Bank of Canada still concerned about risks to the outlook for inflation

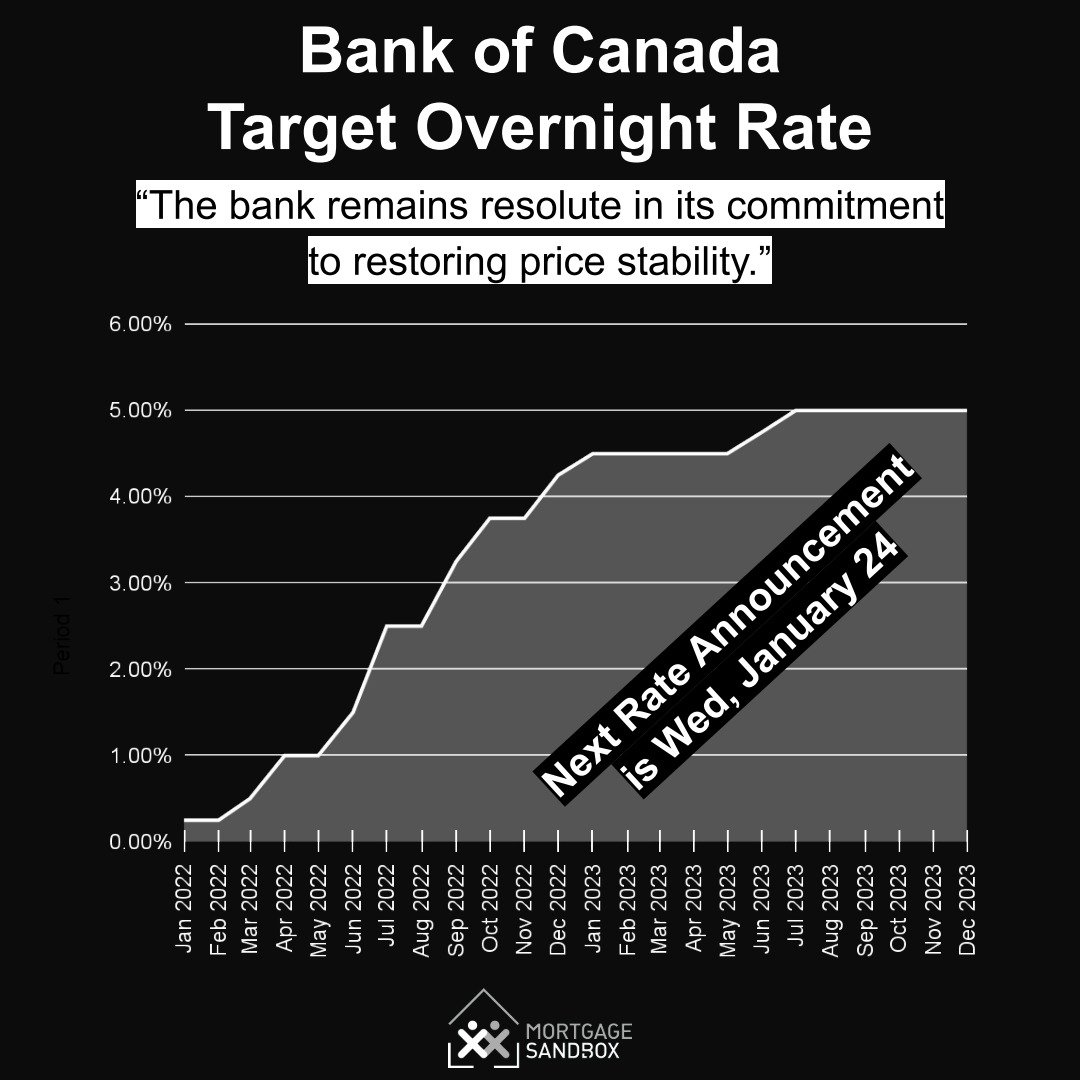

The Bank of Canada (BoC) held its benchmark interest rate, the overnight rate, at 5% on December 6th, signalling that it is taking a cautious approach to combating inflation amidst a slowing global economy.

The central bank also maintained its quantitative tightening (QT) program, which involves reducing the size of its asset holdings as it seeks to raise long-term rates and bring down elevated price pressures.

“The global economy continues to slow and inflation has eased further,” the BoC said in a statement. “In Canada, economic growth stalled through the middle quarters of 2023 and inflation pressures have reduced.”

The BoC’s decision reflects growing concerns about the potential for a global recession triggered by monetary tightening and the ongoing war in Ukraine. While inflation remains a pressing issue, policymakers are wary of stifling economic growth with excessive rate hikes.

“With further signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet,” the statement added.

The BoC’s preferred measures of core inflation have been around 3½-4% in recent months, with the October data coming in towards the lower end of this range. However, shelter price inflation has picked up, reflecting faster growth in rent and other housing costs along with the continued contribution from elevated mortgage interest costs.

Despite the recent easing in inflation, the BoC remains vigilant in its pursuit of price stability. “Governing Council is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed,” the statement emphasized.

The next scheduled announcement of the overnight rate will be on January 24, 2024, when the BoC will also release its next Monetary Policy Report (MPR). The MPR will provide a more comprehensive assessment of the economic outlook and inflation risks.

In the meantime, the BoC will continue to monitor economic conditions closely and adjust its policy stance as needed to ensure that inflation returns to target in a sustainable manner.