Metro Montreal Home Price Forecast - Oct 2020

HIGHLIGHTS

|

This article covers:

Where are Metro Montreal prices headed?

What factors drive the price forecast?

Should investors sell?

Is this a good time to buy?

1. Where are Metro Montreal home prices headed?

Home Price Overview

Metro Montreal prices have accelerated significantly in the past few months, pushing more potential home buyers out of the market.

People planning to sell their home will take heart because home values are at all-time highs. Given the current recession and pandemic, sellers may want to push ahead and sell during the pandemic because there is no guarantee that home prices will regain the recent highs any time soon.

The Coronavirus Pandemic, the resulting recession, and the potential for a second or third wave of infection are now the primary source of uncertainty for home values.

Metro Montreal Detached House Prices

House price growth in Metro Montreal has accelerated through 2020. The “soft landing” that government policymakers were targeting has not materialized, nor have promises of a ‘market crash.’

We believe politicians are hoping to guide the market toward a typical annual real estate cycle with price growth in the range of 1 to 3% annually – in line with income growth.

An examination of the five factors driving home prices (see the section below) makes us believe it is unlikely that record house prices will be sustained through the next 12 months.

House price growth in Montreal has been very high. Overall, according to the CMHC, there is a low risk of a price correction in Montreal.

Metro Montreal Condo Apartment Prices

Metro Montreal apartment prices are continuing upward. Uninterrupted by wave 1 of the pandemic.

We expect that Montreal developers will shift toward larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floorplans comes to the market, it may depress the values for small floorplan condos.

At Mortgage Sandbox, we would like to see developers building more 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Many parents who work-from-home and have taken on child-minding find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

Still a challenge for first-time homebuyers

A Montreal household earning $52,500 (the median Metro Montreal household before-tax income) can get a $300,000 mortgage. That’s enough to buy a benchmark priced condo, but buying a house is out of reach for most locals.

What about the rest of Canada?

Read the Toronto Real Estate Forecast, Ottawa Forecast and the Metro Vancouver Forecast.

2021 Metro Montreal House Price Forecast

Looking forward to 2021, some forecasters expect prices to continue rising while others expect prices to drop.

The highest forecast for Canadian home prices in a September Reuters poll of 16 economists was price growth of 10% in 2021, while the lowest prediction called for a 10% drop. Roughly half the economists anticipated a decline while half expected a rise.

Moody’s Analytics, who develop mortgage risk software for Canadian banks, predicts a drop of nearly 7% drop in Montreal.

CMHC, the government housing agency, predicts a ‘peak-to-trough’ drop of between 9% and 19%.

There is no consensus among economists. Market sentiment and government stimulus have led to price acceleration and record home purchases even though most economic fundamentals have faltered.

Our advice to homebuyers embarking on the most expensive purchase of their lifetime, and sellers who want to get as much equity as possible out of their homes, is to place a little more weight on CMHC and Moody’s Analytics. They may be projecting lower values in the future, but:

CMHC sells insurance to banks that limits their losses if a mortgage goes bad.

Moody’s Analytics sells software to banks that helps them assess the risk of their mortgage portfolios.

Both organizations are unique to see market conditions across the regions and all the banks.

In the next section, we examine the five factors that drive these forecasts. They will help explain why some several forecasters are anticipating price drops.

For a more thorough comparison of the Coronavirus Recession to the Great Recession and the Great Depression and their impacts on property prices, check out our recent article: “Should I sell my home today?”

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many real estate risks can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms, and we then present the most optimistic estimates, the most pessimistic prediction, and the average forecast. Do you want to learn more about real estate risk? We've written a comprehensive report that explains the level of uncertainty in the Canadian real estate market.

Our forecast inputs:

2. What factors drive the price forecast?

Mortgage Sandbox 5 Forces Framework

At the highest level, supply and demand set house prices and all other factors drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are core demand, non-core demand, government policy, supply, and popular sentiment.

In the long-run, the market is fundamentally driven by economic forces, but sentiment can drive prices beyond economically sustainable levels in the short-run.

Below we will summarize how the five factors result in the current Montreal forecast.

Core Demand

Core demand is a function of:

Population Growth: The pace at which people are moving to an area. An average of roughly 2.5 people live in one household.

Home Price Changes: The current market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: Your maximum mortgage is calculated using income (i.e., how much money you can put toward mortgage payments) and interest rates (how big are the mortgage payments).

How have these changed lately?

Population Growth

Quebec’s population is almost always growing, but the rate of growth is important for our analysis.

If population growth is the same or lower than in the past, then there is less upward pressure on prices.

At the moment, population growth is lower in Ontario. As a result of ongoing COVID-19 related travel restrictions, we may observe lower growth through to the end of 2020 and into 2021.

READ: Fewer People = Less Demand : Easing Population Growth to Weigh on Housing, TD Bank

Home Price Changes

House prices are near records across Metro Montreal. Prices growth reduces affordability and reduces the pool of qualified potential buyers. In an ironic twist, this means rising prices create downward pressure on prices.

As a rule-of-thumb, homeownership costs are considered unaffordable when they exceed 40% of household income.

In March 2020, Montreal homeownership costs were 43.4% of the median household income. In other words, Montreal home prices had exceeded economic fundamentals, in a low interest rate environment, before the impact of the Coronavirus.

House prices have continued to rise, and this forces us to contemplate if or when economic fundamentals might re-exert their influence on the market.

Savings-Equity

Rents are rising faster than incomes (3.6 percent annually), so first-time buyers will struggle to come up with down payments.

The stock market has dropped because of the pandemic, so anyone who managed to save a down payment and invested it in ‘blue-chip stocks’ may now find out they’ll need to save for a few more months or years.

However, since homes prices have risen, most homeowners seeking to upgrade will have more home equity in 2020 to deploy toward the purchase of an upgrade.

Financing

Mortgage Interest Rates

Median incomes have not changed materially, but employment levels are dropping. To mitigate the impact, the Bank of Canada has dramatically reduced its ‘Target Rate,’ but mortgage qualifying rates have not fallen nearly as much.

Lower interest rates were a significant factor driving up home prices between 2018 and 2019.

Employment and Incomes

Median Montreal incomes have not changed materially, but employment levels are dropping. Job losses from Coronavirus containment efforts are a more powerful force than low mortgage rates. Without income, you can not qualify for a mortgage.

Brendan LaCerda, a Senior Economist with Moody’s Analytics, estimates that each 1% rise in unemployment results in a 4% drop in home prices. Until now, the impact of unemployment has been delayed by the CERB and mortgage payment deferral program.

Using this ratio, a prolonged 2.5% rise in Quebec unemployment to 7.5% would result in a 10% price drop and a 5% rise in Quebec unemployment to 10% would lead to a 20% fall in values.

The ‘official’ unemployment figures do not include unemployed people who are not looking for work (e.g., people who work in industries that have not fully reopened like tourism or hospitality). The true ‘effective’ levels of unemployment are higher.

Even after people get re-hired, they will need to be on the job for three months before they qualify for a mortgage pre-approval.

Small businesses and commission salesforce have to show 2 years of consistent income to be eligible for a mortgage. Unless banks change their lending policies, 2020 will drag down their mortgage qualifying income until mid-2023 (when they file their 2022 taxes).

Homeownership Costs

In 2020, before factoring in the pandemic, Montreal raised property taxes by 2%, and the City of Montreal has proposed a tax freeze in 2021.

City revenues have been hit hard by the pandemic, and the city now faces a $500 million deficit. While the provincial and federal governments may provide support, homeowners will likely be expected to help as well. Residents should expect property taxes increases or reduced services to make up for the pandemic revenue shortfalls. If cities put off infrastructure and capital spending, then the deferred costs will eventually result in higher taxes.

Property taxes are factored into your mortgage affordability calculations, so an increase in taxes lowers homebuying budgets.

Overall Core Demand

Despite lower interest rates, due to the Coronavirus' impacts, short-term core demand for homes will likely be much lower as we head into 2021.

Non-core Demand

This represents short-term investment, long-term investment, and recreational demand (i.e., homes not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Since non-core demand is ‘optional’ (i.e., not used to shelter your own family), it is more volatile than core demand.

Foreign Capital

Since British Columbia and Ontario introduced foreign home buyer taxes, foreign capital flowing into Montreal properties has grown dramatically.

With the international travel restrictions that are part of Coronavirus containment efforts, we can expect very little foreign investment in Canadian real estate.

Long-term Rentals

Rental investments are a significant driver of home prices, but recently rents have been falling across Canada.

Rental investors may try to time any future property purchases for the end of the Coronavirus containment period, and they will avoid properties with tenants who have outstanding rent arrears.

Short-term rentals

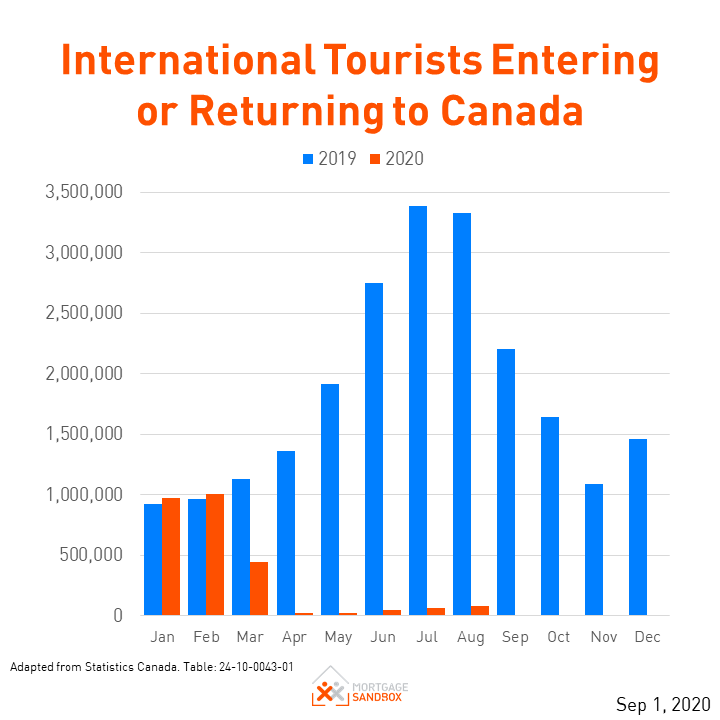

We are watching short-term rentals closely because travel restriction will effectively shut down many short-term rentals until the end of the pandemic.

Statistics show that since the travel restrictions were put in place, international travel to Canada has dropped 98 percent.

House Flipping

With Coronavirus containment efforts underway, house flipping will be very risky, so we expect serial flippers will stay out of the market until they see a bottom to the market.

It may be 6 months to a year before the market finds the bottom, and the flippers emerge to pick up some bargains.

Dark Money

Dark money is the proceeds of crime or money that are transferred to Canada illegally. This includes money earned legitimately and illegally transferred from countries with capital controls (e.g., China) and legitimate earnings moved from countries subject to international sanctions (e.g., Iran, Russia, and North Korea).

To hide the illegal nature of the funds, it is laundered in the real estate market. Sometimes, the property's true owner is hidden by using a Straw Buyer, and other times the property is owned by a shell company.

Sometimes a real estate agent or lawyer will accept the illegal cash to help the nefarious individuals hide its true origins. In 2015, a B.C. realtor was caught with hundreds of thousands of dollars in her closet at home.

We see no evidence of a diminished role for dark money in local real estate.

Overall Non-core Demand

The net effect of all the recent changes will reduce capital inflows toward residential real estate for non-core uses, putting downward pressure on Metro Montreal home prices.

Government Policy

Governments have shielded Canadians and the housing market from the impacts of the pandemic induced recession using the CERB program, mortgage payment deferrals, and suspending tenant evictions. Most of these measures have now expired.

Mortgage and Housing Agency Tightens Mortgage Rules

Effective July 1st, CMHC has made changes to their mortgage rules that disqualify roughly 10 percent of potential homebuyers with Fair-Poor credit. The remaining buyers who qualify for a mortgage will qualify for 10 to 8 percent less money.

The purpose of the change is to protect taxpayers from having to cover the costs of bad loans.

These changes effectively offset any benefit that lower qualifying mortgage rates provide.

COVID-19 Support Measures

Mortgage Payment Deferral

A typical mortgage deferral is an agreement between the borrower and the lender to pause or suspend mortgage payments for one or two months. For the Coronavirus, they have extended this for up to 6 months.

After the agreement ends, your mortgage payments return to normal. The mortgage payment deferral does not cancel, erase, or eliminate the amount owed on your mortgage. The borrower still accrues interest that will have to be paid.

A Canadian with a $250,000 mortgage who defers their mortgage by six months adds approximately $4,000 in accrued interest to their mortgage balance.

IMPORTANT: Statistics in August, showed that 10 percent of Montreal mortgage holders were still unable to make their mortgage payments. Mortgage deferrals expire after 6 months and that means by October many of these deferrals will have expired. Unless these borrowers have found new jobs, they will fall into default.

Short-term Rental Regulation

Montreal boroughs plan to implement short-term rental restrictions to free up apartments for tenants looking for long-term leases.

Beneficial Ownership Registry

Quebec rules to identify foreign resident beneficial owners come into effect in October 2020.

A foreign resident buyer tax may follow soon after. The new disclosure rules require buyers to disclose their citizenship and residency status. If a company or partnership purchases the property, then the notary must determine if a foreign resident owns 50 percent or more of the property. For trusts, the notary needs to determine if the trust's beneficiary is a resident of Canada. Already, most experts can spot some loopholes in this set-up, but the government is trying.

Foreign Buyer Taxes

The federal government is contemplating foreign ownership taxes, and the Quebec government is beginning to measure international buyer influence in the market accurately, which could be the first step leading to a foreign buyer tax. The desired effect is to reduce unnecessary (non-core) demand until more supply can come to the market.

Overall Government Influence

Overall, the government is now unwinding many of the programs supporting home values through the recession. Compared to three months ago, there is now much less support from the government to maintain home values.

If prices continue to rise aggressively or suddenly drop dramatically, we should expect policy interventions to moderate the market. Unfortunately, our inability to predict government actions adds uncertainty to future home valuations.

Supply

Supply comes from two sources.

Existing sales: Existing home sales are sales of ‘used homes.’ They are homes owned by individuals who sell them to upgrade, move for work, or some other reason. The real estate board only reports existing home sales and listings.

Pre-Sales and Construction Completions: Most new homes are sold via pre-sales before the construction has started. These are predominantly apartments and townhomes. Data on pre-sales is private and difficult to find, but construction starts (reported by the government) are a very accurate lagging indicator of pre-sale activity.

Rising supply releases the upward pressure on prices caused by demand.

Months of Supply of Existing Homes

Supply is tight, and Montreal is a ‘seller’s market.’

There are a rising number of condo apartments for sale, and active listings are trending higher. A flood of listings could tilt the apartments into a ‘balanced market.’

In a balanced market, there should be fewer bidding wars and no-subject offers. Sellers will, once again, need to compete against each other. In a balanced market, your real estate agent's quality becomes more important because you are negotiating on an equal footing. Preparation and strategy play a greater role in negotiations.

Coronavirus short-term rentals sold or converted (medium-term impact)

Travel restrictions and cancelled events have effectively shut down short-term rentals for the summer months and the foreseeable future. The drop in bookings may force many owners of apartments primarily used as short-term rentals to sell their condo or repurpose it for long-term rentals adding up to 13,000 homes to the market in the next six months.

We surveyed over 50 Canadian real estate agents, and 50 percent had observed a majority of short-term rentals being listed as long-term furnished apartment rentals. 25 percent expected AirBnBs owners would sell their homes to cash in the capital gains.

Mortgage Delinquencies and Foreclosures

Data indicates that more Canadians miss their monthly payments, and most mortgage payment deferrals will expire in September and October.

According to Equifax, the credit bureau company:

“Mortgage delinquencies have also been on the rise. The 90-day-plus delinquency rate for mortgages rose to 0.18 percent, an increase of 6.7 percent from last year.”

A separate survey by MNP reported a staggering number of Canadians are stretched to their financial limits:

“Over 30 per cent of Canadians say they’re concerned that rising interest rates could push them close to bankruptcy, according to a nationwide survey conducted by Ipsos on behalf of MNP, one of the largest personal insolvency practices in the country.”

Although the CMHC can help Canadians via Canadian lenders by refinancing mortgages, it will not help overextended Canadians who chose to finance their homes with private mortgage lenders.

Baby Boomers Downsizing?

In 2020, 45% of baby boomers will be aged 65 and over and, according to a recent survey, 27 percent of Quebec Boomers plan to move into a smaller home as they near or enter their golden years.

A recent report on all Canadian Boomers from RBC says:

“Over the coming decade, we expect baby boomers to ‘release’ half a million homes they currently own—the result of the natural shrinking of their ranks, and their shift to rental forms of housing, such as seniors’ homes, for health or lifestyle reasons.”

We prefer the term '‘right-sizing’ to ‘downsizing’ because most boomers selling a house buy luxury apartments with large floor plans in buildings with shared pools, saunas, gyms, and party rooms. That hardly sounds like a downgrade.

As baby boomers begin right-sizing and list their million-dollar homes for sale, they will add supply in what is considered the luxury market. If not enough Gen-X and millennial buyers are to buy these expensive homes, there is a risk that this may depress prices at the top of the market, which will then compress prices for townhomes and condo apartments.

In the near-term, supply is tight, but in the medium-term, there are risks of excess housing supply.

Pre-sales and Completions

New Construction

There is a record number of homes under construction in Montreal and in 2020 new home completions almost matched the record set in 2019.

As buildings under construction complete in 2021 and 2022, and people move out of their rental or sell their current home, this new supply should alleviate some of the pressure in the market.

Pre-sales

Metro Montreal pre-sales are purchases of brand-new homes from developers. Typically, a developer must sell 70% of homes in a building before they can starts construction so housing starts are a good indicator of successful pre-sales.

So far in 2020, housing starts have eclipsed the record set in 2019.

Popular Sentiment

There's no way of predicting popular sentiment, but sentiment can shift quickly, as witnessed in the past two years.

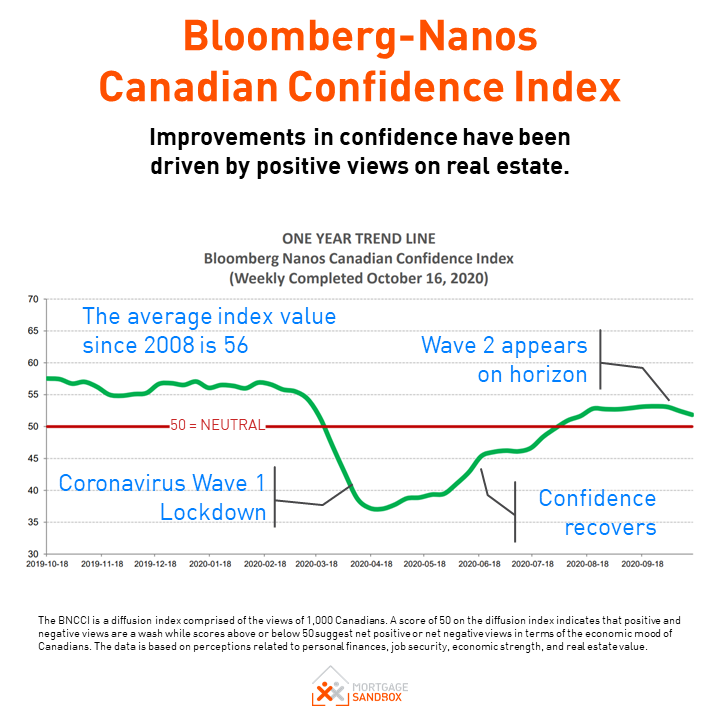

Canadian Consumer Confidence

The Ipsos-Reid and Nanos Canadian Confidence Index has shown a noticeable drop in confidence. “Consumer confidence among Canadians has improved significantly, buoyed by positive views on real estate. Confidence has recovered remarkably well when compared to the 2008 Great Recession. It would appear that sentiment is the primary driver of real estate market activity because the other four drivers are materially weaker.

Coronavirus Containment

If Quebec cannot control the second wave, we expect localized restrictions and lockdowns that will depress sentiment.

In a nationally broadcast address, Prime Minister Trudeau has clearly stated that the second wave of Covid-19 is already happening across Canada. Chief Public Health Officer Dr. Theresa Tam has said that "Unless public health and individual protective measures are strengthened, and we work together to slow the spread of the virus, the situation is on track for a big resurgence in a number of provinces."

A study headed by Dr. Kristine A. Moore, medical director at the University of Minnesota Center for Infectious Disease Research and Policy, warns that the pandemic will not be over soon and that people need to prepare for possible periodic resurgences of disease. Optimistically, a vaccine will not be widely available until mid-2021 and 70% of the population would need to be infected to provide herd immunity. Unfortunately, more than 30% of the population have conditions that make them vulnerable.

3. Should Investors Sell?

From a seller’s perspective, more changes in the market that influence prices downward, so now may be a better time to sell than in two years, and the annual real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

4. Is this a good time to buy?

Homebuyers who waited now benefit from lower interest rates and prices that are unchanged from a year ago. They can now get a larger mortgage and buy more house with their larger buying budget.

Coronavirus containment efforts may make it difficult to visit a bank or view homes. However, if you are considering a purchase, you can get a mortgage pre-approval from a mortgage broker and ask a Realtor to monitor the market, all without leaving your home. Then you’ll be ready when the ‘fog clears’.

Looking ahead to 2021, prices are unlikely to rise dramatically, so buyers shouldn’t feel the need to rush to an offer. Also, keep in mind that the annual real estate cycle usually favours buyers in late summer.

If you are going to buy, be sure to drive a hard bargain and cover your bases with smart and educated decisions. Don’t bite off more than you can chew.

Are you Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

CMHC: Mortgage Deferrals On Toronto Real Estate 12%, Vancouver 11% (Better Dwelling, Oct 14)

Montreal real estate still on fire with home prices up 12.5 per cent over last fall (CTV, Oct 14)

Archives: When Vancouver real estate prices were falling in 1982 (CBC, Aug 18)

Despite the COVID-19 pandemic, Montreal broke a real-estate record in July (CTV, Aug 8)

Like this report? Like us on Facebook.