The state of mortgage rates in Canada

After rising steadily since the beginning of 2022, mortgage rates in Canada are expected to remain high for the remainder of 2023 and into 2024.

The Bank of Canada has been raising interest rates in an effort to combat inflation. While many economists believe rates have peaked, a few believe the Bank of Canada might raise rates once again, to ensure that uncontrolled inflation does not stage a comeback.

The United States is facing similar inflation pressures, and on Aug 25th, Jerome Powell the Governor of the US Federal Reserve, said, “We will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.” Investors believe there is a better than 50 per cent chance of one more US rate hike by year-end. If the US is contemplating further rate increases while inflation is at 3.2%, then there’s good reason to believe that the Bank of Canada might follow suit because Canada’s inflation remains at 3.3%.

How much have rates risen so far in this economic tightening cycle?

Average variable rates have risen the most. From 1.7 to 7 per cent. On a $200,000 mortgage with 20 years remaining, that is an increase in monthly payments from $980 to $1,540. Almost a 60% increase in monthly payments and an additional $6,660 annually (after tax).

Competitive fixed five year rates have risen from 2.2 to 5.9 per cent. On a $200,000 mortgage with 20 years remaining, that is an increase in monthly payments from $1,030 to $1,410. Roughly a 40% increase in borrowing outlays and equivalent to $4,600 annually (after tax).

While these examples were for mortgages of $200,000. For many millennials, particularly in Toronto and Vancouver with the most expensive homes, the typical mortgage is higher.

Canadian Fixed Mortgage Rates

Canada's average 5-year fixed mortgage rate is forecast to remain above 5 per cent by the end of 2024. This is down from the current rate of 5.9 per cent but far above 2 per cent, the rate available through most of 2020.

While relief might be on the horizon, it might still be out of reach for many Canadians whose mortgages are due for renewal. According to the Bank of Canada, 65 per cent of Canadian mortgage holders whose terms come due for renewal between 2022 and 2024 will face increased mortgage payments at renewal.

For now, rates are edging higher and many posted 5-year fixed rates are above 6 per cent.

Mortgage rates in Canada are expected to start to decline in 2025. This is due to a number of factors, including a recession economy and declining inflation.

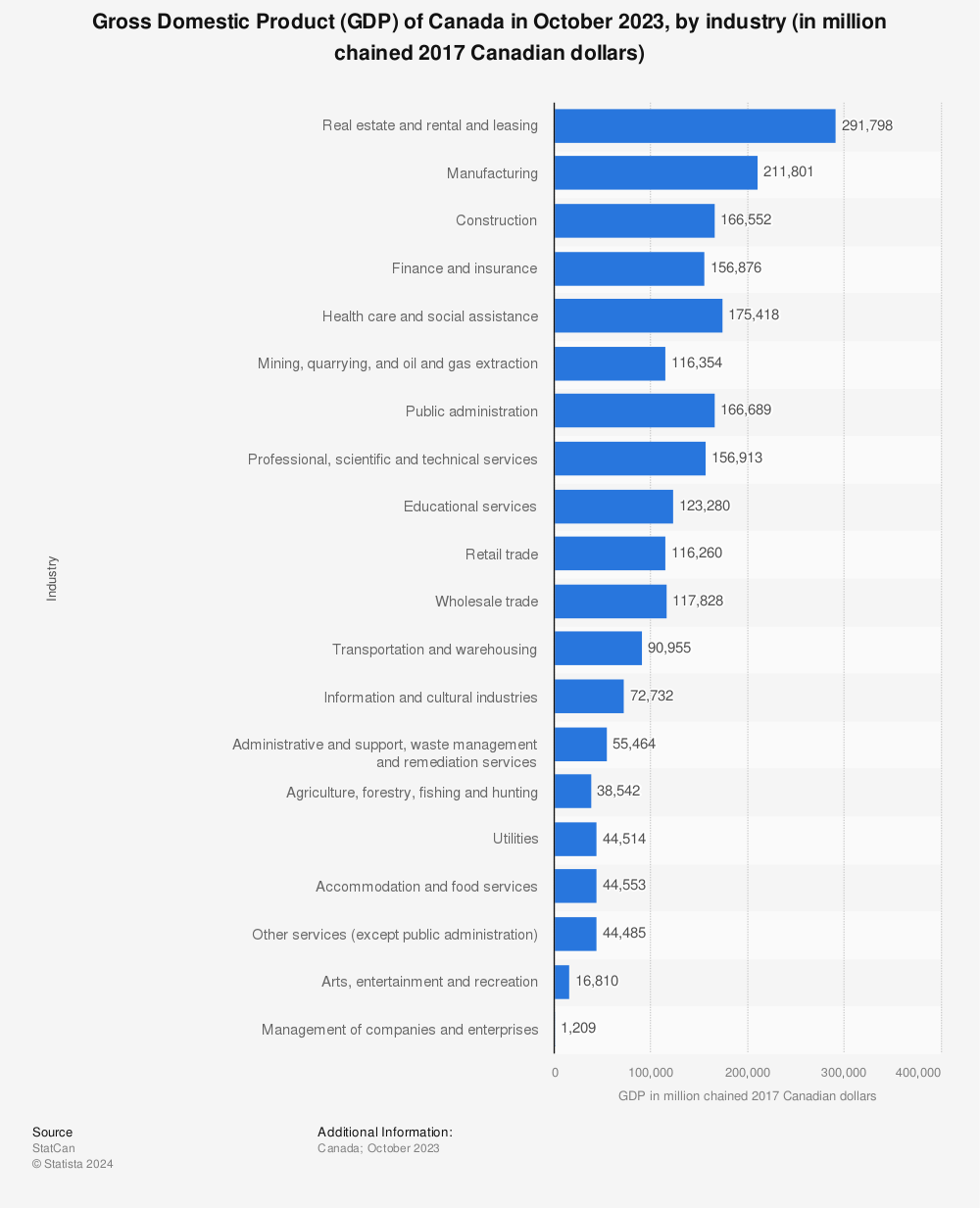

While there have been reports that Canada could avoid a recession. These reports cite Canada’s strong employment numbers, diversified economy, and export diversification. While Canada’s economy is diversified, a lot of GDP is dependent on Real Estate (i.e., sales, rental, leasing, construction, finances, and insurance) and raw material exports (i.e., mining, oil & gas) to China. China is in the grips of an economic slowdown which could impact Canadian exports. Real estate is under pressure from high interest rates.

Variable Mortgage Rates in Canada

The average 5-year variable mortgage rate is forecast to fall more quickly than the fixed mortgage rates, however they are falling from a higher level.

they are expected to drop below 6 per cent by the end of 2024. Since 2022, variable rates have risen the most and there are fewer discounts and promotions available. The spread between the best offers and the least competitive offers has narrowed.

It is important to note that these are just forecasts and actual mortgage rates in Canada may vary. It is always a good idea to shop around for the best mortgage rate when you are buying a home.

Here are many dynamic factors that could affect mortgage rates in Canada in the coming years.

It is important to consider all of these factors when making decisions about your mortgage in Canada.