What is Foreclosure and how can you avoid it in Canada?

Foreclosure evokes fear because it leads to homeowners potentially losing their home as a result of missing their regular mortgage payments. The process is notoriously nasty and sadly, many Canadians each year lose their homes.

Foreclosure is primarily caused by homeowners taking on a mortgage that is far larger than they can handle. This is often because homeowners want to purchase the entire home (and all the titles). Considering the enormous cost of a home, taking a mortgage is commonplace. However, when homebuyers bite off more mortgage than they can chew it puts them on the route towards foreclosure.

Why is the Risk of Foreclosure Growing?

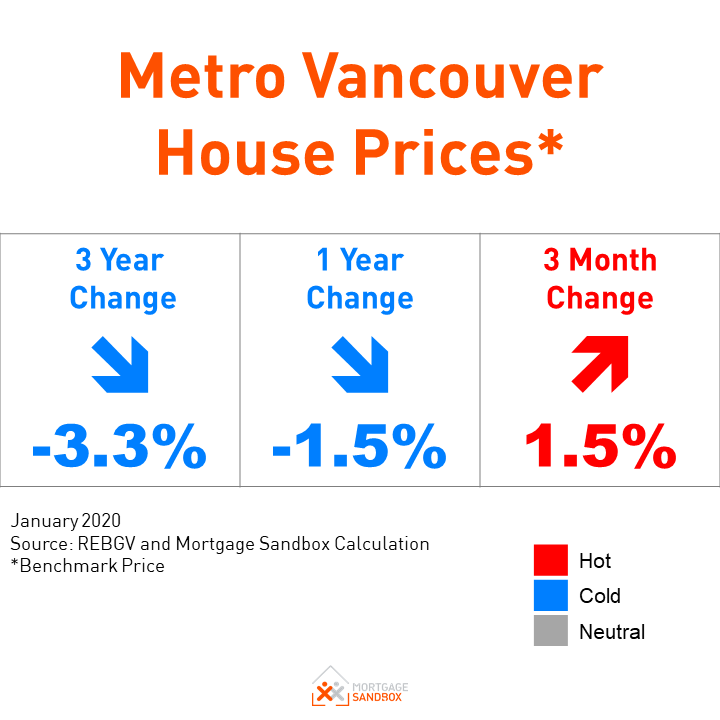

As household debt in Canada continues to grow, homeowners are finding it increasingly difficult to pay all of their monthly bills, including their mortgages. Interest rates have remained near historic lows, so people can afford to borrow more, and house values are growing, so people need to borrow more. These factors mean that our country’s level of household debt keeps climbing. As interest rates rise, higher levels of debt for the average homeowner result in higher chances of them defaulting on mortgage payments. A recent survey by MNP found that 50 per cent of Canadians are $200 away from insolvency.

Lenders Exhaust All Options Before Resorting to Foreclosure

There’s no hiding the fact that foreclosure is an unpleasant process for everyone involved and for the people around them. The stress of losing your home is hard to imagine and the pain extends beyond the homeowner to the lender as well.

While the homeowner faces the emotional, reputational, and financial “gut punch” of losing their home, the lender must go through the painstaking documentation, legal processes, and expenses associated with trying to retake ownership of the property. The lender employees face the demotivating and difficult task of supporting the lawyers the mortgage repayment history and mortgage documentation which is especially difficult in small towns and close-knit neighbourhoods where they are likely to share personal connections to the troubled borrower. The process takes a long time and wears out all parties involved. Since it is a difficult and costly process, lenders will exhaust all the other ways of solving the problem before undertaking foreclosure.

Foreclosure Does Not Always Equal Loss of a Home

If you're a property owner, it's essential for you to understand what the foreclosure procedure includes and how to protect yourself. It's normal to feel that foreclosure implies you have no way to protect your home, yet that is usually not the case.

There are several key factors that come into play when you’re faced with foreclosure:

Your unique personal financial situation

Your willingness to work with the lender to seek a solution (e.g., refinance the mortgage with lower monthly payments over a longer mortgage lifespan)

Whether or not you choose to fight against foreclosure to keep your home

If a borrower in default chooses to ignore their lender and fails to take any corrective action, then they can expect a judge will side with the lender, and they will likely need to deal with the foreclosure process and lose their home.

Mortgage Renewal? Find a mortgage broker who shares your priorities and specializes in your local area.

When is the Foreclosure Process Used in Canada?

Missing one mortgage payment is bad, but it won't put you at risk of foreclosure. With most lenders, you need to miss two or three payments before the lender begins the foreclosure process.

As a homeowner, your best option is to contact your bank immediately after missing a mortgage payment to clarify why it was missed, how you will make-up the payment, and when the payments will be brought up to date. Your loan specialist is always willing to take a late payment, work with you to remedy the situation, and get your payment plan back on track. Lenders want to avoid mortgage defaults and the foreclosure process.

If the missed payments are clearly because of temporary money-related issues, you may have the option to negotiate to miss a payment or two until you get back on track.

Having said that, if you regularly miss your mortgage payments, your lender may begin proceedings to claim ownership of your home. To kick-off the process, the bank needs to send you a letter to formally notify you that the foreclosure procedure has begun soon.

How does Mortgage Debt Recovery Vary by Province?

To recover a loan, lenders can sell your home in every Canadian province but the process can differ slightly from one province to the next. There are two primary means for debt recovery:

Power of Sale

Foreclosure

In Power of Sale, the lender forces the sale of your property whereas with Foreclosure the lender becomes the owner of the property. This may sound like the same thing but in a power of sale, the homeowner gets the remaining equity in the property after the mortgage, interest, and legal fees are paid. With foreclosure, the lender takes ownership of the property and the former homeowner gets nothing. The power of sale process takes around 6 months and a foreclosure can take over a year

1. Power of Sale (ON, NL, NB, P.E.I.)

In Ontario, Newfoundland, New Brunswick, and PEI, lenders can obtain court approval for a Power of Sale route instead of Foreclosing. It’s a much quicker process and can potentially lead to a resolution between you and your lender without foreclosure.

But before starting the Power of Sale process, you’ll be served with a written notice and a 35-day “redemption period,” presenting the opportunity to make good on your mortgage and pay all the outstanding payments. Not only will you need to pay back the mortgage payments that you neglected, but you’ll also be charged several extra penalty fees associated with the Power of Sale.

If all goes well, you should get back in good standing with your mortgage lender. If, however, you don’t take advantage of this redemption period to get your payments back on track, you’ll then be served with a Statement of Claim for Debt and Possession from your lender.

At this point, you’ll be given 20 days to file a Statement of Defence. If the 20 days come and go without a statement filed, you’ll be at increased risk of getting kicked out of your home when a Writ of Possession is obtained by your lender from the court and filed appropriately.

The lender can then sell your home with the help of a real estate agent and any proceeds of the sale will be put towards covering any fees. You will only receive money if there is any money left over after all dues have been paid off. If not, you could find yourself being sued for that remaining balance from your lender.

Risk in the Canadian market puts you at risk of having to sell your home at a lower price than you paid for it. Learn more about Risk in Canadian Real Estate

2. Foreclosure (BC, AB, MB, SK, PQ, and NS)

There is one main difference between a Power of Sale and foreclosure. The Power of Sale does not require the use of the court system. That’s why the process is much faster and can even result in a completed process within a few months.

On the other hand, foreclosure can be a tediously long process that often over a year to make any kind of progress. Foreclosures are more common in the provinces of BC, Alberta, Manitoba, Saskatchewan, Quebec, and Nova Scotia.

Technically, lenders can begin foreclosure as soon as you break any condition specified in your mortgage approval including missing just one mortgage payment. In practice, lenders are in the business of collecting interest so they would rather avoid foreclosure unless they feel there is a risk their loan may never get repaid. It’s in the lender’s best interests (and obviously yours too) to come up with a negotiated resolution. It’s always possible to find a suitable substitute payment plan to put your mortgage payments back on track and avoid foreclosure altogether.

What is the Process of Foreclosure in Canada?

If you live outside of Ontario, Newfoundland, New Brunswick, and PEI where lenders can not use a Power of Sale, you risk facing foreclosure right from the get-go. The process is arduous:

1. This process is a lawsuit in which you become the Defendant and your lender is the Plaintiff. A ‘Statement of Claim’ document will be filed by the lender with the court, a copy of which will be served to you.

2. After receiving a copy of this document, you have 20 days to file your reply in the form of a Statement of Defence or a Demand for Notice.

If you fail to reply, the lender can inform the court that you’re in default regarding the court action (not to be confused with being ‘in default’ with your mortgage).

Failing to reply will communicate to the court that you’ve chosen not to fight the foreclosure process. At this point, you have no other avenues to take to defend yourself.

Your lender will eventually apply for a remedy with the court as a means of getting back the money they loaned out to you to finance your home.

3. At this point, the court will likely issue a Redemption Order, which gives you a certain amount of time to bring your mortgage up to snuff or pay it off completely. If you can come up with enough money, you can effectively stop the foreclosure process at this point.

However, if the court doesn’t think you have the funds, it can go straight to issuing an Order for Foreclosure without even bothering with a Redemption Order. If this happens, the property will be directly transferred to the lender.

OR

The court may also decide on an Order of Sale instead, which involves a sale of the home under the court’s control. You’ll then have a maximum of 30 days to vacate the home after the lender (or a new buyer) has over possession.

What Can You Do to Avoid Foreclosure?

While foreclosure may be imminent, there are some things you can do to avoid this ugly process and keep your home and your credit intact.

Take time to review and understand the terms of your mortgage. A great mortgage broker will help with this.

Renegotiate mortgage payments with your lender if you’re starting to struggle with payments.

Consult with a low or no-cost housing counsellor

Contact a real estate lawyer

Find out if there are any home loan modifications you can take advantage of

Sell your home and downsize before missing a payment

The Bottom Line

Foreclosure is certainly not a pleasant experience. Losing your home can be emotionally devastating and can leave a huge dent in your financial situation and your credit rating.

If you’re having trouble keeping up with your mortgage payments, you’d be well served to either contact your lender about your situation or speak with a financial advisor who can guide you in the best direction to avoid foreclosure or Power of Sale.