Canadian Interest Rate Forecast - April 2020

Canadian Interest Rate Forecast

Predictions for 2020 to 2021

Updated April 3, 2020

In response to the COVID-19 recession

The Bank of Canada has cut rates from 1.75% to 0.25%

HIGHLIGHTS

|

Lower rates because of COVID-19 will not boost home prices in Canada because virus containment measures and the economic fallout will hurt home prices more than lower rates can help.

Before the recent rate announcements, 7 of the 10 economists (70%) surveyed by the C.D. Howe Institute thought rates would drop by one quarter on March 4th while 20 of 34 economists polled by Reuters (60%) said the central bank would leave its target overnight rate unchanged until the end of 2020. Economic models are driven by internal economic factors like employment, export growth, and productivity and they have difficulty accounting for external shocks like the Coronavirus. How could they have factored COVID-19 into their forecasts when Coronavirus didn’t exist five months ago?

Everything has changed now that the Bank of Canada has made these dramatic moves, and governments and economic forecasters are quickly trying to assess the economic damage from the virus. Since a virus outbreak of this magnitude is unprecedented in modern times, it will be difficult to draw from past experience.

In the short-run, rates will stay low to help the economy recover. The long-term forecast looks fuzzy at the moment but are anticipating interest rates will rise as soon as the economy stabilizes. Since Coronavirus will cause such a sharp contraction, as soon as the pandemic clears, we expect a strong economic bounceback.

This article will examine the forecasts for floating variable rates and 5-year fixed rates. Keep reading to learn what the big banks are saying about rates.

Our market research and analysis is partly paid for by advertisers

⇓ The article continues below ⇓

THE CURRENT SITUATION

The Bank of Canada has lowered rates in sympathy with the U.S. and Europe. These cuts were initially in response to weaker economic activity, but the Coronavirus outbreak compounded these fears, and a global recession looks inevitable.

Rate Forecasts Are Only Educated Guesses

No matter how well-researched and modelled an economist's prediction is, mortgage rate forecasts are still only educated guesses and, at best, they are as accurate as a weather forecast. The further into the future that a prediction is made, the less precise it is.

A Weak Economy

In January, the Bank of Canada said it expected to report a slowdown in the Canadian economy for the end of 2019. It estimated growth to be 1.6 percent in 2019 and 2020, and then two percent in 2021. According to a recent Harvard Business Review article, a COVID-19 induced slowdown may not be as bad as people fear, but Canada is very trade-dependent.

Over 30% of the Canadian economy is dependent on exports, but our trading partners are struggling. Global economic growth is the lowest in a decade. Recent U.S. data points to moderate economic growth, China’s economic growth has hit a 30-year low, and German economic growth slowed to 0.6% in 2019 (the worst in years). These concerns are made stronger by the potential impact of the Coronavirus.

Fears of a recession have been gaining traction since the Fall of 2018. We are always monitoring our top 5 recession indicators. We have also written a comprehensive report that explains the current level of risk in the Canadian real estate market.

Concern over the Coronavirus Pulls Down Mortgage Rates

As soon as the risk of a disorderly Brexit was mostly behind us, a new threat emerged. The rising cost of the coronavirus outbreak for business and the world economy will be extraordinarily challenging across the globe.

It is now clear that the impact will be global, and every country will be implementing virus containment measures to ‘flatten the curve’.

Central banks have coordinated efforts to cut rates to cushion the economic impact of Coronavirus containment efforts. Lower interest rates will lower the debt burden for businesses and individuals dealing with the fallout of the virus containment efforts. Reduced rates will not increase the productivity of workers forced to work from home, nor do they somehow allow sports stadiums and arenas to re-open, un-cancel conferences, or replace tourism from countries that are now cut-off from Canadian travel.

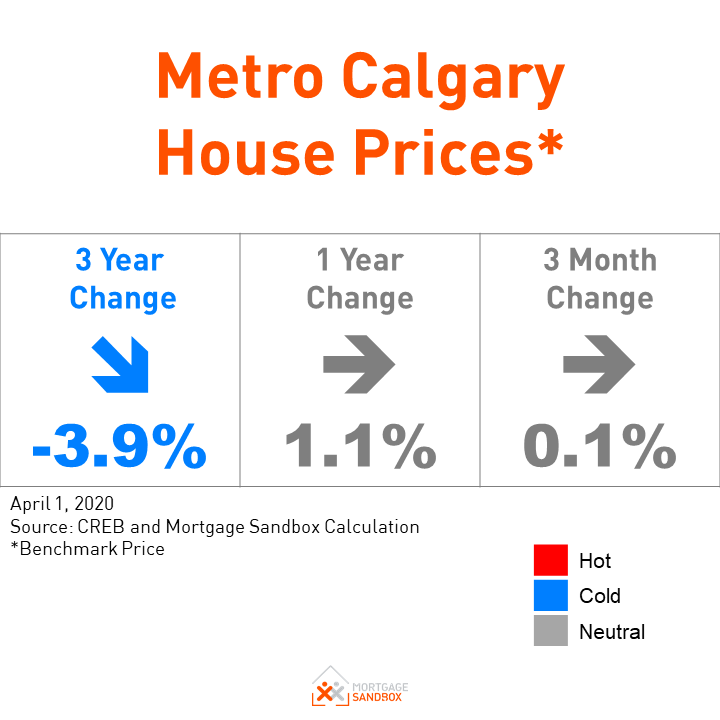

Some real estate industry pundits believe lower interest rates may boost home prices, however, the lower rates will be accompanied by heavy job losses. Nearly 1 million Canadians applied for employment insurance in one week in March. Lower mortgage rates will not help people collecting government assistance to miraculously get approved for a mortgage.

⇓ The article continues below ⇓

Need a Mortgage Broker?

Our FREE app matches you with local, pre-screened, values-aligned Mortgage Brokers Learn More because shared values make better working relationships.

WHAT’S NEXT?

Interest Rates will Rise Eventually

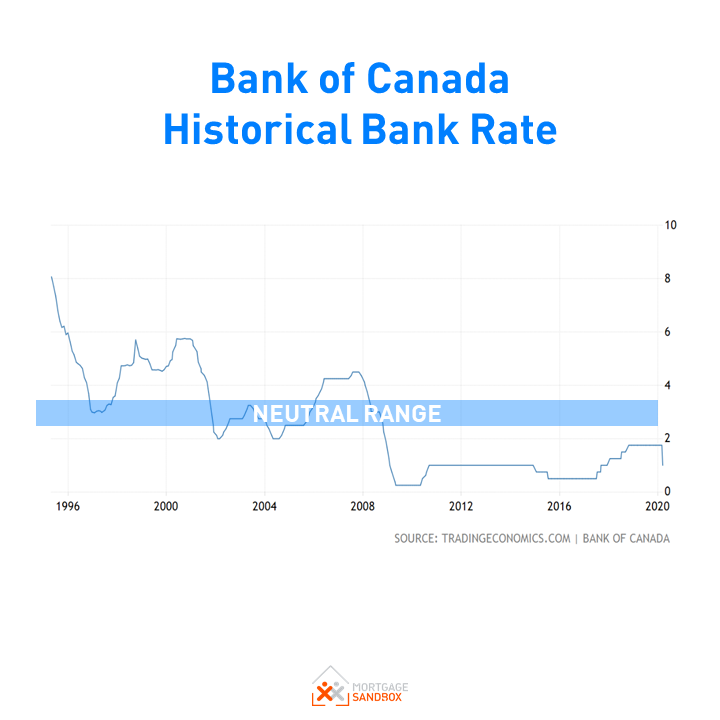

The Bank Rate is well below what would be considered a ‘normal’ range. According to the Bank of Canada, "Governing Council continues to judge that the policy interest rate will need to rise over time into a neutral range to achieve the inflation target." This policy implies that once Canada emerges from a recession then rates will begin to rise.

Bank of Canada Neutral Bank Rate Range

Why look at Bank Rate forecasts?

Variable and adjustable mortgage rates are directly linked to the Bank Rate (the rate at which banks can borrow from the Bank of Canada). If the Bank Rate rises, then prime rates offered by Canadian banks rise, as do variable mortgage rates.

THE BANK RATE FORECAST TO 2021

A deep recession is inevitable. With that in mind, Canadian prime rates used to calculate variable and adjustable mortgage rates will remain low between now and the end of 2020. We are now back to record lows, so in the future, we can expect rates will rise.

5-YEAR GOVERNMENT BOND RATES TO 2021

The average Canadian Bank economist predicts 5-year rates will remain low for the next few months. Rate drops are an appropriate bond-market response to an upcoming recession (i.e., investors sell riskier investments and put them in gold and government bonds).

Similarly, the stock market indices have fallen in expectation of an economic slowdown. Banks publish conservative forecasts, but they are likely looking closely at their exposure in the event there is a significant economic shock. They may become more stringent in their lending policies to reduce their exposure to downside risks in the housing market. Private mortgage lending companies who take on more risk than traditional banks may also pull back on lending.

Before the market gyrations caused by the Coronavirus, the average forecast predicted five-year fixed rates would rise by almost a half of a percent by the end of 2021.

Instead, rates have dropped roughly 1% with the impact of Coronavirus.

The Takeaways

Lock in a 5-year fixed rate?

Buy a home now or wait for the next cycle?

1. Lock in a 5-Year Fixed Rate?

A mortgage rate is usually a three to five year commitment to locking in at a historic low seems advisable if you have job security and will not be selling your house for the duration of the mortgage term.

We recommend variable rates when interest rates are flat or falling, or when you need the flexibility to cancel a mortgage with a lower penalty. If the risk of rates rising still worries you, then you should consider a fixed-rate mortgage.

Our advice is to speak to a Mortgage Broker as early as possible to lock in a rate. You can lock in your mortgage rate up to 120 days before closing on a home purchase or the renewal of your mortgage.

Here’s our mortgage renewal guide that will help you navigate the process.

2. Buy a Home Now or Wait For The Next Cycle?

If you plan to buy in the next three years, be mindful that falling rates increase the amount of mortgage financing a bank can offer you. A larger mortgage allows you to spend more on your home purchase but other buyers a similarly higher buying budget.

With Coronavirus and related recession concerns, there have been job losses and distressed sellers (e.g., laid off, divorce, empty AirBnBs, bankruptcy), which will likely put downward pressure on home prices. Low rates may provide more purchasing power in a market with dropping house prices, and that would be a considerable gain for home buyers.

To get access to experts who know what every lender is doing, consult a mortgage broker. They have the broadest number of options to find you suitable financing.

Need a broker?

Our app matches you with local, pre-screened, values-aligned Mortgage Brokers