Interest Rate Forecast to End of 2019

Last week, we discussed the value of understanding interest rates and the consequences of interest rate changes to your lives. This week, we offer you our quarterly analysis of interest rate forecasts provided by leading financial institutions in Canada and translate these into mortgage rate forecasts. We provide a 2-year forecast to help you decide whether to lock in your mortgage rates or leave them floating.

There have been some minor updates to interest rate forecasts since our last review of rates in March. The overall trend remains upwards, with little debate over how large the rise will be in the next 6 months and but there is more uncertainty in the long run.

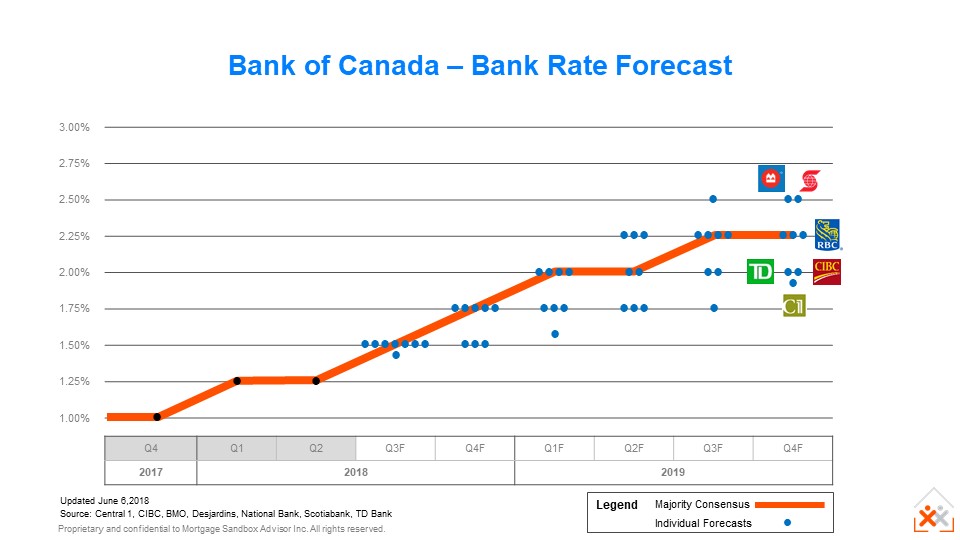

Why do we look at Bank Rate forecasts?

Variable and adjustable mortgage rates are tied to the Bank Rate (the rate at which banks can borrow from the Bank of Canada).

Central 1 were the sole forecast of the 8 we track with any significant change, their projection for the end of 2019 has dropped from 2.25% to 1.90%.

By the end of 2018, a majority of economists expect at least two more rate increases. RBC and National Bank earlier this year were predicting 3 increases but lowered their forecast after rates did not increase at the end of May.

The prime mortgage rate will rise with increased interest rates, so expect variable and adjustable mortgage rates to rise 1% by the end of 2019.

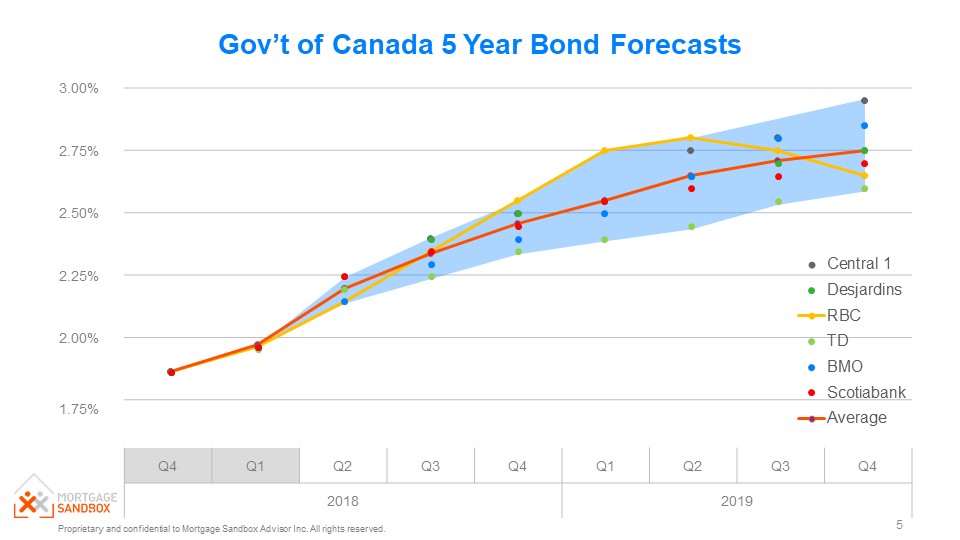

5-Year Fixed Mortgage Rate

5-year government bonds and 5-year mortgage rates move together so one is an ideal guide for the other.

There have been no dramatic changes in the government bond forecasts within the group of 5 institutions we follow. However, both RBC and BMO dropped their peak rates. Interestingly, RBC now project rates to peak in early 2019 at 2.80% and sink to 2.65% by the end of 2019 (The gold trend line on the chart below).

RBC’s unique prediction is one we are playing close attention to. There is a number of factors that influence bond yields which includes private sector saving, economic prospects, interest rates, and inflation. We can infer from the RBC forecast that they expect increased inflation, interest rates, and strong economic growth in the short term. The decline after early 2019 is of more interest. With interest rates predicted to rise (a factor that usually signals upward movement of bond yields), the predicted decline in bond yields would likely be due to a combination of decreased inflation and weakened prospects for economic growth. This predicted drop could even be signaling a recession to come, though it is difficult for us to be certain of this.

We reached out to RBC to try to better understand their prediction. Josh Nye, RBC economist, explained that they expect the BoC to pause the rate increases by 2020 to stay below the 2.5%-3.5% ‘neutral rate’*. They argue that 5-year bond rate will begin to drop because Canadian yields will ‘overshoot’ as the BoC reaches the rate increase pause.

Regardless, of differences in opinion over when rates will peak, all forecasters predict the 5-year rate will be more than ½% higher at the end of 2019.

Based on these forecasts, you will see that locking in today’s 3.50% 5-year mortgage rate will start benefiting you in 2019 if variable rates climb to 3.65%.

If you are inclined toward a fixed rate mortgage, our advice is to speak to a Mortgage Broker as early as possible to lock in a rate. You can lock in a rate up to 120 days before closing on a home sale or the renewal of your mortgage.

Mortgage Rate Forecast

| Rate | Dec 2016 | Dec 2017 | Today Jun 2018 | Dec 2018 | Dec 2019 |

|---|---|---|---|---|---|

| Prime Rate | 2.70% | 3.20% | 3.45% | 3.95% | 4.45% |

| 5 Year Variable Mortgage Rate | 1.90% | 2.60% | 2.65% | 3.15% | 3.65% |

| 5 Year Fixed Mortgage Rate | 2.49% | 3.25% | 3.50% | 3.80% | 4.15% |

| 5 Year Fixed Mortgage Qualifying Rate1 | 2.49% | 3.25% | 5.50% | 5.75% | 6.15% |

*Neutral Rate - The neutral interest rate of 2.5%-3.5% is appropriate when real GDP is growing around its target rate of 2%, and inflation is stable around 2%. Similar to when you’re cruising on the highway, neither accelerating or decelerating, with your foot just enough on the gas to keep a constant speed.