Will mortgage rates go down in Canada?

HIGHLIGHTS

With the second wave of infection underway, unemployment still high, and many parts of the economy locked-down, The Bank of Canada has committed to keeping key rates low for the foreseeable future.

The Bank of Canada (BoC) target rate is at its "lower bound," so Canadians shouldn't expect further rate drops. The BoC target rate is linked to variable mortgage rates so that variable mortgage rates will remain low too.

Every Economist surveyed expects the Bank of Canada (BoC) will keep its Target Rate at the “effective lower bound” of 0.25% until 2023. The Bank of Canada has said that it will hold the policy interest rate at 0.25% until the economy recovers, the labour market tightens, and inflation reaches a consistent 2 percent.

While low rates are helpful for borrowers, the expectation of prolonged lower interest rates indicates that the economy will likely not recover until 2023.

If an effective vaccine is quickly made available on a large scale, the economic outlook would improve markedly and upward pressure on interest rates would increase. ~ TD Bank, Nov 12th, 2020

Since Coronavirus has caused such a sharp economic contraction, as soon as the pandemic clears, we expect a strong economic bounce back. In other words, the economy will have shrunk so much that it will be easy to improve on the dismal past performance.

For homebuyers with stable employment, the low rate environment combined with less competition from other buyers will create a very favourable home buying environment.

This article will explain the forecasts for variable (floating) rates and 5-year fixed (locked-in) rates. Keep reading to learn what the big banks are saying about rates.

THE CURRENT SITUATION

A Weak Economy

Canada is now in a recession. Recently, most reports have been adjusting expectations downward as a result of a wave 2 of infections. In other words, past predictions underestimated the economic impact of prolonged Coronavirus containment efforts.

The Bank of Canada has said that it will hold the policy interest rate at 0.25% until the economy recovers, the labour market tightens, and inflation reaches a consistent 2 percent. Inflation has never consistently reached 2% since the 2008 financial crisis.

Canada has begun the battle against the second wave. Europe began this battle before Canada and it has resulted in restrictions on bars and restaurants, localized and national lockdowns, and curfews. Canada should expect similar measures and another hit to economic growth.

Overall, a hyperactive virus warrants extreme and ongoing vigilance, slowing the transition “back the normal.” ~National Bank of Canada, November 2020

In May 2020, Dr. Anthony Fauci, director of the U.S. National Institute of Allergy and Infectious Diseases said the second wave of coronavirus infections was "inevitable" but very few people chose to believe what he was saying.

They are likely still underestimating the duration. Most forecasts still assume two waves of infection even though we know that a vaccine likely won’t be widely available until the Summer of 2021.

A study headed by Dr. Kristine A. Moore, the medical director at the University of Minnesota Center for Infectious Disease Research and Policy, also warns that the pandemic will not be over soon and that people need to prepare for possible periodic resurgences of disease.

When will the COVID-19 Pandemic end?

Canada has not yet flattened the curve on wave 2 and we should probably be preparing ourselves mentally for wave 3 in the Spring.

There is now promising news about two vaccine candidates from Pfizer and Moderna. After initial emergency authorization, the government will likely prioritize vaccination for front-line health care workers, essential workers, and public safety officials. As well, immunocompromised individuals and residents of nursing homes.

Vulnerable Canadians will be vaccinated next – more than 25% of Canada’s population (almost 10 million people) is considered at higher risk. Since Canada will be sharing the vaccine with other countries, it will likely take 6 to 9 months to vaccinate vulnerable Canadians and reach the ‘new normal.’ Optimistically, the pandemic will end sometime between June and September 2021.

Canadian Economic Vulnerability

Even before we entered the Coronavirus Recession, the Bank of Canada list of top economic vulnerabilities included high Canadian household debt and concern that house prices had become detached from economic fundamentals. For more on this, we recommend you review this comprehensive report that explains the current level of risk in the Canadian real estate market.

“[R]ising COVID-19 case rates pose risks to the scale of subsequent improvements. These are already leading more provinces, states and local jurisdictions to pause or reverse their reopening plans, compounding the detrimental influence on business and consumer confidence.” ~ BMO Nov 11, 2020

Will low mortgage rates fire-up home prices?

Some real estate industry pundits believe lower interest rates and constrained supply may boost home prices. This might be true if low rates were not a response to heavy job losses and pay-cuts.

According to MNP, half (47%) of Canadians now say they are $200 or less away from insolvency, a four-point increase from the last wave.

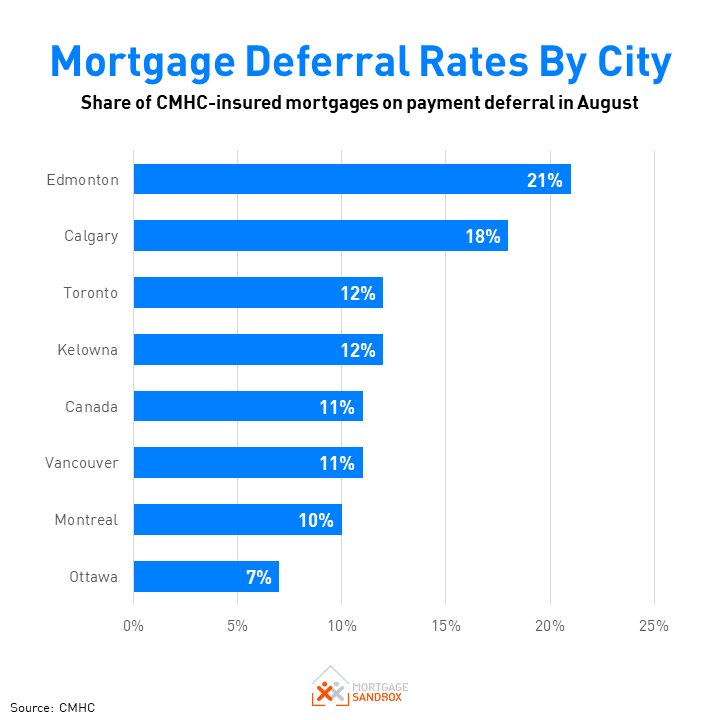

Most mortgage deferrals expired in October. Unless those borrowers have found new work, they will use up their savings, and then they will be forced to sell their home in the following three to six months.

All of the other factors at play will outweigh the effect of lower mortgage rates. For more detail on the key drivers of home prices, Mortgage Sandbox provides an analysis of the five factors driving home prices in Ontario, British Columbia, and Alberta.

WHAT’S NEXT?

Interest Rates Will Not Rise Any Time Soon

The Bank Rate is well below what would be considered a ‘normal’ range. According to the Bank of Canada, "Governing Council continues to judge that the policy interest rate will need to rise over time into a neutral range to achieve the inflation target." This policy implies that once Canada emerges from a recession, rates will begin to rise.

Variable and adjustable mortgage rates are directly linked to the Bank Rate (the rate at which banks can borrow from the Bank of Canada). If the Bank Rate rises, then prime rates offered by Canadian banks rise, as do variable mortgage rates.

THE BANK RATE FORECAST TO 2023

A deep recession is inevitable. With that in mind, Canadian prime rates used to calculate variable and adjustable mortgage rates will remain low between now and the end of 2022.

Generally, we recommend a variable rate mortgage when rates are flat or falling. If the risk of rates rising worries you, then you should consider a fixed-rate mortgage.

5-YEAR GOVERNMENT BOND RATES TO 2022

The average Canadian Bank economist predicts 5-year rates will begin to rise. While they may be rising, they will remain relatively low when compared to the past 10 years.

Rates are expected to rise because The Bank of Canada announced it would stop buying Canadian Mortgage Bonds after October 26, 2020. It began buying mortgages from banks back in March 2020 because private investors were refusing to purchase them at the low rates on offer at the time.

Now that private institutional investors are buying the bonds, the BoC feels it no longer has to intervene in markets to hold down mortgage rates.

Bond yields (i.e., rates) started to drift higher as soon as the BoC announced the end of the mortgage bond-buying program on October.

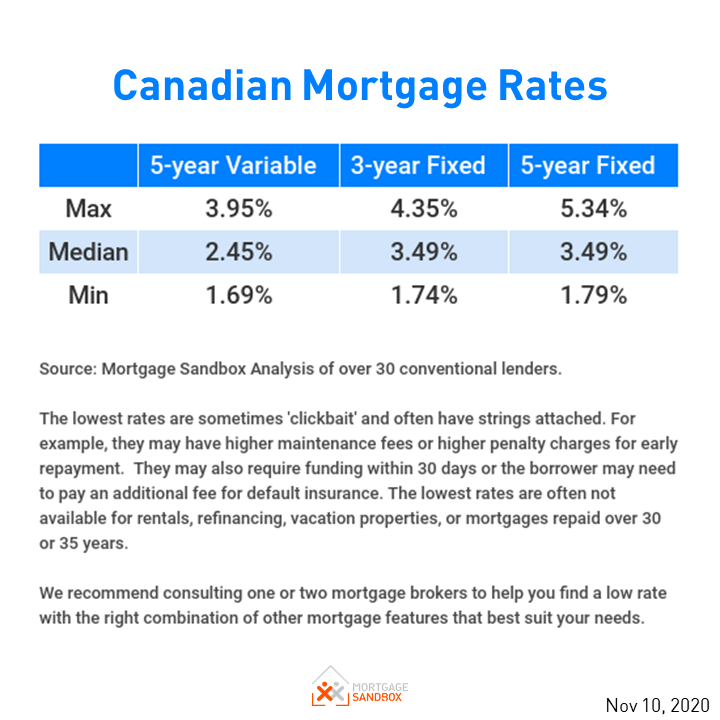

Five-year fixed rates are expected to rise between a half and three-quarters of a percent by the end of 2022.

MORTGAGE RATE OUTLOOK

Fixed-rates are currently setting record lows. In 6 months, fixed rates will probably be the same or slightly higher than today. Locking in today's 2.00% 5-year fixed mortgage rate will only start benefiting you financially if variable rates begin to climb. At the moment, that seems unlikely to happen until 2023.

Although locking in your rate today isn’t a huge financial gain, it does provide peace of mind.

If the risk of rates rising worries you, then you should consider a fixed-rate mortgage rate term.

If you are planning to sell or move in the next few years, however, locking in a fixed rate can result in a significant penalty fee if you cancel the mortgage before completion of the full term.

Our advice is to speak to a Mortgage Broker as early as possible to lock in a rate. You can lock in your mortgage rate up to 120 days before closing on a home purchase or the renewal of your mortgage.

Here’s our mortgage renewal guide that will help you navigate the process.

HOUSING MARKET IMPLICATIONS

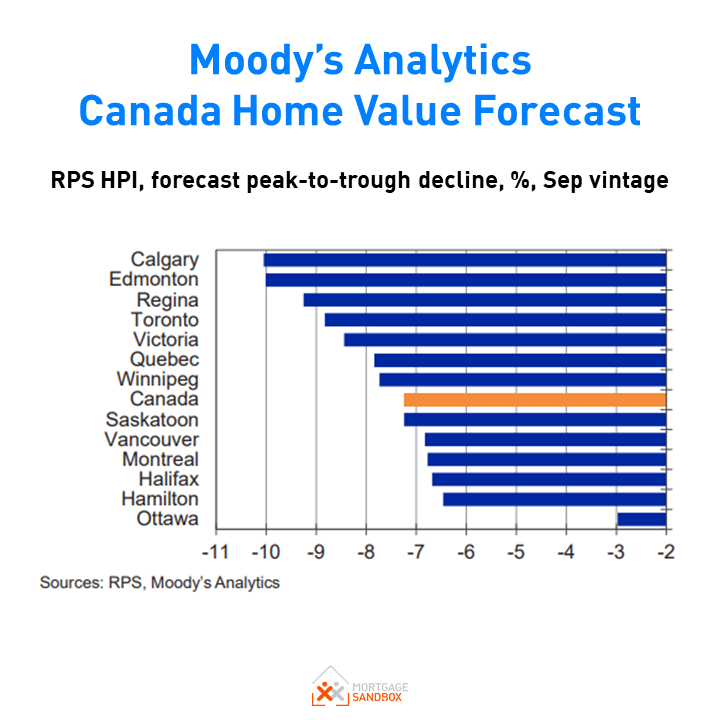

On balance, there are more economic factors putting downward pressure on home prices than upward pressure, but that was also the case in the summer of 2020 when buyer sentiment carried prices higher.

The link between home prices and economics seems to have weakened. If we believe that home prices are related to the strength of the economy then prices may have peaked for this economic real estate cycle.

If we believe that interest rates are the primary driver of home prices, then the forecasted rise in rates would also indicate prices will moderate in 2021.

Population growth is also expected to remain below average in 2021.

Homebuyer Advice

If you plan to buy in the next three years, be mindful that prices will likely fall in the short-run, so a ‘wait-and-see’ approach may be best. The Coronavirus Recession will lead to job losses and distressed sellers (e.g., laid off, divorce, empty AirBnBs, bankruptcy), which will likely put downward pressure on home prices. For buyers who are still employed, low rates will provide more purchasing power in a falling market, and that is a gift to home buyers.

Home Seller Advice

If you were planning to sell, then it may be worthwhile selling sooner than later. If we use the Great Recession as a guide, it could take between two and ten years for home prices to recapture current highs.

Like this post? Like us on Facebook for the next one in your feed.