The Top 4 Things You Need to Know About Home Insurance

When you buy a home, the lender requires you to get home insurance, but they only require bare-bones coverage for the value of the building. Most insurance policies have a monthly premium and you pay a fee when you make an insurance claim. The fee is called a deductible.

You need to be concerned about more than just the resale value for the lender. Home insurance is intended to protect you from potential costs incurred from damage to your property or theft of your household items. A home is likely your most valuable investment and you need to know the extent of your coverage.

A 2017 JD Power Study found almost 50% of Quebec respondents thought they had overland flood coverage, but the Insurance Bureau of Canada estimates as few as 10% of Canadian homeowners actually have that coverage.

This article will cover:

Different types of home insurance

Different coverages

Innovative trends in insurance that provide extra value and save you money

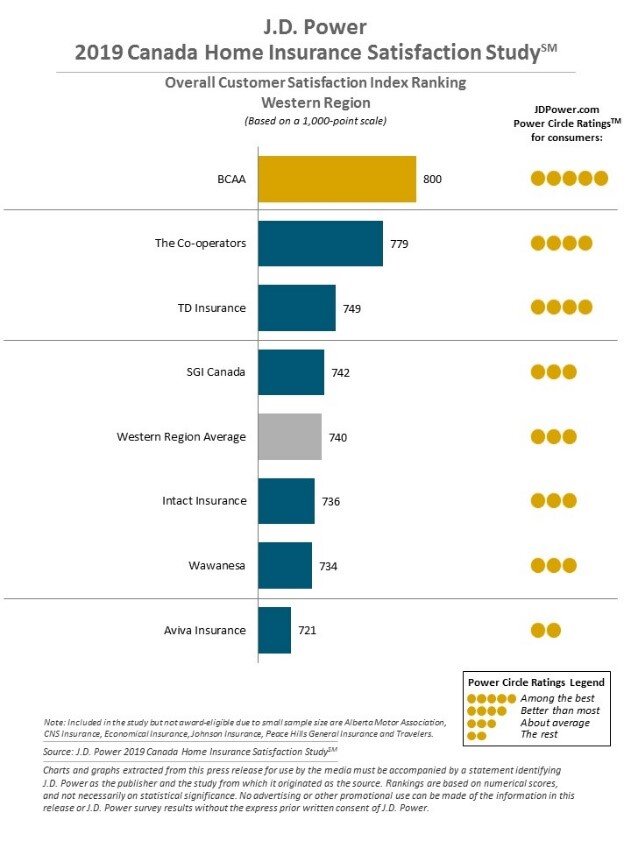

Customer satisfaction ratings of the larger insurers for Western Canada

1. Types of Insurance

Not all home insurance is made the same. There are four primary types of home insurance that the average homebuyer needs to know about:

House Insurance

Condo Insurance

Renters (Tenant) Insurance

Rental (Landlord) Insurance

| Coverage | House Insurance | Condo Insurance | Renters (Tenant) Insurance | Rental (Landlord) Insurance |

|---|---|---|---|---|

| Building (House) | ● | ● | ||

| Building Improvements (Condo) | ● | ● | ||

| Detached Structures (House) |

● | ● | ||

| Condo (Strata) Coverage | ● | ● | ||

| Personal Property | ● | ● | ● | |

| Specialty Property | ● | ● | ● | |

| Additional Living Expenses | ● | ● | ● | |

| Rental Income | Optional | Optional | ||

| Personal & Premises Liability | ● | ● | ● | ● |

| Identity Theft | Optional | Optional | Optional | |

| Fire & Smoke | ● | ● | ● | ● |

| Crime & Vandalism | ● | ● | ● | ● |

| Severe Weather & Flooding | Optional | Optional | Optional | Optional |

| Water Damage & Sewer Backup | Optional | Optional | Optional | Optional |

| Earthquake | Optional | Optional | Optional | Optional |

Metro Vancouver

Real Estate Insight and Forecast

2. Different Types of Coverage

Before we dive into the details, it’s important to understand that most insurers have tiered coverage. For illustrative purposes, we will call them standard, premium, and premium plus. The challenge with this pricing model is, that if you want coverage for jewellery above $10,000 then you may have to buy the premium package, but the premium package also covers fur coats, golf clubs, and two bicycles which you don’t need. So essentially, you’re paying to insure a lot of things that you don’t have or don’t want to insure.

There is only one insurance company, that we know of, that allows “made-to-measure” insurance coverage. More on this later.

Fire & Smoke

Coverage for your home and personal belongings in case they are damaged or destroyed in a fire. If you are a renter or live in a condo then this only covers your belongings. The landlord or strata have coverage for the building.

Severe Weather & Flooding

With climate change, weather events are becoming more frequent and severe. This covers damage from wind storms and floods. Keep in mind there are restrictions on flood coverage, particularly if your home is near a river flood plain.

Strata Coverage

Protection to offset costs assessed to you by your strata corporation for the cost of strata deductibles, or repairs to the building and common property.

Building Improvements

Protects renovations and improvements you’ve made to your home, like custom cabinets and countertops.

Crime & Vandalism

Coverage for your personal belongings if they are lost, damaged, or stolen. This coverage is in effect even if the item was not inside the home when it was stolen or damaged.

Personal & Premises Liability

Personal liability provides coverage for injury to someone visiting your home, and accidental damage you may cause to someone else’s property anywhere in the world. Keep this in mind if you’re at a store and accidentally break a high-value item.

Water Damage

If a pipe bursts or your washing machine leaks all over your hardwood floors, this coverage will save your skin.

Speciality Items

Protection for items like jewellery, watches, bikes, computers and cameras. Some items are subject to value limits, so you have to pay close attention to these. You don’t want to settle for $500 coverage for bicycles when you have a $1,000 bike. Making a claim on these items may also require a receipt or an appraisal.

Additional Living Expenses

If an event related to a claim requires you to move out of your home this covers the extra living expenses.

Earthquake

This is most relevant to British Columbia with over 1,200 mini-quakes every year. Regular insurance doesn’t cover your home and belongings in the event of an earthquake.

Identify Theft

Identity theft occurs when someone obtains key information or identification like social insurance or driver's license numbers, in order to impersonate you to cause you financial harm. For example, they may try to steal your savings, use credit cards in your name, or apply for a mortgage on your home.

Rental Income

Protects lost rental income lost if all or part of the home is uninhabitable due to damage from an insured loss.

Our platform matches you with local, pre-screened, values-aligned Realtors and Mortgage Brokers because shared values make better working relationships

3. Two innovative trends in insurance

Customized Insurance

As mentioned earlier, there is only one insurance company, SquareOne, that allows “made-to-measure” insurance coverage. They are a fully online insurer based in Vancouver, BC that is growing dramatically and has recently expanded into the U.S.

To get a customized quote click the button below:

Value-added Services

Some insurers are trying to differentiate themselves by offering related extra services alongside insurance. In some cases, paying for these services reduce the price of your insurance policy.

Home security – Remote monitoring services

Emergency support – Automatic gas shutoffs during a fire, smoke, or water leakage

Comfort – Remote home control and assistance

Senior citizen support – Special caregivers, meal delivery discounts, and emergency support

4. Canadian Customer Satisfaction

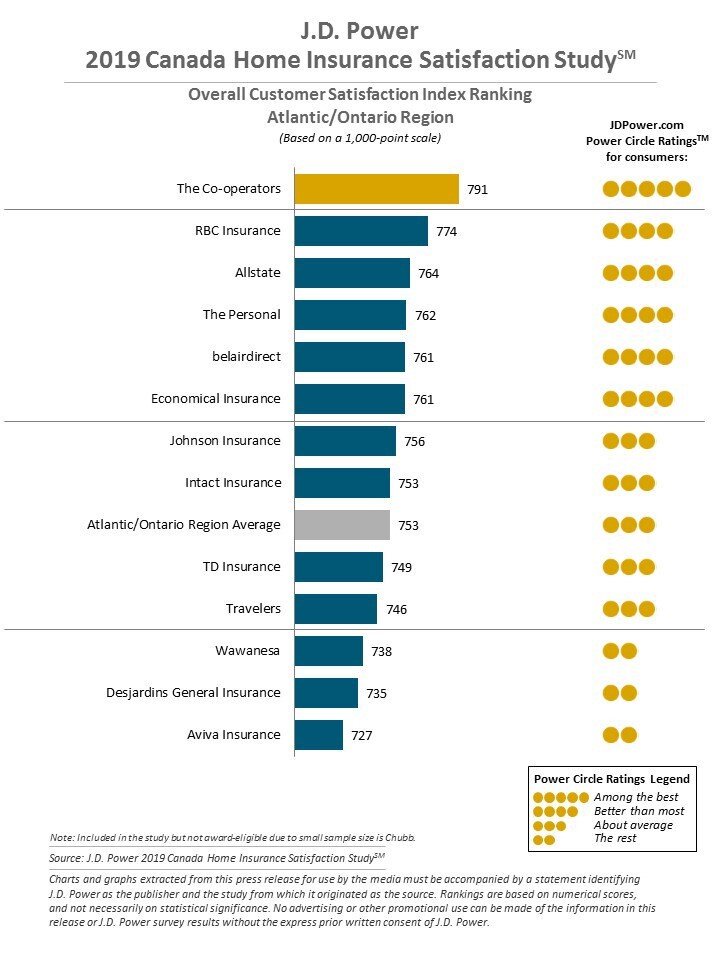

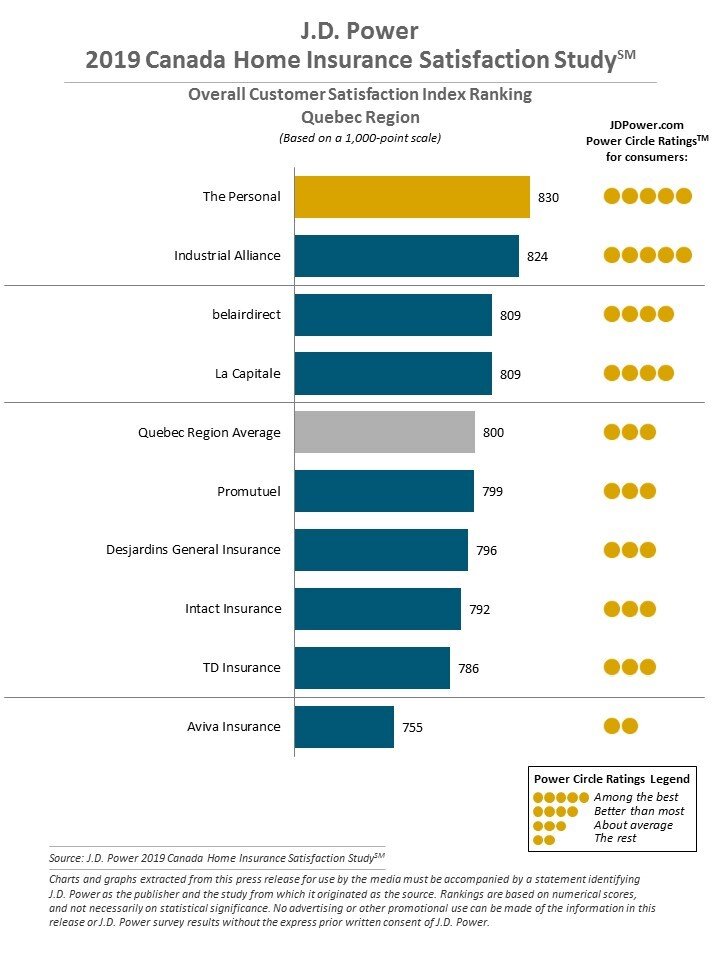

Every year, J.D. Power conducts a survey of large home insurance companies in Canada. The Canadian results are below and you can see other regions in the full report.

Some key findings from the survey are:

More than 50% of Canadians feel their insurance provider failed to provide satisfactory pricing, coverage, and service.

The insurers ranked most highly by customers had strong mobile apps and easy to use websites.

Toronto

Real Estate Forecast and Insights

Conclusion

In summary, it is critical to get the correct type of insurance for your living arrangements and understand the breadth of your insurance coverage. Don’t simply choose the cheapest coverage and risk a financial blow-up if something catastrophic happens to your home.

Like this post? Like us on Facebook for the next one in your feed.