Okanagan Property Market — Balanced — Sep 2023

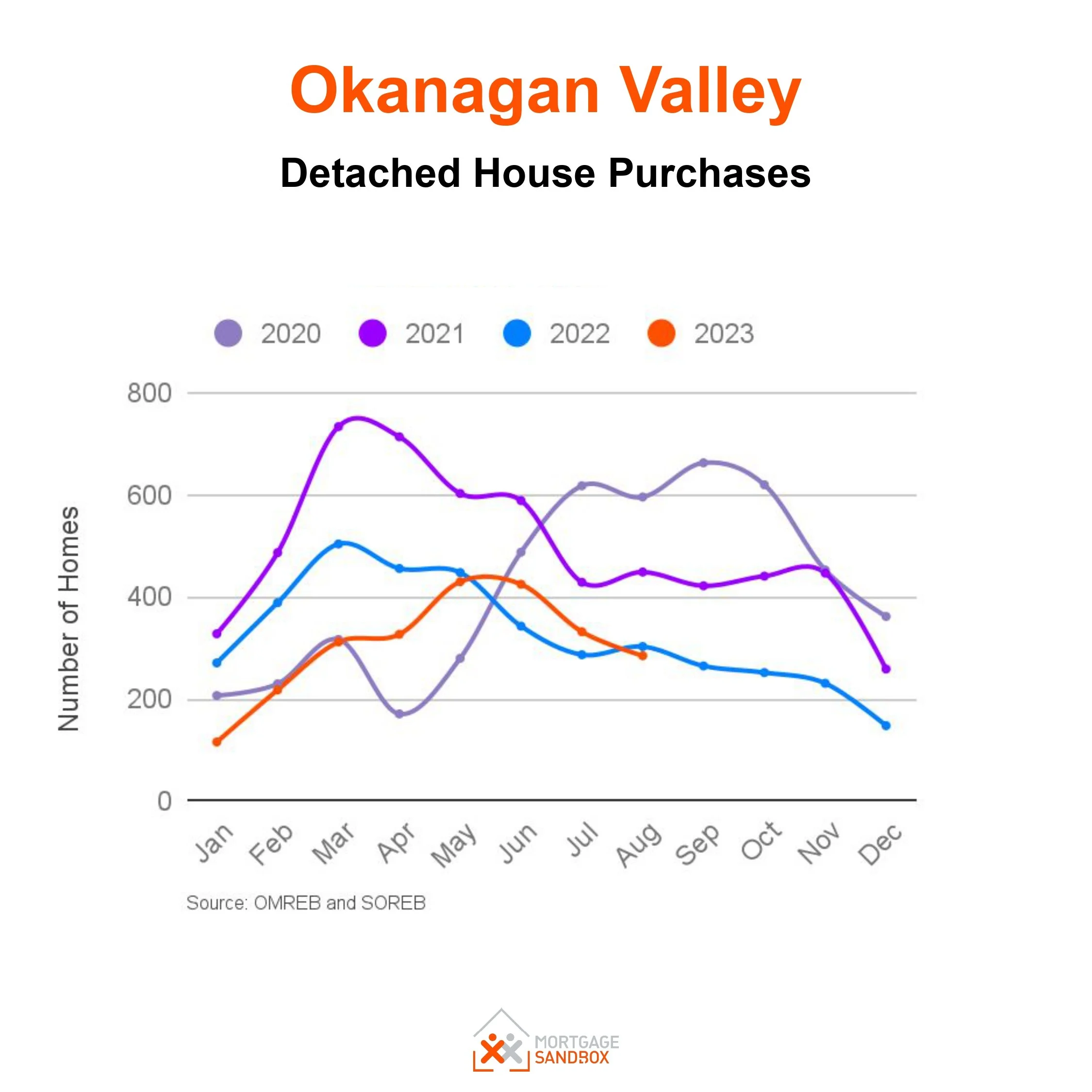

The Okanagan property market, which includes Kelowna, Penticton and Vernon, is starting to cool off after a period of rapid price appreciation.

Benchmark house values peaked in June. At that time, house prices were:

Central Okanagan & Kelowna: Benchmark House $1,063,800

North Okanagan & Vernon: Benchmark House $785,800

South Okanagan & Penticton: Benchmark $783,600

While the Okanagan forest fire might bear some responsibility for depressing the market, the drop in purchases and accumulation of inventory is a pattern emerging across Canada.

Both the detached house and condo apartment markets are balanced. This means buyers and sellers have equal power to negotiate prices, terms, and conditions.

Why are there fewer home purchases in the Okanagan?

There are several factors contributing to the cooling of the Okanagan property market.

Okanagan Forest Fires: There have been evacuation orders throughout the summer and into September. This is hardly a good time to go house shopping. However, the extended forest fire season might discourage some potential homebuyers from setting down roots in the Okanagan.

Government Regulation: The B.C. Government recently announced that the maximum 2024 rent increase in the province is 3.5 per cent when landlord expenses are growing at 5.6 per cent. While the policy is a relief to tenants, it signals to landlords that the government prioritises affordability to tenants above ensuring that landlords can break even on their investments. We should expect that out-of-province rental investors might build their rentals in other cities like Calgary or Toronto rather than take on the risk of unpredictable rent controls.

Mortgage Rates: Rising interest rates are making it more expensive to borrow money, which is reducing buyer demand.

Why might prices drop in the Okanagan?

Increasing Inventory: Another factor contributing to the cooling market is the accumulating number of homes for sale. During the pandemic, supply was as low as two months, but today, it has reached six months and trending upward. This supply increase gives buyers more options and reduces the heat in bidding wars.

Faltering Consumer Sentiment: Consumer sentiment tends to reinforce existing trends. It’s like an amplifier. While confidence in real estate was rising in the first half of 2023, it has now stalled. If a sustained downward price trend emerges, confidence is likely to tumble. Byers with low confidence in price appreciation often delay their purchases and compound the weakness in the market.

Despite the cooling market, there are still some challenges facing homebuyers in Okanagan. The market is still relatively expensive, and the forest fires have destroyed housing stock. However, the market is more balanced, and buyers are starting to have more options.

Reports earlier in 2023 were hopeful for a recovery after the double-digit price drops in 2022. However, the recent trends suggest that the market is cooling down again. Home sellers in the Okanagan should be prepared to negotiate.

Here are some other things to keep in mind about the Okanagan property market:

The market cooling down is broad, impacting all property types. Speculative investment appears to have shifted from British Columbia to Calgary.

The rental market is still strong, with rents continuing to rise. This could be cyclical — due to potential first-time homebuyers delaying their exit from the rental market. When mortgage rates fall, and buyers re-enter the market, rents could fall sometime in late 2024 or 2025.

The government is taking steps to cool down the housing market, such as introducing a foreign buyers' ban.

Overall, the Okanagan property market is showing signs of cooling down. Both the detached house market and condo market are balanced, and sellers should be prepared to negotiate.