How will Coronavirus affect Canadian real estate?

At the end of February, the World Health Organization (WHO) upgraded the global risk of the coronavirus outbreak to "very high" - its highest level of risk assessment. Many scientists specialized in infections diseases are now advising people in Canada to prepare for an outbreak. This virus is unique in that many people who are infected will never show any symptoms. With SARS or Ebola, it’s obvious that someone is sick. With Coronavirus, you can appear perfectly healthy, have no fever or other symptoms, and carry the virus and spread it to others. It may take up to 18 months for a vaccine to be developed and Chinese data seems to show a 2% fatality rate among the people who show symptoms and are diagnosed positive. According to The Scientist, the most vulnerable to Coronavirus are the elderly, as well as people with heart disease, diabetes, asthma, chronic respiratory problems, high blood pressure, and cancer.

Presently, the virus has been most disruptive to Mainland China, Hong Kong, Iran, Italy and South Korea. But there have been cases reported in Canada and the U.S. that have no direct connection to international travel.

There will be a tragic human toll however this article will focus on the impact of Coronavirus on Canadian real estate. Simply put, Coronavirus could have devastating consequences on the Canadian Real Estate Market.

In this article we explore:

How will Coronavirus in other countries impact Canadian Real Estate prices?

How will an outbreak in Canada impact home prices?

Foreign buyers will find it more difficult to leave their home countries

In 2017, industry estimates suggested between 5 to 10 percent of Toronto homes were bought by foreign buyers. Since then a foreign buyer tax was introduced in Ontario. Official figures now show foreign buyers making up a far smaller share of the market. Unofficially, the levels of foreign investment are likely the same. Foreign buyers can incorporate a Canadian holding company, with limited information about the owners, and if the Canadian company buys a property enabling the foreign shareholders to avoid the foreign buyer tax. This tax avoidance scheme and rampant money-laundering in Canadian real estate are the reasons that British Columbia is implementing a beneficial ownership registry in May 2020. No other Canadian province has followed British Columbia’s lead. For the purposes of this article, let’s assume foreign buyers make up approximately 5% of Vancouver, Toronto, Ottawa, and Montreal home buyers. Restrictions on people coming into Canada will have a serious impact on the property market.

As we have seen in China and Italy, countries restrict the movement of their residents when they are battling the Coronavirus. People living in these areas will be distracted by containment efforts and not thinking about foreign real estate investments. The few who do think about Canadian real estate will find it difficult to come to Canada.

In China, no one is questioning the seriousness of the Coronavirus. In Hubei Province, a major manufacturing region in China, more than 70,000 people have been stricken, according to official figures. Foreign medical experts have suggested that the true total may be much higher. The restrictions are having an enormous impact on the Chinese economy.

China has imposed mandatory 14-day quarantines, roadblocks, and checkpoints across much of the country, including in provinces far from Hubei where there have been only a handful of cases.

Restrictions like those in China are spreading to other countries, many of which are sources of foreign investors in Canadian real estate. For example, in Italy, eleven towns and villages in Lombardy, the region around Milan, and Veneto, which includes Venice, are in a quarantined red zone, home to a total of 55,000 people. The Italian virus outbreak is in the northern industrial heartland of the country and these restrictions will impact the country’s fragile economic growth. Interestingly, many countries are refusing entry to Italians. We interviewed an Italian living in Paris who hadn’t been to Italy in 6 months and he was refused entry to Israel.

In addition to domestic containment efforts that restrict movement, global airlines are cancelling flights between the affected countries. On February 25th, Air Canada cancelled all flights to and from China up until April 10th. More broadly, airlines all over the world are raising isolation for other affected countries.

China and Hong Kong: Most North American commercial airlines, including Air Canada, United, American and Delta, have suspended all flights to and from mainland China.

South Korea: Delta Air Lines is suspending its Minneapolis-to-Seoul line until the end of April and reduced Seoul-bound flights from Atlanta, Seattle and Detroit, while Hawaiian Airlines has also cut flights between Honolulu and Seoul until April 30. Air Canada still flies to Seoul.

Italy: Budget airline EasyJet has cancelled some flights to Italy as demand for flights to Milan falls. British Airways is cancelling 56 round-trip flights between London and Milan, Bologna, Venice and Turin. Italy is now the largest cluster of cases outside Asia, with more than 300 infections. Wizz Air and Brussels Airlines have also cut their Italy schedules. Donald Trump said at a controversial press conference on Wednesday that he may consider an Italy travel ban which would be ineffective since Italians could easily fly to the U.S. via neighbouring European Union countries with open borders like France or Austria.

Japan: United has suspended flights to Japan due to coronavirus fears.

Iran: The country has one of the highest death tolls outside China, and several cases across the Middle East have been linked back to Iran. Oman’s civil aviation authority has suspended all civil flights with Iran, while the UAE has issued travel bans to Iran. Turkey closed its land border and Turkish Airlines — the leading foreign airline in the country — ceased all flights to and from Iran on February 23rd. Emirates and Qatar Airways are the only remaining foreign carriers still flying to Iran, but Qatar Airways is quarantining passengers who return from Iran or South Korea and are showing symptoms.

If you live in any of these countries, you have more important concerns than how to buy a Toronto condo or a house in West Vancouver. Now consider that all of this happened in 30 days! Imagine for a moment what the next 90 days will be like. The medium-term impact could send shudders through the Canadian housing market and put downward pressure on prices.

If more Canadians get infected, the real estate market will freefall

Officials on the US West Coast have reported three unexplained coronavirus cases, raising concerns the virus could be spreading within the community. Canada is already preparing for a pandemic and Canadian public health expect widespread transmission will lead to 'social distancing' measures.

Deputy Chief Public Health Officer Howard Njoo says that, if there is a widespread infection, Canada will look at cancelling certain mass gatherings and public events. Like China, Italy, and Japan, Canada will close schools, cancel sporting events, rock concerts, and other social gatherings.

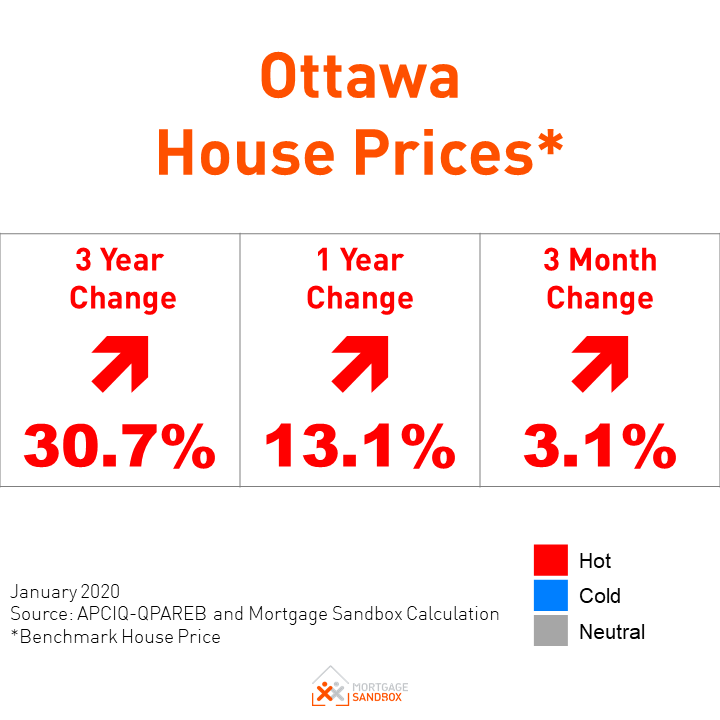

Aside from what is required by the government, we can expect homebuyers will be afraid to attend open houses. In Vancouver, prices are only a few months into recovery after an 18-month slump. In Ontario, the real estate markets in the Greater Toronto Area and Ottawa have been soaring for years. A sustained outbreak of the virus in Canada could bring prices back to Earth.

China’s property market has slowed to a crawl with the spread of the virus. A local home seller from Chengdu, one of China’s biggest and fastest-growing cities, says, “It’s been like a desert.” “Nobody has come since the outbreak.”

According to Lawrence Yun, chief economist at the United States National Association of Realtors, China has been the greatest source of foreign demand for U.S. real estate. Chinese buyers have a strong appetite for luxury high-rise condominiums, and he predicts that the virus in China will cause upper-end luxury properties in California and New York to be softer as a result. If there are risks in those luxury markets, then the risk extends to the luxury markets in Vancouver, Toronto, and Montreal.

In the medium term, these social distancing measures, widespread disruption due to employees working from home or people under quarantine will lead to lower economic growth and potential job losses. For example, imagine if the NHL hockey playoffs were cancelled and how the earnings of sports bars and hockey arenas would be impacted. What if a small business owner were quarantined and they had to close their business for the 14-day quarantine period.

The Bank of Canada lowering interest rates will not help in these circumstances. Lower interest rates will not reverse social distancing and other containment measure and they will not restore business revenues. Credit card rates will still hover around 20 percent and people with employment uncertainty will still have difficulty qualifying for mortgages regardless of the interest rate.

Nothing is guaranteed

Regardless of how dire the situation looks at the moment, there is a chance that coronavirus will be contained and relegated to a historical footnote like SARS.

However, the Canadian Mortgage and Housing Corporation, a federal government agency, identified Vancouver, Toronto, and Hamilton to be moderately vulnerable to a housing correction before the Coronavirus was discovered. Victoria was identified as being at high risk. UBS, a large Swiss bank specialized in serving the world’s ultra-wealthy, has identified Vancouver and Toronto as having housing bubbles.

Coronavirus could be the event that tips these markets into the negative. The Toronto market has been so hot lately that it’s hard to imagine a correction, but the facts point to genuine real estate market risk.

Like this post? Like us on Facebook for the next one in your feed.