Okanagan Home Price Forecast - July 2020

HIGHLIGHTS

The impact of Coronavirus on the Okanagan Valley will likely be very significant.

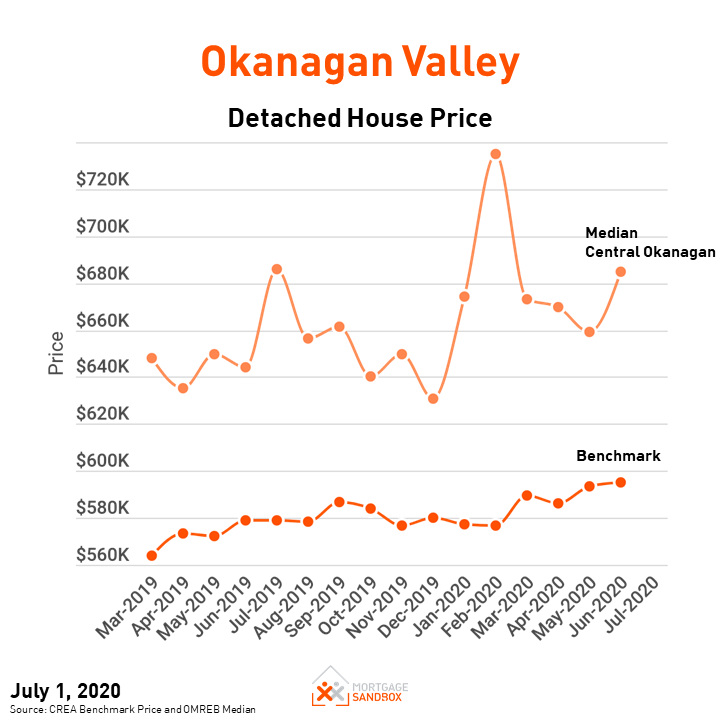

The Okanagan Valley benchmark home price has held its value, but the price of the median home purchase has dropped significantly. This is a sign that buyers are avoiding the top of the market.

Homebuyers stayed on the sidelines from March through May, but in June they jumped back into the market with both feet. In coming months we will learn if this is a trend or 3-months of backed-up demand piled into one month.

The luxury vacation home market in the region will be affected by the further weakening of the Alberta economy and an international travel ban.

Buyer interest was high in the first three months of 2020, but the market has slowed with the impact of the Coronavirus Recession.

We are watching several key risks:

The possibility of a second wave and corresponding lockdown in Canada.

How well the U.S. manages the pandemic - roughly 25% of the Canadian economy relies on exports south of the border. As well, most tourists to Canada are American.

The impact of expiring eviction freezes and mortgage payment deferrals. These are delaying the true impact of the pandemic on housing. They can not be extended indefinitely.

This article covers:

Where are Okanagan Valley prices headed?

What factors drive the price forecast?

Should investors sell?

Is this a good time to buy?

1. Where are Okanagan prices headed?

Home Price Overview

Fortunately for home buyers, prices have been relatively flat between May 2018 and March 2020. A wait-and-see approach has allowed them to save more for a down payment with no risk of being priced out of the market.

Given the current recession and pandemic, sellers may want to push ahead and sell during the pandemic. There is no guarantee that home prices will regain the current highs any time soon because a Coronavirus induced recession may inflict long-term economic damage.

Coronavirus is now the primary source of uncertainty for home values.

Okanagan Valley Detached House Prices

House prices are entering 2020 at values reached in 2018. Perhaps this is the “soft landing” that government policymakers are targeting?

We believe politicians were hoping to guide the market toward a typical annual real estate cycle with price growth in the range of 1 to 3% annually – in line with income growth.

Okanagan Condo Prices

Okanagan Valley condo apartment prices grew dramatically until 2018 and, since then, they have plateaued. Today, the benchmark Okanagan condo is not affordable without help from family.

Entering the Coronavirus Recession, there is already plenty of condo supply. If supply continues to come to market, the more expensive, higher quality, and larger (i.e., 2 and 3 bedrooms) apartments will drop in price, and this will depress the values downward for more modest condos.

At Mortgage Sandbox, we would like to see developers building more 4 and 5 bedroom condos. Not everyone can afford to put their family in a house, and for many parents work-related travel makes it difficult to stay on top of basic upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Still a challenge for first-time homebuyers

Although Okanagan home prices have moderated, they are still not very affordable. A homebuyer household earning $71,000 (the median Metro Kelowna household before-tax income) can only get a $270,000 mortgage. For that household to buy a benchmark priced $380,000 condo, they would need to save $110,000 cash for a down payment or receive a very generous gift from family. For most people, that’s just not on the cards.

2021 Okanagan Valley House Price Forecast

The regional performance also hides some variation. Over the past 3 years, a Vernon house would have gained 23%, but a Kelowna house only rose 15% in the same timeframe. Most striking is a 17% drop in Central Okanagan condo prices from their peak in February 2019. This local variation is what makes relying on regional forecasts difficult. Real estate is local.

The average of the 2020 forecasts used in our analysis predicted a modest rise of 2% each of the next two years. CMHC provides a range and their best-case scenario anticipated a price rise of 7% in 2020, but their pessimistic scenario projected prices to drop 3%.

A second wave containment effort?

Two key assumptions underpin the more optimistic home price forecasts:

COVID-19 control measures in in Canada will be gradually relaxed — but not eliminated entirely — over the remainder of 2020. There will not be a second or third “lockdown” in response to new waves of infection.

Unemployment will not exceed 15%.

At Mortgage Sandbox, we are placing greater emphasis on the forecasts that include a ‘second wave’ of infection.

Dr. Anthony Fauci, director of the U.S. National Institute of Allergy and Infectious Diseases, believes the second wave of coronavirus infections is ‘inevitable.’

A study headed by Dr. Kristine A. Moore, medical director at the University of Minnesota Center for Infectious Disease Research and Policy, warns that the pandemic will not be over soon and that people need to prepare for possible periodic resurgences of disease. Optimistically, a vaccine will not be widely available until mid-2021 and 70% of the population would need to be infected to provide herd immunity. Unfortunately, more than 30% of the population have conditions that make them vulnerable.

Our forecast adjustment for COVID-19

In a presentation to the Federal Standing Committee on Finance on May 19th, CMHC’s CEO revealed that the agency now expects average Canadian home prices to fall between 9% and 18%.

In a March interview, Brendan LaCerda, a Senior Economist with Moody’s Analytics, estimates that each 1% rise in unemployment results in a 4% drop in home prices.

Using this ratio, a prolonged 2.5% rise in B.C. unemployment to 7.5% would result in a 10% price drop and a 5% rise in B.C. unemployment to 10% would lead to a 20% fall in values.

For a more thorough comparison of the Coronavirus Recession to the Great Recession and the Great Depression and their impacts on property prices, check out our recent article: “Should I sell my home today?”

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because several risks can impact property prices. Risks are events that may or may not happen. As a result, we review a variety of forecasts from leading lenders and real estate firms, and we then present the most optimistic estimates, the most pessimistic prediction, and the average forecast. Want to learn more about real estate risk? We've written a comprehensive report that explains the level of uncertainty in the Canadian real estate market.

Our forecast inputs:

2. What forces drive the price forecast?

Mortgage Sandbox 5 Forces Framework

At the highest level, supply and demand set house prices and all other factors simply drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are core demand, non-core demand, government policy, supply, and popular sentiment.

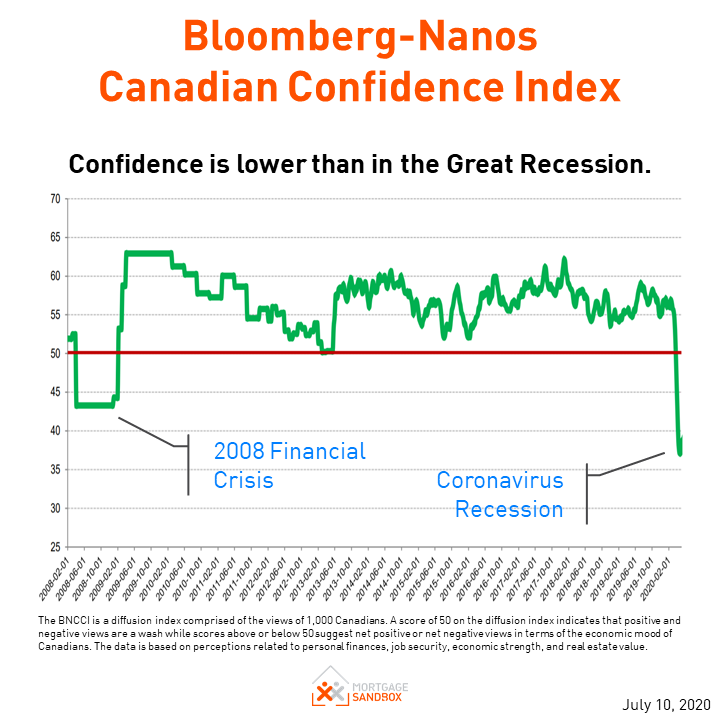

In the long-run, the market is fundamentally driven by economic forces, but in the short-run, sentiment can drive prices beyond economically sustainable levels.

Below we will summarize how the five factors result in the current Okanagan forecast.

Core Demand

Core demand is a function of:

Population Growth: The pace at which people are moving to an area. An average of roughly 2.5 people live in one household.

Home Price Changes: Changes in the market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: Your maximum mortgage is calculated using income (i.e., how much money you can put toward mortgage payments) and interest rates (how big are the mortgage payments).

Home Price Changes

Price growth reduces affordability and creates downward pressure on prices. Home prices haven’t changed significantly since 2018. So they have a neutral effect on the affordability equation.

Savings-Equity

Rents were rising faster than incomes, so first-time buyers struggled to come up with down payments.

To add insult to injury, anyone who managed to save a down payment and invested it in ‘blue chip stocks’ may now find out they’ll need to save for a few more months, or years.

Existing homeowners have not benefited much from price appreciation but they will have paid down their mortgage, so they had more home equity to use when buying a bigger home. That gain in equity may be short-lived as the economic impact of Coronavirus is likely to depress prices trapping people in their ‘starter home’ until prices recover.

With the Coronavirus containment efforts, the banning of evictions, the conversion of Airbnbs into long-term rentals, and a halt to immigration, we believe rents will drop. That will allow renters to save more toward a future purchase when the market thaws.

Financing

Median Okanagan Valley incomes have not changed materially, but employment levels are dropping. To mitigate the impact, the Bank of Canada has reduced rates dramatically, but mortgage qualifying interest rates have not fallen nearly as much.

Job losses from Coronavirus containment efforts are a more powerful force than low mortgage rates. Without income, you can not qualify for a mortgage.

Unfortunately, unemployment in B.C. has more than doubled with the Coronavirus Recession and job losses will have knocked a lot of people out of the housing market. For those who have held onto their jobs, an MNP survey released June 22nd says, a quarter of British Columbians are working reduced hours or receiving reduced pay.

Even after people get re-hired, they will need to be on the job for three months before they will qualify for a mortgage pre-approval. As well, small businesses and commission salesforce have to show 2 years of consistent income to qualify for a mortgage. Unless banks change their lending policies, 2020 will drag down their mortgage qualifying income until mid-2023 (when they file their 2022 taxes).

Overall Core Demand

Despite lower interest rates, due to the impacts of the Coronavirus, short-term core demand for homes will be much lower than it was in 2019.

Non-core Demand

This represents short-term investment, long-term investment, and recreational demand (i.e., homes not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Since non-core demand is ‘optional’ (i.e., not used for to shelter your own family), it is more volatile than core demand.

Foreign Capital

Foreign capital inflows were already dropping due to a combination of taxes and the ownership registry:

The annual B.C. speculation and vacancy tax rate is 2% for foreign owners and satellite families.

Since some foreign buyers were circumventing the tax using Canadian shell companies and straw buyers, the BC government will launch its corporate beneficial ownership registry in May of 2020.

Now with the travel bans that are part of Coronavirus containment efforts, we can expect there will be very little foreign investment in Canadian real estate.

Long-term Rentals

Rental investments are a significant driver of home prices. As it relates to our analysis, we expect domestic interest in long-term rental income properties will dry up so long as Coronavirus eviction bans are in place. The government has not developed an exit strategy for landlords with rent arrears for when social isolation policies are lifted. How will tenants repay three to six months of rent arrears?

Rental investors will simply try to time any future property purchases for the end of Coronavirus containment period, and they will avoid properties with tenants who have outstanding rent arrears.

As well, recent reports of rents falling across Canada will discourage new rental investment until rental rates stabilize.

Short-term rentals

We are watching short-term rentals closely because international travel bans will have a severe impact on short-term rentals in urban centres for the next few months (Canada’s tourist high season). Lakeside homes and cabins popular with Canadian vacationers should fare better.

Few entrepreneurs will be buying real estate for short-term rentals until international travel restrictions are lifted.

House Flipping

With Coronavirus containment efforts underway, house flipping will be very risky so we expect serial flippers will stay out of the market until they see a bottom to the market.

It may be 6 months to a year before the market finds bottom and the flippers emerge to pick up some bargains.

Dark Money

Dark money is proceeds of crime or money that is transferred to Canada illegally. This includes money earned legitimately that is illegally transferred from countries with capital controls (e.g., China) and legitimate earnings moved from countries who are the subject of international sanctions (e.g., Iran, Russia, and North Korea).

In order to hide the illegal nature of the funds, it is laundered in the real estate market. Sometimes the true owner of the property is hidden by using a Straw Buyer and other times the property is owned by a shell company.

Sometimes a real estate agent or lawyer will accept the illegal cash to help the nefarious individuals hide its true origins. In 2015, a B.C. realtor was caught with hundreds of thousands of dollars in her closet, at home.

$5 billion in illicit cash was laundered through real estate in 2018, and approximately three percent of straw buyers were students, homemakers or unemployed. An eye-opening report by Royal LePage says that Canadian residents on student visas buy 1 out of 10 homes in B.C. It would appear that the parents of students are using their children to evade the Foreign Buyer Tax. The beneficial ownership registry may reduce the number of student purchasers if their parents, who are foreign residents, are identified as the ultimate beneficial owners.

We see no evidence of a diminished role for dark money in local real estate.

Overall Non-core Demand

The net effect of all the recent changes will reduce inflows of capital toward residential real estate for non-core uses, and this will put downward pressure on Okanagan home prices.

Government Policy

Governments were trying to engineer a ‘soft landing’, but now they are trying to protect against a housing crash by encouraging banks to allow borrowers to defer their mortgage payments up to six months.

Mortgage and Housing Agency Tightens Mortgage Rules

Effective July 1st, CMHC has made changes to their mortgage rules that disqualify roughly 10 percent of potential homebuyers with Fair-Poor credit. The remaining buyers who qualify for a mortgage will qualify for 10 to 8 percent less money.

The purpose of the change, is to protect taxpayers from having to cover the costs of bad loans.

COVID-19 Support Measures

Mortgage Payment Deferral

A typical mortgage deferral is an agreement between the borrower and the lender to pause or suspend mortgage payments for one or two months. For the Coronavirus, they have extended this for up to 6 months.

After the agreement ends, your mortgage payments return to normal. The mortgage payment deferral does not cancel, erase, or eliminate the amount owed on your mortgage. The borrower still accrues interest that will have to be paid.

A Canadian with a $250,000 mortgage who defers their mortgage by six months adds approximately $4,000 in accrued interest to their mortgage balance.

IMPORTANT: Statistics in May, show that 7 percent of British Columbia mortgage holders applied for mortgage deferrals. Mortgage deferrals expire after 6 months and that means by October many of these deferrals will have expired. Unless these borrowers have found new work they will fall into default.

Eviction Bans and Suspensions

The B.C. government has suspended the enforcement of evictions for non-payment indefinitely.

Short-term Rental Regulation

A recent court decision upheld a strata corporation’s restrictions on short-term rentals. In the case, the condo owner was ordered by a B.C. Civil Resolution Tribunal to pay $46,400 in fines.

Speculation and Vacancy Tax

At the end of 2019, the annual Speculation and Vacancy Tax rate on foreigners quadrupled from 0.5% to 2.0%

Beneficial Ownership Registry

BC’s Corporate Beneficial Ownership Registry came into effect in May of 2020. This may help to reduce dark money in B.C. real estate.

Supply

Supply comes from two sources.

Existing sales: Existing home sales are sales of ‘used homes’. They are homes owned by individuals who sell them to upgrade, to move for work, or some other reason. The real estate boards only report existing home sales and listings.

Pre-Sales and Construction Completions: Most new homes are sold via pre-sales before the construction has started. These are predominantly apartments and townhomes. Data on pre-sales is private and difficult to find, but construction starts (reported by the government) are a very accurate lagging indicator of pre-sale activity.

Rising supply releases the upward pressure on prices caused by demand.

Months of Supply of Existing Homes

This year, it will be more challenging to buy homes during a pandemic so only motivated sellers will sell. At the same time, a majority of willing buyers will be sidelined by employment and savings concerns.

In the past, a lack of active listings was driving the seller’s market. During the pandemic, we expect a lack of willing buyers will shift the market in favour of buyers.

Coronavirus short-term rentals sold or converted (short-term impact)

In 2017, 125,857 guests stayed at Airbnbs in the Okanagan Valley. Travel bans will effectively shut down short-term rentals for the next few months (Canada’s tourist high season). The drop in bookings may force many owners of apartments primarily used as short-term rentals to sell their condo or repurpose it for long-term rentals adding thousands of homes to the market in the next six months.

We surveyed over 50 Canadian real estate agents and 50% had observed a majority of short-term rentals being listed as long-term furnished apartment rentals and 25% expected Airbnbs owners would sell their homes to cash in the capital gains.

Mortgage Delinquencies and Foreclosures

The most recent data indicates that more Canadians are missing their monthly payments, and job growth has been healthy. Some economists have been warning of a recession, and even without a recession, it appears more Canadians are over-extending themselves. Surprisingly, the increases in delinquencies are led by Ontario and British Columbia, and not Alberta.

According to Equifax, the credit bureau company:

“Mortgage delinquencies have also been on the rise. The 90-day-plus delinquency rate for mortgages rose to 0.18 percent, an increase of 6.7 percent from last year. Ontario (17.6%) led the increases in mortgage delinquency followed by British Columbia (15.6%) and Alberta (14.8%). The most recent rise in mortgage delinquency extends the streak to four straight quarters.”

A recent survey by MNP reported a staggering number of Canadians are stretched to their limits:

“Over 30 per cent of Canadians say they’re concerned that rising interest rates could push them close to bankruptcy, according to a nationwide survey conducted by Ipsos on behalf of MNP, one of the largest personal insolvency practices in the country.”

Job losses from Coronavirus containment will worsen this situation. Although the CMHC can help Canadians via Canadian lenders offers options to defer payments, re-amortize mortgages, add interest arrears to your mortgage balances. It will not help overextended Canadians from their credit card debt nor will it protect Canadians who chose to finance their homes with private mortgage lenders. Antrim, one of the larger private lenders in B.C. has lent $500 million in British Columbia. 1,529 of their mortgages are in Metro Vancouver with an average weighted interest rate of 8%. Most of their mortgages need to be re-approved every 12 months.

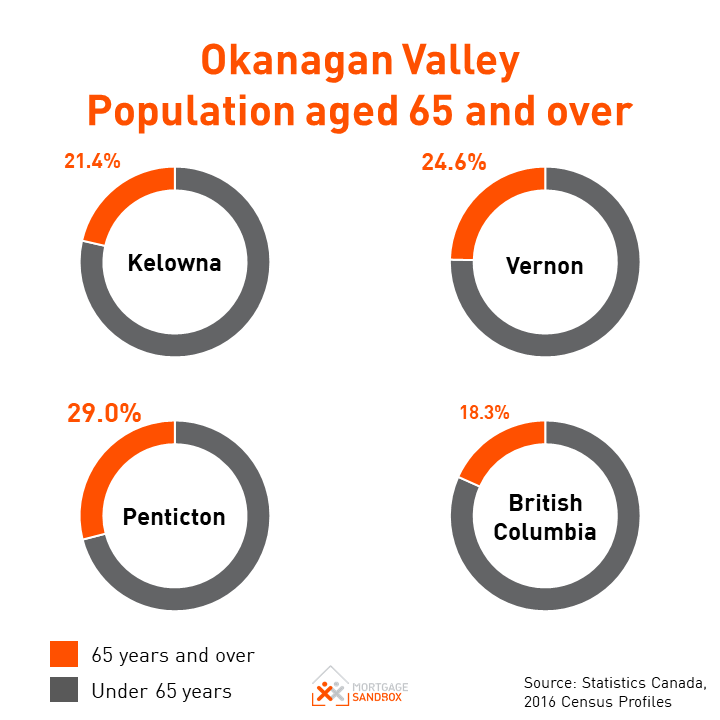

Baby Boomers Right-sizing?

According to a recent survey, 26 percent of B.C. Boomers who own a home had most of their retirement savings tied up in real estate. Nationally, a vast majority of Boomers want to live in their home forever, but for many that will not be possible. Most of them are not on track to have enough savings in retirement. The Coronavirus Recession won’t help.

An RBC survey says:

“Over the coming decade, we expect baby boomers to ‘release’ half a million homes they currently own—the result of the natural shrinking of their ranks, and their shift to rental forms of housing, such as seniors’ homes, for health or lifestyle reasons.”

We prefer the term '‘right-sizing’ because most boomers selling a house are buying luxury apartments with large floor plans in buildings with shared pools, saunas, gyms, and party rooms. That hardly sounds like a step down.

As baby boomers begin right-sizing and list their million-dollar homes for sale, they will add supply in what is considered the luxury market. If not enough Gen-X and millennial buyers are to buy these expensive homes, there is a risk that this may depress prices at the top of the market, which will then compress prices for townhomes and condo apartments.

In the near-term, supply is tight, but in the medium-term, there are risks of excess housing supply.

Pre-sales and Completions

New Construction

New home completions have been picking up but are nowhere near the levels achieved in 2019. There is also a healthy number of homes under construction and many are nearing completion. As these buildings complete in 2020 and 2021, and people move out of their rental or sell their current home, this new supply should further alleviate some of the pressure in the market.

KEY CONSIDERATION: Condo units completing in late 2021 were sold at peak prices before the recent price correction. These “peak price” condos will be very difficult to flip at a profit and buyers taking possession will have difficulty obtaining mortgages when if the market value turns out to be lower than the purchase price. As a result, peak priced condos may be re-released to the market but with tight sales timelines.

Pre-sales

Pre-sales, which are purchases of brand-new homes from developers, are measured using housing starts. Developers need to sell at least 70% of a project to secure financing and begin construction and that’s why construction starts are a good indicator success pre-selling new developments.

Pre-sales will slow down during the pandemic. So far in 2020, housing starts are ahead of 2019 levels but lower than the preceding two years. Developers will likely try to entice buyers with price discounts, move-in allowances, and cool amenities.

Popular Sentiment

There's no way of predicting popular sentiment, but as witnessed in the past two years, sentiment can shift quickly.

If cases in B.C. rise once again then we can expect sentiment to worsen. In the short-term we expect buyers will hold back while many sellers will move forward.

The Nanos Canadian Confidence Index has showed a noticeable drop in confidence. “Consumer confidence among Canadians remains net negative but continues to be on the rise.’ It is still well below the low that was reached during the 2008 Financial Crisis.

3. Should Investors Sell?

From a seller’s perspective, there are more changes in the market that influence prices downward so now may be a better time to sell than in two years and the annual real estate cycle usually favours sellers in the first half of the year.

With Coronavirus containment efforts, open houses may be impossible. However, you can get a Realtor to help you plan small repairs and improvements to your home so that it will be ready when the real estate market thaws.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check our our Complete Home Seller’s Guide.

4. Is this a good time to buy?

Homebuyers who waited now benefit from lower interest rates and prices that are unchanged from a year ago. They can now get a larger mortgage and buy more house with their larger buying budget.

Coronavirus containment efforts may make it difficult visit a bank or view homes. However, if you are considering a purchase, you can get a mortgage pre-approval from a mortgage broker and ask a Realtor to monitor the market, all without leaving your home. Then you’ll be ready when the ‘fog clears’.

Looking forward to 2021, prices are unlikely to rise dramatically so buyers shouldn’t feel the need to rush to an offer. Also, keep in mind that the annual real estate cycle usually favours buyers in late summer.

If you are thinking of buying just be sure to drive a hard bargain and cover your bases with smart and educated decisions. Don’t bite off more than you can chew.

Planning to Buy? Check our our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

June home sales in Greater Vancouver surge 64 per cent: real estate board (Global, Jul 3)

A Quarter of British Columbians are Working Reduced Hours or Receiving Reduced Pay (MNP, Jun 22)

High unemployment, lower immigration to restrain Canada housing market (Reuters, June 24)

Home price declines will likely depend on unemployment rate: Former CMHC chair (Bloomberg, Jun 8)

Five-year fixed mortgage rate in Canada falls to 1.99% for first time (Financial Post, Jun 8)

CMHC draws fire for tightening mortgage rules (Bloomberg, Jun 4)

Like this report? Like us on Facebook.