas politically savvy Scotiabank delays a rate drop prediction to the end of 2019. If we look out to March, then Central 1 (the Credit Union Economics) and CIBC join the rate cut chorus. In fact, Scotiabank predicts TWO rate cuts by March 2020. Why?

Why are economists predicting the Bank of Canada will cut rates?

There are five key reasons the Bank of Canada might lower rates:

1. Risk of Global Recession

A global recession may be coming sooner than anyone thought. There are some key signals that a recession may be on our doorstep.

Economic Slowdown: China’s GDP growth has dropped to 6.2 percent, its weakest pace in almost three decades. Germany, the EU’s powerhouse, is on the brink of recession. With the US now reporting slower growth, the combined impact of slower growth in these large global economies has caused serious concern.

"There is room for us to cut interest rates," said the deputy governor of the People's Bank of China. "But whether we do it or not depends on the economic growth and price conditions." https://t.co/gqmRLMolOy

— CNN Business (@CNNBusiness) August 20, 2019

Investment Flight to Safety: Investors are so concerned that they are selling stock in favour of gold and government bonds. Gold and government bond prices are rising because investors are moving their money to the safest investments they can find. The price of bonds has risen so substantially that a 10-year bond earns less interest than a 2-year bond. That’s called an “inverted yield curve”.

Inverted Yield Curve: The yield curve has inverted to the point where some 10-year bonds yield negative returns. That means people are buying bonds and paying (rather than earning) interest for the privilege of parking their money in a safe place. Every recession over the past 50 years has been preceded by an inverted yield-curve and Canada is experiencing the steepest yield-curve inversion in 20 years.

Since 1955, an inverted yield curve has predicted 9 past U.S. recessions — here’s why pic.twitter.com/iJ4IdZfV9s

— NowThis (@nowthisnews) August 27, 2019

2. Other Central Banks are Dropping Rates

For the first time in over a decade, the US Fed lowered its target rate by 0.25% to 2.00% in July 2019. The Fed hints it will cut interest rates again as soon as September. In August, the Bank of Mexico Lowered its Interest Rate, Citing Global Concerns. In June, the Royal Bank of Australia also lowered its target rate for the first time since 2016.

#NEW Ahead of Fed Chair Jerome Powell’s speech at the Jackson Hole symposium on Friday, WH Economic Adviser Larry Kudlow predicts he will indicate a series of rate cuts to come.

— Greta Wall (@GretaLWall) August 22, 2019

“I think the handwriting is on the wall for lower rates.”

pic.twitter.com/PLu8jf7OBY

When Canada’s trading partners cut interest rates, and Canada doesn’t match their cuts, it weakens their currencies and makes Canadian exports more expensive in their local currencies. This hurts Canadian exports which in 2016 made up 31% of Canadian economic activity.

One of Vancouver and Toronto’s largest exports are investment properties. As the Canadian dollar strengthens, foreign owners who spent US dollars or yuan to buy these homes will see property values rise in their local currency. For speculative foreign buyers, these homes will cost more. This means some owners may sell their property to cash in on the currency imbalance while speculative investors will hold off until the Canadian dollar is more favourable. This would put downward pressure on home prices.

3. High Canadian Household Debt

The Bank of Canada is still concerned about the debt levels held by Canadians because it makes them vulnerable to hardship if they’re laid off in a recession or if interest rates on consumer debt (i.e., credit cards, car loans, and mortgages) begin to rise. Check out page 6 of this Financial System Review for more information.

Ratio of Canadian household #debt to disposable income, 1990-present. Feeling squeezed? https://t.co/NPhEpguyBI pic.twitter.com/lnUILMk7nP

— Generation Squeeze (@GenSqueeze) November 7, 2015

4. Canadian Housing Market Risk

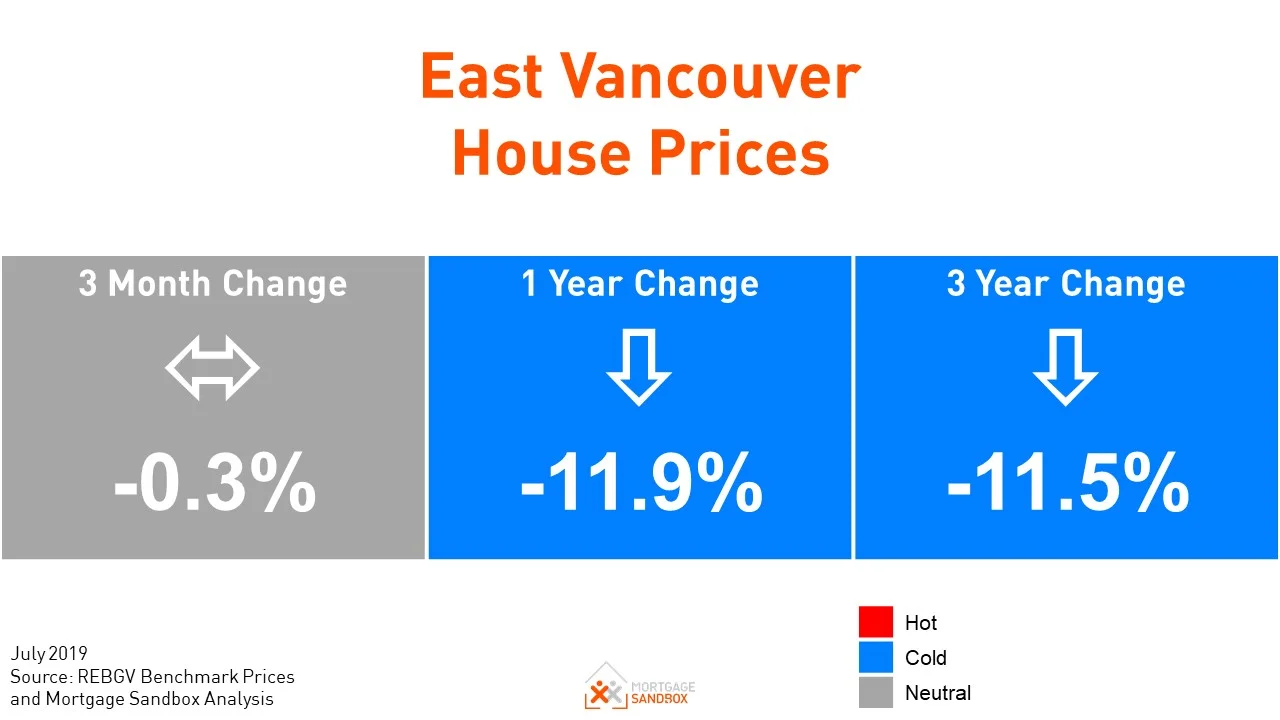

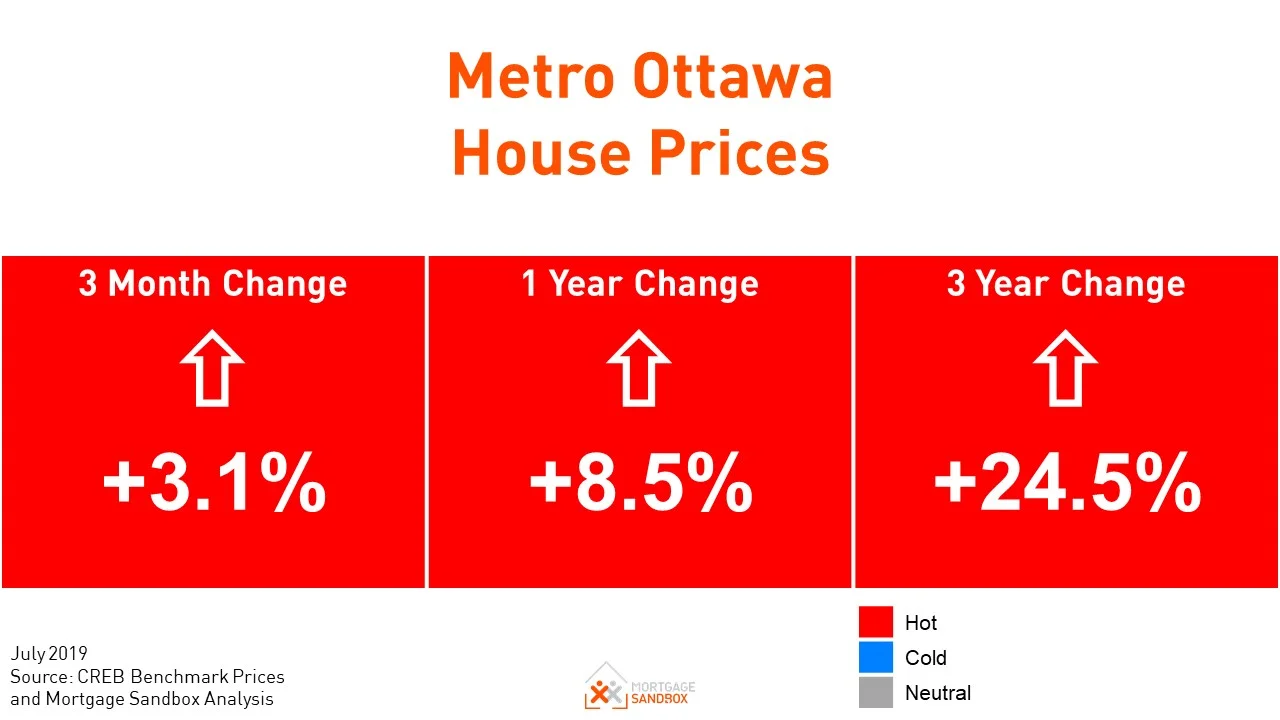

Property prices in most Canadian markets are much higher than is justified by economic fundamentals and this makes them vulnerable to a “bubble burst” worse than what is being observed in Vancouver today. Check out page 15 of this Financial System Review for more information.

The vulnerability of Canada’s #housing market remains moderate. After being at a high degree of vulnerability for three years, the rating for #VanRE has eased to moderate. Read our latest report here ➡️ https://t.co/8pryvxukF2 pic.twitter.com/eM6sx2cOIw

— CMHC (@CMHC_ca) August 1, 2019

5. Trade Wars

Canada has been embroiled in a trade war with the United States, its largest trading partner. As well, Canada’s 2nd largest trading partner, China has blocked imports of Canadian Canola. 75% of our exports are to the United States and 5% of exports go to China. Our next largest trading partners are the UK and Japan with only 3% and 2% of our exports respectively.

Conclusion

A rate cut is unlikely before the election because it could be used to support a political narrative. Interest rates will likely drop by the end of the year which, in the short run, makes debt cheaper but it isn’t a reason to celebrate. Lower rates will only come if there is accompanying bad news like a recession resulting in lost jobs, a housing correction, or rising consumer bankruptcies.

Like this post? Like us on Facebook for the next one in your feed.