Metro Montreal Home Price Forecast - Apr 2021

HIGHLIGHTS

Metro Montreal home values are rising across all categories.

The Canadian national housing agency has identified Montreal as a moderately risky property market.

Mortgage rates are rising from historic lows, and unemployment is still high.

Current demand and price increases appear to be primarily driven by the effects of pandemic-related restrictions - people are desperate for more living space. Often buyers are moving away from the cities so they can afford a larger home. It is unclear if this will persist after the pandemic is over.

We are in the midst of the third wave of infections, but luckily this is probably the last wave.

This article covers:

What is the current state of the property market?

Where are prices headed?

Should investors sell?

Is this a good time to buy?

1. What is the current state of the property market?

Home Price Overview

Metro Montreal has a population of roughly 4.3 million and was ranked 41 of the best 100 cities in the world.

Montreal's home prices have accelerated significantly in the past few months, pushing more potential home buyers out of the market.

During the pandemic, people upsizing were the first wave of buyers. They needed more space to work from home and segregated spaces for two parents to work and kids to learn. Following the acceleration of house prices (and weakness of condo values), many renters began to fear missing out on another home price rally. First-time homebuyers wanting to build equity have jumped into the apartment market.

A recent CIBC survey found that more than 20% of people currently working from home will be returning to the office. As well, we expect the vast majority of students to return to their schools full-time. This points to a possible bounce back to the migration to the outer suburbs, exurbs, and cottage country. An important question raised by the current demand is:

If work-from-home and school-from-home are temporary market drivers, what will happen when the pandemic is over?

This uncertainty is a core component of risk, and we delve into this later.

People currently planning to sell a home will take heart because home values are at all-time highs, and they want to push ahead and sell during the pandemic.

People planning to buy a home could wait for a possible market correction, but there’s no guarantee that prices will be lower by the end of 2021.

The recession, high unemployment, and the eventual lifting of restrictions are now the primary sources of uncertainty for home values. Some pundits predict consumer behaviour similar to the ‘roaring twenties’ post-pandemic. Canadians who prioritize newfound freedom, nightlife, and travel will feel less hurry to go home shopping.

Metro Montreal Detached House Prices

House price growth in Metro Montreal continues to gather pace. Prices are rising but demand hasn’t been as astronomical in Montreal as in other Canadian cities. As well, population growth in 2020 and 2021 are a shadow of previous years. It appears the current price increase is the result of fewer Montrealers choosing to sell than normal. We could call it a pandemic-induced reluctance to sell.

We believe politicians are hoping to guide the market toward a typical annual real estate cycle with price growth in the range of 1 to 3% annually – in line with income growth.

The recent aggressive and accelerating price growth across Canada has triggered government intervention. In April, the bank regulator proposed to increase the mortgage stress test by roughly 0.5%. The change would go into effect in June.

Metro Montreal New Construction Home Prices

Since June 2019, new home prices have been accelerating, and higher have not discouraged Montrealers from buying pre-sale homes. Housing starts (a lagging indicator of pre-sales) are trending well above levels achieved in recent years.

However, it seems unlikely that record house prices will be sustained through the next 12 months based on economic fundamentals.

Market Risk

House price growth in Montreal has been so high that, according to the CMHC, there is a moderate risk of a price correction in Montreal. If interest rates rise significantly, even if prices are unchanged, Montreal may find that CMHC assesses the market as overvalued.

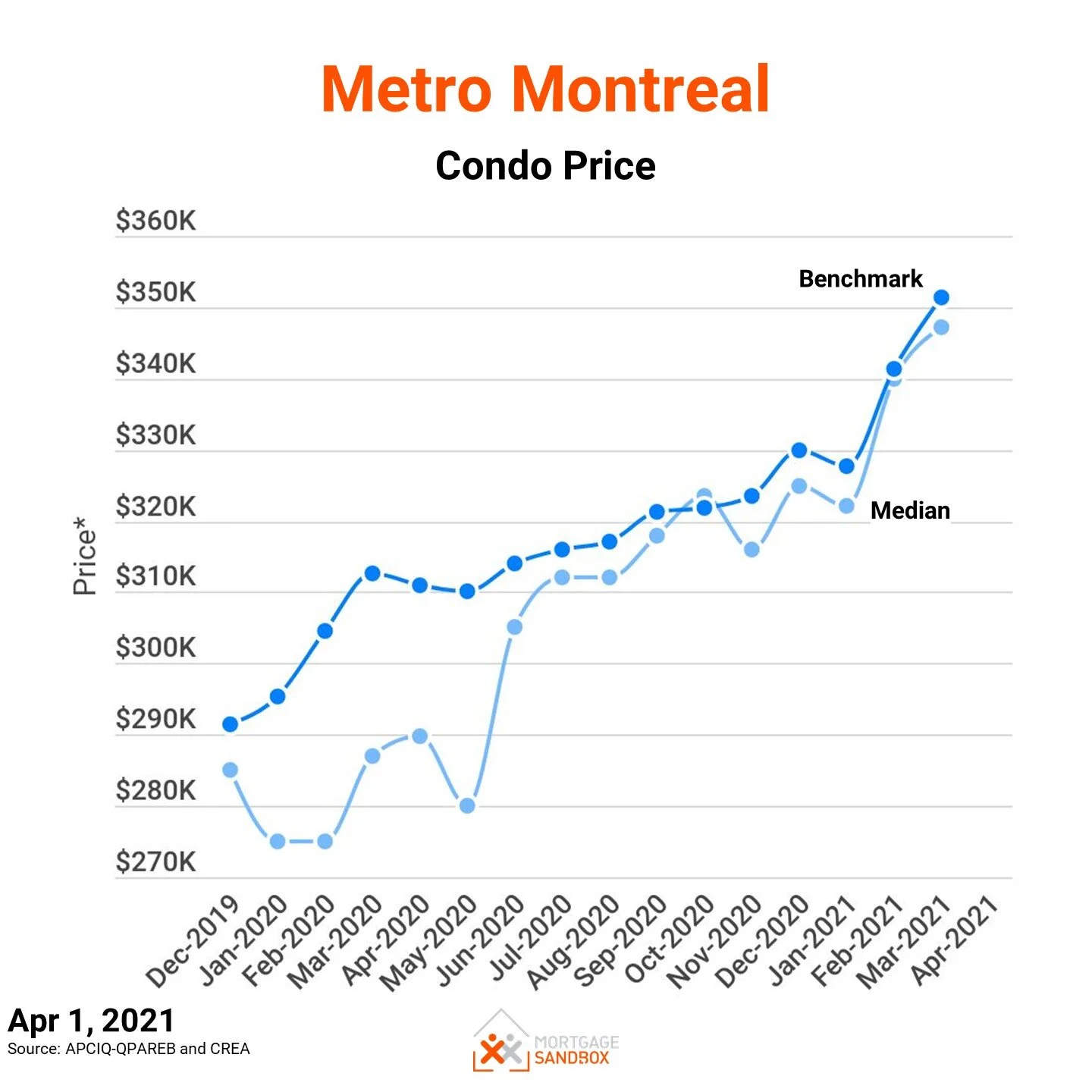

Metro Montreal Condo Apartment Prices

Metro Montreal apartment prices are continuing upward. Uninterrupted by the three waves of the pandemic.

In 2020, demand for condos was higher but not jaw-droppingly so. Now condos look hotter than houses! In most Canadian cities, the opposite is true.

With more people working from home, we expect developers will begin marketing larger (i.e., 2 and 3 bedrooms) apartments to meet buyer preferences. As the supply of more generous floor plans comes to the market, it may depress the values for small floor plan condos.

At Mortgage Sandbox, we would like developers to build 4 and 5 bedroom condos because:

Not everyone can afford to buy a house for their family.

Canadians who now work from home need more room to segregate workspace from living space within their homes.

Many Canadians with longer working hours find it challenging to stay on top of necessary house upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

Many people prefer to live in higher-density neighbourhoods with all the essential amenities within walking distance.

2. Where are prices headed?

There is a lot of uncertainty in the forecasts for 2021 and 2022. Many of the forecasters we've surveyed have different expectations for:

How long will the third wave of COVID-19 infections and associated restrictions last?

Will Canadians be able to fully return to their offices and classrooms in September or December 2021?

Will the federal government succeed in achieving its aggressive immigration targets during a pandemic and with high unemployment?

Since the mortgage payment deferrals expired in October, will the anticipated distressed home sellers appear in the housing market?

As a result of their varying assumptions, some forecasters expect prices to continue rising, while others expect are more likely prices to drop.

For example:

A Royal LePage survey found that their real estate agents expect Montreal values to rise by 6%.

The highest forecast for Canadian home prices in a September Reuters poll of 16 economists was price growth of 10% in 2021, while the lowest prediction called for a 10% drop. Roughly half the economists anticipated a decline while half expected a rise.

Moody’s Analytics, which develops mortgage risk software for Canadian banks, predicts a drop of nearly 7% drop in Montreal.

Moody’s didn’t attempt to pinpoint the timing of the decline in values. However, our research shows that most past declines in Canadian home values have begun between May and July. Traditionally, there is less supply (fewer listings) between February and May, which puts upward pressure on prices.

CMHC, the government housing agency, predicts a peak-to-trough drop of between 9% and 19%. They expected government aid and mortgage deferrals would cushion the blow in 2020. The market will be impacted in 2021 and recover in 2022.

There is no consensus among economists. Market sentiment and government stimulus have led to price acceleration and record home purchases even though most economic fundamentals have faltered.

CMHC sells insurance to banks to help limit their losses if a mortgage goes bad, and Moody’s Analytics sells software to banks to help them assess the risk of their mortgage portfolios. These two forecasts help paint the worst-case scenario. There is downside risk in the market.

Curious how we arrive at our forecast range? Check out our full assessment of the five factors that drive these forecasts. These five forces help explain why several forecasters are anticipating price drops.

FIVE FACTORS DRIVING MONTREAL HOME PRICES

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because many real estate risks can impact prices. Risks are events that may or may not happen. As a result, we review various forecasts from leading lenders and real estate firms, and we then present the most optimistic estimates, the most pessimistic prediction, and the average forecast. Do you want to learn more about real estate risk? We've written a comprehensive report that explains the level of uncertainty in the Canadian real estate market.

Our forecast inputs:

3. Should Investors Sell?

From a seller’s perspective, more changes in the market that influence prices downward, so now may be a better time to sell than in two years, and the annual real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

4. Is this a good time to buy?

It’s hard to say, prices have been rising, but there is a downside risk. It seems unlikely that prices will be lower in December than they are today.

Regardless, the annual real estate cycle usually favours buyers in late summer.

If you are in a hurry to buy because you’ve recently expanded your household (Congratulations!), try to drive a hard bargain and pay less than the recent prices for a comparable home in the area. Of course, this is easier in the condo market than in the house market.

As well, when it comes to financing, don't bite off more than you can chew.

Are you Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

The scorching real estate market has resulted in buyers sacrificing home buying rights (CTV , Apr 17)

Booming real estate market has many retirees looking to sell sooner than expected (CTV , Apr 17)

The housing crisis is hitting young people hard, Conseil jeunesse de Montréal says (Montreal Gazette, Apr 14)

Bank regulator proposes higher mortgage stress test level, making it harder to qualify for home loan (CBC, Apr 9)

From first time buyers to luxury homes, Canada's real estate market is on fire (CTV, Mar 30)

Experts split on when, or if, Montreal's skyrocketing real estate prices will come back to earth (CTV , Mar 21)

Like this report? Like us on Facebook.