Could Canadian Property Prices Crash?

HIGHLIGHTS

|

Economists measure risk in terms of volatility and uncertainty. If prices in a market move dramatically (i.e., up or down) and unpredictably (e.g., not connected to local economics), then it is considered risky. Let’s look at price volatility and uncertainty in Canadian real estate.

Price Volatility

We saw a run-up in Calgary home prices during the oil boom, and that’s no surprise, but did you know that a benchmark Calgary home is cheaper now than it was in 2017? Whoever promises real estate prices only up in the long-term must have a very long time horizon in mind.

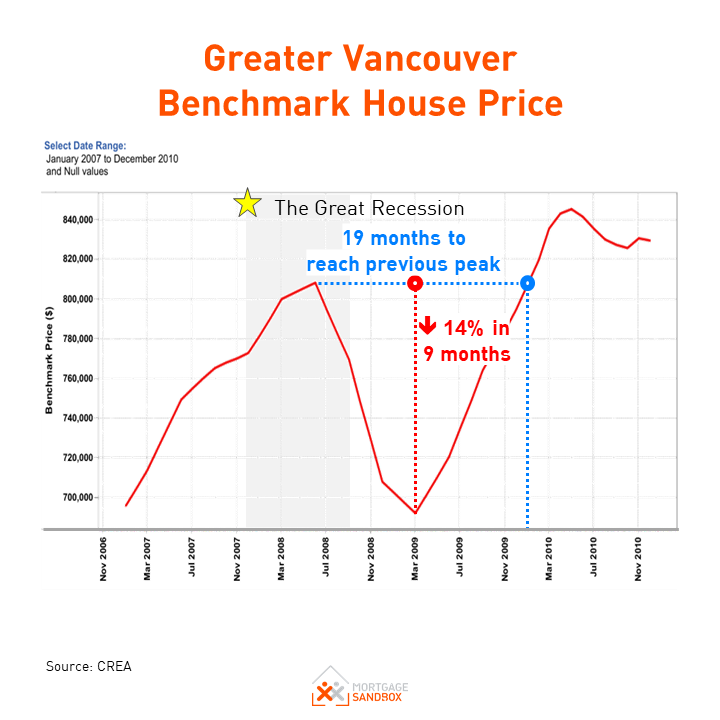

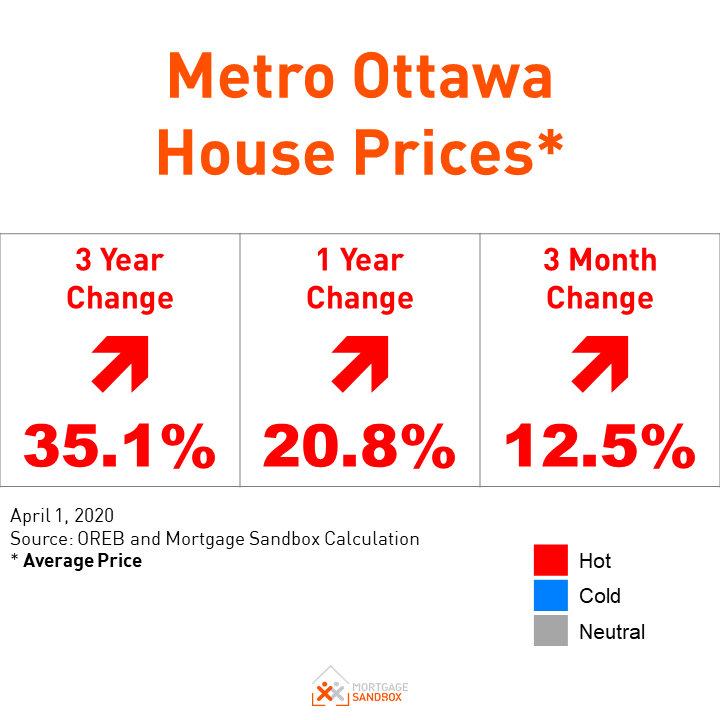

In the past two years, Toronto and Vancouver prices have risen, fallen, and then risen once again. Neither Toronto nor Vancouver house prices have recovered to their previous peak prices. In contrast, Ottawa’s home price growth (33% rise in house prices over 3 years) looks slow and steady. Correction: 10% annual price growth in Ottawa is not slow.

Is Canada experiencing a real estate bubble? Do all bubbles eventually burst? At present, the Toronto and Vancouver housing markets (which touch almost 1 in 3 Canadians) are more volatile than blue-chip stock indices, like the S&P 500, which would be considered a safe investment by most. From an economist’s standpoint, a market that swings wildly upward has a higher likelihood of dropping downward, hence growing concern that years of record-breaking highs could lead to a period of declining prices.

Need a Realtor?

We can help you find local, pre-screened, values aligned, Realtors

Uncertainty

As property prices distance themselves from local incomes and economic fundamentals, they become more dependent on market sentiment. With a Coronavirus recession underway, the gap between economic fundamentals and property prices has widened dramatically. This gap between sound economics and property values increases the potential for uncertainty and doubt. In times like this, people start reaching for other explanations as to why prices will remain high.

The most persuasive argument suggests home values will remain high because there is very little housing supply, and supply will never catch up to demand. In the medium-term, this is true. However, in the short-run, with immigration choked, short-term rentals sitting empty, and many potential buyers out of work, there may be many people wanting to buy, but very few people will be able to. In the very long-run, supply should be able to sync up with demand, and this will allow prices to become affordable to the median household.

Price growth reduces affordability and creates downward pressure on prices. As a rule-of-thumb, home ownership costs are considered unaffordable when they exceed 40% of household income.

Vancouver home ownership costs are 80% of median household incomes

Toronto home ownership costs are 68% of median household incomes

Victoria home ownership costs are 58% of median household income

Montreal home ownership costs are 43% of median household income

To put it plainly, we could argue that 100% of Canadians want to own a home, but in pre-Coronavirus conditions, only 68% managed to buy a home (most purchased a home in the decades before the current highs). In a Coronavirus Recession on par with the Great Depression, we can expect people’s purchasing power is much lower.

Most buyers are afraid this is the case, and their feelings of uncertainty prompt them to take a ‘wait-and-see’ approach when they see a hot the market softening significantly. Many sellers may not have the luxury of a ‘wait-and-see’ strategy.

In essence, potential homebuyers are waiting for news that inspires more confidence in an upward movement in prices.

Who else believes there is risk in real estate?

Before the recession, some of the most respected economic analysts in the world thought there was concrete evidence that Canadian real estate was at a high risk of a significant correction.

The Bank of Canada

In early 2019, the Bank of Canada was expressing concern about the vulnerabilities posed by Canadian home prices straying far beyond economic fundamentals.

Poloz: “In terms of housing market imbalances, we have also seen some lessening in this vulnerability, though it remains elevated.” #cdnecon pic.twitter.com/1Ebfs9icP2

— Bank of Canada (@bankofcanada) June 7, 2018

In May of 2019, the Bank of Canada updated its Financial System Review and highlighted that the top two Canadian risks are:

High household debt

Imbalances in the housing market

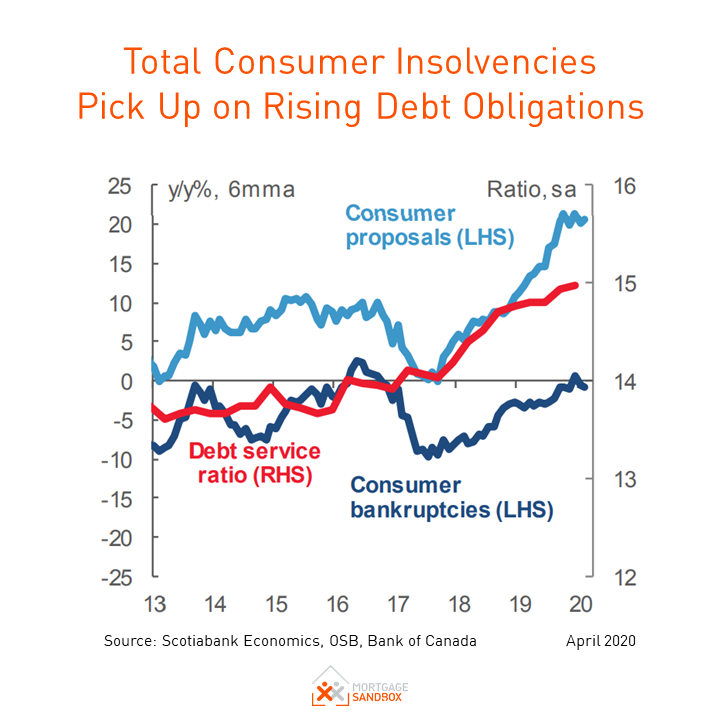

Bank of Canada Vulnerability #1: High household debt

Canadian Debt to Disposable Income Has Been Rising Steadily

“Highly indebted households are those that have a lot of debt relative to their income. They have less flexibility to deal with sudden changes, such as a decline in income or in the price of their home. When many households are highly indebted, the effects of negative shocks on the financial system and the economy are greater.

Overall, the vulnerability associated with high household indebtedness remains significant, although it has declined modestly. As households adjust to changes in mortgage policies and past increases in interest rates, the pace of borrowing has slowed, and the quality of new mortgages has improved. Nonetheless, a large amount of debt in Canada is held by highly indebted households.”

By the way, when a Bank of Canada economist says that a vulnerability remains significant, that is code for, “Oh jeez, hold on tight!”.

The Bank of Canada was concerned about how resilient Canada would be when facing a financial stress event. In 2013, the Bank of Canada published a paper that provides past examples of financial stress events. Keep in mind, these impacted financial markets and often resulted in recessions, but they did not necessarily result in a significant house price drop. The past high financial stress events listed by the Bank of Canada were:

2007 - Lehman Brothers bankruptcy leads to the Great Recession

2001 - Bursting of dot-com bubble

1994 - Mexican peso crisis

1992 - Black Wednesday, European exchange rate mechanism crisis

1989 - Toronto house price collapse

The Coronavirus Recession will go down in history as a high financial stress event.

Bank of Canada Vulnerability #2: Imbalances in the housing market

Okay, so the Bank of Canada’s biggest concern was Canadians taking out really large mortgages to buy homes, so it’s no coincidence that their second most pressing concern is the housing market.

“When house prices grow at a faster pace than can be explained by economic fundamentals, a price correction that leads to financial stress becomes more likely. This can be serious when buyers are highly indebted.

Overall, imbalances in housing have diminished but remain an important vulnerability. Froth from rising expectations of house price growth has declined in housing markets in the Toronto and Vancouver areas over the past two years. While the Toronto market appears to be stabilizing, prices and resale activity continue to decline in Vancouver. Ongoing difficulties in the oil sector are weighing on housing markets in oil-producing provinces.”

Basically, they are saying that if homes become too unaffordable, then there is a risk that eventually, prices will drop to an affordable level so that all the properties for sale can find a buyer…eventually.

Canadian Commercial Banks

The CEO of Scotiabank and the Chief Economist for CIBC feel that these risks are much less likely to affect Canada. These banks have huge mortgage portfolios, and they are closely watching these risks. These same banks have been tightening their mortgage rules.

RBC began publishing a periodic report on real estate risk a few years ago as prices in Vancouver and Toronto broke records. They identified high-risk factors in every major Canadian city. By their assessment, Toronto and Vancouver seem most vulnerable to a downturn in popular sentiment.

According to UBS, a Swiss bank that serves the world's ultra-wealthy, there are eight financial centers that are in bubble territory. Vancouver and Toronto are two of the ‘bubble cities.’

Canadian Mortgage and Housing Corporation (CMHC)

The Canadian Mortgage and Housing Corporation (CMHC) is the federal housing agency mandated to help Canadians buy homes. Their risk assessment concludes that Victoria is highly vulnerable while Vancouver, Toronto and Hamilton are only moderately vulnerable. Their price concerns were price acceleration, overheating, and overvaluation.

As incomes and employment drop in these major urban markets, overvaluation will become more severe.

Concerned by real estate market risk, CMHC and the Canadian Federal Bank Regulator began enacting policies as far back as 2008 to ‘re-risk’ real estate by reducing how much Canadians could borrow.

2008: Reduced the maximum lifespan of a mortgage from 40 years to 35 years.

2010: Applied a stress test against the 5-year contract rate for mortgages with a down payment of less than 20%.

2011: Reduced the maximum lifespan of a mortgage from 35 years to 30 years.

2012: Reduced the maximum lifespan of a mortgage from 30 years to 25 years on mortgages with a down payment of less than 20%.

2016: Applied a stress test against the 5-year posted rate for mortgages with a down payment of less than 20%.

2016: Banned default insurance on refinances, mortgages longer than 25 years, and single-unit rentals.

2018: Applied a stress test to mortgages with a down payment greater than 20%.

The July 2008 change was presented as part of a "responsible and measured approach” by the government to ensure Canada’s housing market remains strong and to reduce the risk of a U.S.-style housing bubble developing in Canada."

Office of the Superintendent of Financial Institutions (OSFI)

The Office of the Superintendent of Financial Institutions (OSFI), the government agency that oversees bank risk, says “key vulnerabilities include Canadian household indebtedness” and on June 4th, 2019, they raised the amount of capital that Canadian banks need to hold to weather a financial crash. Essentially, the regulator ordered Canadian banks to take out a larger insurance policy against a financial crisis.

This is the same arm of the government that, in January 2018, required Canadian banks to apply a stress test when Canadian borrowers apply for a mortgage.

In hindsight, this was very prudent. No one could have anticipated the COVID-19 pandemic. However, we should be thankful that a government bailout of Canadian banks is that much less likely.

What about other International Economic Institutions?

An October 2017 International Monetary Fund (IMF) Report also suggests Canadian real estate vulnerability. As well, in a February 2018 presentation, the U.S. Federal Reserve identified Canadian housing as so overheated because it exceeded their “Evidence of Exuberance Scale.” The IMF and U.S. Fed were looking at Canada as a whole, but Vancouver and Toronto are well above the Canadian average.

Based on BIS’ analysis, Canada has a greater than 50% chance of a financial correction (BIS would call it a “stress event”).

Finally, in June 2019, the IMF said that in the event of a downturn, the Canadian banks will be fine, but Canadian households are vulnerable. The impact on households would be significant as the share of households with debt at risk (defined as households with mortgage payments greater than 40% of income) would increase from 17% to 29%. If that happened, defaults would rise, and the Federal government would have to inject C$15 billion into the Canada Mortgage and Housing Corporation (CMHC).

The IMF was right. In response to the Coronavirus Recession, the Bank of Canada has announced that it will start purchasing about C$500 million worth of mortgages every week. CMHC has said it will acquire up to C$50 billion of mortgages to provide stable funding to banks. Effectively, this is a C$50 billion-dollar bailout of the mortgage market with an additional C$2 billion added to the bailout every month. Technically, this is already a mortgage crisis.

A number of international institutions are concerned that we have a lot of debt relative to our income, that our regular debt payments are too high relative to our income, and that the situation will worsen as interest rates rise to their natural levels, or if a recession brings unemployment and wage reductions.

At the core of these warnings is a belief that people’s loans should not exceed their ability to repay them. This means smaller home buying budgets since most Canadian debt is to support home purchases.

Risk of a Recession Triggering a Housing Downturn

Most experts say there’s no need to panic just yet, but there are a number of reports you may want to watch to help anticipate the magnitude of the recession.

1. The Coronavirus Confirmed Cases

At the end of February, the World Health Organization (WHO) has upgraded the global risk of the coronavirus outbreak to "very high" - its top level of risk assessment; then one month later, they upgraded Coronavirus to a “Pandemic.” Many scientists who specialize in infectious diseases are now advising people in Canada to prepare for an outbreak. This virus is unique in that many people who are infected will never show any symptoms. With SARS or Ebola, it’s obvious that someone is sick. With Coronavirus, you can appear perfectly healthy, have no fever or other symptoms, and carry the virus and spread it to others. It may take up to 18 months for a vaccine to be developed, and Chinese data seems to show a 2% fatality rate among the people who show symptoms and are diagnosed positive. According to The Scientist, the most vulnerable to Coronavirus are the elderly, as well as people with heart disease, obesity, diabetes, asthma, chronic respiratory problems, high blood pressure, and cancer.

2. Duration of the Recession

Economic conditions will not improve until businesses are allowed to re-open. For businesses to re-open, we need the number of new cases to level off at a sustainable rate of infection. Judging by Europe’s experience, that may not happen until June or July. Even then, there may be a second or third wave of containment measures.

3. Severity of the Recession

There isn’t a risk of a recession in Canada. As recession is already underway.

Canadian unemployment was roughly 6% at the beginning of 2020, and according to an April 21st article in Maclean’s Magazine, Canada’s unemployment rate rose to 22 percent.

The U.S. Federal Reserve forecasts that the United States could realistically reach a rate of 30% unemployment.

In the past three months, economists have consistently underestimated the impact of COVID-19. This is because a pandemic of this scale is unprecedented in modern times.

Recent analysis highlights that this recession could last up to six months, and it may be more severe than the financial crisis was in 2008.

A survey of Canadian small businesses in mid-March 2020 shows business confidence had dropped dramatically, even before more stringent containment measures were put in place.

Will home prices drop? For how long?

House prices could easily drop by 20%. In a recent interview, Brendan LaCerda, senior economist with Moody’s Analytics, estimates that each 1% rise in unemployment results in a 4% drop in home prices. Using this ratio, if Canadian unemployment reaches a sustained 11% (a 5% increase), then home prices could drop by 20%.

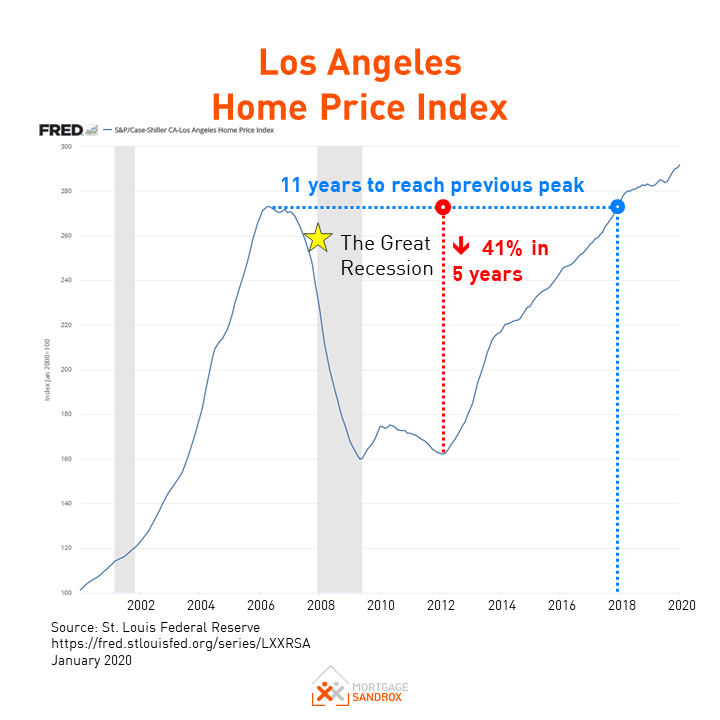

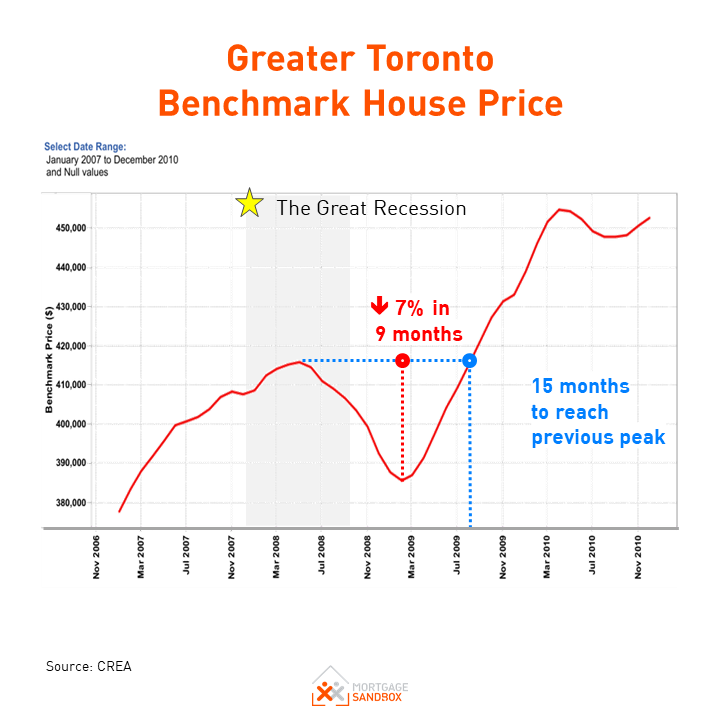

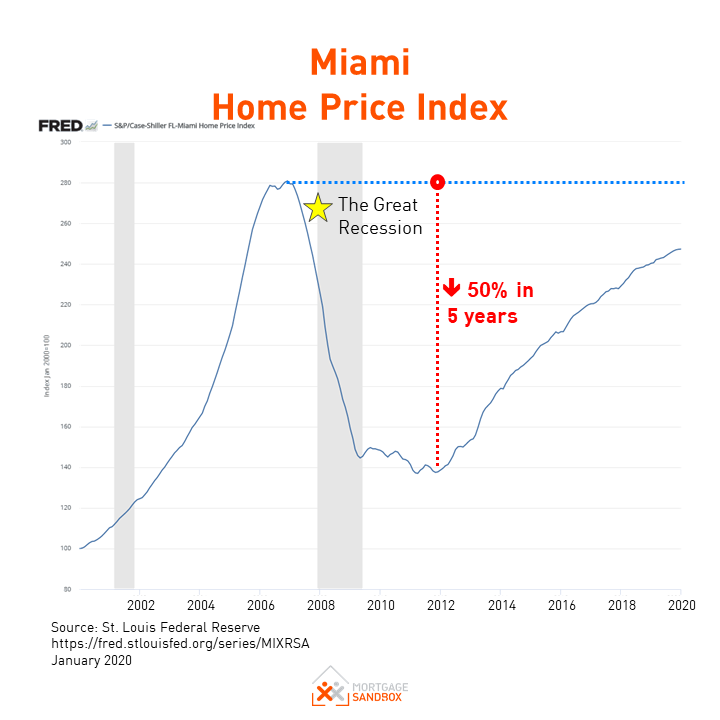

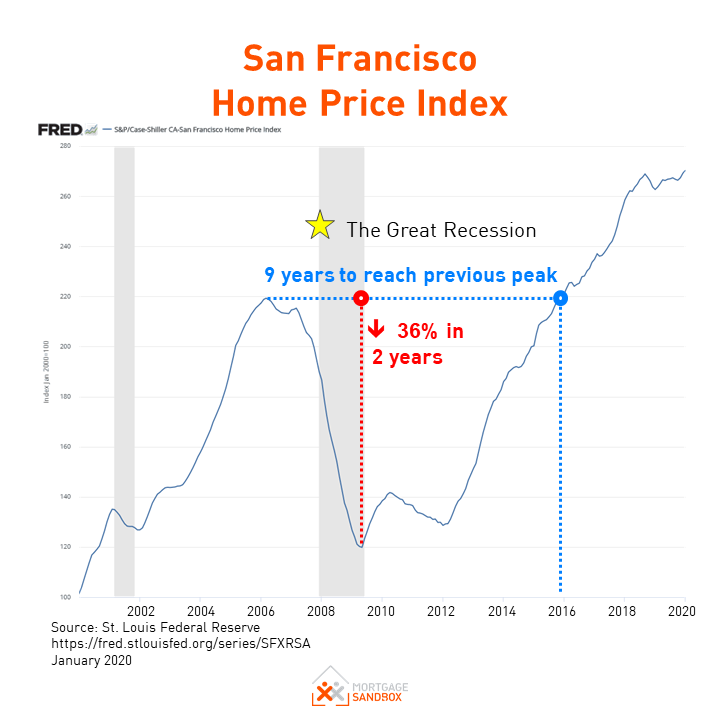

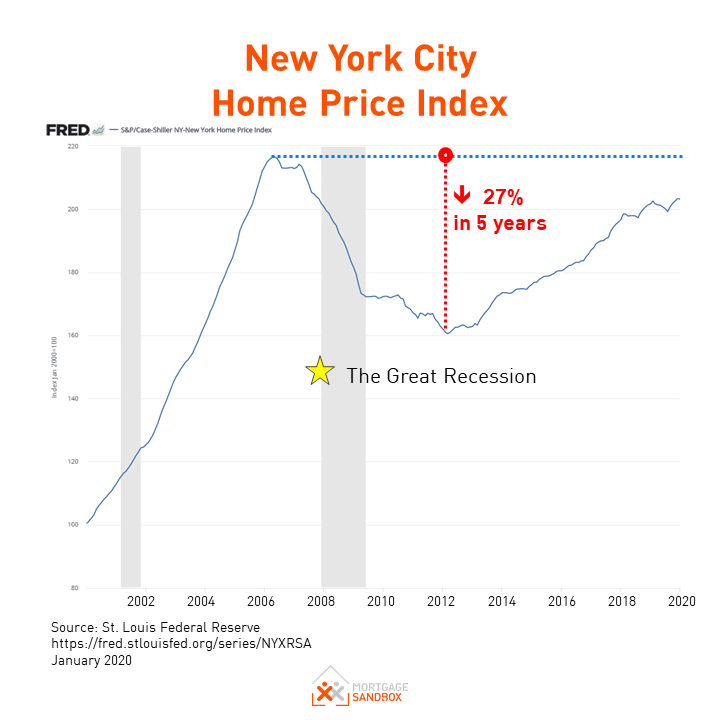

If we look at how several cities weathered the 2008 Financial Crisis, we see that price drop ranged from 7% to 50%. Some markets still haven’t reached their previous peaks.

It may take a decade for home prices to regain current values.

What should I do?

This article is important in the spirit of transparency because many in this industry avoid discussing the downside risks in real estate values. Buyers and Sellers need to be aware of the risks to make well-informed decisions.

Should Homeowners Sell?

If you will need to sell within 3 years, or your retirement savings are tied up in real estate, then you may want to sell now. We recommend you discuss this with a real estate agent and a financial advisor first. Your local market may be insulated from a housing correction.

Like eHarmony for finding a Realtor

Find a Realtor predisposed to work well with you.

Is it a Good Time to Buy?

A wait-and-see approach may be prudent. It can take two or more years for real estate values to hit bottom. If your family is growing, then go ahead and buy, but be sure to drive a hard bargain.

Like this post? Like us on Facebook for the next one in your feed.