Property Market Recovery? Or A "Pause" In The Correction?

Despite significant headwinds, home prices across Canada have unexpectedly increased this Spring.

We know from the Annual Real Estate Cycle that Spring is typically the “hotter” time of the year due to lower active listings and higher buyer interest. However, many factors could thwart a price recovery in Canada.

What are the headwinds that could lead to a continued price correction?

1. High mortgage rates

High rates make it more challenging for buyers to afford higher prices. Mortgage rates are still around 5%. That’s nearly a decade high.

Even though the Bank of Canada has paused interest rate increases, it might continue to raise rates if inflation isn’t brought well under 3%. The U.S. Fed raised their target rate on May 3rd, and the European Central Bank raised rates on May 4th and signalled more rate increases were expected.

If Canada’s trading partners continue to raise rates and Canada doesn’t follow, the Canadian dollar will weaken. A weaker dollar makes imports more expensive and will lead to inflation which then forces the Bank of Canada to raise rates.

This is not a certainty, but it’s a risk.

2. Low consumer confidence

Fewer than 40% of Canadians think prices will be higher in 6 months.

3. A looming recession in Canada.

Over 70% of Canadian consumers and 66% of Canadian businesses think a recession is likely in 2023.

4. Record Construction in Major Canadian Urban Centers

The completion of more homes than Canada has ever seen raises risks of a short-term oversupply of expensive (i.e., brand new) homes. If the high-end market were to experience a correction, the resale market would be affected too.

Of course, with record immigration, we can absorb all the housing being produced over the long run; however, many of the challenges we have in the market today have to do with a supply mismatch. Many empty nesters are living in large detached houses that exceed their needs. While many families are making do with townhomes and apartments. There’s likely enough supply for everyone if they switch to needs-based housing, but that’s not how the market works.

Likewise, we believe all the construction is needed to house Canada’s higher population. Nevertheless, a majority of people seeking to buy homes might not be able to afford today’s prices, even after a correction.

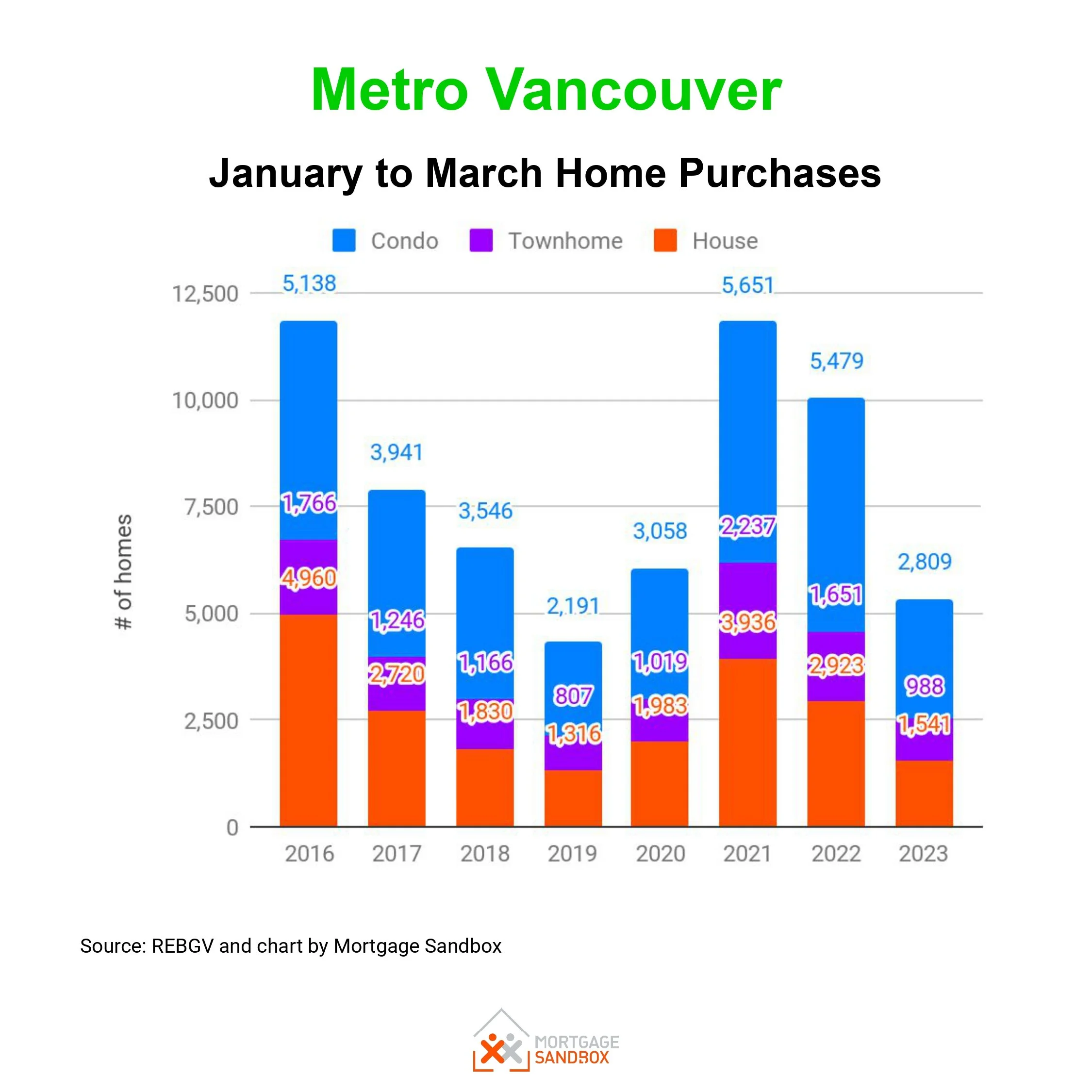

5. Demand is Low

In Spring 2023, with the exception of Calgary, residential home purchases in most urban centres were well below average (a market contraction).

Why are prices rising? It’s supply

When we say supply, we don’t mean housing stock - we mean active listings.

Housing Stock: Housing stock refers to the total number of completed housing units available within a specific geographical area, such as a city or a neighbourhood. It includes all types of housing units, such as single-family homes, apartments, condominiums, townhouses, and mobile homes. The housing stock is an essential measure of the available housing supply. It is the pool of homes whose owners might choose to list a home for sale or for rent.

Active Listings: Active listings refer to the total number of properties that are currently available and listed for sale in a particular real estate market. These properties include homes, condos, townhouses, and other types of residential properties that are listed for sale by their owners or real estate agents. Active listings are a stronger indicator of supply.

For example, in Spring 2023 there are 13,000 homes listed for sale in Metro Vancouver out of a total housing stock of 1.1 million homes. In other words, at any point in time, only 1 to 2% of total housing stock is available to buyers.

Even with lower buyer purchases/demand listings are not accumulating. Why?

1. Peak Price Anchored: Potential Sellers Anchored to Previous Peak

Potential sellers think their home is worth more than its current price on the market, so they’re waiting in the hopes that prices will rise to the peak values of Spring 2022.

Even though, technically, a home is only worth its current value on the market, people fundamentally don’t feel that’s true. This phenomenon is called anchoring.

2. Trapped: People Can’t Qualify for a New Mortgage

Families that want to upgrade to a larger home can’t qualify for a new mortgage at the current rates. If they can’t buy something new, then they will not sell their old home.

3. Opportunistic Landlords: Strong Rental Market

Typically, when people right size their housing (e.g., bigger home for a family, smaller home for empty nesters), they sell the home and buy a new one. However, the rental market is so strong that many potential sellers have been tempted to rent their old homes instead.

Conclusion

Whatever the reasons for the unusually low listing, there is no historical precedent for an extended long-term dry spell in listings. As a result, we should expect listings to return to the average sometime in the next year.

If that happens, the current price increases might be a short-term bump in a longer-term market correction. Here are two examples where this happened in the past.

Toronto - Spring 2018

In 2018, after a dramatic decline in Toronto house values, prices rose for four consecutive months (January to April) and then turned back into the negative.

Vancouver - Spring 2017

In 2017, after a significant correction in Vancouver house values, prices rose from January to July (six months) and then dropped below the previous trough.

At this point, we don’t know if we’re looking at a recovery or a pause along the downward path of a market correction. However, with so many market headwinds, the risk that this is simply a pause is high.