Ultimate Guide to Mortgage Renewal

Welcome to our independent guide to the mortgage renewal process.

Follow our 5-step guide to feel confident you are getting the best renewal deal. Our five steps to the mortgage renewal process are listed below. We explain why each step is essential, and then we provide tips for each step in the process:

Start Early

Consider Your Long-Term Plan

Do your homework

Ask for better terms

Let a mortgage broker do the work for you

Step 1. Start Early

Start shopping for a new mortgage 6 months before your current mortgage is up for renewal. In an uncertain interest rate environment, 1 week can mean a quarter percent difference in rate. Also, if your lender doesn’t have a renewal offer that fits your needs, starting early gives you time to look for another lender. You may not be able to switch your mortgage over until your actual renewal date arrives, but it’s best to give a mortgage broker time to find the best product and get all the paperwork ready, so you’re not left scrambling at the last minute. One week isn’t enough time to switch so, to be safe, you should allow at least a month.

Need a Mortgage Broker?

Our app matches you with local, pre-screened, values aligned mortgage brokers.

Step 2. Consider Your Long-Term Plan

Before you renew your mortgage, you should review your personal and financial goals to determine the type of mortgage you need. Key considerations:

Is there a chance you could get a job opportunity in the next 3 to 5 years that would require you to move?

Might you want to upgrade to a larger home because your household is growing?

Are your kids moving out soon? Might you want to down-size or right-size your home?

Is there a chance you could get a big bonus or receive an inheritance you might use to repay your mortgage?

If you know there’s a chance you’ll want to change homes, potentially move to a new city in the next few years, or you think you may want to pay down a large portion of your mortgage, then you may want to look for a shorter term or a lender with more favourable early repayment fees.

Given that a mortgage is your largest financial obligation, a renewal should be done with your financial goals and circumstances in mind. Once you know what you need, you’re in a better position to ask your current lender for a rate, and engage a mortgage professional to look at other options.

Step 3. Do your homework

Information is power. Before attempting to negotiate a better deal from your current lender, find out what other lenders are offering. Plenty of websites post current rates, but advertised rates are usually only applicable to the best-case scenario (i.e., ‘click-bait’ rates are intended to get you in the door, but you may not get the advertised mortgage rate).

There are many factors that can influence the mortgage rate. Here’s what you want to look at once you know how long you want to lock in for:

Rate

Pre-payment Options

Early Payoff Penalties/Fees

Other Fees

If you speak directly to a bank or credit union, they can only give you advice on their own mortgages. Contact a Mortgage Broker if you want help to quickly compare your options across many lenders. Remember, there is no penalty for switching lenders on the renewal date.

Step 4. Ask for better terms

The renewal letter that comes in the mail is seldom the best rate available. Yes, signing and returning the letter is quick and easy, but you will pay for the convenience with a higher interest rate.

Always ask your current lender for a better rate. Some people feel uncomfortable negotiating a better renewal deal. If this is the case, then get a mortgage broker to negotiate with the available lenders and beat the offer in your renewal letter.

Remember to keep the personal and financial objectives from step 2 in mind. You are not just negotiating the rate. You are looking for a combination of:

Payment Schedule Flexibility

Pre-payment Options

If you take the route of switching lenders, a mortgage broker may become your best friend. Rather than you meeting all the lenders, a mortgage broker can pull your credit report once and quickly identify the lenders who best fit your objectives.

Step 5. Let a mortgage broker do the work for you

Time is valuable. If you don't want to spend your time researching lenders, rates, and features, a mortgage broker will do the work for you. Mortgage brokers don’t charge you anything for most types of financing since they are usually paid a commission or finder’s fee by the lenders. According to the research from the Bank of Canada, people who use a mortgage broker typically save more money.

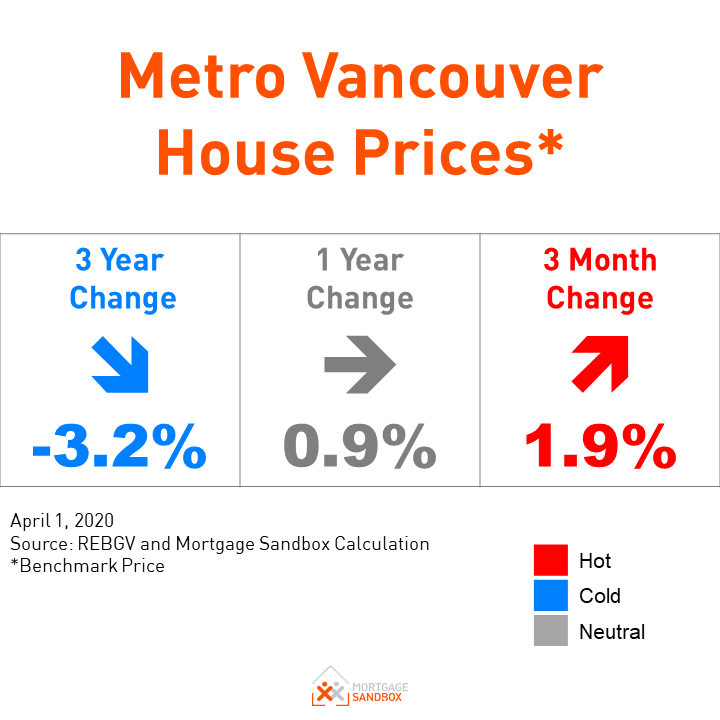

Each month we update our forecast of Canadian mortgage rates forecast and our real estate price forecasts to provide with the latest rate/price information for your area.

Like this information? Like us on Facebook.