What is an underwater mortgage?

What is an Underwater Mortgage? An underwater mortgage is a mortgage that is bigger than the market value of the home that it is financing.

In other words, the balance owing on the mortgage loan is higher than the value of the home used as collateral for the mortgage.

Homes that have underwater mortgages are also sometimes described as homes with negative equity.

This situation can occur when home values have fallen. In most cases, a lender will allow you to continue to repay the mortgage and live in a home with negative equity. Nevertheless, there are some circumstances where underwater mortgages can cause significant challenges.

Selling a Home With Negative Equity

When you sell a home with an underwater mortgage, the price of the home will not be high enough to pay off the mortgage and realtor fees. The realtor commission and shortfall on the mortgage need to be covered by the home seller out of pocket. Let’s call this a negative equity trap.

The negative equity trap is a risk of using high leverage to buy a home. In a worst-case scenario, if you lose your job and can’t pay the mortgage any longer, you may not have access to enough cash to sell the home. You don’t have enough money to pay the mortgage, but you also don’t have enough money to cover the costs of selling the home, so you’re forced to keep the home and default on the mortgage payments.

Renewing Underwater Mortgages

Private lenders offer mortgages to riskier borrowers that the Mainstreet can’t serve. Since they are taking on higher risk, they usually only commit to lending money for twelve months at a time. If the equity in a home drops significantly, they may choose not to renew the mortgage. In many cases, a borrower can find another lender, but if finding another lender is too expensive or difficult, the borrower might need to sell their home.

Historical Context

The United States had a big challenge with underwater mortgages in the 2008 financial crisis. In some U.S. cities, home values dropped 50% over four years before they began to rise once again.

The COVID-19 Pandemic

At the beginning of the Coronavirus Pandemic, Canadian borrowers were given the option to defer mortgage payments id they were unable to make their monthly commitments. Quebecers, Albertans and Ontarians were the most reliant on this program.

CMHC’s outgoing CEO, Evan Siddall referred to an upcoming mortgage deferral cliff in fall of 2020. Mr. Siddall is concerned because:

When the deferral program expires in October 2020, many of the people who took advantage of it may still be unemployed and unable to make their monthly payments.

The deferred interest payments are added to the mortgage balance, so the size of people’s mortgages has been rising (eroding their equity every time they missed a mortgage payment).

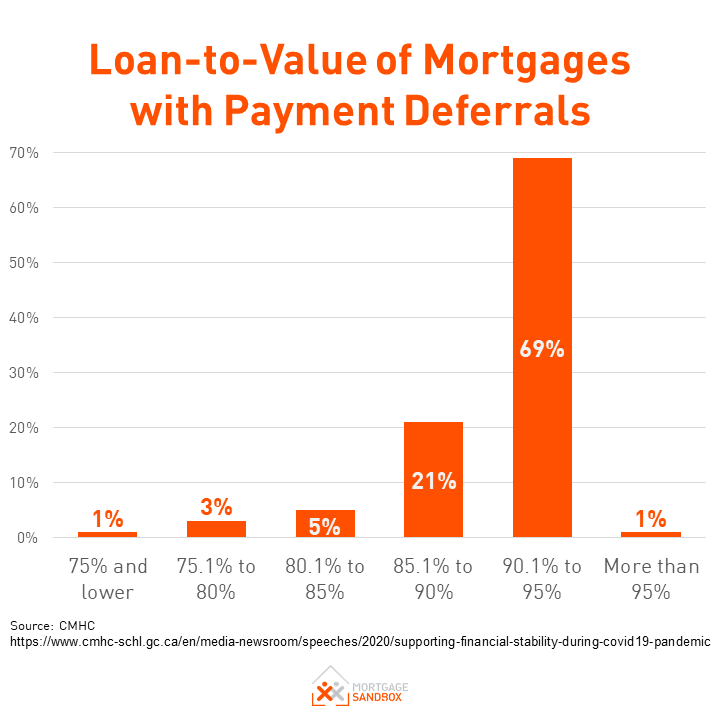

70% of borrowers who deferred their mortgage had less than 10% equity in their home to begin with.

The CMHC predicts home prices could drop between 9% and 18% by the end of 2021.

If we combine these factors, then it raises the likelihood that Canadians could be stuck in a negative equity trap.

Like this post? Like us on Facebook.

people need to sell their home