Victoria Property Market — Reaching Tipping Point — Oct 2023

The Victoria property market has experienced many changes in recent years, with prices rising rapidly during the COVID-19 pandemic and then starting to decline in mid-2022. As of September 2023, the market is starting to show signs of stabilising, but several factors are still impacting buyer and seller activity.

While British Columbia’s population growth has been breaking records from the Summer of 2022 until now, the dramatic demand rise hasn’t resulted in purchase activity due to affordability constraints.

Looking back to 2016, this year has had the fewest completed purchase transactions.

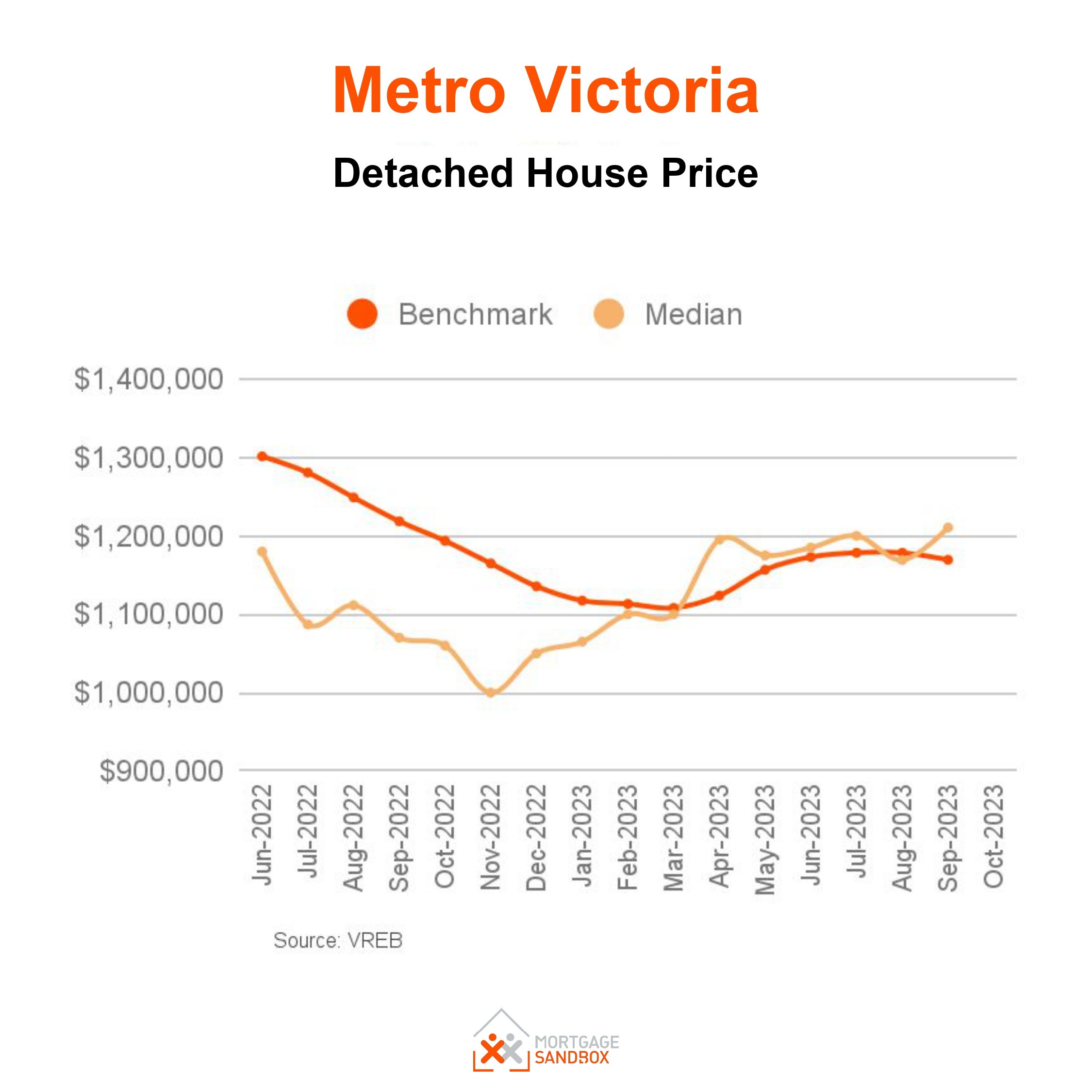

The benchmark price of a house dropped in September. This is likely the beginning of a slide in prices running into 2024.

Several factors contribute to the recent upswing in the Victoria property market. One factor is rising supply. In 2022, prices started to fall when supply rose to the current levels.

While the benchmark prices published by the real estate boards are still rising, the median prices have stalled or dropped.

House purchase-sale volumes have been falling after an average Spring.

While purchases are losing momentum, inventory is beginning to accumulate on the market. In 2023, prices rose due to record-low listings rather than record demand. As inventory grows, buyers will gain more power to negotiate.

The detached house market has grown from 2 months to nearly 4.5 months worth of listings. The house market is nearly balanced.

Victoria condo apartment market inventory is growing, too, from 3 months to 4 months of supply. The condo market is still a seller’s market, but buyers are gaining more negotiating power as the year progresses.

Active house listings are higher than in the past three years.

Why are there fewer home purchases in Victoria?

There are several factors contributing to the cooling of the Victoria property market.

Government Regulation: The B.C. Government recently announced that the maximum 2024 rent increase in the province is 3.5 per cent when landlord expenses are growing at 5.6 per cent. While the policy is a relief to tenants, it signals to landlords that the government prioritises affordability to tenants above ensuring that landlords can break even on their investments. We should expect that out-of-province rental investors might build their rentals in other cities like Calgary or Toronto rather than take on the risk of unpredictable rent controls.

Mortgage Rates: Rising interest rates are making it more expensive to borrow money, which is reducing buyer demand.

Why might prices drop in Victoria?

Increasing Inventory: Another factor contributing to the cooling market is the accumulating number of homes for sale. While three or four months of supply is not high, it is much higher than is was earlier this year. This supply increase gives buyers more options and reduces the heat in bidding wars.

Faltering Consumer Sentiment: Consumer sentiment tends to reinforce existing trends. It’s like an amplifier. While confidence in real estate was rising in the first half of 2023, it has now stalled. If a sustained downward price trend emerges, confidence is likely to tumble. Byers with low confidence in price appreciation often delay their purchases and compound the weakness in the market.

Reports earlier in 2023 were hopeful for a recovery after the double-digit price drops in 2022. However, the recent trends suggest that the market is cooling down again. Home sellers in Victoria should be prepared to negotiate.

Here are some other things to keep in mind about the Victoria property market:

The market cooling down is broad, impacting all property types. Speculative investment appears to have shifted from British Columbia to Calgary.

The rental market is still strong, with rents continuing to rise. This could be cyclical — due to potential first-time homebuyers delaying their exit from the rental market. When mortgage rates fall, and buyers re-enter the market, rents could fall sometime in late 2024 or 2025.

The government is taking steps to cool down the housing market, such as introducing a foreign buyers' ban.

Overall, the Victoria property market is showing signs of cooling down. The house market is balanced but the apartment market is still a seller's market, and buyers should be prepared to face competing bids and conditions negotiations.