Surrey Real Estate Update

Metro Vancouver House and Condo apartment prices both dropped in July but that’s predominantly the influence of the City of Vancouver.

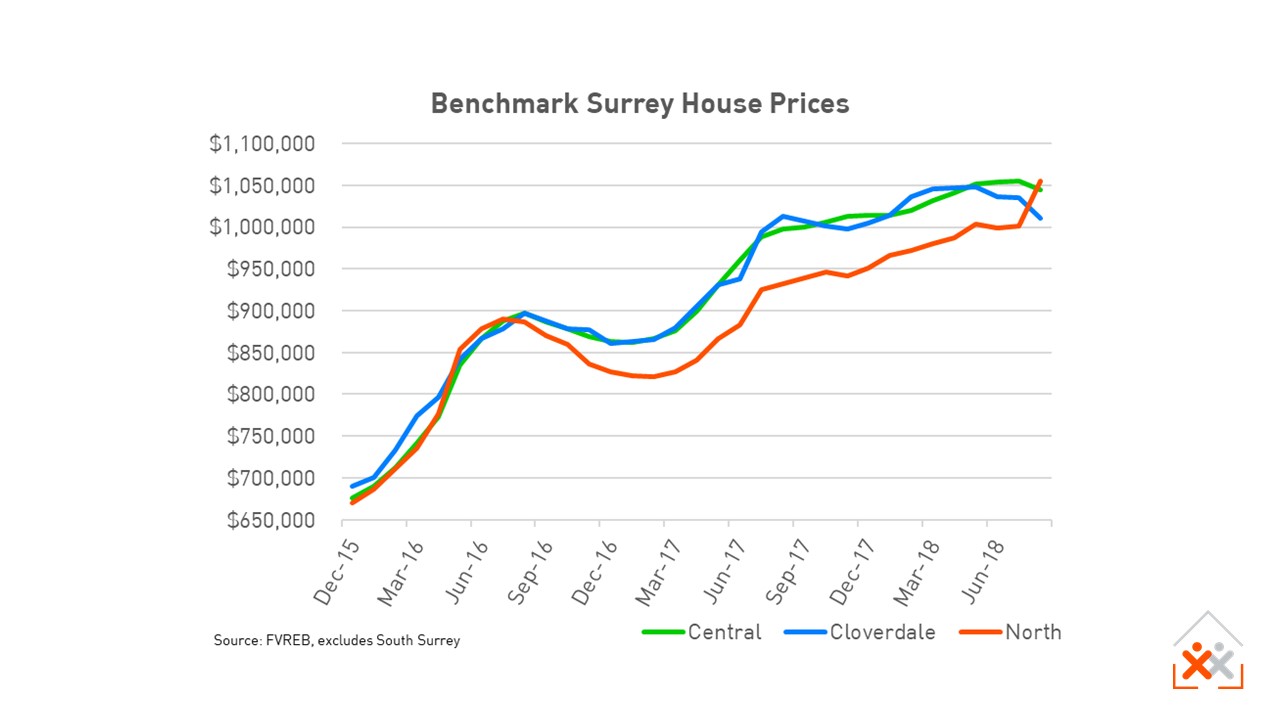

Surrey home prices are still rising steadily, but can they continue at this pace? Will people lose interest in buying real estate if it only appreciates by 1-3% annually?

In Surrey, condos are king

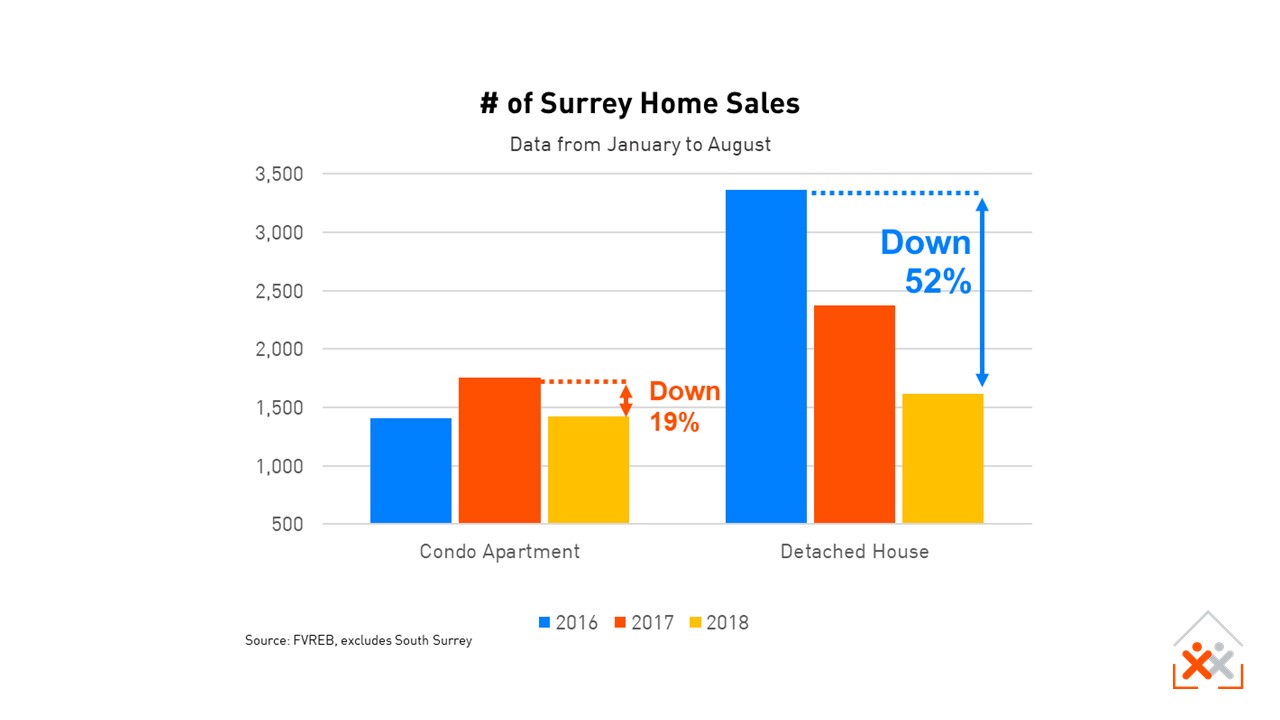

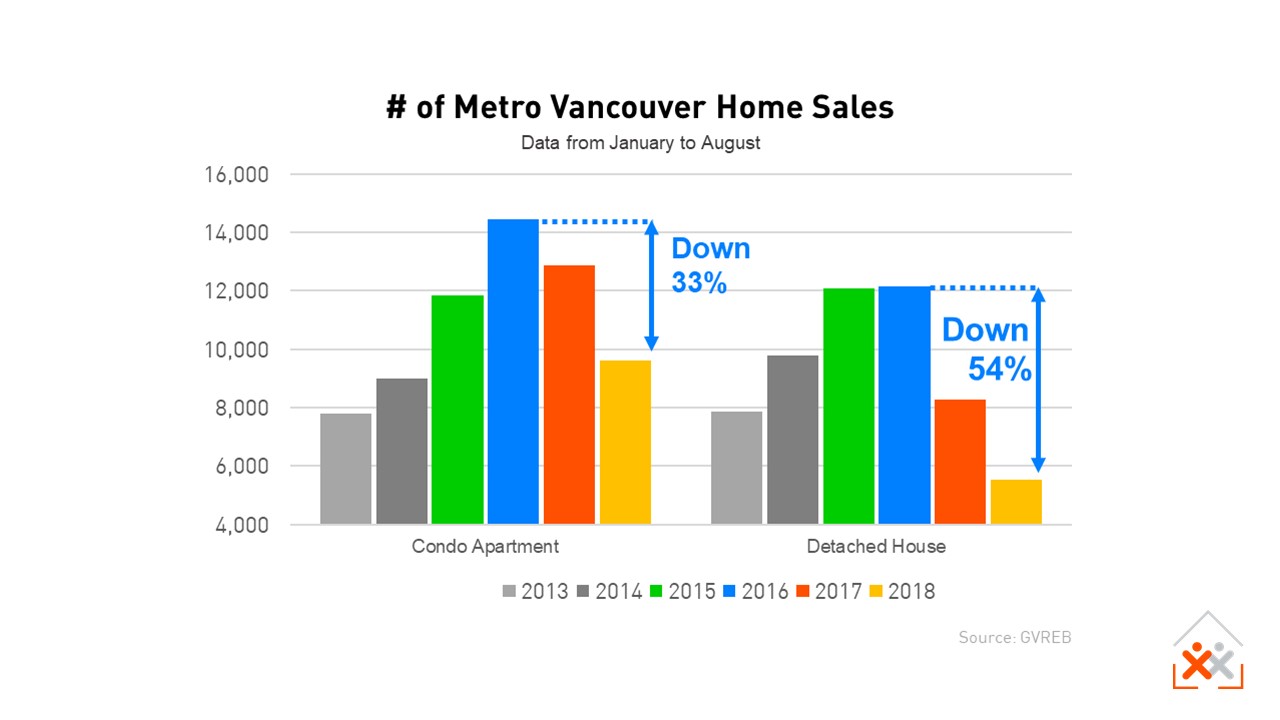

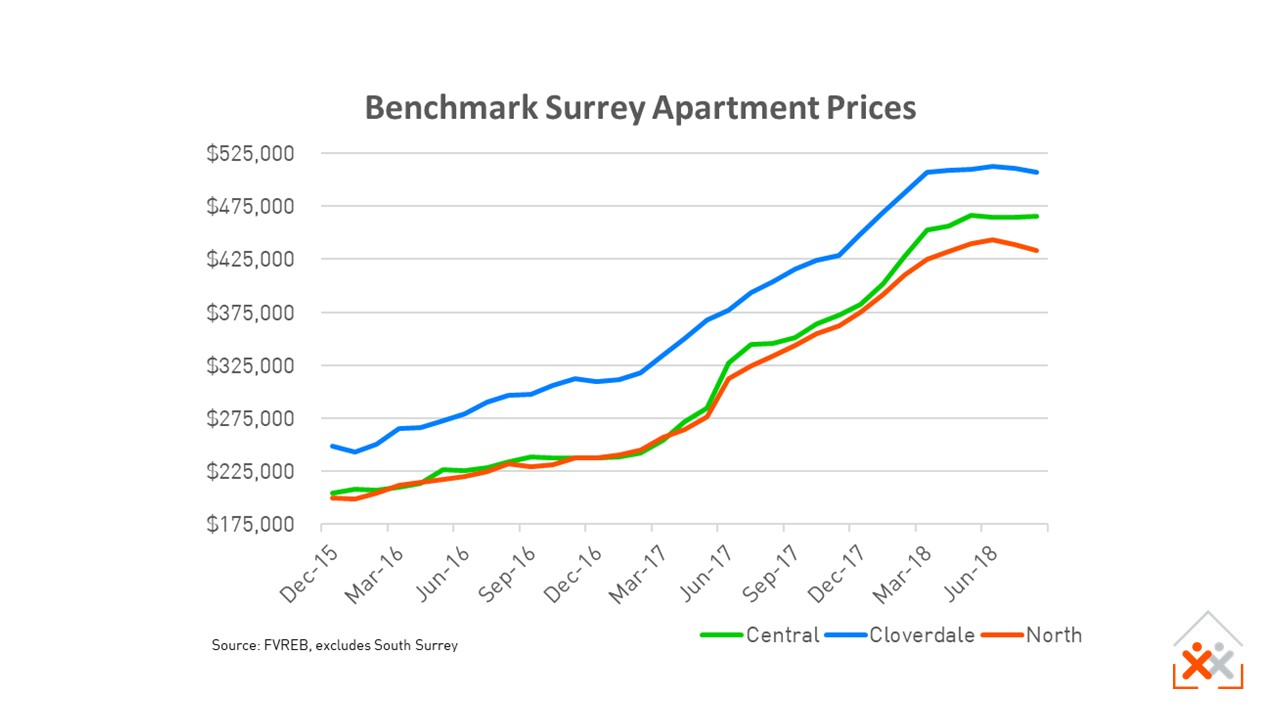

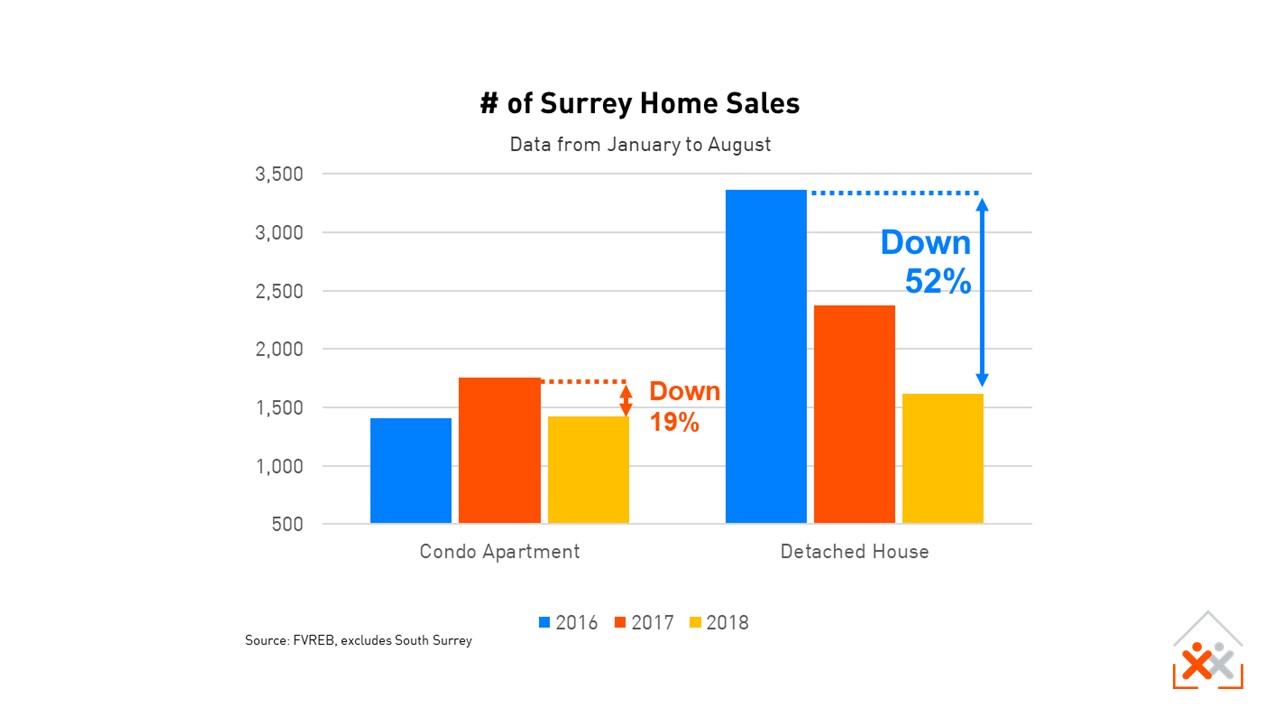

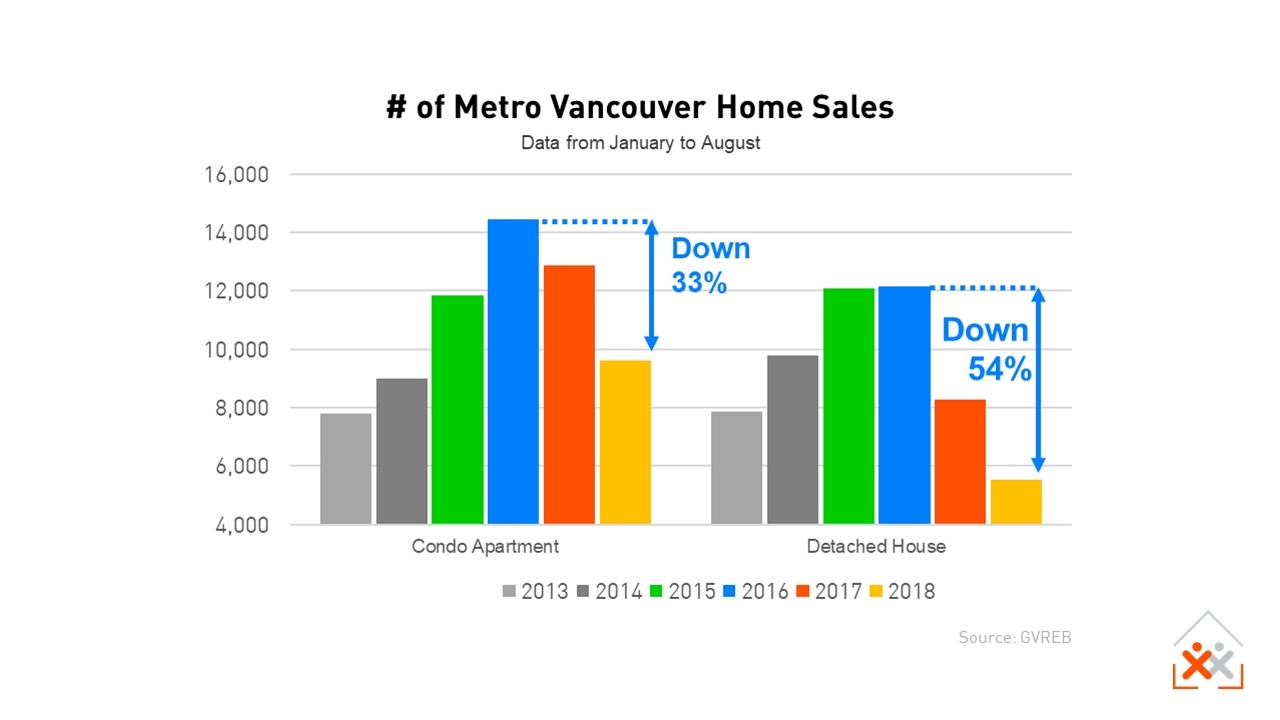

In Surrey, Condo sales are down 19% from 2017, but still higher than 2016. In contrast, broader Metro Vancouver condo sales are down a whopping 33%. Surrey condo prices did drop in July and August but there isn't a clear downward price trend yet. At a benchmark price of $800,000, the market for downtown Vancouver condos has weakened significantly while East Vancouver condo prices have barely registered a price drop to $550,000. In perspective, East Vancouver condos are more comparable to Cloverdale where a condo costs close to $510,000. So a further weakening in the East Vancouver condo market could have a knock on impact to Surrey condo prices. After all, why would an investor buy a condo rental for $510,000 in Cloverdale if one were available in East Vancouver for $500,000? Even with more condos coming to market in Surrey, currently sellers still have the upper hand. There are only enough condos available for sale to last about 3 months at the current rate of sales.

Surrey houses look poised for a drop

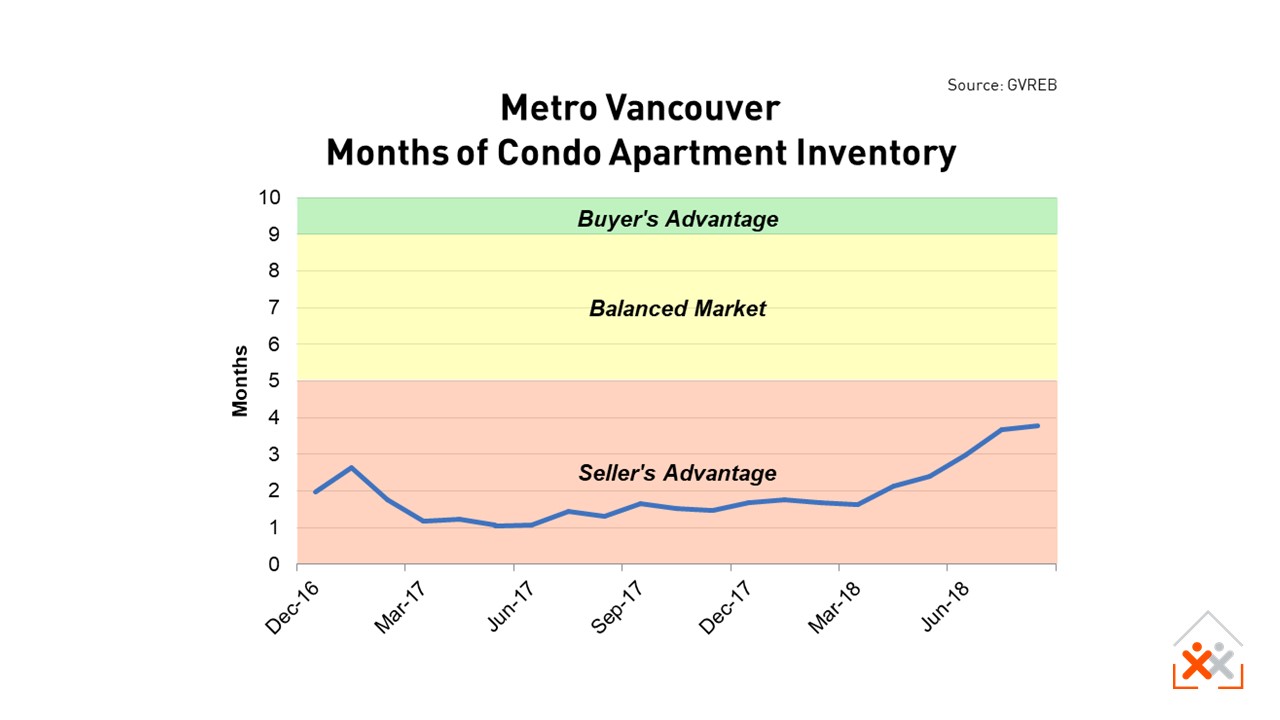

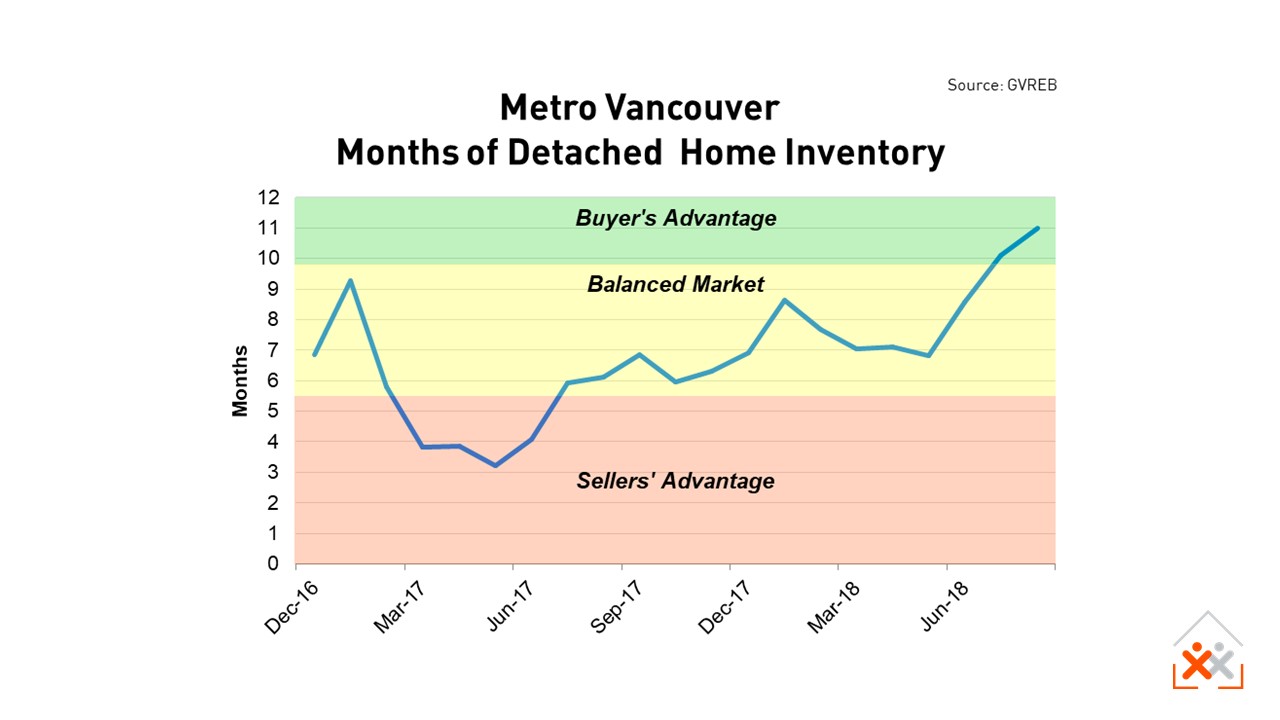

Cloverdale house prices have dropped recently while Central Surrey and North Surrey have held steady. In comparison, City of Vancouver prices have been dropping. Is it reasonable for a house in Central Surrey to command $1 million when an East Vancouver home can be had for $1.5 million, or a home in East Burnaby for $1.3 million? East Vancouver home prices peaked in November 2017 and if they were to continue dropping then they would put downward pressure on Burnaby prices, and Surrey home prices would likely follow. Price trends aside, Surrey has seen a 52% drop in house burchases since 2016! In 2016, a benchmark Surrey house could be bought for $900,000, but ever since prices broke the $1 million sales have dropped (see chart). This could be explained by federal government policies that make it harder to finance homes valued over $1 million. With almost 7 months of inventory for sale, the Surrey house market is squarely in a balanced market territory and trending quickly toward a buyer’s advantage. If this trend continues, it is possible that by December buyers will be in a position to negotiate prices down and ask for concessions.

Buyer vs. Seller’s Advantage

In the real estate industry, there are metrics used to indicate when buyers and sellers have more negotiating power. As a rule-of-thumb, less than 5 months of inventory (i.e., homes for sale) means it is a “Sellers Market” and the seller has the upper hand in a price negotiation. When there’s more than 9 months of inventory for sale, it’s a “Buyers Market” and buyers have more negotiating power. The theory is that buyers know that it could take over 9 months to sell the home, so the seller should probably drop the price to make sure the buyer in front of them purchases the home, or they could potentially be having open houses for 9 more months.

Conclusion

There is still a lot of uncertainty in real estate these days. The markets for both houses and condos in Metro Vancouver are trending toward a position where buyers can ask more from sellers, and this is true for Surrey as well. If you are going to try to time the market, then this is a time for sellers to pull the trigger before conditions soften further. For buyers, it seems prudent to wait and see.

If your family is growing and you need a larger space or simply a place to call your own, or you believe timing the market is pointless, then take advantage of these tips to reduce your risk.