Empowering Homebuyers

As far as most people can recall, Metro Vancouver homes have been the priciest in Canada. They were expensive in 2007 before the financial crisis, and as prices continued to climb we started calling it a housing crisis 2015. Since 2015, prices have risen another 50%.

Home prices have now reached levels where 81% of the homes for sale in Metro Vancouver are only affordable to the wealthiest 17% of households. It means that if we change nothing, more than 83% of the next generation will never own a home.

We’ve all heard people blame lack of supply and speculative demand as key issues driving unaffordability. I believe both supply and demand are to blame, but no one is looking closely at the exchange process between sellers (supply) and buyers (demand). The exchange process is a key contributor to the crisis and modernizing it is a key to achieving affordable homes.

This article explains the key issues with the exchange process and provides recommendations on two types of improvements that can be quickly implemented:

The MLSⓇ system should be made accurate and complete.

Real Estate practices should be more ethical.

Simply put, the MLSⓇ system is a poor one for managing housing inventory. It is more akin to a classifieds website than an inventory management system. Why is this an issue? Can’t we just buy houses like we buy cars on Craigslist?

MLSⓇ’ inaccuracy is important because three key stakeholder groups rely on reporting from MLSⓇ to make some of most impactful decisions in their lives and for the economy. Who are these stakeholders and what do they use MLSⓇ for?

Home buyers depend on MLSⓇ for accurate and transparent information about local markets and to assess fair prices for homes.

Government and central bank policymakers responsible for monitoring risks use this data to inform housing and interest rate decisions.

Industry forecasters, economists, and senior bank employees use MLSⓇ to evaluate risk in the housing market and tighten or loosen lending policy.

What’s wrong with MLSⓇ?

Though it’s appearance could definitely use some improvement, that doesn’t affect the valuable information it provides. There are two major issues with the data in MLSⓇ:

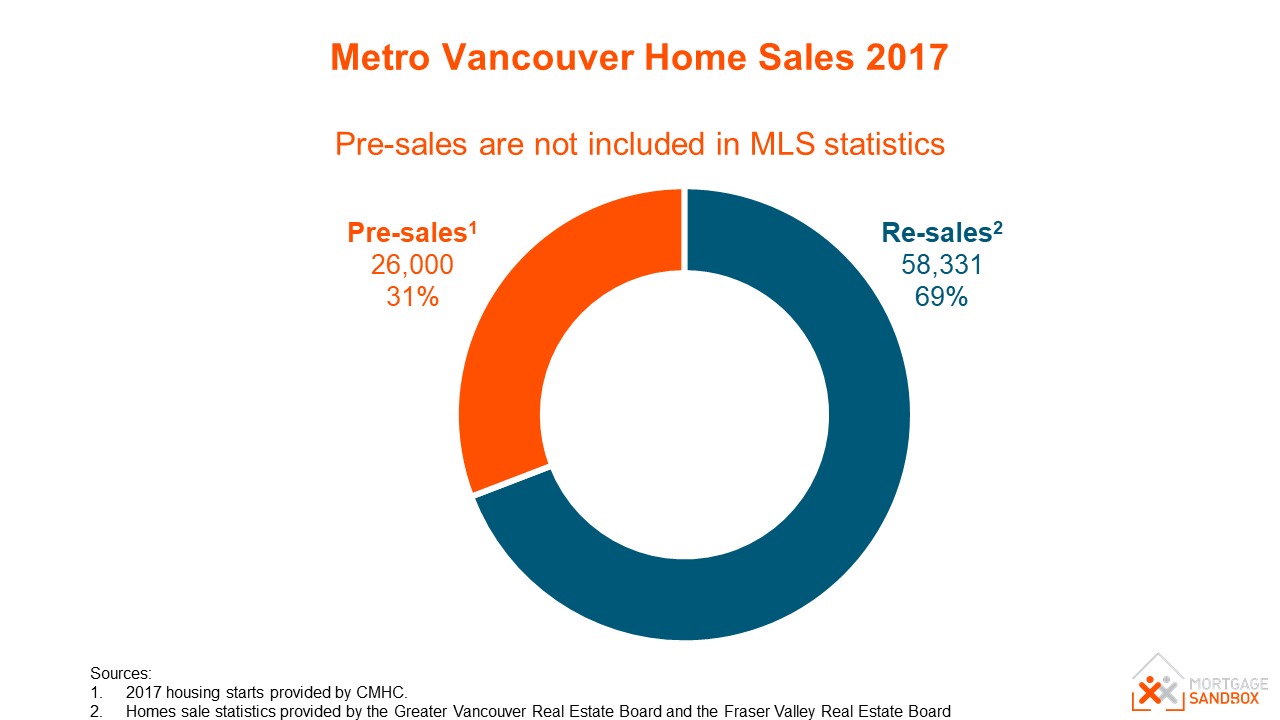

Pre-sales are not included

There are no controls on cancelling and relisting homes

Today, the following key statistics from MLSⓇ are materially inaccurate: active listings, new listings, sales, and benchmark price. This is because pre-sales are not listed. Pre-sales make up 1 in 3 homes sold, but it’s almost impossible to know exactly how many are sold or their prices. The addition of pre-sales would allow stakeholders to get a more accurate and transparent representation of the market through MLSⓇ.

Next, the key stat for determining the aggressiveness of buyers – average days on market – is distorted by the ability of realtors to cancel and relist (recycle) a property listing. There are instances where a single property listing has been recycled more than 6 times in one year. Recycling listings make the “days-on-market” figure meaningless since this has no bearing on the number of days homes have actually been for sale.

Recycling listings make the housing market look far hotter than it is and encourages buyers to offer more money, move more quickly, and take greater risks, in turn, this drives up prices. The chart below shows that in the City of Vancouver the number of dropped condo apartment listings has been trending upward over the past three years. It used to lie between 8-15% with spikes in December because sellers don’t want to host open houses during the holidays. It has risen alarmingly in the last year and has averaged almost 25%. Interestingly, this increase has coincided with a reduced sales activity in the housing market. Are agents deliberately canceling listings to relist them and make them appear new and more attractive?

Recycling listings depresses the average days on market statistic which signals to home buyers that homes are being bought quickly and therefore they should too. This artificially shifts power to sellers who can then charge higher prices.

Recommendations:

Modernize MLSⓇ to provide complete and accurate information

Add all pre-sales into MLSⓇ so that all the supply data is accessible from one source.

Raise ethical standards for canceling/relisting of listings.

Modify MLSⓇ so that if a home was previously listed within 9 months of a new listing, the original list date and days on market is presented.

The housing market has evolved from facilitating local property purchases to a global market where houses are traded as commodity investments, but real estate sales practices have not kept pace with the change. Examining sales practices prohibited for investment brokers and comparing them to common practices in real estate paints an alarming picture.

| Prohibited Investment Practices | Common Real Estate Practices |

|---|---|

|

Market Manipulation - Efforts to artificially increase the price of a company’s shares.

|

Efforts to artificially increase the price of a property sale price.

|

|

Illegal Representation - In making a recommendation, no assurance must be given or guarantees made as to:

|

Real estate is presented by real estate agents as a high return and low risk investment even though past return is not a guarantee of future returns.

|

Recommendations:

Define new ethical standards for Real Estate

Prevent Market Manipulation by:

Prohibiting practices intended to manipulate the market

Require a mandatory minimum of 10 business days to secure financing and obtain property inspection

Prevent Illegal Representation by:

Prohibiting guarantees or high certainty of investment return

Why change?

All of these recommendations are intended to soften the current bias toward higher prices.

Recycling listings:

Serves to shorten Days on Market and signal to buyers that they need to offer high and offer fast.

Excludes pre-sales which makes supply look 30%-40% smaller, signaling that buyers should try to outbid others for limited supply.

Makes homes that have actually been struggling to sell look like hot property, misleading buyers into thinking they can't drive a hard bargain.

“Front-running” or "Scalping"

When a Realtor flips a pre-sale assignment, and say makes a quick $25,000 profit, the profit made by the Realtor is passed on as a cost to the homebuyer. This is very similar Ticket Scalping that distorts concert ticket prices.

Market Manipulation (e.g., planned bidding wars)

Bidding wars engineer an auction to drive up price.

Research shows “first-price auctions” leads to significantly higher prices and weaker bidders tend to bid more aggressively.

Illegal Representation (i.e., prices only rise – asymmetric risk)

Leads buyers to believe they will earn a return regardless of the purchase price and reduces inhibitions to overpaying.

Conclusion

In summary, the out of date MLS system and real estate practices impact homebuyers' ability to buy a home at a fair market value. Ethical changes are needed by homebuyers that view real estate industry professionals as some of the least trustworthy people. We would love to hear your opinions on what we've discussed and what we may have missed, and if you support the changes we are advocating for, follow this link to show support in our petition:

Like this post? Like us on Facebook for the next one in your feed.