Will Canadian house prices go down in 2023

The Canadian housing market has been one of the most stable and lucrative investment opportunities for many years. However, as we look towards 2023, there is a growing concern that house prices in Canada may experience a significant downturn. Some people believe the 2022 price peak was a Canadian housing bubble that has just begun to burst.

Several factors could lead to a significant drop in Canadian house prices in 2023, including:

Increased borrowing costs.

The Bank of Canada's reluctance to lower rates until inflation has been stabilized below 2 per cent.

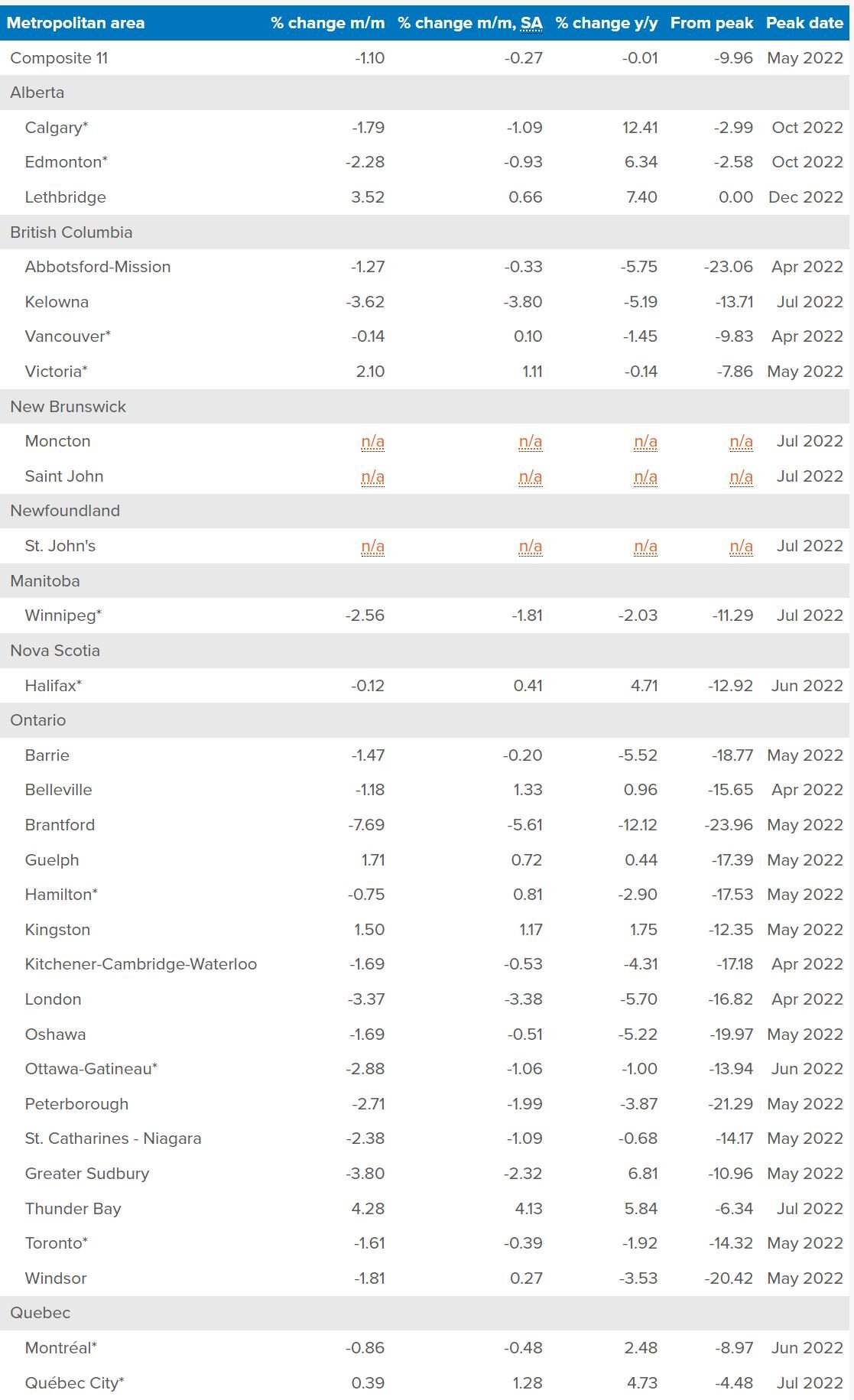

The current price trends which already show a 10-20% drop in prices from the peak.

Borrowing costs have doubled over the past year!

One of the main drivers of the hot housing market was super-low mortgage rates. Rates were dropped to record lows to cushion Canadians against the impact of the pandemic-induced recession. Low rates were not part of a housing policy decision.

Over the past year, now the pandemic is over, borrowing costs have doubled.

When mortgage rates were close to 2 per cent, a Canadian comfortable with a $2,500 monthly mortgage payment could borrow $590,000 toward a home purchase. Now mortgage rates are nearly 5 per cent, so with the same monthly payment, they can only borrow $430,000.

If we assume they have a $50,000 down payment saved up, then their home-buying budget dropped from $640,000 to $480,000 over the past year. That’s a 25 per cent drop in home-buying budget.

As borrowing costs increase, the affordability of housing at current prices decreases. When people cannot afford to buy homes, the demand for housing decreases, leading to a decline in house prices. This is a key reason why Canadian house prices are expected to decrease in 2023.

The Bank of Canada is unlikely to lower rates until 2024

The Bank of Canada has indicated that it is unlikely to lower rates until 2024. This means that borrowing costs will likely remain high for the foreseeable future.

The Bank of Canada is reluctant to lower rates due to concerns over inflation. High inflation makes everyday items like food, fuel for your car, and household heating more expensive. While house prices are a concern, they are a lesser concern than making sure every Canadian house food and heating.

Inflation is currently running above the Bank of Canada's target of 2%, and the Bank of Canada is concerned that lowering rates too early could lead to further inflation. As a result, the Bank of Canada is likely to keep rates high, making it more difficult for Canadians to secure mortgages.

The Bank of Canada forecasts inflation to slow to about 3 per cent by the middle of 2023, from 6.3% in December 2022, and reach the 2 per cent target in 2024. Once it reaches the target, the bank will want to be sure inflation has stabilized before lowering rates.

Bank of Canada Governor Tiff Macklem said that the economy remains overheated and continued to leave the door open to higher interest rates. Macklem also reiterated the bank's policy stance in opening remarks to the House of Commons finance committee https://t.co/5zJNWLt0XG pic.twitter.com/wE3VDHqXUa

— Reuters (@Reuters) February 16, 2023

Prices have already dropped 10 to 20 per cent from the peak

Prices are already falling, put to 20 per cent in many markets, and the trend has not broken.

There are very few fundamental factors at play that can help break that trend except for population growth. However, new arrivals in Canada are still having to borrow at current mortgage rates, and most will need time to save a down payment to purchase in Canada.

Canadian Real Estate Consumer Confidence, Nanos-Bloomberg

Since prices have fallen, many Canadians have begun to second-guess real estate as a low-risk and low-volatility investment. Fewer than 1 in five Canadians believe house prices will increase in six months.

A correction in the housing market is a natural part of the market cycle. After years of steady growth, a correction is needed to bring prices back to a more sustainable level. While a correction can be painful for homeowners and investors, it is a necessary part of the market cycle.

By most definitions, a correction greater than 20% is a bubble bursting. While it is near impossible to predict the market, it seems irresponsible for industry leaders to deny the risks.

Toronto Real Estate Bubble? Try Affordability Crisis: RE/MAX Executive

The trouble with ‘bubble’: Why Canada’s red-hot housing market is defying the burst : Globe and Mail

It seems likely prices will continue to drop in 2023

Given the factors outlined above, it seems likely that Canadian house prices will continue to drop in 2023. While no one can predict exactly how much prices will drop, it is clear that the market is in a state of correction. Borrowing costs will likely remain high until 2024. This will lead to a decrease in demand for housing, which will put further downward pressure on house prices.

Conclusion

The Canadian housing market has been one of the upwardly volatile and lucrative investment opportunities for many years. It seems it was only a matter of time until the volatility snapped back with a correction. As we look towards 2023, there is a growing concern that house prices in Canada may experience a continued downturn.

It’s not all doom and gloom. Even a pull back of 30% would leave most prices above pre-pandemic levels.

While a decrease in house prices may be painful for homeowners and investors, it is a necessary part of the market cycle. A correction in the housing market is needed to bring prices back to a more sustainable level.

As we look towards 2023, it is vital for Canadians to be aware of the potential risks and to take steps to protect themselves and their investments. This may include being cautious about taking on too much debt, refinancing their mortgages to lower their monthly payments, and seeking professional advice. By being proactive and informed, Canadians can navigate the challenging housing market and emerge stronger in the years to come.