Okanagan Valley Home Price Forecast

HIGHLIGHTS

Home values in the Okanagan declined in 2022. We are amid a resurgence in prices, but it’s unclear if this is a bounce before a correction or a sustainable bull market.

In comparison to recent years, Okanagan homebuyer demand is weak to moderate while supply is growing.

A multi-factor analysis identifies the Okanagan Valley as a high-risk real estate market.

Budgets for home purchases are under strain due to the significant increase in mortgage rates since their historical lows.

This article covers:

What is the state of the Okanagan property market?

Where are prices headed?

Should investors sell?

Is this a good time to buy?

1. What is the state of the Okanagan property market?

Home Price Overview

The pandemic turbocharged the Okanagan housing market, driving prices upward at a remarkable pace and causing aspiring homeowners to be pushed further away from their dreams. And just when they thought things couldn't get trickier, rising interest rates now force even more potential buyers to sit on the sidelines.

Yes, prices are rising again, but it’s not a result of more buyers - it’s the result of fewer sellers.

For those contemplating selling their homes, time is of the essence. Home values in many areas of the Okanagan dropped double digits from the 2022 peak. While prices have been rising so far this year, the data has mixed messages, and the recovery might stall in the summer. Current conditions are leaving everyone uncertain about when markets will stabilise.

On the other hand, prospective homebuyers might consider waiting for a lighter mortgage burden. Mortgage rates are relatively high. Unfortunately, patience will be needed because rates are anticipated to remain high until 2024.

The market fundamentals are riddled with risk and uncertainty as consumer sentiment has taken a substantial hit. But remember, consumer sentiment can be a volatile and unreliable predictor of future price trends.

Okanagan Valley Detached House Prices

Let's delve into Okanagan detached house prices. Since reaching its peak in the spring of 2022, prices took a significant nosedive, and now they are swinging back upward. The market is volatile and unpredictable, and that is a problem. While the government managed to shield the real estate market from the recession begun by the pandemic, the market is now grappling with the weight of higher interest rates.

Our politicians strive to return the market to a more typical real estate cycle, where prices grow consistently and modestly at an annual rate of 1 to 3%, in line with income growth. They are orchestrating efforts to guide the market toward this balanced trajectory without much success.

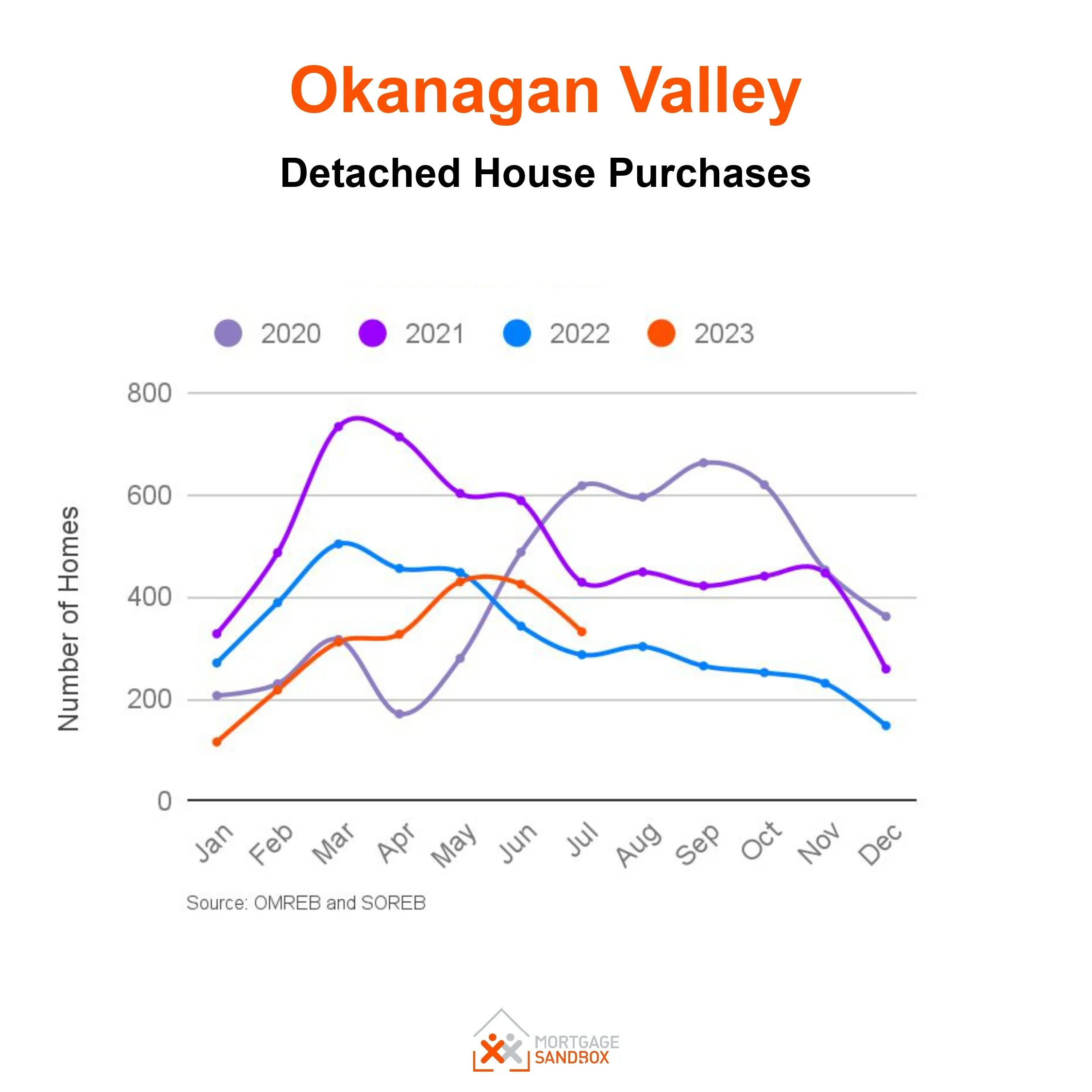

Whereas many people want to buy a home, affordability is very low, and this is reflected in the number of successful purchases. Significantly fewer people can realise their homeownership dream in these market conditions.

Metro Kelowna New Construction Home Prices

Prices of new homes have begun to drop, and some new construction homebuyers might find they will have paid much more than the most recent buyers in their development.

Does this concern you? Read the Pros and Cons of Buying Pre-sale Homes

Market Risk

Based on Mortgage Sandbox Analysis, Kelowna is at high risk of a significant market correction.

Okanagan Condo Prices

After breaking records during the pandemic, like house prices, the Okanagan benchmark apartment price is experiencing a bounce. Many hope this is a sustainable market recovery.

Condo purchases in early 2021 can only be described as stratospheric. 🚀

Purchases now are trending lower than in most of the previous three years.

With more people working from home, we expect developers will begin marketing larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floor plans comes to the market, it may depress the values for small floor plan condos.

At Mortgage Sandbox, we would like developers to build 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Canadians who work from home need more room to segregate workspace from living space within their homes.

Many Canadians with longer working hours find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

Sub-market Reports

Still a challenge for first-time homebuyers

Although Okanagan home prices have moderated, they are still not very affordable. A homebuyer household earning $71,000 (the median Metro Kelowna household before-tax income) can only get a $270,000 mortgage. For that household to buy a condo, they would need to save at least $100,000 cash for a down payment or receive a very generous gift from family. For most people, that’s not on the cards.

What about the rest of B.C.?

Read the Vancouver Home Price Forecast and Victoria Home Price Forecast.

2. Where are Okanagan Valley home prices headed?

There is a lot of uncertainty in the forecasts for 2023 and 2024. Many of the forecasters we've surveyed have different expectations for:

Will the federal government achieve its aggressive immigration targets?

How much will interest rates rise? How quickly? For how long?

There has yet to be a consensus among economists. Market sentiment and government stimulus have led to price acceleration and record home purchases even though most economic fundamentals have faltered.

How do we arrive at our forecast range? Check out our full assessment of the five factors that drive these forecasts. These five forces help explain why several forecasters are anticipating price drops.

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many real estate risks can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms. We then present the most optimistic estimates, the most pessimistic predictions, and the average forecast. Do you want to learn more about real estate risk? We've written a comprehensive report explaining the uncertainty level in the Canadian real estate market.

Our forecast inputs:

3. Should Investors Sell?

From a seller’s perspective, more changes in the market that influence prices downward, so now may be a better time to sell than in two years. The annual real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritise flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

Fixed or Variable rate mortgage? Find out where mortgage rates are headed before you start to negotiate.

4. Is this a good time to buy?

It’s hard to say, prices have been falling, but interest rates are projected to rise, which means prices could fall further. It's almost impossible to time the market. If you are buying your forever home and don't plan to sell for ten years, then the risks of buying now are lower.

Regardless, the annual real estate cycle usually favours buyers in late summer.

If you are considering buying, be sure to drive a hard bargain and pay as close to market value as you can. Also, don't bite off more than you can chew when it comes to financing.

Are you planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Recent News

Here are some recent headlines you might be interested in:

Posthaste: Canada's housing market is hot again — expect it to stay that way, economists say (Financial Post)

Friction upon reentry: Three landing scenarios (KPMG Economics)

Posthaste: Canada's housing market is showing green shoots, but something is missing (Financial Post)

Banks seek workarounds to avoid mortgage default for struggling variable-rate borrowers (Financial Post)

Larger investors dominate condo ownership in smaller cities in Ontario and B.C. (The Globe & Mail)

Interest rate hold could add heat to real estate markets: mortgage experts (BIV)

More than half of GTA condo investors losing money on properties, says new report (CBC)

Private mortgage lenders refusing to renew loans to borrowers (The Globe and Mail)

Richmond developer allows buyers to move in today, pay mortgage in two years (Richmond News)

Rising rates are exposing weak spots in the financial system and the next flashpoint could be real estate (Financial Post)

Immigration fuels Canada's largest population growth of over 1 million (BBC News)

Housing affordability - first improvement in 2 years (National Bank of Canada)

Like this report? Like us on Facebook.