It's called "home porn," those sensuous scenes in house flipping TV shows where some broken-down shack is transformed into a mansion worthy of the Prince Harry and Meghan Markle. And it all comes together in a few weeks at prices anyone can afford! It should come with a “DON’T TRY THIS YOURSELF” disclaimer because in a falling market you can get seriously burned.

All tagged Vancouver House Prices

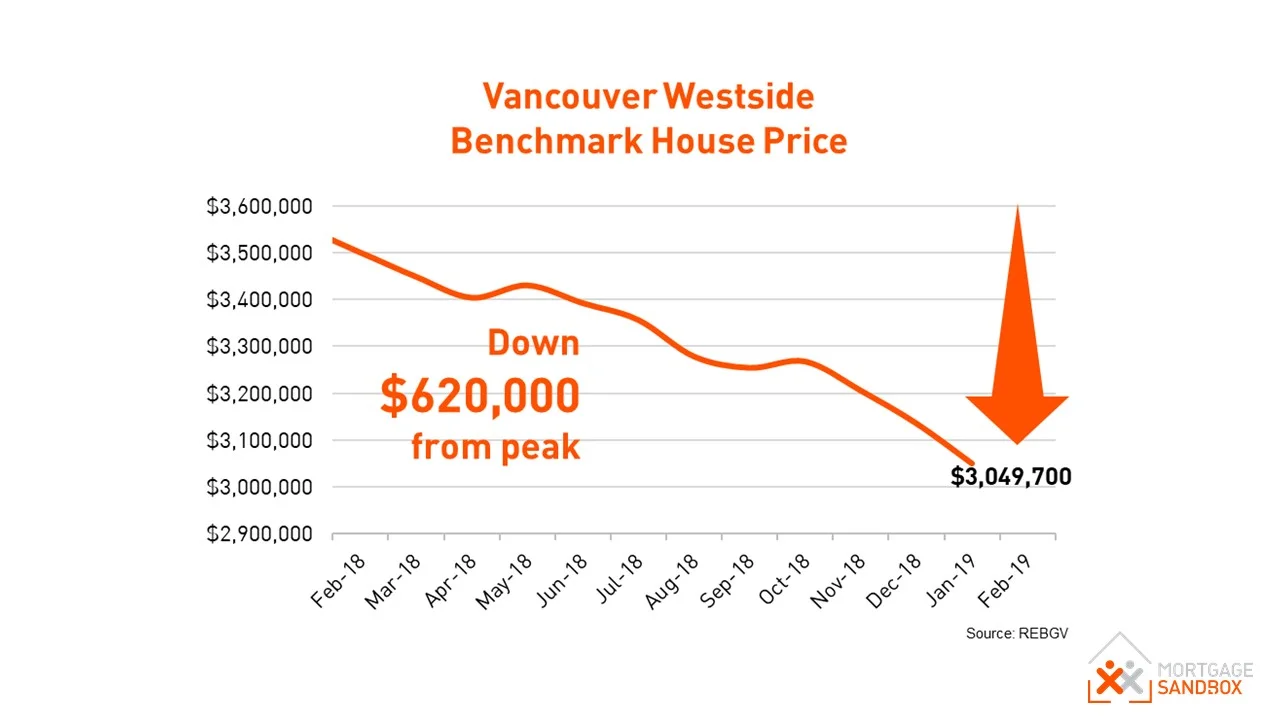

Hardest Vancouver Markets to Flip a House

It's called "home porn," those sensuous scenes in house flipping TV shows where some broken-down shack is transformed into a mansion worthy of the Prince Harry and Meghan Markle. And it all comes together in a few weeks at prices anyone can afford! It should come with a “DON’T TRY THIS YOURSELF” disclaimer because in a falling market you can get seriously burned.

Key factors at play in the Vancouver housing market

An examination of the factors at play in the Vancouver Real Estate market reveals a definitive strengthening in the factors influencing the market downward.

Prices could continue to rise but the risk of a correction has risen significantly. There is still a critical supply issue so, regardless of home prices, many more homes need to be built in Vancouver.

How much fuel is left in the real estate rocket?

Canadian condos have shown tremendous price growth since 2016 but it is uncertain how much price growth potential remains in condos. Some major Canadian banks have forecast the real estate market in Vancouver and Toronto will hit a tipping point by the end of 2019. As the impact of interest rate increases, government regulation, and taxes work their way through the market toward the middle of 2018 the accuracy of these forecasts will be revealed.

Full Steam Ahead! – Metro Vancouver 2018 Home Price Forecasts

The consensus seems to be that 2018 will see more price gains than 2017, and that detached house prices will stay relatively flat while condo prices rise continue to climb.

Vancouver Real Estate – West Coast Express to Affordability?

At the end of November, Vancouver city council voted to adopt a new 10 year housing strategy. Honestly, what took so long? Vancouver real estate has been too expensive since 2010, and started being referred to in the media as a crisis in 2015.

Real estate is a low risk, high return investment. Not.

There is no such thing as a low risk investment with consistently high returns. If there were such an investment, then everyone would buy, pushing up prices until the investment returns were equivalent to other low risk investments. This may have already happened in Canada, but perhaps real estate is different.