Canadian Interest Rate Forecast to 2023

HIGHLIGHTS

|

Every economist surveyed expects the Bank of Canada (BoC) will keep its Target Rate at the “effective lower bound” of 0.25% until the second half of 2022. Royal Bank is the only forecaster calling for a rise in the Target Rate by September 2022.

The Bank of Canada has said that it will hold the policy interest rate at 0.25% until the economy recovers, the labour market tightens, and inflation reaches a consistent 2 percent.

While low rates help borrowers, the expectation of prolonged lower interest rates indicates that the economy will likely not recover until late 2022.

The first COVID-19 vaccine shipments arrived in Canada on December 13th. All the provinces have announced a phased vaccination approach and B.C. has provided the most specific timeline to full vaccination and return to normal. B.C.’s Provincial Health Officer, Dr. Bonnie Henry, says that by September 2021, everyone who wants a vaccine will have received one.

Since Coronavirus has caused such a sharp economic contraction, as soon as the pandemic clears, we expect a strong economic bounce-back. In other words, the economy will have shrunk so much that it will be easy to improve on the dismal past performance.

For homebuyers with stable employment, the lower interest rate environment combined with less competition from other buyers will create a very favourable home buying environment.

This article will explain the forecasts for variable (floating) rates and 5-year fixed (locked-in) rates. Keep reading to learn what the big banks are saying about rates.

THE CURRENT SITUATION

A Weak Economy

Canada is now in a recession. Recently, most reports have been adjusting expectations downward as a result of a wave 2 of infections. In other words, past predictions underestimated the economic impact of prolonged Coronavirus containment efforts. Assuming the vaccination program will not be complete until September 2021, Canadians should prepare themselves emotionally for a third wave.

The Bank of Canada has said that it will hold the policy interest rate at 0.25% until the economy recovers, the labour market tightens, and inflation reaches a consistent 2 percent. Inflation has never consistently reached 2% since the 2008 financial crisis.

Canada has not yet flattened the curve on wave 2 and we should probably be preparing ourselves mentally for a third wave in the Spring.

A study headed by Dr. Kristine A. Moore, medical director at the University of Minnesota Center for Infectious Disease Research and Policy, explored scenarios for the pandemic's evolution. Her research team predicted that the second wave in the Fall of 2020 was a likely scenario.

Now that we are in the midst of the second wave, we need to look ahead to what’s next.

Scenario 1 - Cautious Optimism

Canadians continue to follow health policy guidance and wear masks and continue social distancing until enough people are vaccinated to provide herd immunity. The second wave is the last.

Scenario 2 - Reckless Optimism

In Spring 2021, once most of the vulnerable have been vaccinated, many Canadians will stop wearing masks and social distancing. They will hold the mistaken belief that vaccinating the most at risk is good enough.

This could lead to a massive third wave of infections. The lives of many people who are vulnerable, but didn’t know it, would be lost in this scenario. The provinces would likely have to reimpose local restrictions and lockdowns.

When will the COVID-19 Pandemic end?

Several vaccine candidates have been approved and it will take 6 to 9 months to vaccinate enough Canadians to achieve herd immunity. Vaccine supplies, physical logistics, and anti-vaccine attitudes will be the greatest challenges once vaccines are approved.

We may see a return to something near normal as early as June 2021. More likely, Canada will have some form of restrictions until the Fall of 2021.

WHAT’S NEXT?

The Bank of Canada Target Rate Will Not Rise Any Time Soon

The Bank Rate is well below what would be considered a ‘normal’ range. According to the Bank of Canada, "Governing Council continues to judge that the policy interest rate will need to rise over time into a neutral range to achieve the inflation target." This policy implies that once Canada emerges from a recession, rates will begin to rise.

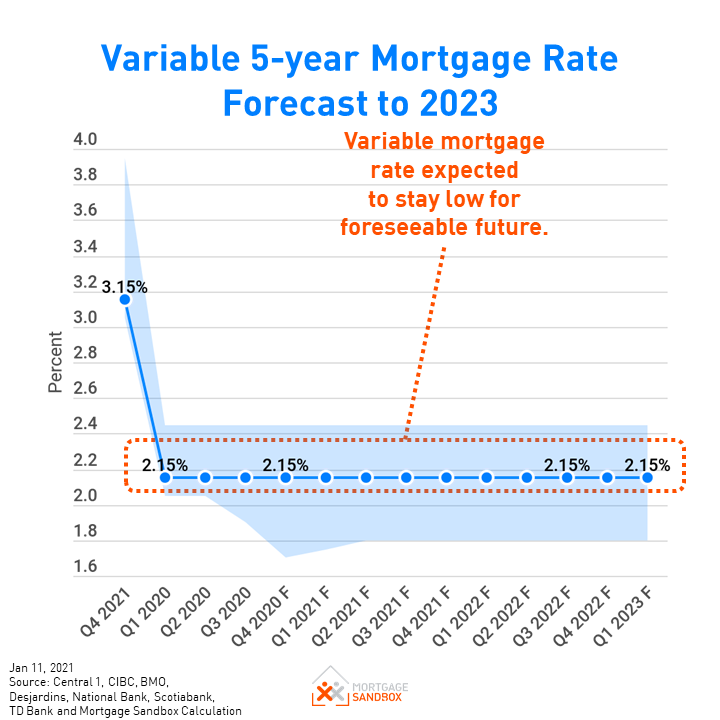

Variable and adjustable mortgage rates are directly linked to the Bank Rate (the rate at which banks can borrow from the Bank of Canada). If the Bank Rate rises, then prime rates offered by Canadian banks rise, as do variable mortgage rates.

THE BANK RATE FORECAST TO 2023

Canadian prime rates used to calculate variable and adjustable mortgage rates will remain low between now and the end of 2023.

Generally, we recommend a variable rate mortgage when rates are flat or falling. If the risk of rates rising worries you, then you should consider a fixed-rate mortgage.

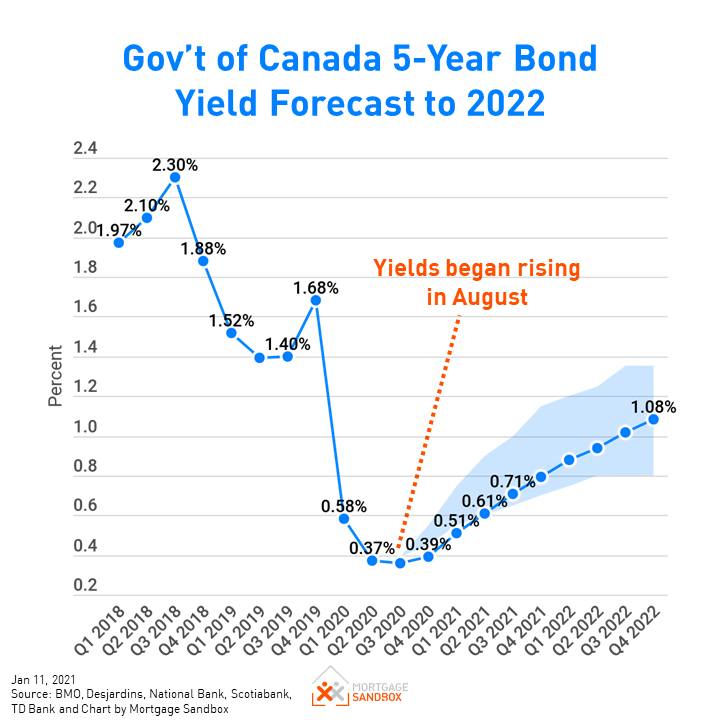

5-YEAR GOVERNMENT BOND RATES TO 2022

The average Canadian Bank economist predicts 5-year rates will begin to rise. While they may be rising, they will remain relatively low when compared to the past 10 years.

Bond yields (i.e., rates) started to drift higher in August and they are expected to continue rising so long as the economy shows stability.

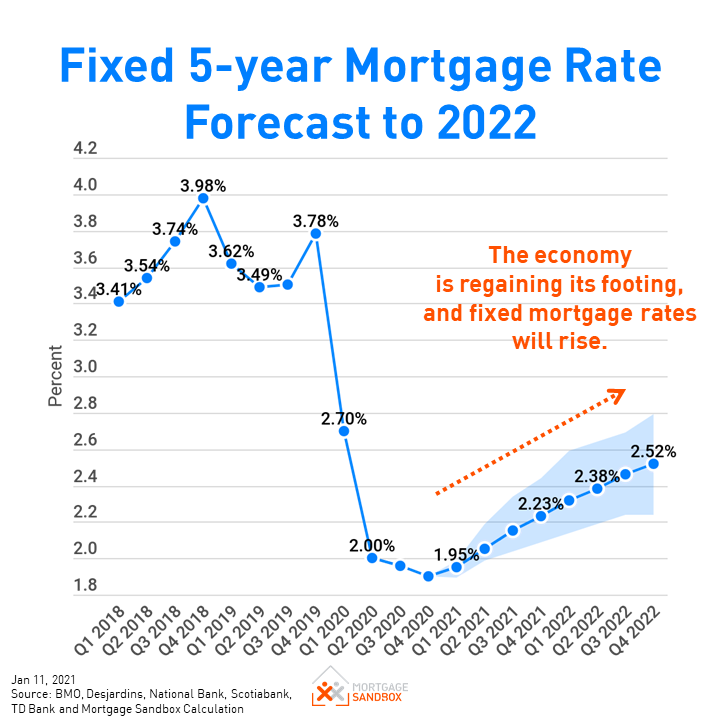

Five-year fixed rates are expected to rise between a half and three-quarters of a percent by the end of 2022.

The Takeaways

Lock in a 5-year fixed rate?

Buy a home now or wait for the next cycle?

1. Lock in a 5-Year Fixed Rate?

Fixed-rates are currently setting record lows. In 6 months, fixed rates will probably be the same or slightly higher than today. Locking in a 2.00% 5-year fixed mortgage rate will only start benefiting you financially if variable rates begin to climb. At the moment, that seems unlikely to happen until late 2022 or early 2023.

Although locking in your rate today isn’t a huge financial gain, it does provide peace of mind.

If the risk of rates rising worries you, then you should consider a fixed-rate mortgage rate term.

If you are planning to sell or move in the next few years, however, locking in a fixed rate can result in a significant penalty fee if you cancel the mortgage before completion of the full term.

Our advice is to speak to a Mortgage Broker as early as possible to lock in a rate. You can lock in your mortgage rate up to 120 days before closing on a home purchase or the renewal of your mortgage.

Here’s our mortgage renewal guide that will help you navigate the process.

2. Is it a better time to Buy or Sell a home?

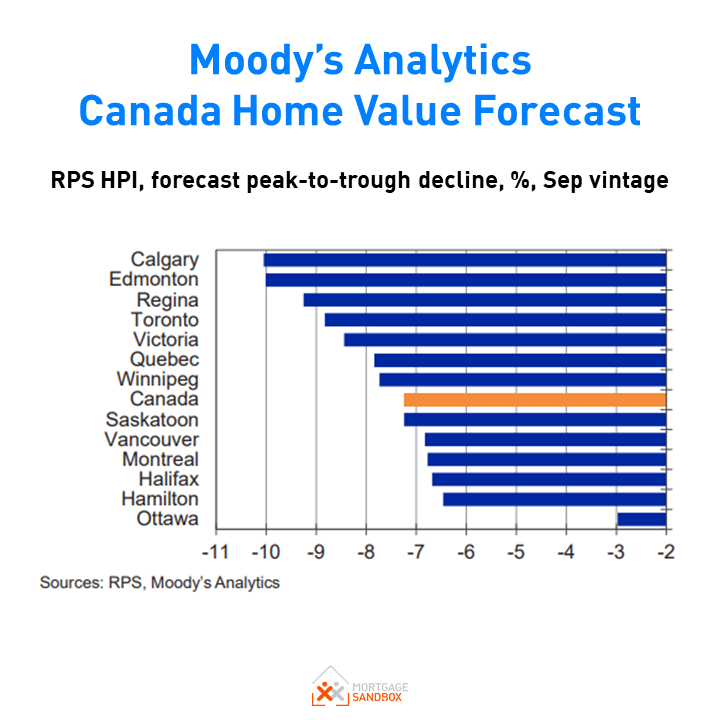

There are more economic factors on balance, putting downward pressure on home prices than upward pressure, but that was also the case in the summer of 2020 when buyer sentiment carried prices higher.

The link between home prices and economics seems to have weakened. If we believe that home prices are related to the economy's strength, then prices may have peaked for this economic real estate cycle.

If we believe that interest rates are the primary driver of home prices, then the forecasted rise in rates would indicate prices will moderate in the second half of 2021.

Population growth is also expected to remain below average in 2021.

Homebuyer Advice

If you plan to buy in the next three years, be mindful that there is a risk that prices will fall in the short-run, so a ‘wait-and-see’ approach may be appropriate. For buyers who are still employed, low rates will provide more purchasing power in a falling market, which is a gift to home buyers.

Home Seller Advice

If you were planning to sell, then it may be worthwhile selling sooner than later. If we use the Great Recession as a guide, it could take between two and ten years for home prices to recapture current highs.

Like this report? Like us on Facebook.