Baby boomer retirement tsunami

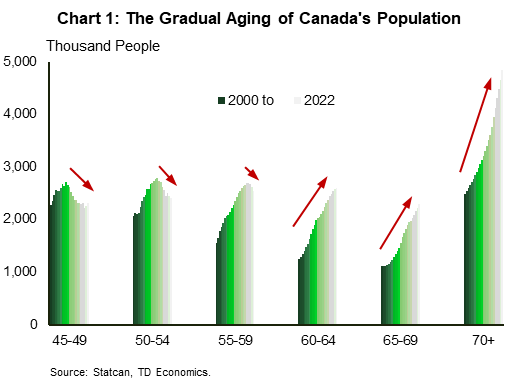

The aging population in Canada poses a challenge for companies to maintain their workforce. The number of older people in Canada has significantly increased over the past two decades, and this trend will have a significant impact on consumer spending patterns, healthcare costs, and housing development, as well as the availability of workers and potential skills mismatch for employers. Although rising immigration can help fill the retirement gap in terms of workforce numbers, it doesn't necessarily address the matching of new Canadians to industries requiring specialized skills nor does it address the cost of retired baby boomers on Canadian social services like pensions and healthcare.

The baby boomer generation, now aged between 58 and 77 years, is already starting to retire and retirements are expected to accelerate in the coming years.

This poses a challenge for businesses that need to hire and train new workers to replace those who retire. While high immigration targets can help offset the wave of retirees by increasing the prime working age population, ensuring that the labor supply in Canada has the necessary skills to meet the demands of businesses will be a critical challenge for the economy.

Fortunately, recent factors have mitigated the impact of the aging population on labor market participation. There has been an increase in the percentage of people remaining in the workforce across age cohorts from 55 years and older. Several factors contribute to this, including the elimination of mandatory retirement age, the ability to defer retirement benefits, an increase in service sector jobs, and overall better health among the older generation.

The COVID-19 pandemic has further boosted labor market participation among individuals in their mid-50s and early-60s, possibly due to concerns about retirement savings, rising rent and housing costs, and the decline in financial market assets. However, there are both cyclical and structural reasons behind the increasing labor force participation of older age cohorts, including the cost of living and financial market volatility.

This trend of older individuals staying in the workforce has resulted in fewer retirements compared to the increase in people reaching retirement age. In fact, calculations show that there are approximately 1.1 million more workers aged 60 and older than there would have been if participation rates from the early 2000s remained constant. This differs from the situation in the United States, where the pandemic alone has led to an estimated 3 million excess retirements. The willingness of older Canadians to continue working has been a significant buffer for the Canadian economy, which still has around a million unfilled job vacancies.

However, the pace of retirements is expected to accelerate, as indicated by the increase in retirements in 2022. It is projected that by 2025, the number of people aged 65 and older will grow by 1 million, resulting in nearly 900,000 workers leaving their jobs in the next three years. This represents a 50% increase in the average number of retirees per year compared to the previous decade.

This challenge should not be overlooked by Canadian firms, as the decline in labor force participation among older age cohorts is inevitable despite some individuals extending their careers. Policymakers are aware of this issue and have implemented measures such as high immigration targets and policies to encourage more women to enter the workforce, such as the affordable childcare program. However, companies may face difficulties in finding employees with the right skills as they replace older workers with younger ones, which could lead to a deficit in experience and institutional knowledge. Effective job-to-skills matching is crucial, especially considering the potential skills mismatch between retiring workers and new immigrants.

To address these challenges, it is essential to break barriers in all areas of the labor market and recognize the credentials and experience of foreign workers. The aging population in Canada presents an opportunity to make the necessary structural changes to integrate and support both current and future Canadians, which can lead to significant benefits for the country.

What does this mean for housing?

Once baby boomers have retired, they will explore right-sizing options. This will increase demand for apartment condos and increase the supply of single detached houses.