Metro Edmonton Home Price Forecast - July 2020

HIGHLIGHTS

The impact of Coronavirus on Metro Edmonton will likely be very significant.

Metro Edmonton benchmark home prices are still trending downward, but the value of the median home purchase has dropped significantly. This is a sign that buyers are avoiding the top of the market.

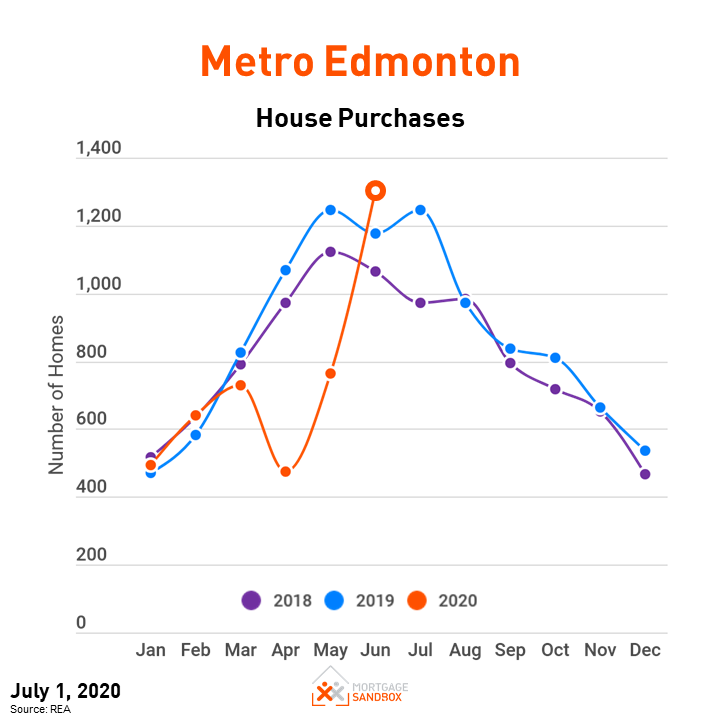

Homebuyers stayed on the sidelines March through May, but in June they jumped back into the market with both feet. In the coming months, we will learn if this is a trend or 3-months of backed-up demand piled into one month.

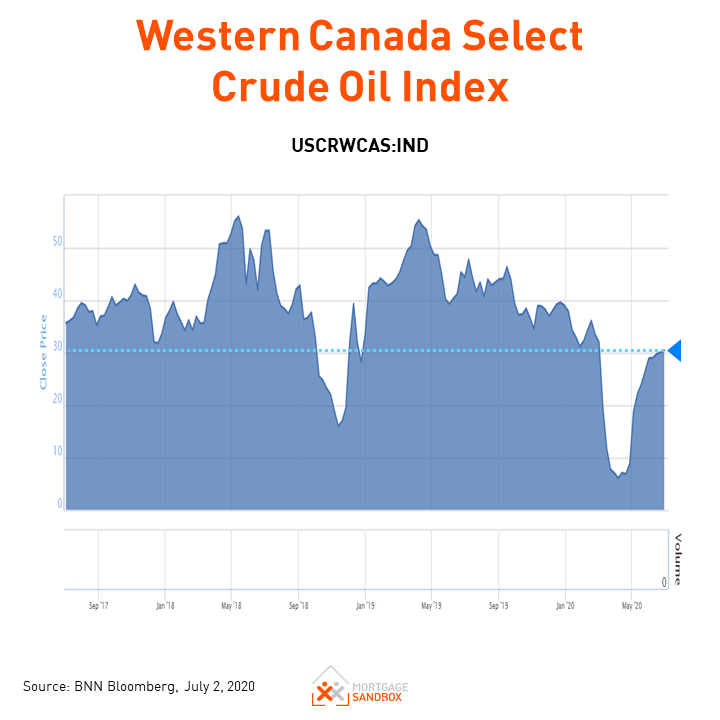

The pandemic has had a severe impact on oil prices and employment, but the impact of job losses will not be felt until October when the mortgage payment deferral program expires. Alberta's continued over-reliance on oil revenue has, once again, made it more vulnerable to global forces.

We are watching several key risks:

The possibility of a second wave and corresponding lockdown in Canada.

How well the U.S. manages the pandemic - roughly 25% of the Canadian economy relies on exports south of the border. As well, most tourists to Canada are American.

The impact of expiring eviction freezes and mortgage payment deferrals. These are delaying the true impact of the pandemic on housing. They can not be extended indefinitely.

A prolonged global economic contraction may continue to depress oil prices.

This article covers:

Where are Metro Edmonton prices headed?

What factors drive the price forecast?

Should investors sell?

Is this a good time to buy?

1. Where are Metro Edmonton prices headed?

Home Price Overview

Homebuyers are happy that prices have dropped over the past few years, and there is little risk of being priced out of the market.

Home sellers may take heart that home prices have been dropping slowly. Given the current recession and pandemic, sellers may want to push ahead and sell during the pandemic. There is no guarantee that home prices will regain the current levels because a Coronavirus induced recession may inflict long-term economic damage.

Coronavirus is now the primary source of uncertainty for home values.

Metro Edmonton Detached House Prices

Benchmark house prices in Edmonton have been following the traditional seasonal real estate cycle while trending downward year-over-year. We had hoped that soon home values would begin to grow 1 to 3% annually – in line with income growth. The Coronavirus pandemic has dashed those hopes.

Whereas typically prices begin to rise in the Spring market, this year prices have dropped.

As always, real estate markets are local and in some Metro Edmonton submarkets, house prices have held steady and in other submarkets, values have been dropping.

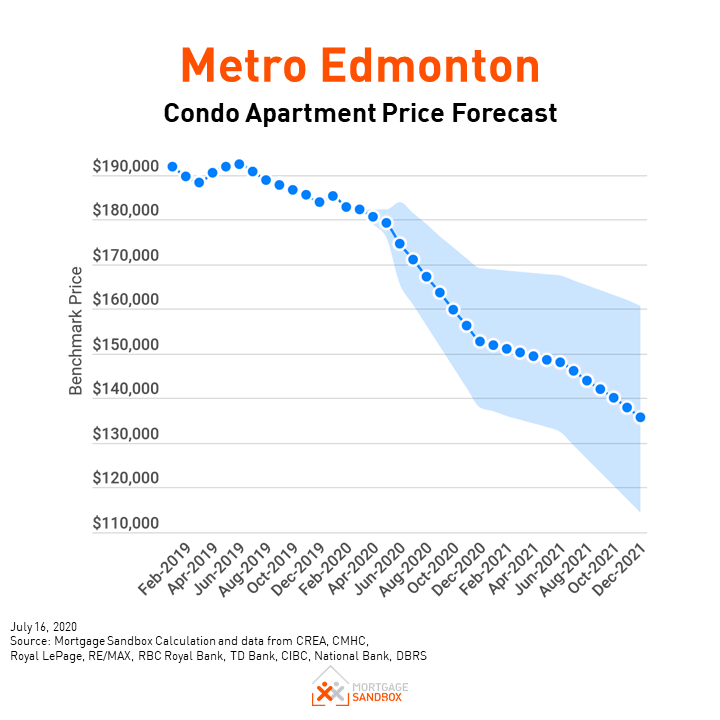

Metro Edmonton Condo Prices

Metro Edmonton apartment prices have been sliding downward for years. Today, a benchmark Edmonton condo is very affordable.

Although sales were picking up, they were broadly in-line with previous years, and prices were not rising because there was plenty of supply. This will be the slowest Spring-Summer for real estate in over 20 years.

Over time, more expensive, higher quality, and larger square-footage (i.e., 2 and 3 bedrooms) condos will drop in price, and this will shift the values downward for more modest condos.

Very affordable for first-time homebuyers

Edmonton’s home prices are very affordable. A first-time homebuyer household earning $94,000 (the median Metro Edmonton household before-tax income) can get a $390,000 mortgage. That’s more than enough for a first-time homebuyer to buy a benchmark $200,000 condo or a $400,000 house. Edmonton does not need any help with housing affordability but it could use some help boosting the economy to attract more homebuyers.

2021 Metro Edmonton House Price Forecast

At the beginning of 2019, Royal LePage predicted house prices in Metro Edmonton would drop 2.4% in 2019 while the Royal Bank forecast a 1.1% rise in Alberta prices. In the end, these forecasters were wide of the mark. House prices dropped 2 to 4% and benchmark apartment prices shed around 4% of their value.

For 2020, the average of the forecasts used in our analysis predicted a modest drop of 1% each of the next two years. CMHC provides a range and their best-case scenario resulted in a price rise of 2% in 2020 but their pessimistic scenario anticipated price would drop 5%.

A second wave containment effort?

Two key assumptions underpin the more optimistic home price forecasts:

COVID-19 control measures in in Canada will be gradually relaxed — but not eliminated entirely — over the remainder of 2020. There will not be a second or third “lockdown” in response to new waves of infection.

Unemployment will not exceed 15%.

At Mortgage Sandbox we are placing greater emphasis on the forecasts that include a ‘second wave” of infection.

At Mortgage Sandbox, we are placing greater emphasis on the forecasts that include a ‘second wave’ of infection.

Dr. Anthony Fauci, director of the U.S. National Institute of Allergy and Infectious Diseases, believes the second wave of coronavirus infections is ‘inevitable.’

A study headed by Dr. Kristine A. Moore, medical director at the University of Minnesota Center for Infectious Disease Research and Policy, warns that the pandemic will not be over soon and that people need to prepare for possible periodic resurgences of disease. Optimistically, a vaccine will not be widely available until mid-2021 and 70% of the population would need to be infected to provide herd immunity. Unfortunately, more than 30% of the population have conditions that make them vulnerable.

Forecast adjustment for COVID-19

In a presentation to the Federal Standing Committee on Finance on May 19th, CMHC’s CEO revealed that the agency now expects average Canadian home prices to fall between 9% and 18%.

In a March interview, Brendan LaCerda, a Senior Economist with Moody’s Analytics, estimates that each 1% rise in unemployment results in a 4% drop in home prices.

Using this ratio, a prolonged 2.5% rise in Alberta unemployment to 8.5% would result in a 10% price drop and a 5% rise in Alberta unemployment to 11% would lead to a 20% fall in values.

The figures above do not include the folks who are unemployed but currently are not looking for work.

For a more thorough comparison of the Coronavirus Recession to the Great Recession and the Great Depression and their impacts on property prices, check out our recent article: “Should I sell my home today?”

cast, and the average forecast. Want to learn more about real estate risk? We’ve written a comprehensive report that explains the level of risk in the Canadian real estate market.

Our forecast inputs:

2. What forces drive the price forecast?

Mortgage Sandbox 5 Forces Framework

At the highest level, supply and demand set house prices and all other factors simply drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are core demand, non-core demand, government policy, supply, and popular sentiment.

In the long-run, the market is fundamentally driven by economic forces, but in the short-run, sentiment can drive prices beyond economically sustainable levels.

Below we will summarize how the five factors result in the current Edmonton forecast.

Core Demand

Core demand is a function of:

Population Growth: The pace at which people are moving to an area. An average of roughly 2.5 people live in one household.

Home Price Changes: Changes in the market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: Your maximum mortgage is calculated using income (i.e., how much money you can put toward mortgage payments) and interest rates (how big are the mortgage payments).

Home Price Changes

From the peak, prices have dropped 9 to 21% depending on where you’re looking and what type of home you want. Lower Edmonton prices improve affordability and improved affordability should add upward pressure on prices.

Savings-Equity

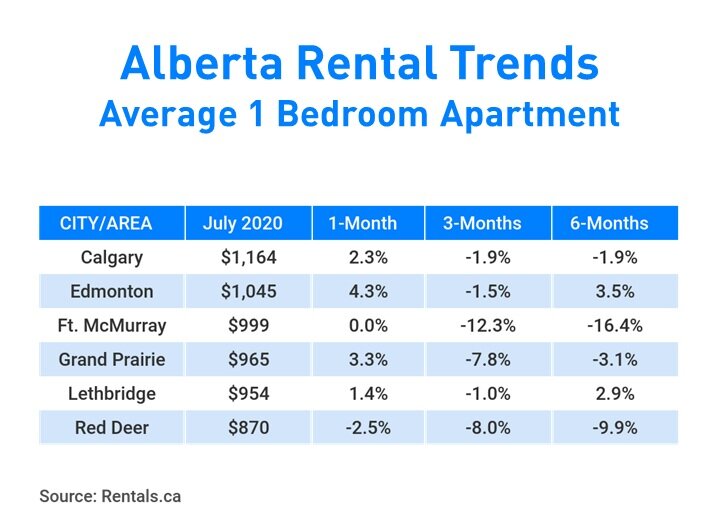

With rents dropping, first-time buyers were able to save for a down payment.

On the downside, anyone who invested their future down payment in the stock market may now find out they need to save for a few more months, or years.

In the short-run, home prices will drop further, and this will reduce homeowner equity. This loss of equity makes it more difficult for people in ‘starter homes’ to move up the housing ladder.

Financing

Median incomes have not changed materially, but employment levels are dropping. To mitigate the impact, the Bank of Canada has reduced rates dramatically, but mortgage qualifying interest rates have not fallen nearly as much.

Before the Coronavirus, the Bank of Canada believed one of the most critical risks to Canada’s financial system was a severe nationwide recession. We now know that a recession is upon us.

Incomes in Alberta are higher than in other provinces, and that should help home price inflation. Unfortunately, unemployment in Alberta has doubled with the Coronavirus Recession, and job losses will have knocked a lot of people out of the housing market. An MNP survey released June 22nd says, half of Albertans’ report that their work situation has been affected by the pandemic.

Even though homebuyers stayed on the sidelines March through May, in June they jumped back into the market with both feet. In coming months, we will learn if the jump in June purchases is the beginning of a new trend or represents 3-months of backed-up demand piled into one month. Or even panicked buyers trying to complete a purchase before new mortgage rules com into effect.

Even after people get re-hired, they will need to be on the job for three months before they will qualify for a mortgage pre-approval. As well, small businesses and commission salesforce have to show 2 years of consistent income to qualify for a mortgage. Unless banks change their policies, 2020 will drag down their mortgage qualifying income until mid-2023 (when they file their 2022 taxes).

Overall Core Demand

Overall, due to the impacts of the Coronavirus, short-term core demand for homes will be much lower than it was in 2019.

Non-Core Demand

This represents short-term investment, long-term investment, and recreational demand (i.e., homes not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Since non-core demand is ‘optional’ (i.e., not used for to shelter your own family), it is more volatile than core demand.

Foreign Capital

Before the Coronavirus, the Canadian Association of Petroleum Producers predicted that capital spending would drop again for a fifth consecutive year in 2020. They felt activity would not improve without better market access via pipelines and construction of the Trans Mountain Pipeline is likely a long way from completion.

Foreign capital inflows have been a significant influence in Vancouver and Toronto and the travel bans are expected to have a high impact on those markets. This is less of a concern in Edmonton because, in recent years, real estate has been less dependent on foreign capital.

Long-term Rentals

As it relates to our analysis, we expect domestic interest in long-term rental income properties will dry up so long as Coronavirus eviction bans are in place. The government has not developed an exit strategy for landlords with rent arrears when social isolation policies are lifted. How will tenants repay three to six months of rent arrears?

Rental investors will simply try to time any future property purchases for the end of Coronavirus containment period, and they will avoid properties with tenants who have outstanding rent arrears.

As well, recent reports of rents falling across Canada will discourage new rental investment until rental rates stabilize.

Short-term Rentals

Edmonton has roughly 2,400 short-term rentals. 63 percent are ‘commercial operators’ and rent the entire home.

The travel bans will effectively shut down short-term rentals for the next few months (Canada’s tourist high season). We expect diminished interest in buying houses and apartments to be used as short-term rentals.

House Flipping

With the uncertainty brought on by the Coronavirus, house flippers will pull out of the market until they believe that prices are near the bottom. At that time, they’ll go bargain hunting but that could be several months away.

Dark Money

Dark money is proceeds of crime or money that is transferred to Canada illegally. This includes money earned legitimately that is illegally transferred from countries with capital controls (e.g., China) and legitimate earnings moved from countries who are the subject of international sanctions (e.g., Iran, Russia, and North Korea).

In order to hide the illegal nature of the funds, it is laundered in the real estate market. Sometimes the true owner of the property is hidden by using a Straw Buyer and other times the property is owned by a shell company.

Sometimes a real estate agent or lawyer will accept the illegal cash to help the nefarious individuals hide its true origins. In 2015, a B.C. realtor was caught with hundreds of thousands of dollars in her closet, at home.

We see no evidence of a diminished role for dark money in local real estate. A recent report says Alberta is to blame for the majority of Canada’s money laundering.

Overall Non-Core Demand

The net effect of all the recent changes will reduce inflows of capital toward residential real estate for non-core uses, and this will put downward pressure on Edmonton home prices.

Government Policy

Governments are now trying to protect against a housing crash.

Mortgage and Housing Agency Tightens Mortgage Rules

Effective July 1st, CMHC has made changes to their mortgage rules that disqualify roughly 10 percent of potential homebuyers with Fair-Poor credit. The remaining buyers who qualify for a mortgage will qualify for 10 to 8 percent less money.

The purpose of the change, is to protect taxpayers from having to cover the costs of bad loans.

COVID-19 Support Measures

Mortgage Payment Deferral

A typical mortgage deferral is an agreement between the borrower and the lender to pause or suspend mortgage payments for one or two months. For the Coronavirus, they have extended this for up to 6 months.

After the agreement ends, your mortgage payments return to normal. The mortgage payment deferral does not cancel, erase, or eliminate the amount owed on your mortgage. The borrower still accrues interest that will have to be paid.

A Canadian with a $250,000 mortgage who defers their mortgage by six months adds approximately $4,000 in accrued interest to their mortgage balance.

IMPORTANT: Statistics in May, show that 26 percent of Alberta mortgage holders applied for mortgage deferrals. Mortgage deferrals expire after 6 months and that means by October many of these deferrals will have expired. Unless these borrowers have found new work they will fall into default.

Eviction Bans and Suspensions

The Alberta government has restricted evictions tenants who are unable to pay rent until August 14, 2020, landlords are required to negotiate a payment plan with their tenant to cover any unpaid rent.

Short-term Rentals to Require a Business Licence

The City of Edmonton is debating new rules for short-term rentals, however, it doesn’t appear that these rules will have a large impact on the short-term rental industry.

Supply

Supply comes from two sources.

Existing sales: Existing home sales are sales of ‘used homes’. They are homes owned by individuals who sell them to upgrade, to move for work, or some other reason. The Calgary Real Estate Board only reports existing home sales and listings.

Pre-Sales and Construction Completions: Most new homes are sold via pre-sales before the construction has started. These are predominantly apartments and townhomes. Data on pre-sales is private and difficult to find, but construction starts (reported by the government) are a very accurate lagging indicator of pre-sale activity.

Rising supply releases the upward pressure on prices caused by demand.

Months of Supply of Existing Homes

At the beginning of 2020, sales were higher than in previous years. Spring is traditionally the busy season for real estate activity; however, this year was one of the slowest Springs in over a decade.

Coronavirus short-term rentals sold or converted (short-term impact)

Travel bans will effectively shut down short-term rentals for the next few months (Canada’s tourist high season). The drop in bookings may force many owners of apartments primarily used as short-term rentals to sell their condo or repurpose it for long-term rentals adding up to 2,400 homes to the market in the next six months.

We surveyed over 50 Canadian real estate agents, and 50% had observed short-term rentals being listed as long-term furnished apartment rentals while 25% of agents expected most short-term rentals would be sold.

Mortgage Delinquencies and Foreclosures

The most recent data indicates that more Canadians are missing their monthly payments, and job growth has been healthy. Some economists have been warning of a recession, and even without a recession, it appears more Canadians are over-extending themselves. Surprisingly, the increases in delinquencies are led by Ontario and British Columbia, and not Alberta.

According to Equifax, the credit bureau company:

“Mortgage delinquencies have also been on the rise. The 90-day-plus delinquency rate for mortgages rose to 0.18 percent, an increase of 6.7 percent from last year. Ontario (17.6%) led the increases in mortgage delinquency followed by British Columbia (15.6%) and Alberta (14.8%). The most recent rise in mortgage delinquency extends the streak to four straight quarters.”

A recent survey by MNP reported a staggering number of Canadians are stretched to their limits:

“Over 30 per cent of Canadians say they’re concerned that rising interest rates could push them close to bankruptcy, according to a nationwide survey conducted by Ipsos on behalf of MNP, one of the largest personal insolvency practices in the country.”

Job losses from Coronavirus containment will worsen this situation. Although the CMHC can help Canadians via Canadian lenders offers options to defer payments, re-amortize mortgages, add interest arrears to your mortgage balances. It will not help overextended Canadians from their credit card debt nor will it protect Canadians who chose to finance their homes with private mortgage lenders. Many Calgarians turned to private mortgage lenders to help them through recent economic tough times and those private lenders may get cold feet and ask to be repaid as the Coronavirus crisis unfolds.

Baby Boomers Downsizing?

According to a recent survey, 44 percent of Alberta Boomers who own a home plan to downsize in the retirement and 45 percent would consider a condo apartment for their next purchase. Nationally, a vast majority of Boomers want to live in their home forever, but for many that will not be possible. Most of them are not on track to have enough savings in retirement. The Coronavirus Recession won’t help.

An RBC survey says, “Over the coming decade, we expect baby boomers to ‘release’ half a million homes they currently own—the result of the natural shrinking of their ranks, and their shift to rental forms of housing, such as seniors’ homes, for health or lifestyle reasons.”

As baby boomers begin downsizing and list their large and expensive homes for sale, they will add supply in what is considered the luxury market. If not enough Gen-X and millennial buyers are to buy these expensive homes, there is a risk that this may depress prices at the top of the market, which will then compress prices for townhomes and condo apartments.

In the medium-term, there are risks of excess housing supply.

Pre-sales and Completions

New Construction

Near-record number of condos were built in 2019 and although housing starts have dropped the demand from Baby Boomers should continue to provide support for apartment construction. As more buildings complete in 2020 and 2021, and people move out of their rental or sell their current home, this new supply should help maintain a balanced market.

Pre-sales

Pre-sales, are purchases of brand-new homes from developers. We have no direct data for Calgary, but housing starts are a very good lagging indicator that pre-sales are continuing just as strong as prior years.

Pre-sales will trend down as showrooms close during the pandemic. When social distancing measures are lifted developers will likely try to entice buyers with price discounts, move-in allowances, and cool amenities.

Popular Sentiment

The economy is reopening, and it’s time to break out the champagne! We need to celebrate the small victories because there is a long road ahead. 96 percent of Canadian oil is exported to U.S. markets, and the United States has not been managing the pandemic well.

Alberta’s economic hard times, media coverage of low oil prices, delayed pipelines, and rail blockades all weigh on local buyer sentiment. There's no way of predicting popular sentiment, but as witnessed in the past two years, sentiment can shift quickly.

If cases in Alberta begin to rise again, then we can expect sentiment to worsen. In the short-term, we expect buyers will hold back while many sellers will move forward.

The Nanos Canadian Confidence Index has shown a noticeable drop in confidence. “Consumer confidence among Canadians remains net negative but continues to be on the rise.’ It is still well below the low that was reached during the 2008 Financial Crisis.

3. Should Investors Sell?

From a seller’s perspective, there are more changes in the market that influence prices downward so now may be a better time to sell than in two years and the seasonal real estate cycle usually favours sellers in the first half of the year.

With Coronavirus containment efforts, open houses may be impossible. However, you can get a Realtor to help you plan small repairs and improvements to your home so that it will be ready when the real estate market thaws.

Sellers should always consult a mortgage broker early to prioritise flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

Planning to Sell? Check out our Complete Home Seller’s Guide.

4. Is this a good time to buy?

With lower prices, homebuyers who waited have been rewarded and Coronavirus containment efforts will push prices further downward.

It is likely that prices will drop significantly in 2020 so a wait-and-see strategy is advisable. Regardless, the seasonal real estate cycle usually favours buyers in late summer.

If you are in a hurry to buy because you’ve recently expanded your household (Congratulations!), just be sure to drive a hard bargain and pay less than the recent prices for a comparable home in the area. As well, when it comes to financing, don't bite off more than you can chew.

Planning to Buy? Check out our Complete Home Buyer’s Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

No Nosedive Ahead for Canadian Real Estate Prices (RE/MAX, May 22)

In Canada’s oil capital, a real estate glut compounds the misery (BNN Bloomberg, Apr 21)

Residential real estate: a reckoning or just a softening? (Morningstar, May 20)

Home prices won't recover from COVID for at least 2 years, CMHC says (CTV, May 5)

Canadian Housing Market Will Stay Down ‘For Years’ Due To Lower Immigration (HUFFPOST, May 2)

Like this report? Like us on Facebook.