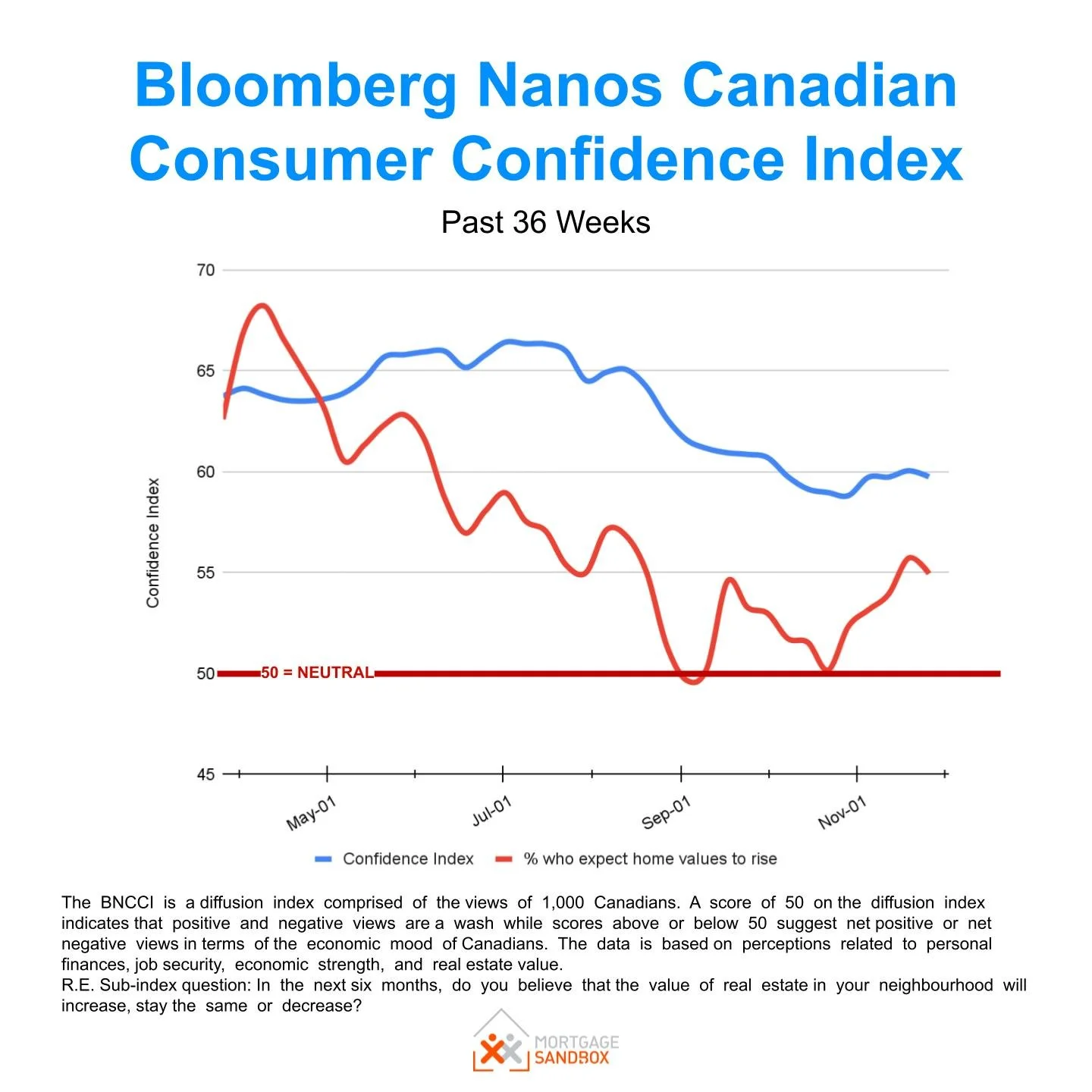

Less than 20% of Canadians believe home prices will be higher in 6 months. Find out the key reasons why Canadians have lost confidence in what they used to believe was the “safest investment” available.

All in Homebuying

When will Baby Boomers Downsize

Many Baby Boomers might choose to sell in 2023. Here are five key drivers of boomers’ decision to downsize and potentially add a lot of housing supply to the market.

Why are home prices in Hamilton falling?

We've seen a lot of changes in the Hamilton housing market over the last few years. The impact of the pandemic-induced low interest rates pushed demand through the roof. Now, a near tripling of mortgage rates has contributed to falling home prices.

Canadian Boomers are Quitting the Workforce

As far back as 2008, CNN reported on the expected effects of Baby Boomers (the largest generational cohort) retiring from the workforce. The pandemic has accelerated the process.

Confidence in Real Estate Shattered

Canadian consumer confidence is negative and has not started to improve yet.

U.S. Fed poised to raise rates in 2022

Higher U.S. interest rates will pressure Canada to match or devalue the Canadian dollar

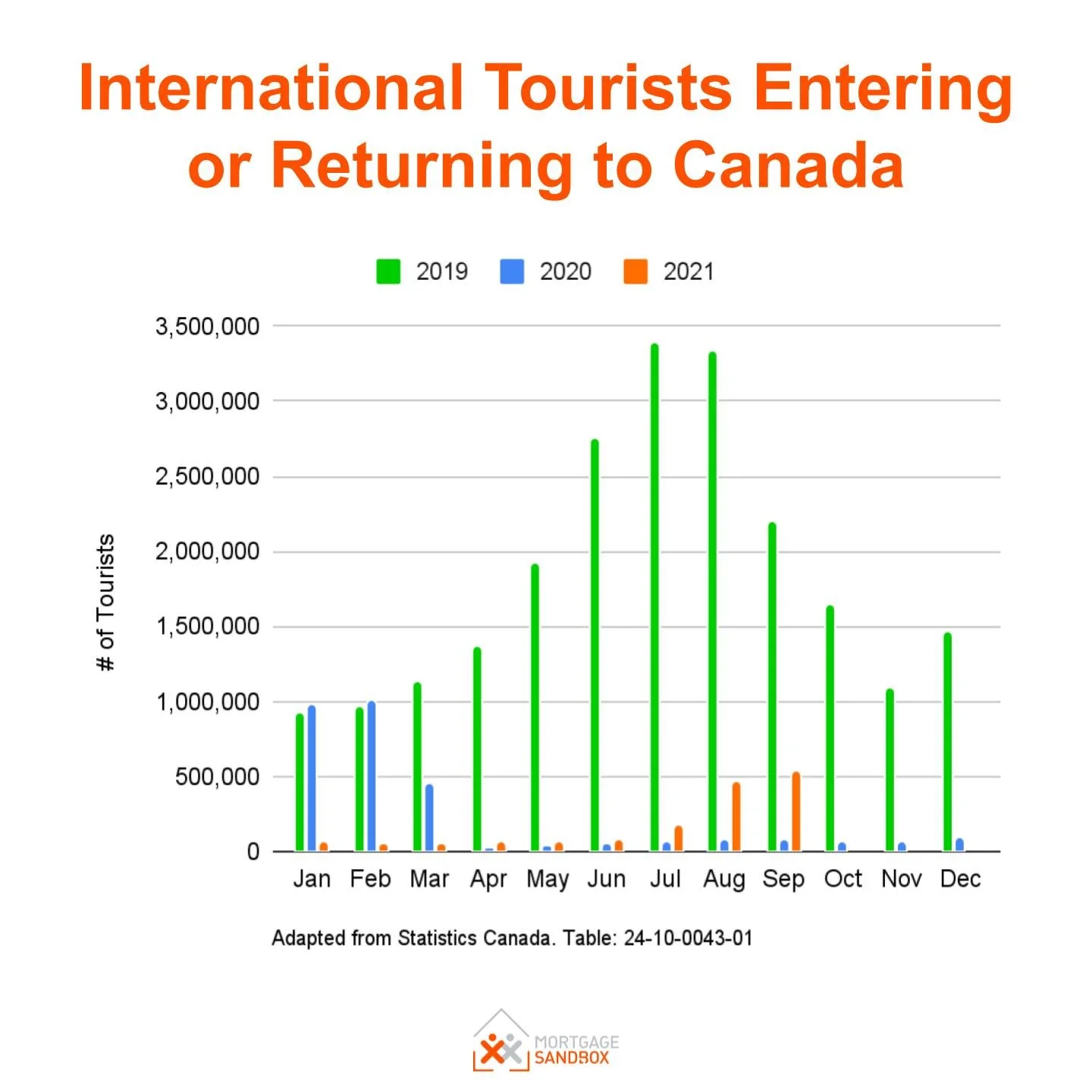

Airbnb Empires Postponed

Tourism was recovering a little, but Omicron has scuppered any ambitious plans.

From Euphoria to Normal

Canadian Confidence is Trending Lower