Canadian Property Market Has Hit "Pause"

Canada’s housing market is stuck in a holding pattern, with national home sales showing only modest gains. Between July and August, sales edged up 1.3%, supported by provinces like Alberta (+4.2%) and Quebec (+3.4%), but weighed down by declines in British Columbia (-2.3%) and Ontario (-0.5%).

Markets that are performing better than 2023

Markets that are doing more poorly than 2023

The Bank of Canada's recent rate cuts have not led to a buying frenzy, and buyers remain cautious. Affordability remains a significant challenge due to high mortgage rates and prices. Even though rates and prices are dropping in major markets, they haven’t fallen enough to bring affordability in line with incomes. Many potential buyers are waiting for deeper cuts before making a move. Without more supply, lower mortgage rates will push prices back up.

Active listings have increased for seven of the last eight months. The increase in supply has eased previous market shortages, bringing inventories to the equivalent of 4.1 months of sales—more than double the lows of 2021. This has shifted some power back to buyers, allowing them more negotiating leverage and contributing to relatively stable property prices. The national composite MLS Home Price Index remained flat in August, holding at $717,000, though prices were down 3.9% year-over-year.

Balanced supply and demand conditions are preventing significant price growth, with the Canadian housing market in a “wait-and-see” mode. While there’s no immediate sign of a rebound, further rate cuts from the Bank of Canada, anticipated in the coming months, could gradually boost demand. However, price increases will likely remain constrained by affordability challenges, especially in higher-priced markets like B.C. and Ontario.

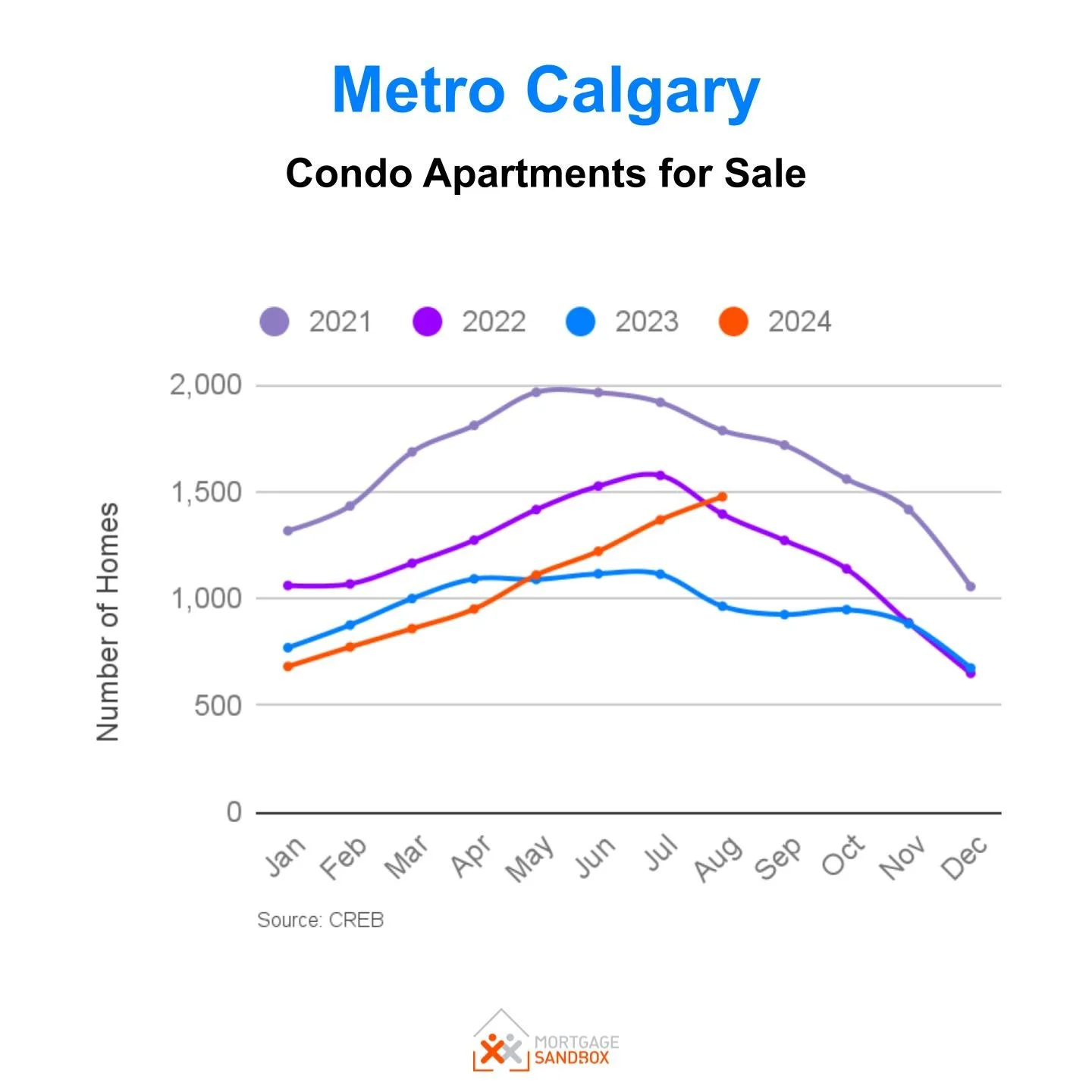

On the flip side, Alberta and Prairie provinces continue to outperform national averages in terms of price growth, driven by higher local incomes and lower property prices – they haven’t hit an affordability ceiling yet. Meanwhile, as economic uncertainty looms, rising unemployment and weaker consumer confidence, particularly among younger Canadians, could keep housing activity subdued well into 2024.

By some accounts, the Bank of Canada is now lowering rates because it fears the risk of a recession more than the risk of resurging inflation.