Metro Toronto House Price Forecast to December 2020

Home prices in Metro Toronto are following two distinct and different paths. Whether you’re looking at houses, townhouses or condos, prices are still far beyond what would be considered affordable. At this point, house prices have hit a ceiling while condo values are breaking new highs every month. If these trends continue then condos will be almost as expensive as houses and this paradox is the foundation for our forecast.

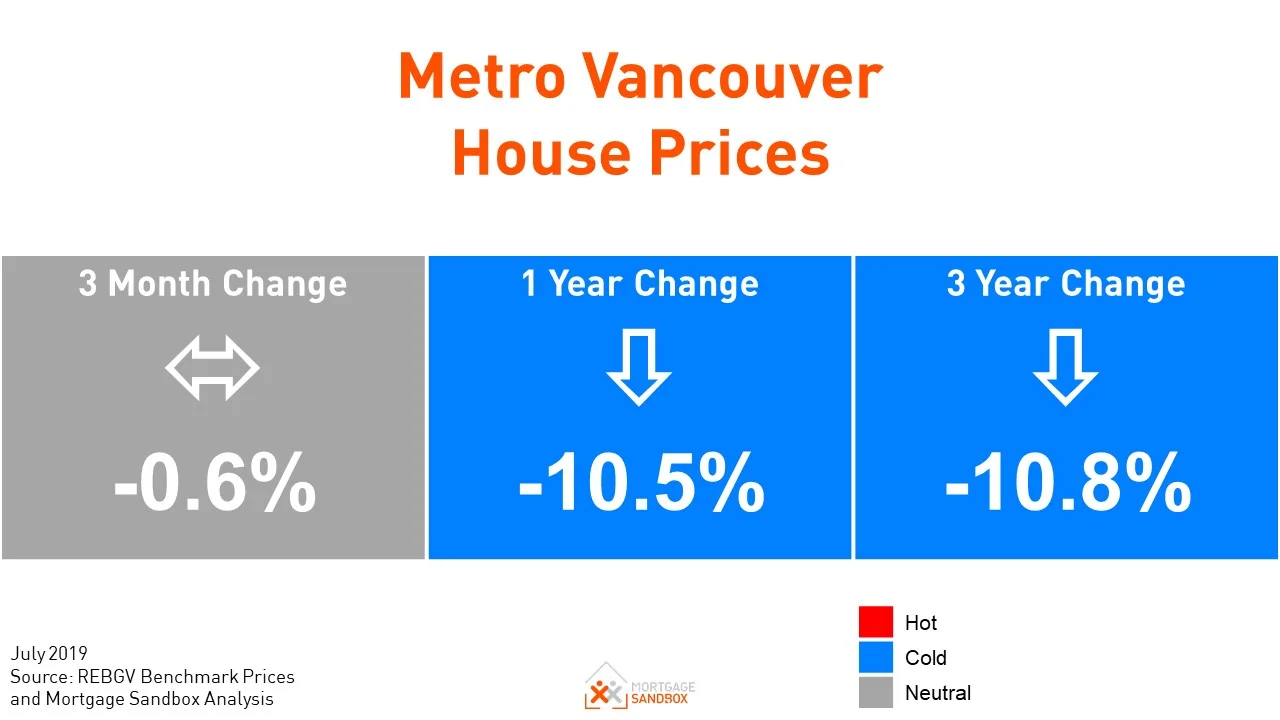

Torontonians like to compare the local market to other global cities, so it is important to point out that most of Vancouver’s market indicators are similar to those seen recently in San Francisco, Manhattan, Sydney, Stockholm, and London. These markets have weakened significantly and home prices have been dropping in what has been described as a synchronized global real estate slowdown.

This article covers:

How did prices perform last year?

Where are prices headed in 2020?

Why prices are going in that direction?

What should sellers do?

What should buyers do?

How did Toronto home prices perform last year?

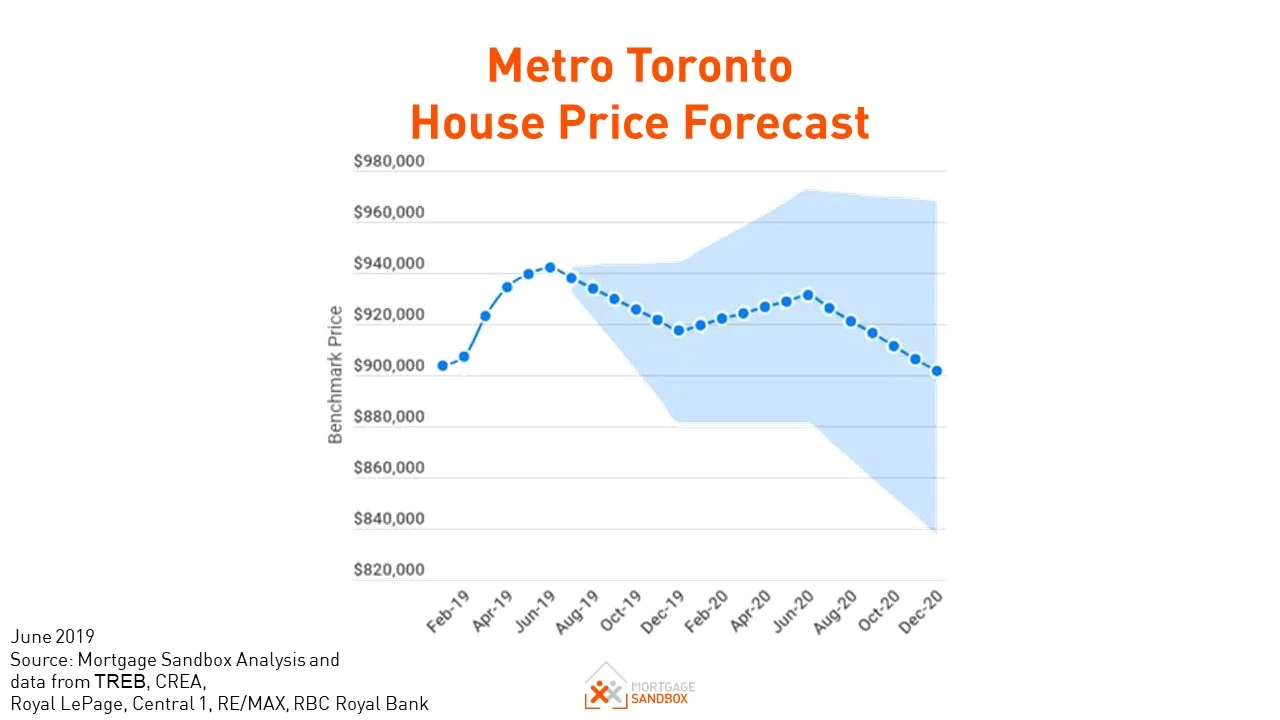

In December 2018, we forecasted that by December 2019 prices of all property types would be flat or drop slightly. Single family house prices have been following the familiar seasonal pattern where prices rise in the spring and recede in the fall. In 2018, house values started the year at $907,000 rose by $30,000 and then ended the year down at $903,000. So far this year prices have risen $40,000 since January to $940,000.

Condo values are continuing to break records. A benchmark GTA condo was $470,000 at the beginning of 2018 and ended the year at $510,000, up $40,000 (8%). So far this year condo prices have risen $30,000. Condo price appreciation is doing more to errode affordability than interest rates or mortgage rules.

Where are Toronto home prices headed in 2020?

Looking forward to 2019, we see most forecasters expect prices to flatten or drop slightly.

The brunt of price drops will likely be felt by higher priced properties (i.e., more expensive neighbourhoods and detached single family homes). Metro Toronto house prices rises have already begun to run out of steam during the summer.

The market is still very “tight” with 1 out of every 2 homes listed selling within a month but the number of homes purchased is still 20% below the activity levels seen in 2016 and 2017. Given the current market tightness putting upward pressure on prices and the growing affordability problem (local employee incomes can’t support these prices in the long run), we believe prices will likely weaken in the second half of 2019. Homebuyers and homeowners shouldn’t expect much price appreciation between now and the end of 2020.

Frustrated with your current realtor? Find a realtor and mortgage broker who shares your priorities and specializes in your local area.

Why are Toronto Home prices so resilient?

Toronto is a Seller’s Market

What does this mean exactly? Well, the market for all homes (houses, townhomes, and condos) are all trending toward a position where sellers have more negotiating power than buyers. This means sellers know that buyers don’t have many choices, so they orchestrate bidding wars which push buyers to spend more than they would in a balanced market. At Mortgage Sandbox, we advocate for Balanced Markets that put buyers and sellers on an even footing and lead to more moderate and sustainable price growth, more choice, fewer bidding wars, and ultimately a little less stress.

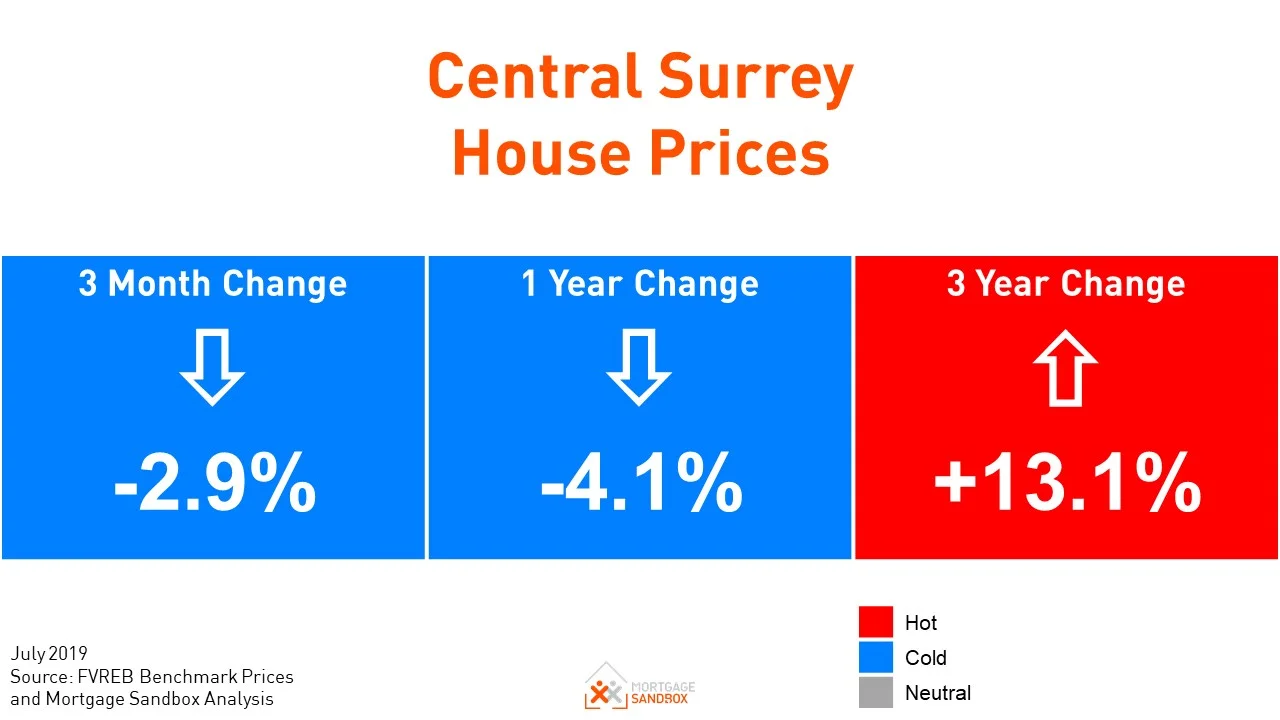

Foreign Capital is Moving From Western to Eastern Canada

In the past year, the foreign money pouring into Vancouver and British Columbia appears to have moved to Toronto, Montreal, and Ottawa. In particular, the Ottawa real estate market has grown dramatically with all property type prices smashing records.

Metro Vancouver house prices are some of the highest in the world (i.e., foreign investors like to buy low and sell high). Therefore, investors have shifted to cheaper locations such as Toronto and Ottawa. A benchmark house in Metro Vancouver is still valued at $1.4 million, so a benchmark GTA house for $940,000 is a relative bargain. Evidence for this shift in investor interest is seen in the dramatic drop in Vancouver home purchases and simultaneous upswings of activity in Toronto, Montreal, and Ottawa. Homes in Richmond, BC are very popular with foreign speculators so they are a great indication of the trend in capital flows. The chart below makes it clear to see that foreign demand has sunk.

Other factors driving the slow-down

At Mortgage Sandbox, we break down our market analysis to five key factors: affordability, capital flows, government policy, supply and popular sentiment. Read the full report to understand how these factors are affecting prices in Ontario.

What should Buyers do?

In Metro Toronto, buyers of homes have less negotiating power. So long as you aren’t taking on an uncomfortable amount of debt and this is your “forever home”, buying in the late summer and early fall will provide a more favourable market. Usually there are more homes for sale and fewer interested buyers at this time of year.

At the end of the day, a home is a place to live more than it is an investment. If you feel you need a home to have the lifestyle you’ve always wanted, then there is no guarantee that waiting will bring lower prices. Even though the federal government housing agency believes Toronto is at risk of a house price correction, it’s impossible to perfectly time the peaks and troughs of the market. The Metro Vancouver market was very tight, very hot, and rated as very vulnerable for several years right up until prices started dropping and confidence in further price increases flagged. A keen market observer in Vancouver would have had only 2 months warning of the market correction.

What should Sellers do?

Real estate holds more uncertainty for sellers. Current forecasts would indicate that waiting longer will not bring significant increases in home values and the federal housing agency believes the Toronto market is very vulnerable to a correction. In the early 1990s, Toronto saw a dramatic real estate correction and it took almost 20 years for prices to match their previous peak. If you don’t like risk and you know you need to sell in the next 5 years, it may be prudent to list earlier rather than later.

For the latest market information for Metro Toronto and specific real estate trends in the GTA, bookmark our Metro Toronto Real Estate Insights page.

Conclusion

In summary, we believe home values will be flat or down between now and December 2020. Be aware of the seasonal real estate price cycle where prices are typically experience more buyer interest and upward pressure between February and July, then stabilise in late summer before experiencing downward pressure through to the end of January.

Our Sources: