Rates continue to climb

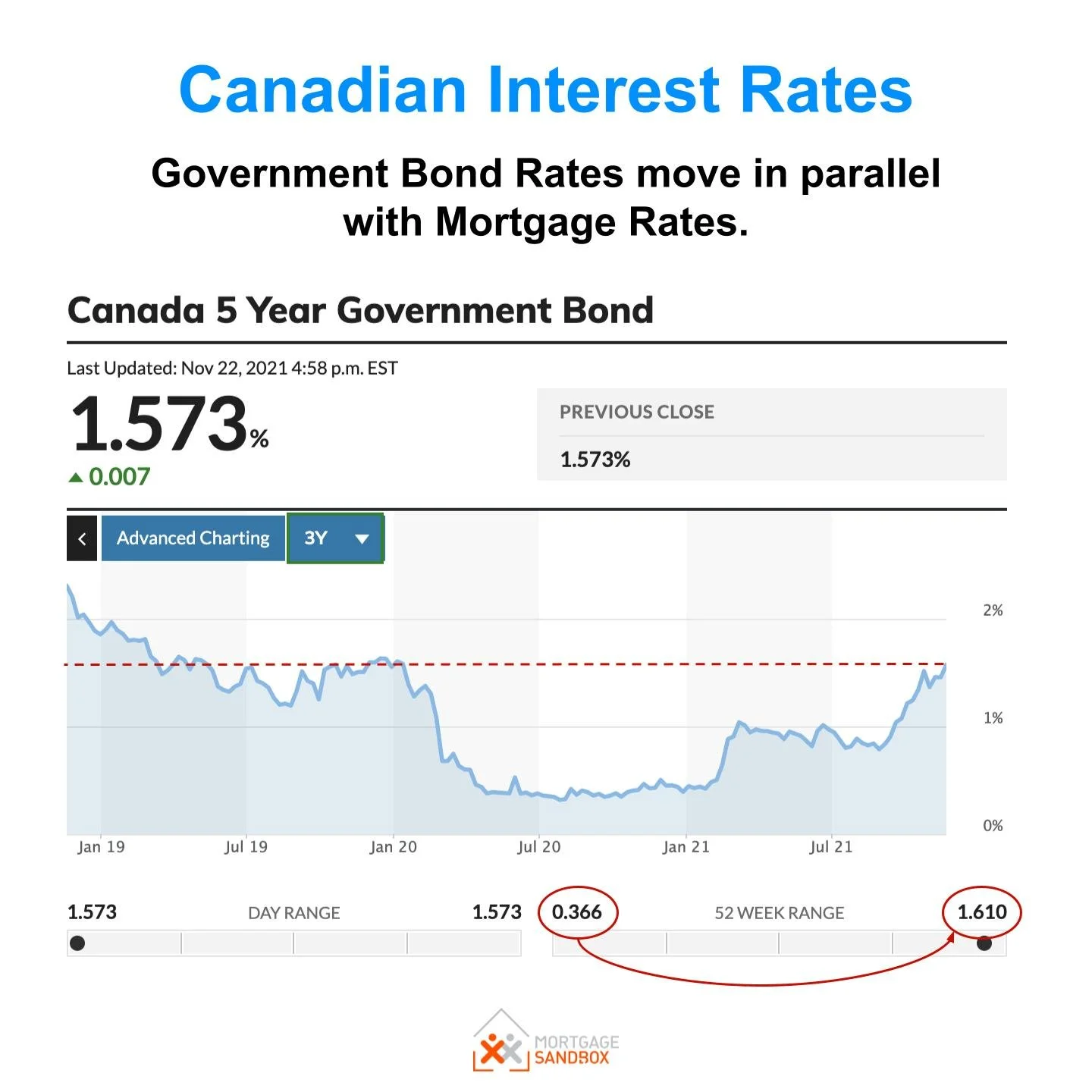

Five-year bond rates continue to rise and mortgage rates are also beginning to rise. In the past year bond rates have risen more than one percent and mortgage rates have risen just under 1 percent.

Five-year mortgage rates are still low at roughly 2.6% but they are significantly higher than they were at their lower point.

As an example, a homebuyer who can only afford a $2,000 monthly mortgage payment back in January 2021 with a 1 .8% mortgage rate could get a mortgage of $485,000. That plus let's assume they've saved a $150,000 down payment would give them a home buying budget of roughly $635,000.

Today with mortgage rates at 2.6%, they can get a mortgage of 450,000 and that drops their home buying budget to $600,000. That's a 5% drop in home-buying budgets.

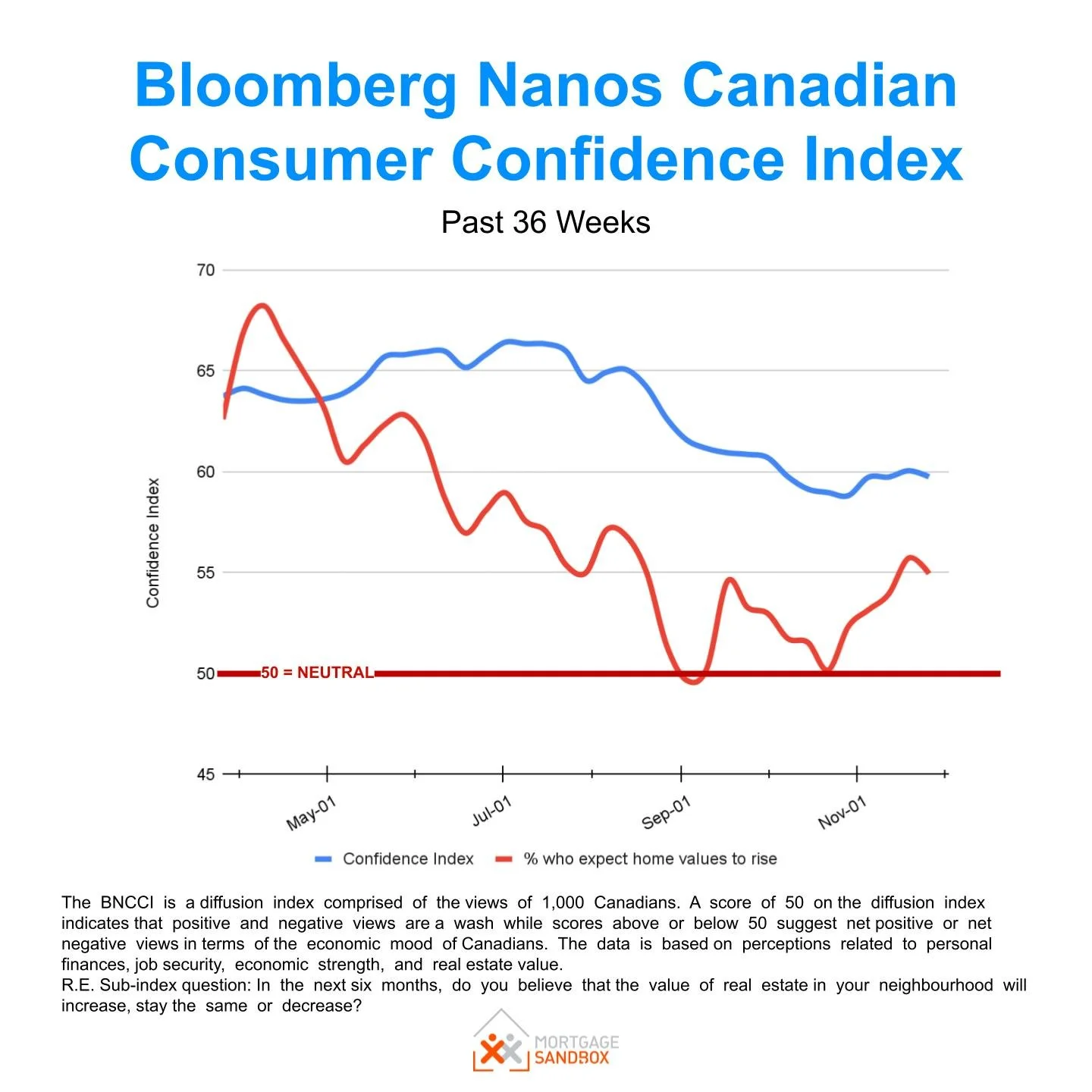

In most Canadian markets home buyers are using their entire budget when they buy a home so a 5% drop in buyer budgets will either result in a 5% drop in prices or it will lead to many potential buyers being priced out of the market.

What does this mean for me?

If you're buying, lock in your rate four months in advance or the likely rate rises and you might be able to outbid buyers who are relying on financing at a higher interest rate.

If you're selling, keep in mind there's a higher risk of a market correction when rates rise. Particularly when the market has been as frothy as it has been in the past year.