What is a REIT?

Learn the benefits and drawbacks of investing in a Real Estate Investment Trust (‘REIT’)

Everyone has heard that real estate is a good investment but not everyone is able to buy an investment property. There is a really simple way you can buy real estate with as little as a few hundred dollars.

What is a REIT?

Instead of buying a property yourself, you buy a Real Estate Investment Trust (‘REIT’). REITs are companies that own and operate real estate properties, including rental apartment buildings, shopping malls, office buildings, warehouses, and hotels.

You can buy a REIT by buying units in a mutual fund or buying shares in the REIT on the stock exchange.

How do REITs work?

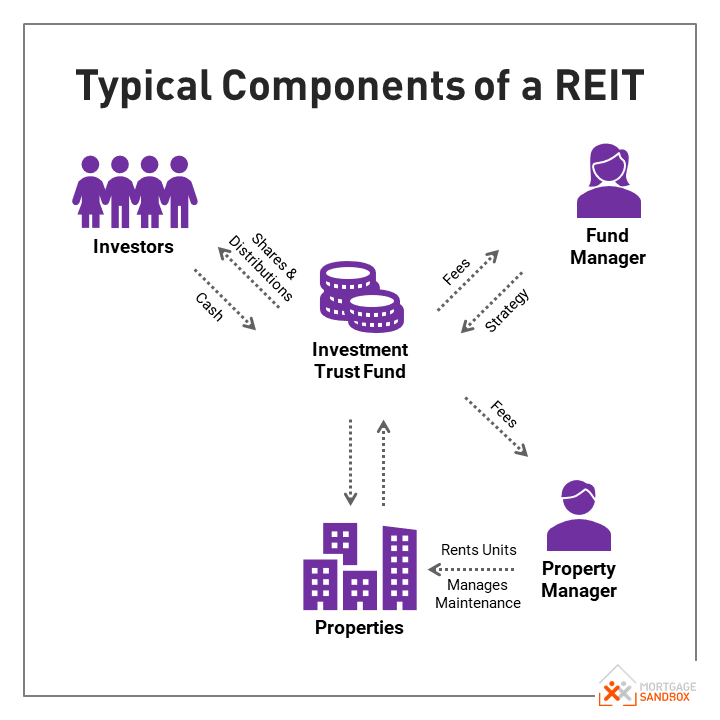

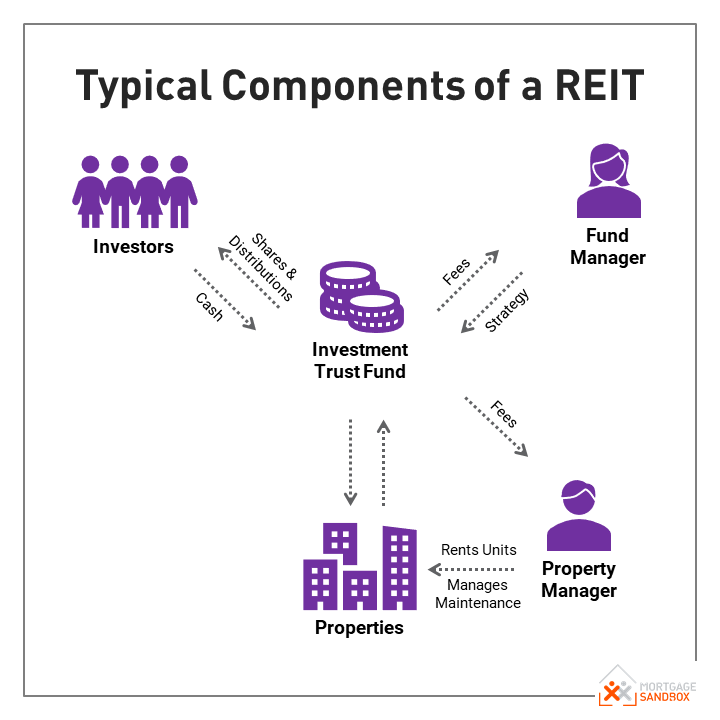

At the creation of a REIT, the fund manager will present an investment strategy describing what they plan to buy, how much they plan to mortgage the properties, whether they plan to buy top-quality properties or fixer-uppers, etc.

There are two really cool things about REITs.

They allow you to invest in commercial real estate. Most people can’t afford to buy an office tower or a shopping mall so this is an opportunity you can only get using a REIT.

They usually specialize in a specific type of real estate. So if you’re interested in a lower risk investment then you can buy seniors homes and if you have a higher risk appetite you can buy hotels and theme parks.

Once the fund managers find investors who like their strategy, the investors invest their savings in the REIT and then the fund manager searches for properties that fit the investment criteria.

The fund managers are specialists so they will have a very good understanding of the true value of a property based on its monthly rents.

The fund manager will likely get mortgages on the properties so the fund can collect properties with less invested cash. That leverage can increase the distributions but it also adds an element of risk to the investment.

Why do mortgages add risk? Well, if the economy hits a recession then vacancies could rise and monthly lease rates then drop. In this scenario, the revenue generated by the property falls, but the monthly mortgage payments are locked-in and that creates a risk that your cash flow may not cover your commitments. It’s similar to the risk of a mortgagee on a house that you’re renting.

Once the REIT has bought a bunch of properties they will need to keep all the units leased, collect the rests, and take care of the maintenance and repairs. Usually they contract a local property manager to do this. Sometimes they do it themselves, but if they only have a couple of properties in Edmonton, for example, it may not make sense to hire a local employee to manage those properties.

The benefits of a REIT

There are some huge benefits from investing in a REIT.

You can invest in real estate with a small amount of initial savings.

If you need to get your cash back, you can sell your shares or redeem your units within a few days.

You have the ability to buy commercial property like office buildings and industrial parks.

You can buy very specific types of real estate - you can even buy theme parks or self-storage units.

You can diversify your portfolio by buying real estate in different regions and countries, and mixing commercial and residential apartment buildings.

A big fund can get economies of scale across the properties wrestling in lower management expenses.

The rents paid on real estate provide a stable cash flow.

The interest on the mortgages is an expense deducted from the property revenues.

They provide attractive returns.

The downside of investing in a REIT

Dividends are taxed.

They are traded on the markets, so a stock market correction can impact the price of the shares or units.

The fund managers and property management fees may be on the high side.

The value of larger multi-unit and commercial property are generally more closely tied to economic fundamentals so you’re less likely to get any extraordinary capital gains.

Summary

If you want to invest in real estate, buying your own property is only one way to do it. You also have the option of pooling your money with other investors and buying real estate using a REIT.

Talk to your investment advisor to learn more about the REITs available to you and whether a REIT fits your overall investment objectives.

Like this post? Like us on Facebook for the next one in your feed.