Ottawa Conundrum: A Seller's Market but Values are Falling

The Ottawa property market is experiencing a period of tentative optimism tempered by structural and policy-driven constraints.

In October 2024, the city saw 1,179 homes sold, a marked improvement from September and a year-to-date increase of 9.4% over 2023. This signals renewed interest in homeownership and investment properties. However, this recent growth belies some underlying challenges. Total sales remain 3.9% below Ottawa’s five-year average, with persistent demand and supply imbalances, fluctuating prices, and evolving conditions in the rental market.

Long-Term Slowdown

While typical seasonal fluctuations usually bring periods of cooling in the real estate market, Ottawa has seen consistently tepid demand throughout 2024, exept for the last two months.

Some analysts believe the recent interest rate cuts from the Bank of Canada (BoC) will bolster confidence in property markets.

In the broader context, after the Bank of Canada increased rates by 4.75%, the most recent cuts, totalling 1.5%, still leave rates relatively high.

Yet, even with an uplift in sentiment, Ottawa remains in a prolonged period of low demand. Sales figures have been declining since the 2021 market peak, indicating the slowest overall demand in the last decade.

While Ottawa unemployment is one of the lowest in Canada, thanks to government jobs, Ottawa home prices may have outpaced government incomes for too long.

These trends highlight the complexity of the current landscape for both first-time buyers and seasoned investors, who must carefully navigate price movements, financing options, and property types as the market continues its tentative recovery.

Persistent Price Declines

Prices across Ottawa’s property types have gradually declined. The MLS® Home Price Index (HPI) benchmark price for a detached house reached $724,500 in October 2024, a slight year-over-year increase of 0.4% but a 1.4% drop in the last three months. The median house value has dropped 2.9%, and the median is a good leading indicator.

Apartments have experienced a year-over-year 3.9% decline, falling to $407,500. The median has dropped 8.3% and the declines have persisted in the last three months.

Metro Ottawa Condo Apartment Price

Price declines have persisted across housing types since the spring, although the declines have been gradual rather than steep.

Notably, since condos have shed more value than houses, the price gap between detached houses and condo apartments has widened, now standing at nearly $320,000, up from $280,000 a year ago. This widening, in effect, means the rungs on the “property ladder” are further apart, and many people who might have been wanting to upgrade to a bigger home can no longer do it.

Supply-Side Constraints

Ottawa’s housing supply remains a focal point of concern. Active listings saw a modest increase, up 8.9% from October 2023, reaching 3,354 units. Nevertheless, this boost is insufficient to alleviate Ottawa’s longstanding supply shortage.

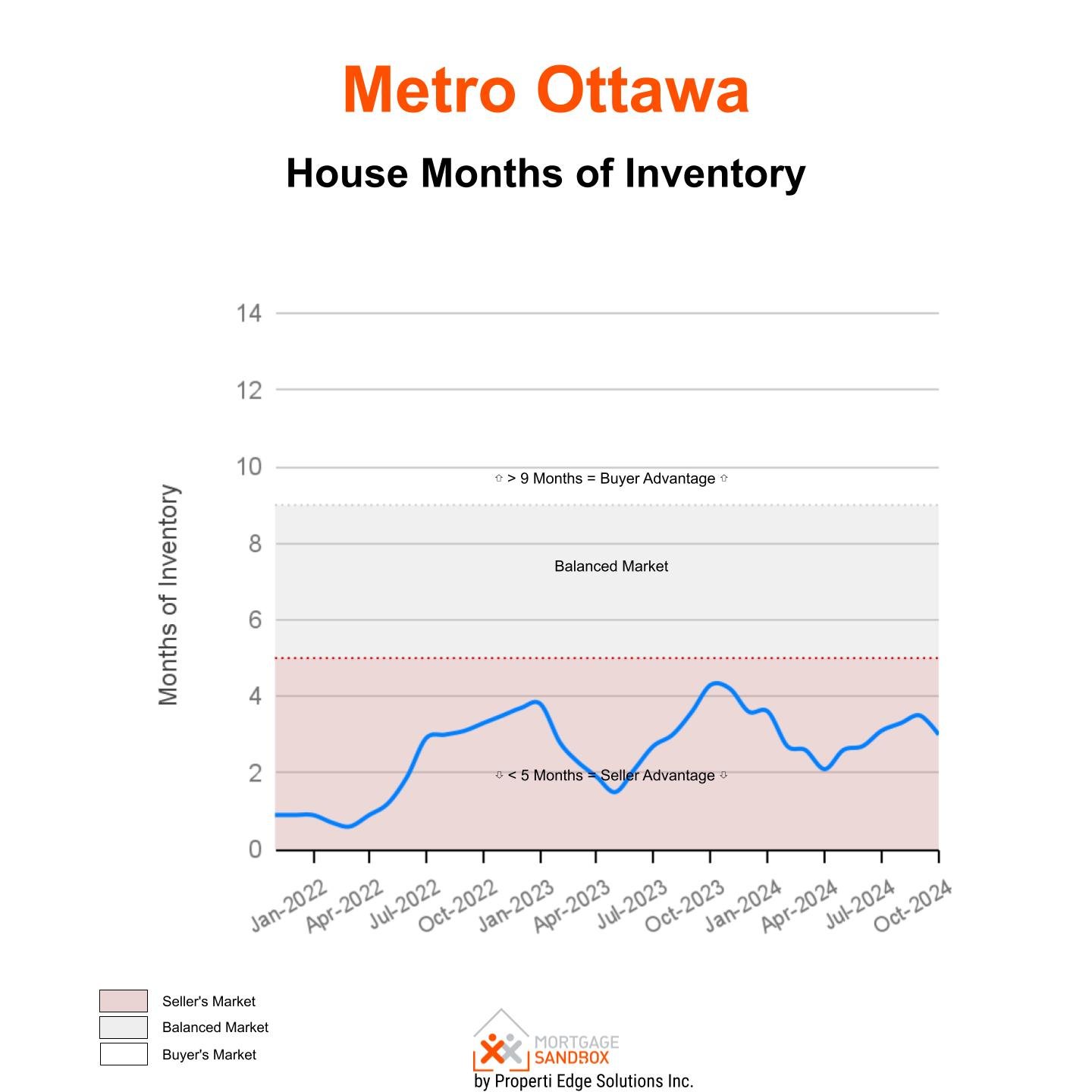

Even though active listings are rising, there are only 3 months’ worth of house listings on the market and 4 months of apartment listings. Ottawa would need over 5 months supply to be considered a balanced market.

The current supply dynamics maintain Ottawa’s status as a seller’s market, where the limited availability of listings grants sellers negotiating power.

However, the power is somewhat tempered by constrained buyer budgets, as high mortgage rates reduce overall affordability. For sellers, this means that while they still have an advantage in negotiations, they may need to manage expectations regarding pricing, especially in a market with constrained purchasing power. Even though rates are dropping, they are still relatively high.

Policy Implications

The Ontario Ministry of Municipal Affairs and Housing issued a bulletin in October 2022, projecting that Ottawa needs an additional 151,000 homes by 2031 to meet affordability goals. However, annual completions between 2021 and 2023 averaged just 8,000 to 9,000 units, leaving the city very much off pace. The situation may worsen, as housing starts in 2024 have been slower than any of the previous three years.

In response to these challenges, local policymakers and the Ottawa Real Estate Board are calling for measures to stimulate new housing starts and implement inventory-boosting policies. Such policies may include incentives for new construction, zoning reforms to facilitate higher-density developments, or tax breaks for builders who prioritize affordable housing.

Rental Market Stagnation and Landlord Pressures

Ottawa’s rental market has experienced notable stagnation in 2024. After three years of significant growth, one-bedroom rent rates have plateaued this year, raising questions about future increases. This stagnation has created challenges for landlords, particularly as mortgage renewal rates continue to rise. Landlords face an increasingly tight margin as flat rental rates meet higher financing costs, potentially squeezing profitability.

For prospective buyers considering an investment in Ottawa’s rental market, these conditions underscore the importance of due diligence. While the city’s rental demand remains stable, the lack of recent rent increases limits income growth potential. Investors need to consider whether properties will generate sufficient returns to cover higher financing costs, especially given the challenges landlords currently face.

Outlook for Spring 2025 and Strategic Recommendations

The uptick in activity seen in September and October 2024 could signal a more vibrant market come spring 2025. Buyers and investors alike may look to capitalize on Ottawa’s relatively stable prices and the potential benefits of further Bank of Canada rate adjustments. However, with affordability concerns and an uncertain economic outlook, there remains a level of caution across the market.

Key Recommendations for Buyers, Sellers, and Investors:

For Buyers: Close monitoring of interest rate trends is essential. Prospective homebuyers, especially those on the edge of affordability, should consider consulting with mortgage professionals to understand the implications of fixed versus variable rate mortgages in this environment. Additionally, buyers can benefit from observing the completion of new housing projects, which may offer more affordable options in the near future.

For Sellers: This remains a seller’s market, but sellers should be aware of the limitations on buyer budgets due to high borrowing costs. Strategic pricing and understanding market comps for specific property types, such as single-family homes or townhouses, will be crucial to maximizing returns.

For Investors: With Ottawa’s rental market showing signs of stagnation, prospective investors may want to assess the potential profitability and return on investment of properties closely. Considering the impact of higher mortgage rates on rental income, investors should calculate their returns with an eye toward flat rental rates and potential rate increases in the medium term. While property is a good investment, in the current market conditions, you might find a better return on investment in another asset class. Discuss this with your Wealth Manager.

As Ottawa’s property market navigates a period of change, both buyers and sellers must adapt their strategies to a landscape marked by constrained supply, cautious optimism, and variable financing conditions. The spring 2025 market may bring more certainty, but for now, Ottawa’s real estate trajectory is one of cautious opportunity.