How do the two home price cycles affect home prices?

There are two distinct cyclical home price patterns in real estate – economic and annual.

The economic home price cycle typically lasts around a decade and significantly affects home prices. The annual cycle has a less-powerful impact on home values, but as a home buyer or seller, you can save or earn money by using these cycles to your advantage.

Homeowners who are living in their ‘forever home’ shouldn’t need to pay much attention to these cycles. This information is most relevant to people who have plans to buy or sell.

In this article, we will explore:

The four phases of the economic real estate cycle

The four seasons of the annual real estate cycle

Before diving into the details, let’s establish some common vocabulary:

Vacancy Rate – The percentage of rental units in a market that are unoccupied (empty).

Construction Rate – The number of new units built in a given period.

Rental Rate – The monthly cost of renting a home.

Absorption Rate – The rate at which homes listed for sale are purchased.

Recession – A recession is declared when the economy shrinks for two consecutive quarters (6 months).

Buyer’s Market – A real estate market in which it would take 9 or more months to absorb all of the available homes on the market. In this market, prices tend to stagnate or decline because there are many sellers and fewer buyers. Buyers then use their strong negotiating position and push sellers to accept a lower price.

Seller’s Market – A real estate market in which it would take 5 or fewer months to absorb all of the available homes on the market. In this market, prices tend to increase above recent comparable sales because the negotiating power lies with the sellers. In this market, buyers are often forced to engage in bidding wars.

The Economic Real Estate Cycle

There are four phases of the economic cycle. Sometimes the economic cycle impacts Canada as a whole, while other times, provinces experience regional slow-downs.

Phase 1: Recovery

The recovery phase comes immediately after prices hit the bottom of a cycle and levelled-off. Prices in this phase are flat or rising.

Home purchases begin low, when compared to recent years but growing. This phase has low absorption rates, fewer homes are under construction, high (but decreasing) vacancy rates.

This phase is characterized by improving economic conditions, like wage growth and higher employment. The good economic news improves buyer sentiment while also providing them with bigger paycheques, and that leads to stable or rising home prices.

During the recovery phase, the real estate market transitions from a buyer’s market to a balanced market.

Homebuyers

In the beginning, buyers slowly re-enter the market to take advantage of the low home prices. As the economy recovers and home purchases pick-up steam, home values begin to appreciate.

Interested buyers should consider moving quickly during this phase before the market tilts to in favour of sellers and prices accelerate.

Home Sellers

While home values are steadily improving, homeowners are reluctant to sell. Those homeowners with intentions to sell, recall the prices at the peak of the market and want to wait until prices have recovered closer to the previous peak. It can take between a year and a decade for values to reach a previous market peak, depending on the severity of the downtown and the strength of the recovery.

NOTE: Sellers, who plan to buy another home immediately, should keep in mind that selling at the close to the bottom of the market reduces your realtor commission costs because Realtor commissions are a percentage of the sale price. Selling low shouldn't hold you back from buying a new home because your new home will be purchased close to the bottom of the market as well.

Phase 2: Expansion

In the expansion phase, the economy is growing and reaching full capacity. Unemployment is falling, companies complain that they can’t find talent, and consumer confidence is continuing to improve. Home listing absorption rates are high, and vacancy rates are falling. Developers respond by pre-selling lots of condos, and you'll see cranes sprouting in major urban centres.

Homebuyers

At this point in the cycle, the market shifts from a balanced market to a seller’s market. There is more than one homebuyer for every five homes for sale. Buyer competition begins to lead to bidding wars and an upward acceleration in home prices.

This phase is not the best time for buyers looking to get a deal because buyers have such low negotiating power. For renters, the benefits of buying at a high point in the cycle may outweigh the cost of paying rent while you wait for the cycle to run its course.

Home Sellers

Rising home values and buyer demand makes the expansion phase an ideal time for people who intend to sell within a 3-year timeframe to put their homes on the market.

NOTE: Sellers who plan to buy another home immediately should keep in mind that selling at the peak raises your costs. Realtor commissions are tied to the sale price, and even though you sold your home at a peak price, you will likely buy your next property at a peak price too.

Phase 3: Recession

As of June 2020, Canada is in a recession.

Recessions usually last between six months and a year and are characterized by a balanced or buyer’s market.

In a recession, job losses force young people to move back home, and homelessness and vacancy rates rise. Some of the people out of work will be in a tight enough financial situation that they’ll need to sell their home, or they will need to sell their home to take a job in another city. All of this leads to higher sales listings.

Prices usually don’t drop right away because the real estate market is slow-moving, but prices do level off and begin to fall. People can collect employment insurance for almost a year. As well, a cash strapped borrower has to miss three months of payments before a lender will begin to turn up the pressure.

In the 2008 recession, U.S. mortgage delinquencies were 3% immediately before the recession. Delinquencies peaked at 12% six months after the recession had ended.

Recessions are incredibly challenging to predict. Typically, even with our never-ending efforts to avoid the economic cycles, there is a recession every seven to ten years.

Homebuyers

As homes get listed in a market full of uncertainty, the market advantage tilts toward a buyer’s market with more than 9 homes listed for every motivated homebuyer.

With bad economic news percolating, homebuyers become scarce. Job losses take a bite out of many people’s savings and postpone any plans they may have had to buy a home.

The people who have kept their jobs just witnessed a bunch of their colleagues get laid-off, so they are not feeling as comfortable committing to a mortgage. The result is fewer buyers on the market.

Home Sellers

Home sellers don’t want to sell into a weak market, so they will delay listing and hope the market recovers within a reasonable timeframe.

Phase 4: Excess Supply

With vacancy rates and construction completion rates still at a high level, the number of unsold properties pile-up on the market and surpass (current) buyer demand. In the absence of competition to buy the available properties on the market, the home prices continue to drop.

Developers struggle to pre-sell new projects, and since they need to pre-sell 65-75% of a project to secure bank financing, they can’t break ground, and housing starts slow. These factors plant the seed of a future supply shortage.

Buyers are not yet back in the market like they were in the good times. As well, it takes 4 to 6 years for all the condos sold in good economic times to complete construction, so supply will continue to come to market during and after the recession.

“But aren’t those condos already pre-sold!?” Yes, you’re right, they’re usually 70% pre-sold. Most condos are pre-sold to people who live in the same city, either in another condo they own or in a rental. When the building completes, they will vacate their current home (adding supply to the market) to move into their new condo. That is how a recession can lead to excess supply.

IMPORTANT: Past price appreciation is never a guarantee of future price gains. If real estate becomes too expensive relative to local incomes, then it becomes more vulnerable to significant price corrections in a recession.

Homebuyers

If you have stable employment and savings in your pocket, this phase presents a great buying opportunity. You should be able to buy a home at a price well below the peak price. Buying during a downward swing in home prices can set you up for life if you buy the right place at the right time.

IMPORTANT: It’s very difficult to time the market perfectly. If you manage to get a good deal and prices slide a little further, that’s still a win. In the long-run prices will rise and if you bought near the bottom of the market, then you’ll be much better-off than buying at the peak.

Home Sellers

Homeowners who need to sell are confronted with falling property values. If prices have not already bottomed out during the recession, they certainly will when excess supply comes to market.

Past Economic Real Estate Cycles

There are many examples of the economic real estate cycle playing out in Canada’s major metropolitan areas. While each cycle has its own unique characteristics and impacts on housing prices, there are common themes homebuyers and sellers can use to anticipate how future cycles will unfold.

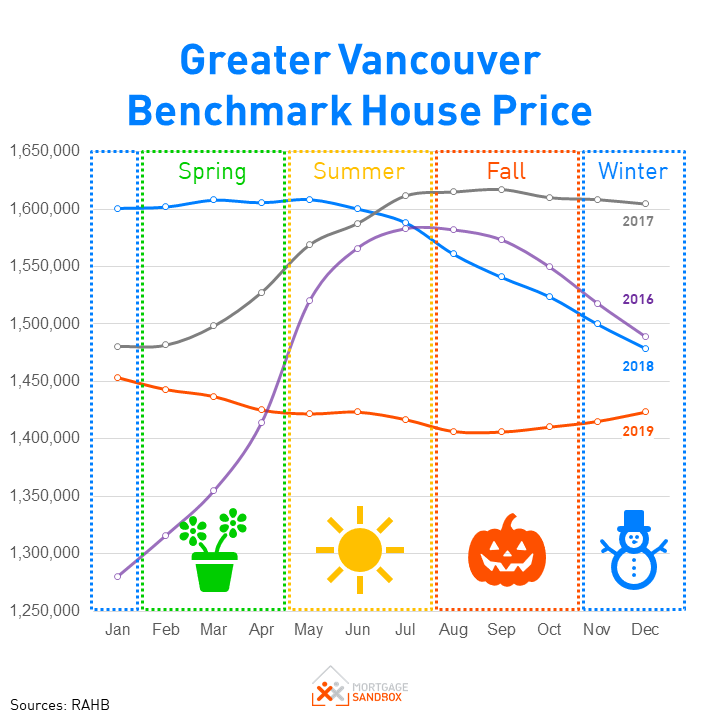

Greater Vancouver (‘V’ Shaped Recovery)

The Vancouver housing market from 2007 to 2010 is an example of the real estate cycle with a quick recovery.

From the peak, prices dropped 14% in 9 months. At the bottom of the market, monthly purchases of homes were 24% lower than the previous year.

Although the effects of the Great Recession reverberated across the world, home values in the Greater Vancouver region recovered to the previous peak in only 20 months. Home values in some U.S. cities still haven’t reached the 2007 peak.

Greater Toronto (‘U’ shaped recovery)

The Greater Toronto housing market from 1985 to 2002 is a good example of a housing bubble leading to a prolonged recovery.

The expansion phase between 1985 and 1989 resulted in a steep rise in the average price of a home in the GTA.

The combination of low unemployment and high population growth throughout the 1980s led to the belief that housing prices would rise indefinitely. A belief that real estate was a zero-risk investment with very high returns helped inflate a housing bubble. The recession only lasted a year but, once the bubble burst, home prices continued to fall 26% over 6 years. Home prices didn’t recover to the 1989 peak until 2002, 13 years later.

Metro Calgary (‘W’ shaped recovery)

Following the ‘Great Recession’, Metro Calgary home values didn’t bounce back the same way that Vancouver did. Although Calgary prices rose in 2010, similar to Vancouver, they subsequently pulled back.

Oil prices were steady during this timeframe, Alberta incomes are higher than anywhere else in Canada, and Alberta was experiencing population growth. This a challenge with real estate markets; sometimes, there are external factors like foreign investment driving the market, and other times homebuyer sentiment is more important than economic fundamentals.

The Annual Real Estate Cycle

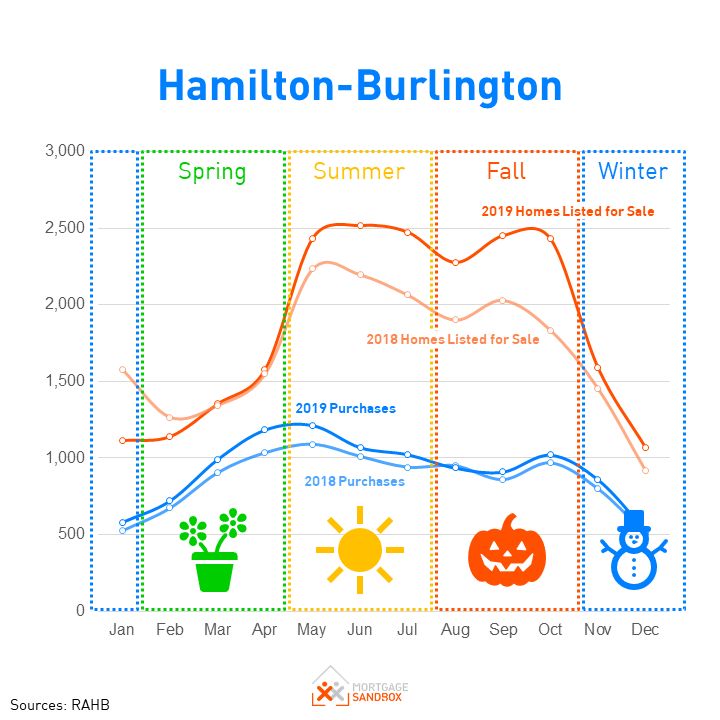

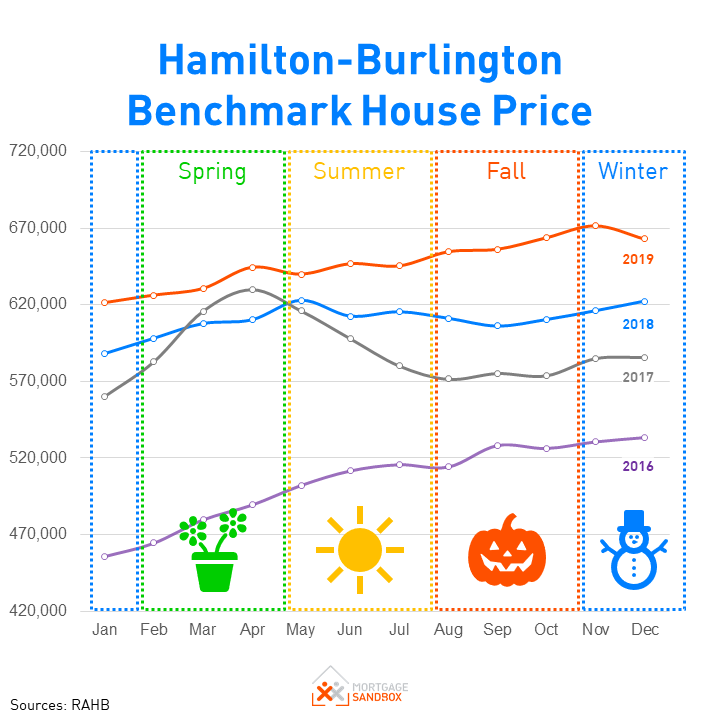

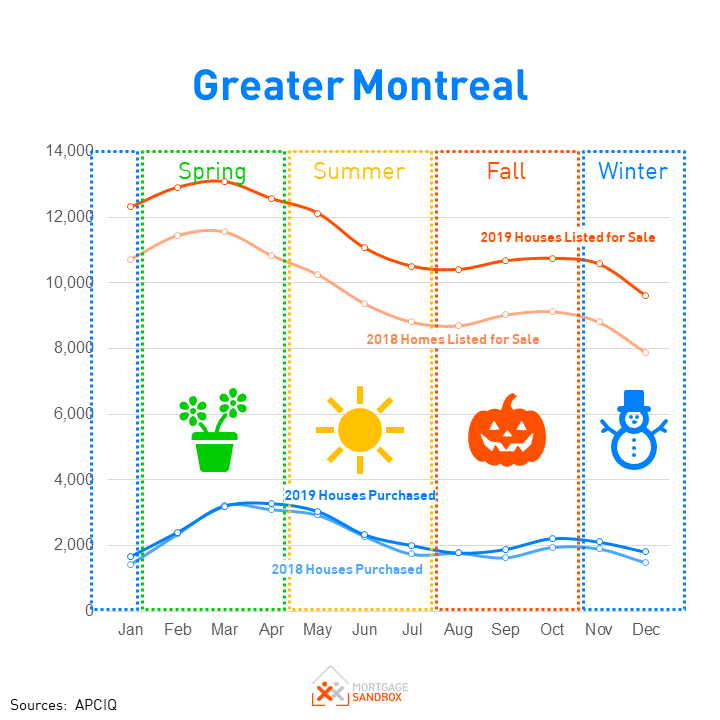

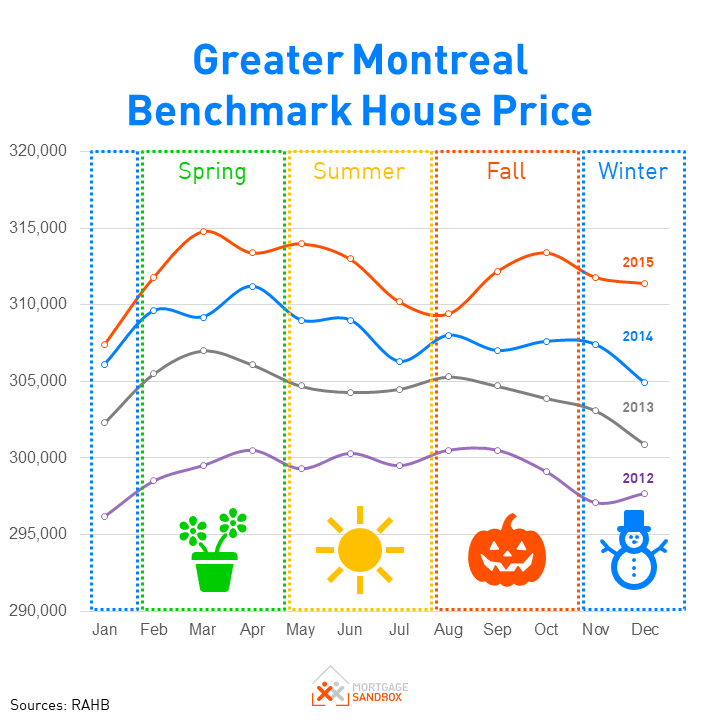

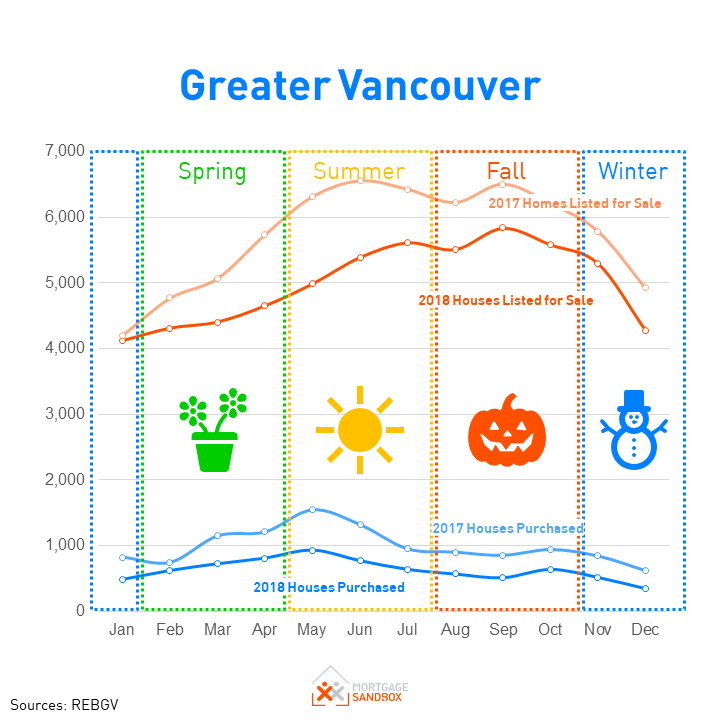

In Canada, the stages of the annual real estate cycle roughly align with the four seasons. However, there is typically a misalignment between buyer interest and seller supply.

This timing misalignment leads to seasonal price fluctuations. In this article, we will explain why there is a misalignment and how it drives the behaviour of buyers and sellers. Ultimately this explains why prices tend to accelerate in Spring and stabilize or recede in the Winter.

Every market is slightly differently shaped; however, the annual cycle typically holds true. Below are some Canadian examples.

Stage 1: Winter – Quiet

The optimism of the holidays and the new year rarely translate into a high number of home purchases.

Homebuyers and sellers prefer to enjoy their holidays.

Homebuyers

For those with children, Winter is mid-schoolyear and very disruptive for a move. More likely than not, winter sellers are motivated, and there is less competition from other buyers, so you may be able to find a great home at a good value.

Home Sellers

Rainy weather on the west coast makes for muddy open houses. The cold and snow in the rest of Canada have killed off all the plants and make it difficult to showcase your beautiful garden or balcony. Finally, the short winter days make for poor lighting if you’re trying to get a buyer to fall in love with a home.

The weather is a more significant factor in Canada, where we have distinct seasons. Perhaps this explains why cities with pleasant weather all-year, such as Brisbane, Australia do not experience the same seasonal price fluctuations.

Stage 2: Spring – Rush

Beginning in February, Spring is typically the time of year when prices accelerate the most. The real estate agencies and mortgage lenders start to crank-up their marketing engines, and buyers begin to play ‘house Tinder’ on the listing websites. Usually, buyers are faster of the starting line than sellers, so the Spring market is characterized by higher purchases while sales listings ramp-up a little later. There is a misalignment in the timing between buyers and sellers.

The Spring rush leads to a surge in buyer interest with tight timelines, which provides sellers with the upper hand in negotiations.

The combination of rising buyer interest and fewer homes for sale starts to drive prices up.

Homebuyers

Typically, families begin their search in February or March, and they hope to buy a place in by April with a closing date at the end of June or in July. The goal is to move over the summer holidays. As you can imagine, if everyone rushes to buy all at once, it will lead to competition and bidding wars for the more attractive homes.

Spring is the least favourable time for buyers to be in the market, but the convenience of a summer move often overrides the financial benefit waiting.

Home Sellers

Home sellers want to sell in the ‘hot’ Spring market, but it takes time to prepare a home to sell well. Often, sellers are tied up in light renovations, painting, and staging, and are unable to take advantage of the Spring sales window.

Stage 3: Summer – Softening

As the summer progresses, purchases tend to fall because buyers are on vacation. Interestingly, sellers are becoming more motivated. They recognize that they need to take advantage of the good weather and that the market will slow down in the Fall. As well, the sellers who were behind schedule trying to list on Spring have finally brought their homes to market. Typically, more homes are listed for sale in Summer than any other time of year.

The decline in the number of buyers, relative to Spring, and a build-up of supply leads to more competition among sellers and a softening of home price growth.

Homebuyers

Families still buy during this period, but it will be increasingly difficult to enroll their children in school without any disruptions. In June and July, many buyers will take a break from their home search for a well-deserved vacation. It’s the patio, camping, beach, and cottage season, and Canadians love the outdoors in Summer.

Home Sellers

Sellers also need a vacation but they need to sell first. At this point, their agent will tell them that if they don’t find a suitable buyer soon, they will want to re-list next Spring.

Buyers are often aware of the change in the power dynamic, so seller seed to be more strategic in their negotiations.

Stage 4: Fall – Activity Drops-off

In the Fall, some sellers have had their home on the market since Spring. Many of these sellers will begin to accept price concessions rather than face the prospect of re-listing in early Spring.

Often, this is the time of year when home values may decline.

Homebuyers

The Fall market favours homebuyers. The drawback for buyers is that you will have to move between homes during the cold (wet on the West Coast) Canadian Winter.

However, buyers could save enough on the price of their homes to cover the cost of professional movers. On balance, the benefits from a Fall purchase are usually more significant than the inconvenience of a Winter moving date.

Home Sellers

Fall is not the best time of year, most buyers will assume you are motivated or desperate if you have chosen not to wait until Spring. Avoid listing in Fall unless your market has very little supply. Even so, a Spring market with short supply will be more lucrative than a Fall market with low supply.

Conclusion

The two home price cycles affect home values to varying degrees. They both have similar characteristics, but the magnitude of price volatility and length of the cycles are very different.

Use your knowledge of the real estate cycles to make more informed decisions about when to buy and when to sell. You will never time the market perfectly, but making an informed decision and being wrong always feels is less frustrating than making a blind decision that turns out wrong.

IMPORTANT: These are the typical cycles in Canadian real estate, but recently real estate in Canada has not been behaving the way it typically does. Several major cities have had long-term systemic shortages of supply, and interest rates have been at historic lows. Both of those factors inflate prices. Even so, you usually still see the influence of these cycles in all Canadian markets.

Always ask a local real estate agent about the impact of the real estate cycles in your area.

It is essential to remember that the primary purpose of buying a home is to provide you and your loved ones with a place to live.

A tax-free investment return is a bonus if you can make it happen.

Need a local Realtor?

We match you with local, pre-screened, values-aligned Realtors and Mortgage Brokers.

Like this report? Like us on Facebook.