Vancouver Home Price Forecast for 2019

Highlights

Prices in Vancouver, Victoria and Kelowna are likely to drop

2019 will be a difficult year for sellers of homes

There will be opportunities for buyers to find some great deals, but they may hold-off hoping to get a better deal in the future

There is still a chronic long-term undersupply of housing in Metro Vancouver and more family-oriented condos are needed

Foreign and speculative capital flows appear to be bypassing BC and flowing to Seattle, Toronto and Montreal

2019 House Price Forecast

There is no consensus among economists as to what will happen in 2019; as well, Mortgage Sandbox has reviewed the various forecasts and performed its own analysis and has arrived at the conclusion that house prices will likely drop significantly in 2019. Perhaps a 3% drop doesn’t sound significant to you, but a 3% drop on the $1.5 million benchmark priced Metro Vancouver home is $50,000 and that’s a significant amount of money to most homeowners.

Before going further, we need to make it clear that forecasts are simply intelligent guesses and history has often proven forecasters wrong. For example, in 2016 Royal LePage (a major real estate brokerage) and the BC Real Estate Association both predicted that house prices would drop 8% in 2017, but instead the benchmark detached home price rose $100,000 from $1.5 million to $1.6 million. In 2017, RE/MAX predicted prices would rise 6% in 2018 but instead they dropped almost 2%.

If you hear of a forecast this year that sounds too good to be true and unbelievably accurate (e.g., estimating to the dollar), then likely it is.

To formulate our forecast, we first evaluated other forecasts from well respected sources and then analyzed what we believe are the 5 key factors influencing housing markets to arrive at the most likely outcomes.

Evaluation of Forecasts

2019 forecasts for Metro Vancouver range from a 5% rise to a 10% drop, and most economists expect a drop. Most of these forecasters work for companies that make money when people buy real estate, so they likely have strong convictions if they’re talking the market down.

Analysis of 5 Factors Driving Prices

Affordability

Affordability is focused on Canadian home buyers in the traditional sense. These are people who are buying a home to live in it and they’re relying on their own income to pay the mortgage. This type of home buying is grounded in the world of classical economics. Some economics argue that historically low interest rates, very low unemployment and good incomes will continue to support home prices. They also argue that the current slow down is caused by higher interest rates and government rules that reduce the size of mortgages people can get. In Vancouver, this argument doesn’t hold water. The Canada Mortgage Housing Corporation (CMHC) has repeatedly declared that house prices in Toronto, Vancouver, Hamilton and Victoria are not supported by economic fundamentals.

To illustrate the point, a family today with a combined income of $200,000 may qualify for a $770,000 mortgage that, with significant savings, will allow them to buy a house priced at $950,000. However, the benchmark house price in Greater Vancouver is $1.5 million and that means current prices are a stretch for motivated wealthy citizens, never mind the other 92%. Population growth, local income growth, interest rates, mortgage financing, and economic stability did not bring prices to their current heights, so they can not be blamed for any price declines.

Capital Flows

Sales are down dramatically from their peaks and this suggests there has been a drop in the capital flows into Vancouver real estate.

There is a global slow down in real estate investment, and Vancouver is likely caught in this slow down which means less foreign direct investment. China imposed foreign real estate investment controls in 2017, and there are reports that these have been effective. On that note, some Chinese property investors may shift their investments to Europe or Australia in light of the recent arrest of a Huawei executive in Canada.

Rental investors will have observed prices dropping over the half year and are likely sitting on the sidelines hoping to buy at the next market trough. Since they aren’t buying a home to live in, they can park their money in a savings account earning 1.5% while they wait for prices to stabilize.

Falling prices also strongly impact property flippers. They run a high risk of losing money if they try to flip a property in a market where houses prices are dropping $100,000 in six months.

Dark money has had a lot of light shone on it in the past year and, as a result, the federal and provincial governments have intervened. Canada Revenue Agency has begun sharing tax information with China. The provincial government has begun tracking presale reassignments and requiring full disclosure of beneficial ownership. If these measures are effective, then dark money will be redirected to more welcoming cities like Seattle, Toronto and Montreal where there are less stringent regulations and less focus on preserving the rule of law.

Finally, there are people who own recreational homes in Vancouver. Coal Harbour has always been a magnet for these buyers. Although there’s no reason to believe this type of investment has weakened, it is believed to be confined to Downtown Vancouver waterfront real estate and Whistler, so it shouldn’t impact the broader market.

In summary, capital flows are greatly diminished and just as a rising tide raises all ships, a receding tide will likely pull prices down.

Government

The government has been tightening mortgage rules for years. Ten years ago, Canadians had access to government insured mortgages that could be repaid over 40 years. Today, government backed mortgages must be repaid within 25 years and they’re only available for homes occupied by owners. Below is a list of the government’s ongoing tinkering with mortgage financing:

2008: Reduced the maximum lifespan of a mortgage from 40 years to 35 years.

2010: Applied a stress test against the 5-year contract rate for mortgages with a down payment of less than 20%.

2011: Reduced the maximum lifespan of a mortgage from 35 years to 30 years.

2012: Reduced the maximum lifespan of a mortgage from 30 years to 25 years on mortgages with a down payment of less than 20%.

2016: Applied a stress test against the 5-year posted rate for mortgages with a down payment of less than 20%.

2016: Banned default insurance on refinances, mortgages greater than 25 years, and single-unit rentals.

2018: Applied a 2% stress test to mortgages with a down payment of greater than 20% to ensure borrowers can handle an interest rate increase.

The City of Vancouver has put restrictions on short-term rentals and added an empty home tax.

As well, the provincial government has raised property taxes on luxury properties, raised property transfer taxes for foreigners and added regulations to ensure people are paying their capital gains taxes on condo reassignments. They’ve also added rent controls and tenant protections.

There is a consensus that the government has enacted many changes with the intention to bring down prices. It appears the government is succeeding and anyone betting against the government should proceed with caution.

Supply

There is an abundance of homes for sale in Metro Vancouver but none of them are at affordable prices, so they are sitting on the market.

After peaking in May 2018, benchmark house prices have dropped $100,000 in 6 months, to $1.5 million.

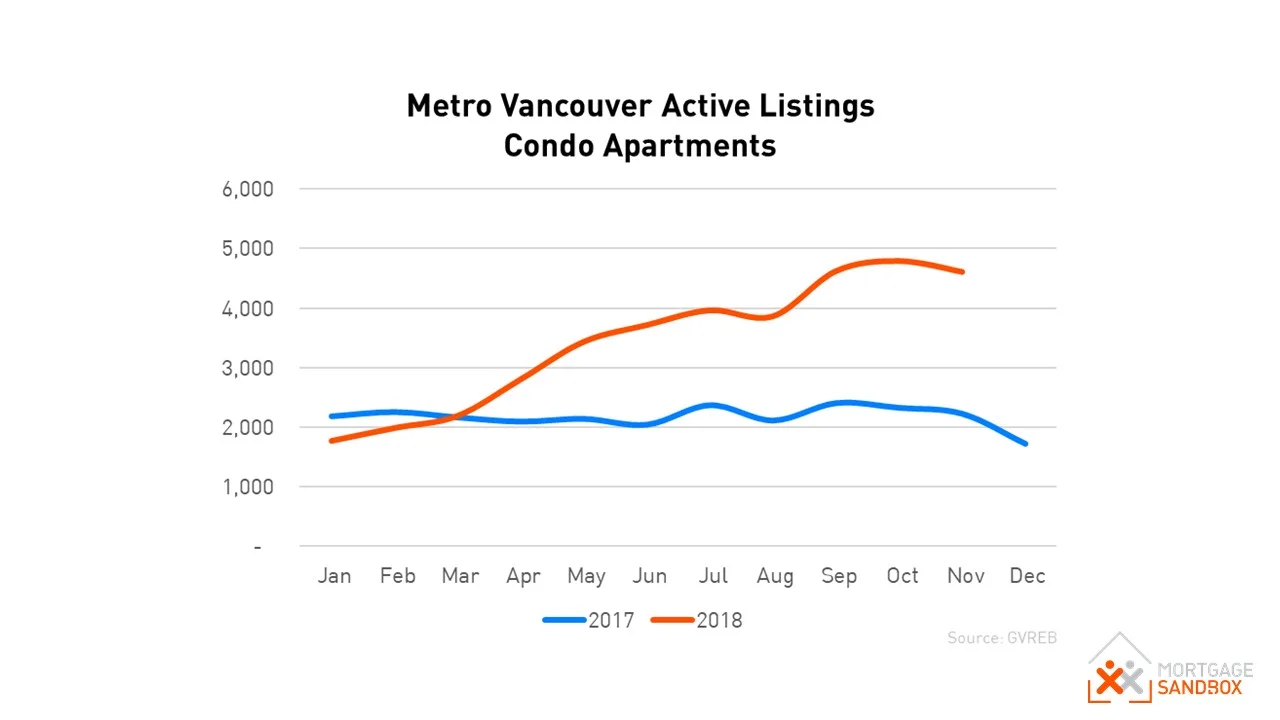

Condo listings have also risen dramatically in 2018 bringing condos into balanced market. Here is the broader supply picture:

In 2018, only 8,000 condos were bought on MLS® and this means that in 2019 Vancouver may temporarily have excess supply. By no means does this imply that the City can’t support further densification. The Vancouver metro area has been chronically short of housing and with population growth any excess supply will be absorbed within a year or two, but in 2019 supply shortages are unlikely to provide support for falling prices.

Popular Sentiment

Sentiment is the key to prices. People fall in love with a home and before making a final decision, they look at the other four factors and ask, “Is it worth it?” The final decision to buy sits in the realm of behavioural economics rather than rational classical economics. People make purchase decisions with their hearts and gut feelings and no one wants to be caught paying too much or selling too cheaply. Here are some key principles of behavioural economics to watch for in 2019.

Uncertainty aversion is the tendency to favour known risks over unknown risks. For example, when choosing between buying or renting, we are more likely to choose the option that provides more certainty. Lately there has been a lot of uncertainty in the Calgary real estate market and that may cause people to choose renting until the market stabilizes and home prices become more certain.

Endowment effect is a bias where we tend to overvalue something that we own, regardless of its objective market value. This has come into play this year with sellers anchoring to the peak prices and only reluctantly lowering their asking prices as the market softened. This has led to unsold houses piling up on the market.

Herd behavior is evident when people do what others are doing instead of using their own information or making independent decisions. This was evident when people stretched themselves to “get into the property ladder” when the market was headed upward. In a down market, baby boomers who intend to cash in their real estate to fund their retirement may stampede to sell their homes and it could accelerate a decline in prices beyond what the forecasts are expecting.

Confirmation bias occurs when people seek out or place higher value on information that fits with their existing beliefs and preconceptions. When most people believed real estate would climb “up and up” forever they only read news that confirmed this. If there is a tipping point where people come to believe that a major correction is underway, then people will reinforce their belief by ignoring news to the contrary and this will prolong any downturn making it a self-fulfilling prophecy.

Anchoring happens when people fixate on a number like the price at the market peak and use this as a reference point to judge current values. It’s a subconscious process and it’s frightening how easily we are influenced. An experiment asked people to write down the last three digits of their phone number multiplied by one thousand (e.g. 678 = 678,000). Results showed that people’s subsequent estimate of house prices were significantly influenced by the arbitrary anchor, even though they were given a 10-minute presentation on facts and figures from the housing market at the beginning of the study. In practice, anchoring effects are often less arbitrary. For example, the list price of the first house shown to us by a real estate agent may serve as an anchor and influence perceptions of houses subsequently presented to us (as relatively cheap or expensive). In 2019, anchoring will most likely be observed when sellers reject offers that are lower than the peak price from 2017, or they simply take their home off the market expecting that prices will rise to the 2017 peaks in the near future.

It’s difficult to ignore sentiment and behavioural economics in a digital age when Google and Facebook will curate your news to reinforce your existing beliefs. Could social media’s content filtering negatively reinforce consumer behaviour and lead to worse recessions and more profound swings in asset prices? It’s clear that social media contributed to the stratospheric rise in the price cryptocurrencies like Bitcoin. Time will reveal if real assets are vulnerable to social media bias too.

Advice for Buyers

In Metro Vancouver buyers of homes have more negotiating power and their power has been growing every month. So long as you aren’t taking on an uncomfortable amount of debt and this is your “forever home”, 2019 will be a good time to buy but 2020 may be even better.

At the end of the day, a home is a place to live more than it is an investment. If you feel you need a home to have the lifestyle you’ve always wanted, then now is the best time since 2008 to be a buyer. Just be sure to drive a hard bargain and keep in mind that prices will likely continue to drop after you buy your home. It’s impossible for everyone to perfectly time the peaks and troughs of the market.

Advice for Sellers

Real estate holds more uncertainty for sellers. Current forecasts would indicate that the longer you wait the less you’ll get for your home. In the early 1990s, Toronto saw a dramatic real estate correction and it took almost 20 years for prices to match their previous peak. There’s no guarantee that’s the case in Vancouver; however, there are some respected economists that have been warning of risk in the market for some time. If you don’t like risk and you know you need to sell in the next 5 years, it may be prudent to list earlier rather than later.

For the latest market information for Metro Vancouver and specific real estate trends in the City of Vancouver, North Vancouver, Richmond, Burnaby and Surrey, bookmark our Metro Vancouver Real Estate Insights page.

Like this post? Like us on Facebook for the next one in your feed.

Sources:

PwC, Emerging Trends in Real Estate 2019 ®

Royal LePage Market Survey Forecast

RE/MAX 2019 Housing Market Outlook

BC Real Estate Association, 2018 Fourth Quarter Housing Forecast

Central 1, B.C. Housing Forecast 2018-2021

Statistics Canada, Vancouver CMA Household Income Distribution